14 Karat Gold Worth Per Gram Guide

The value of a gram of 14 karat gold isn’t a static number it’s alive, constantly shifting with the global market. Because 14K gold is 58.3% pure gold, its raw value is simply 58.3% of whatever pure, 24K gold is selling for at that exact moment.

Your Quick Guide to 14K Gold Value

Ever glanced at a 14K gold necklace and wondered what it’s really worth? The secret is understanding its DNA its composition and how that connects to the nonstop pulse of the gold market. This guide will give you the know how to confidently figure out the true value of your gold items.

Think of 14K gold like a recipe. It’s a precise blend of 14 parts pure gold mixed with 10 parts of other metals, known as alloys. This mix, which works out to 58.3% pure gold, is what gives the metal its fantastic durability and makes it the go to choice for jewelry across North America.

Melt Value vs. Retail Price

First things first, it’s crucial to know the difference between two very different numbers: melt value and retail price.

The melt value is the baseline worth of your gold if it were melted down into its raw elements. It’s a pure calculation based on its weight, purity (58.3%), and the live market price of gold. In contrast, the retail price is what you pay in a store. It’s the melt value plus all the extras craftsmanship, brand name, design work, and the jeweler’s profit margin.

When you go to sell gold, especially scrap pieces or jewelry you no longer wear, buyers are almost always focused on its melt value. Nailing this calculation is your first step to getting a fair deal.

The core idea is simple: the per gram worth of your 14 karat gold is directly tied to the live price of pure gold, just scaled down to its 58.3% purity. Once you get this, you can see right past retail markups and understand your gold’s fundamental, intrinsic value.

How the Spot Price Drives Everything

The “spot price” of gold is the live, up to the second market price for one ounce of pure gold. This price is in constant motion, reacting to global economics, supply, and investor demand. And because they’re linked, the value of your 14K gold moves right along with it.

To give you a clearer picture, this table shows how the per gram value of 14K gold changes based on the live market price of pure (24K) gold. The calculation uses the 58.3% purity standard.

| 24K Gold Spot Price (Per Gram) | 14K Gold Melt Value (Per Gram) |

|---|---|

| $70.00 | $40.81 |

| $75.00 | $43.73 |

| $80.00 | $46.64 |

| $85.00 | $49.56 |

As you can see, the relationship is direct and predictable. When the spot price of gold goes up, what your 14K gold is worth per gram climbs right along with it. A little later in this guide, we’ll show you exactly how to do this math yourself.

Why 14K Gold Is Stronger Than Pure Gold

Have you ever wondered why that beautiful gold ring on your finger isn’t made from pure, 24K gold? It sounds like the ultimate luxury, but pure gold has a major weakness when it comes to everyday items like jewelry: it’s incredibly soft. Imagine a ring made from something as pliable as hardened clay it would scratch, dent, and warp with the slightest pressure.

This is where the art and science of metallurgy come in. To create a metal that’s both gorgeous and resilient enough for daily wear, gold is mixed with other metals. This process creates what we call an alloy. An alloy is a blend of two or more metals, formulated to give the final product better properties than any of the individual ingredients.

When it comes to 14K gold, the recipe is very specific. It contains 14 parts pure gold and 10 parts other metals. This combination means 14K gold is precisely 58.3% pure gold (that’s 14 divided by 24), with the remaining 41.7% made up of these strengthening alloy metals.

The Role of Alloys in Creating Durability

Think of making 14K gold like baking a cake. Pure gold is the flour it’s the main ingredient, but it’s not very good on its own. The alloys are like the eggs, sugar, and butter. When you mix them in just the right amounts, you transform that plain flour into something sturdy and delicious. In the same way, metallurgists carefully select which metals to add to gold to give it specific traits.

These added metals aren’t chosen at random. Each one brings something unique to the table, from strength to a subtle shift in color. The most common alloys mixed with gold include:

- Copper: Known for its reddish tint, copper adds serious hardness and durability to the mix.

- Silver: This metal adds strength while helping to keep a lighter, more classic yellow color.

- Zinc: Often used to fight off tarnish and make the casting process smoother, zinc also adds to the overall strength.

- Nickel or Palladium: These are the key ingredients for creating “white gold,” lending a silvery white look and exceptional toughness.

By combining pure gold with a carefully balanced cocktail of these metals, jewelers create a material that can handle the rigors of daily life, from typing on a keyboard to carrying groceries.

The true genius of 14K gold lies in its perfect compromise. It has enough pure gold to keep that rich, warm glow we all love, while gaining the structural integrity needed for jewelry that’s meant to be worn and cherished for a lifetime.

Comparing Gold Karats for Practicality

Understanding this blend of metals makes it clear why different karats are used for different things. The durability of gold is directly tied to how much alloy is in the mix. Here’s a quick breakdown of how 14K gold stacks up against other common purities.

| Karat | Pure Gold Content | Alloy Content | Durability & Hardness |

|---|---|---|---|

| 24K | 99.9% | ~0.1% | Very Soft |

| 18K | 75% | 25% | Moderately Soft |

| 14K | 58.3% | 41.7% | Hard and Durable |

| 10K | 41.7% | 58.3% | Very Hard |

This table makes it obvious: as the alloy content goes up, so does the metal’s hardness. While 10K gold is even tougher, 14K gold is often seen as the “sweet spot” in the jewelry world. It offers fantastic durability without watering down the rich color and intrinsic value that makes gold so special. This balance is the key to understanding the 14 karat gold worth per gram, as its value is a blend of pure gold content and practical strength.

How to Calculate 14 Karat Gold Worth Per Gram

Alright, let’s pull back the curtain and show you exactly how to figure out the 14 karat gold worth per gram. This isn’t some complex secret known only to jewelers; it’s a simple calculation anyone can do. Learning this formula empowers you to look right past the retail price tag and see the true, raw material value of your gold.

The whole process boils down to two key pieces of information: the current market price of pure gold and the purity of your 14K item. With those two numbers, you can calculate its melt value the baseline worth of the gold itself.

The Simple Formula for Melt Value

Calculating the value of your 14K gold is surprisingly straightforward. The heart of the calculation is a special number we call the purity multiplier. Because 14K gold is 58.3% pure gold, its multiplier is simply 0.583.

Here’s the only formula you’ll need:

(Current Spot Price of Gold Per Gram) x 0.583 = 14K Gold Worth Per Gram

This little formula works every single time. It directly connects the live market price of pure, 24K gold to the actual amount of gold hiding in your 14K piece. It strips away all the other factors like brand names and craftsmanship to give you a clear, honest number.

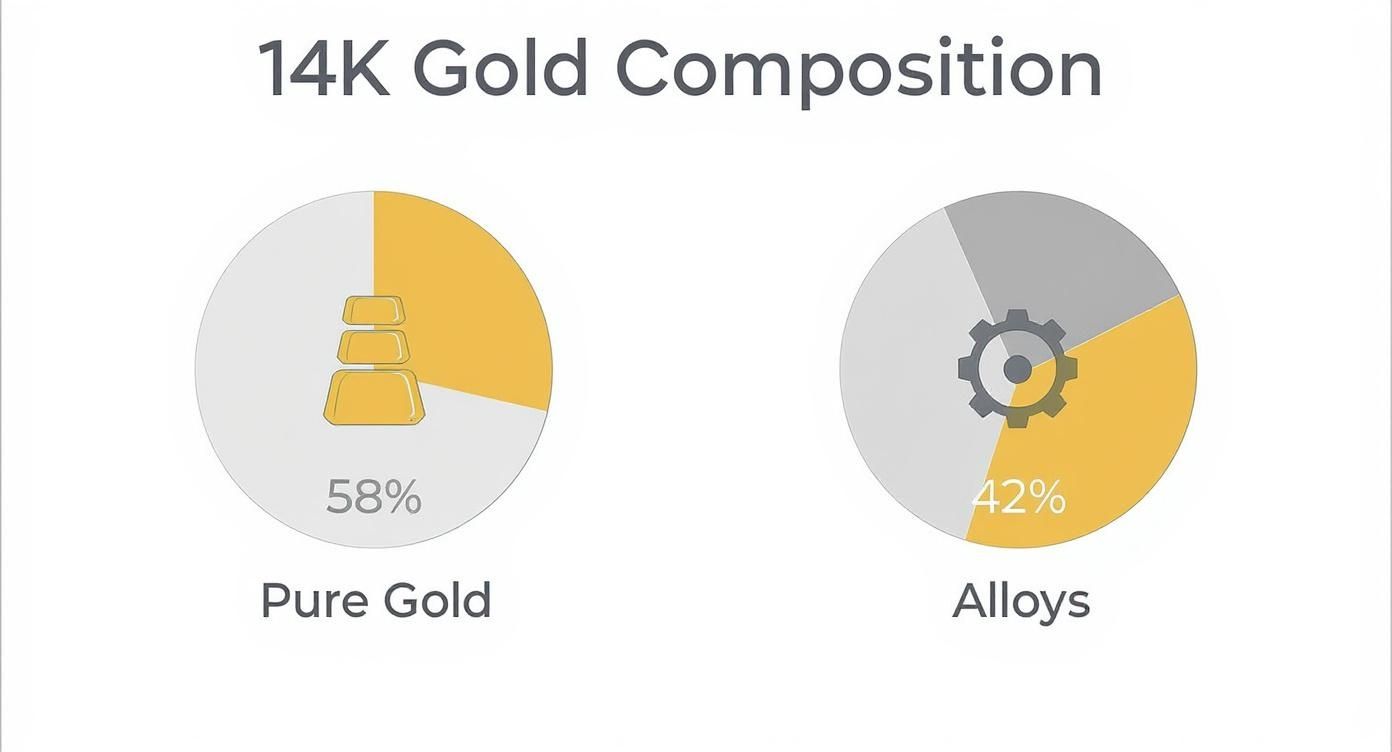

This infographic breaks down what 14K gold is really made of, showing the ratio of pure gold to the other metals that give it strength.

As you can see, the majority of your item is valuable pure gold. The rest is made up of alloys that provide the durability needed for a piece you can actually wear every day.

A Real World Calculation Example

Let’s put this formula into action with a real world example. Imagine the live spot price of pure gold is sitting at $75.00 per gram.

Here’s how you’d calculate the 14K gold worth per gram:

- Find the Spot Price: The current price for pure (24K) gold is $75.00/gram.

- Apply the Multiplier: You multiply that price by the 14K purity factor of 0.583.

- Get the Result: $75.00 x 0.583 = $43.73.

Just like that. With the spot price at $75.00 per gram, the melt value of your 14K gold is $43.73 per gram. It really is that simple. So, if you have a 14K gold chain that weighs 10 grams, its total melt value would be $437.30.

Key Takeaway: The value of your 14K gold isn’t just some random number. It’s directly tied to the global commodities market through a simple and reliable formula. Knowing this puts you in a position of power and clarity.

Why This Calculation Matters

Understanding this calculation is crucial because the price of 14 karat gold per gram is always linked to the global market price of pure gold, but it’s adjusted for its lower 58.3% gold content. Gold prices have historically shown significant ups and downs, influenced by everything from inflation and currency strength to global events. By learning how to do this math yourself, you can adapt to these changes and always know what your gold is worth right now.

The table below gives you a clear comparison of how the 14K gold value changes with different live spot prices. It really helps you see the direct relationship at a glance.

14K Gold Value at Various Market Prices

| 24K Gold Spot Price (Per Gram) | The Math (Spot Price x 0.583) | 14K Gold Melt Value (Per Gram) |

|---|---|---|

| $72.00 | $72.00 x 0.583 | $41.98 |

| $78.50 | $78.50 x 0.583 | $45.76 |

| $83.00 | $83.00 x 0.583 | $48.39 |

| $90.00 | $90.00 x 0.583 | $52.47 |

This table really drives home how dynamic gold pricing is. Armed with this knowledge, you’re no longer just a spectator; you’re an informed owner who can accurately assess the fundamental value of your precious metal.

Decoding the Daily Fluctuations in Gold Prices

If you’ve ever checked the price of gold one day only to see a completely different number the next, you’ve seen the global gold market in action. The 14 karat gold worth per gram isn’t a fixed number; it’s a living value that shifts constantly, pushed and pulled by a complex web of global economic forces.

Think of the global economy as a massive ocean. Gold is like a sturdy ship navigating its waters. When the seas get stormy think economic uncertainty or political turmoil investors scramble for the safety of that ship. This flood of demand drives the price of gold up. On the other hand, when the waters are calm and other investments like stocks are sailing smoothly, demand for gold might ease up, causing its price to dip.

This constant tug of war is why the live “spot price” of gold is the non negotiable starting point for any valuation. It’s the real time price for pure, 24K gold, and it’s the bedrock for calculating the value of every gold alloy, including 14K.

Key Drivers Behind Gold’s Price Swings

So, what are the winds and currents affecting gold’s journey? Several major factors can cause significant price moves, influencing everything from huge financial markets right down to the value of your 14K ring.

- Inflation and Interest Rates: When inflation kicks in, the cash in your wallet buys less. Gold, however, tends to hold its value, making it a classic hedge against a weakening dollar. Central bank decisions on interest rates also play a massive role. When rates are low, a non interest bearing asset like gold suddenly looks a lot more attractive.

- Geopolitical Instability: Global conflicts, trade wars, or political uncertainty almost always send investors running for a “safe haven” asset. Gold has been playing this role for centuries because its value isn’t tied to the policies of any single government. It’s a reliable store of wealth when things get turbulent.

- U.S. Dollar Strength: Gold is priced in U.S. dollars worldwide, creating an inverse relationship. When the dollar gets stronger, it takes fewer dollars to buy an ounce of gold, so its price tends to fall. But when the dollar weakens, gold becomes a bargain for foreign investors, which can boost demand and send its price higher.

The constant interplay between these global factors means the gold market is always on the move. This is exactly why the melt value of your 14K gold today could be noticeably different from what it was last month or even last week.

Tracking Real World Price Movements

These market dynamics aren’t just abstract concepts; they create tangible, measurable price shifts. For example, between late April and May 2024, the price for 14 karat gold per gram bounced between roughly $44.50 and $47.70. That’s a daily volatility that can add up to a swing of 5% to 6% in just a few weeks.

This kind of short term movement is a direct result of macroeconomic data releases, Federal Reserve policy hints, geopolitical headlines, and currency fluctuations. You can see these trends for yourself when you view recent gold price trends on GoldPricez.com.

Understanding this context is crucial. It proves that checking the live spot price isn’t just a good idea; it’s the only way to get an accurate starting point for what your 14K gold is worth right now. The table below shows how different global scenarios can rock the boat.

| Economic Scenario | Likely Impact on Gold Demand | Resulting Price Movement for Gold |

|---|---|---|

| High Inflation | Increases | Tends to Rise |

| Strong Stock Market | Decreases | Tends to Fall or Stabilize |

| Global Political Crisis | Increases Significantly | Tends to Rise Sharply |

| Strong U.S. Dollar | Decreases | Tends to Fall |

Ultimately, the worth of your 14K gold is directly plugged into this vast, interconnected global market. By appreciating these forces, you can better understand its true value and make much smarter decisions.

How to Spot Official Gold Hallmarks

So, how can you be sure the piece you’re holding is genuine 14K gold? The answer is often stamped directly onto the item in the form of a hallmark. Think of these tiny inscriptions as a certificate of authenticity, certifying the gold’s purity for anyone to see.

Learning to be a hallmark detective is a practical skill that gives you a ton of confidence when you’re valuing your gold. All you really need is a good eye and maybe a simple magnifying glass or your phone’s camera. These marks are your first and best clue in verifying the true 14 karat gold worth per gram of your jewelry.

Common Hallmarks and Their Meanings

In the world of gold, hallmarks follow a pretty standardized system. While different regions have their own traditions, the marks for 14K gold are generally consistent and easy to recognize once you know what to look for.

Here are the most common stamps you’ll run into on 14K gold pieces:

- 14K or 14Kt: This is the dead giveaway, the standard hallmark used across North America. It clearly states the item is 14 karats.

- 585: You’ll see this stamp all the time on jewelry made in Europe or other international markets. It means the item contains 58.5% pure gold (or 585 parts per thousand).

- 583: Occasionally, you might spot this mark, especially on older pieces. It also signals 14K gold, representing the slightly different 58.3% purity standard.

Where to Look for These Tiny Stamps

Jewelry makers are pretty clever about placing these marks in discreet spots to avoid messing up the design. Finding them can sometimes feel like a mini treasure hunt.

Pro Tip: Grab a jeweler’s loupe or just use the zoom function on your smartphone camera. These stamps can be incredibly small and hard to read with the naked eye, and a little magnification makes all the difference.

Here’s a quick guide on where to check for hallmarks on common items:

| Jewelry Type | Common Hallmark Location |

|---|---|

| Rings | On the inner surface of the band. |

| Necklaces & Bracelets | On the clasp, a tiny tag near the clasp, or the end caps. |

| Earrings | On the post, the earring back, or a flat edge of the design. |

| Pendants | On the back of the pendant or the small loop (the bail). |

What If There Is No Hallmark?

Don’t panic if you can’t find a stamp. The absence of a hallmark doesn’t automatically mean your item isn’t real gold. On older, well loved pieces, the mark could have simply worn off over time. It’s also possible the item was custom made and never stamped in the first place.

When this happens, your next step is verification. Professional testing is the only way to be absolutely certain of its purity. You can learn more about the different methods available by checking out our guide on how to test gold purity. This will give you the definitive answer you need to figure out its true value.

What to Expect When You Sell Your Gold

Knowing the melt value of your gold is a massive advantage, but it’s only half the story. The next critical piece of the puzzle is understanding what a buyer will actually offer you. Bridging the gap between the calculated 14 karat gold worth per gram and the cash that ends up in your hand is the key to a fair and successful sale.

When you sell gold especially scrap items like broken chains, old rings, or single earrings buyers are purchasing it as a raw material. They aren’t paying for the craftsmanship or the design you fell in love with years ago. They are only interested in the pure gold content they can melt down and refine. This is why their offers are based on a percentage of the melt value you just learned how to calculate.

Why Buyers Pay Less Than Spot Price

Let’s get one crucial fact straight: no buyer will ever pay you 100% of the spot price for your gold. A realistic offer will almost always land somewhere between 70% and 90% of the total melt value. This isn’t a scam; it’s simply the business model that allows gold buyers, refiners, and jewelers to stay in business.

Think of it like any other retail business. A grocery store buys apples from a farm at a wholesale price and sells them to you at a retail price. That markup covers their shipping, rent, employee salaries, and allows them to make a profit. Gold buyers operate the same way. Their offer has to account for several real world costs:

- Testing and Verification: They have to use specialized equipment to accurately verify the karat purity of every single item you bring in.

- Melting and Refining: The process of melting down jewelry, separating the alloys, and purifying the gold costs both time and money.

- Market Risk: The price of gold is constantly changing. It could easily drop between the time they buy your gold and the time they sell the refined product.

- Business Overhead: This covers everything from rent and security to employee salaries and insurance.

- Profit Margin: At the end of the day, they are a business and need to make a profit to keep the lights on.

An offer of 85% of the melt value might feel like you’re losing 15%. A better way to see it is as the buyer’s fair margin for the service, risk, and costs they take on to turn your old jewelry back into pure, usable gold.

Navigating the Selling Process Like a Pro

Now that you have realistic expectations, you can walk into any negotiation with confidence. Your goal is to find a reputable buyer who offers a fair percentage, is completely transparent about their process, and makes you feel comfortable.

A great first step is to arm yourself with information before you even leave the house. Using an online resource that shows current scrap gold prices gives you a solid benchmark. This knowledge is your best defense against a lowball offer.

Finding a Reputable Buyer

Finding the right place to sell your gold is the most critical part of the entire process. A trustworthy buyer will be transparent and professional. A less reputable one might use confusing tactics or pressure to get you to accept less than your gold is worth.

Here’s a quick cheat sheet on what to look for and what to run away from.

| Red Flags (Avoid These Buyers) | Green Flags (Look for These Buyers) |

|---|---|

| No transparent weighing process | Weighs your items on a certified scale right in front of you |

| Vague explanations of their pricing | Clearly explains their payout percentage based on the live spot price |

| High pressure tactics to sell now | Encourages you to get other offers and make an informed choice |

| Cluttered or unprofessional storefront | Positive online reviews and a professional, secure environment |

Getting multiple offers is your single most powerful tool. Don’t just go to the first “Cash for Gold” sign you see. Visit at least three different buyers local jewelers, reputable pawn shops, and even mail in refiners. This lets you directly compare their payout rates and customer service, ensuring you walk away with the best possible price for your 14K gold.

Frequently Asked Questions About 14K Gold

After digging into the math behind the 14 karat gold worth per gram, it’s totally normal to have a few more questions pop up. We’ve pulled together the most common ones we hear to give you clear, straight up answers. Think of this as the final piece of the puzzle to make you feel confident about what your jewelry is truly worth.

Is 14K Gold Considered Good Quality?

Absolutely. In fact, there’s a very good reason why 14K gold is the go to choice for fine jewelry across North America. It hits the perfect sweet spot between high gold content, a beautiful rich color, and the practical strength needed for everyday life.

With a composition of 58.3% pure gold blended with tougher alloy metals, it’s far more resistant to dings and scratches than its higher karat cousins. This smart blend means your jewelry isn’t just valuable it’s durable enough to be worn and loved day in and day out.

Does Gold Color Affect Its Per Gram Worth?

Nope. When it comes to melt value, the color of your 14K gold makes no difference at all. Whether you have a piece of classic yellow gold, modern white gold, or romantic rose gold, it still contains that same 58.3% pure gold.

The color simply comes from the specific metals used in the alloy mix. For example, rose gold gets its signature pinkish hue from a bit more copper, while white gold is mixed with white metals like palladium or nickel. When a buyer calculates the value, they’re only focused on that pure gold content, so the color is just a matter of style.

This table breaks down how 14K stacks up against other common options.

| Karat Purity | Pure Gold Content | Primary Characteristic |

|---|---|---|

| 18K Gold | 75% | Richer color, but softer and more prone to scratching. |

| 14K Gold | 58.3% | The perfect balance of durability, color, and value. |

| 10K Gold | 41.7% | Extremely durable, but has a paler color and less gold value. |

You can see why 14K is often considered the “sweet spot” for jewelry. It offers a much better mix of strength and precious metal content than the alternatives.

How Can I Weigh My Gold Accurately at Home?

For a reliable measurement, you’ll need a sensitive digital scale. A kitchen food scale or a small jeweler’s scale that can measure in grams is perfect. Whatever you do, don’t use a standard bathroom scale it’s just not precise enough for something as light as jewelry.

It’s also crucial to weigh only the gold. If your jewelry has any gemstones, pearls, or other non metal bits, their weight needs to be subtracted from the total. Buyers only pay for the weight of the gold itself, so getting a clean measurement of just the metal is essential for an accurate valuation. It gives you a solid starting point before you even think about getting an offer.

At Gold Calculator, we believe knowledge is your best tool. Our free online tools are built to give you instant, transparent valuations based on live market data. To get a quick and accurate estimate of what your gold is worth right now, visit the Free Gold Calculator page.