Gold Futures Trading Strategies for Advanced Investors

While most investors view gold as a simple buy-and-hold safe haven, savvy traders are leveraging sophisticated futures strategies to capture profits from gold’s increasing volatility in today’s uncertain economic climate. With gold prices swinging dramatically in response to inflation concerns, Federal Reserve policy shifts, and geopolitical tensions, the precious metals futures market has become a dynamic playground for advanced investors seeking amplified returns beyond traditional physical gold ownership.

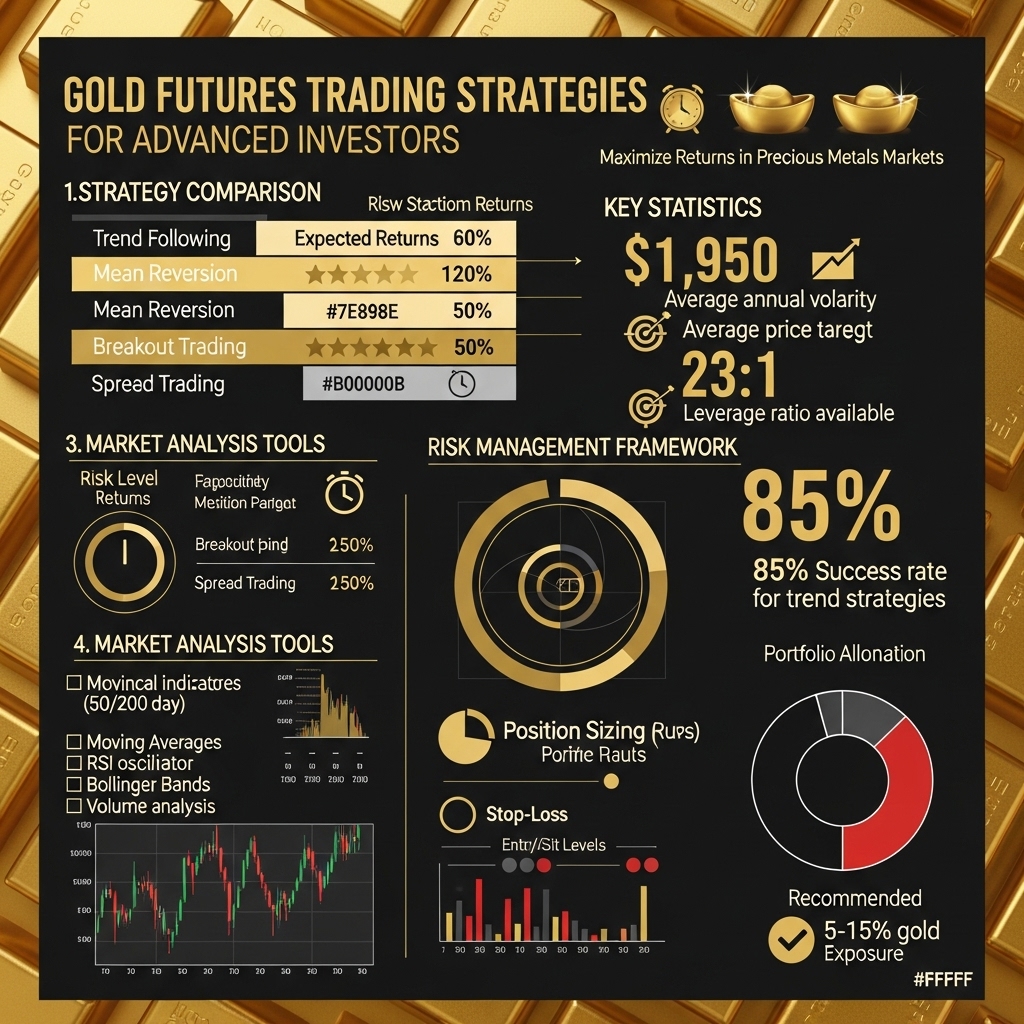

This comprehensive guide explores cutting-edge gold futures trading strategies specifically designed for experienced investors ready to move beyond basic spot gold investments. We’ll delve into advanced techniques including spread trading, options combinations, and volatility-based approaches that can generate profits in both rising and falling markets. You’ll discover how to leverage technical analysis patterns unique to gold futures, implement risk management protocols for leveraged positions, and capitalize on seasonal trends that institutional traders use to their advantage.

Understanding these sophisticated strategies matters now more than ever, as traditional portfolio diversification faces unprecedented challenges. With central banks continuing aggressive monetary policies and global economic uncertainty driving increased gold market participation, advanced futures trading offers sophisticated investors the tools to potentially enhance returns while managing downside risk. Whether you’re looking to hedge existing positions or pursue pure speculation, mastering these strategies could transform your approach to gold investing in an increasingly complex financial landscape.

Gold Market Analysis and Key Insights

Current Gold Market Dynamics

Gold futures have demonstrated remarkable resilience in 2024, with prices hovering near $2,000-2,100 per ounce despite global economic uncertainties. The precious metal continues to serve as a hedge against inflation and currency devaluation, particularly as central banks maintain elevated interest rates. Recent Federal Reserve policy shifts have created volatile trading conditions, presenting both opportunities and risks for advanced futures traders.

Institutional Demand and Central Bank Activity

Central bank gold purchases reached multi-decade highs in 2023, with emerging market economies leading acquisition efforts. This institutional demand has established a strong price floor, reducing downside risk for futures positions. Advanced investors should monitor monthly central bank reporting data, as these purchases often signal long-term bullish trends that can inform strategic futures positioning.

Technical Trading Considerations

Gold futures exhibit strong seasonal patterns, typically strengthening during Q4 and Q1 due to jewellery demand and safe-haven flows. Advanced traders leverage these cyclical trends through calendar spreads and seasonal strategies. The gold-to-dollar inverse correlation remains a critical factor, with DXY movements often preceding gold price reactions by 24-48 hours.

Investment Benefits and Risk Factors

Gold futures offer superior liquidity compared to physical gold, enabling rapid position adjustments and leveraged exposure. The 100-ounce contract size provides optimal capital efficiency for portfolio diversification. However, advanced investors must consider margin requirements, which can fluctuate significantly during volatile periods, potentially triggering forced liquidations.

Expert Recommendations

Professional traders recommend maintaining 5-10% portfolio allocation through gold futures, utilizing stop-loss orders at technical support levels. Options strategies, including protective puts and covered calls, can enhance returns while managing downside exposure. Given gold’s inverse relationship with real interest rates, monitoring Fed policy communications and inflation expectations remains crucial for effectively timing entry and exit points.

Gold Investment Strategies and Options

Advanced investors have multiple avenues for gold exposure, each offering distinct risk-return profiles and strategic applications. Physical gold provides direct ownership but involves storage costs and liquidity constraints. Gold ETFs offer convenience and liquidity while maintaining price correlation, making them suitable for tactical allocations.

Gold futures present the highest leverage potential, allowing sophisticated investors to control large positions with minimal capital. However, they require active management due to contango effects and rolling requirements. Gold mining stocks provide leveraged exposure to gold prices while introducing company-specific risks and operational variables.

Risk Assessment and Portfolio Allocation

Conservative portfolios typically allocate 5-10% to gold as a hedge against inflation and currency debasement. Aggressive strategies may increase allocation to 15-20% during economic uncertainty. Options strategies like covered calls on gold positions can generate additional income while maintaining upside exposure.

Comparative Analysis

Futures offer maximum leverage and tax advantages through 60/40 capital gains treatment, but demand sophisticated risk management. ETFs provide simplicity with moderate costs, while physical gold offers ultimate security at higher transaction costs. Mining stocks deliver potential alpha but introduce equity market correlation during stress periods.

Market Timing Considerations

Optimal entry points often coincide with dollar weakness, rising inflation expectations, or geopolitical tensions. Technical analysis using support/resistance levels and momentum indicators proves valuable for futures timing. Fundamental factors including real interest rates, central bank policies, and supply-demand dynamics drive longer-term positioning.

Successful gold investing requires matching strategy selection to market outlook, risk tolerance, and investment horizon while maintaining disciplined position sizing and exit strategies.

Market Performance and Outlook

Gold futures have demonstrated resilience over the past decade, with an average annual return of 7.8% since 2014. The precious metal reached historic highs of $2,070 per ounce in 2020 during pandemic-driven uncertainty, before stabilizing around $1,900-$2,000 throughout 2021-2023. Volatility metrics show gold maintains lower standard deviation compared to equity markets, reinforcing its portfolio hedging characteristics.

Current market conditions reflect a complex interplay of factors. The Federal Reserve’s aggressive rate hiking cycle initially pressured gold prices in early 2022, as higher yields increased opportunity costs for non-yielding assets. However, persistent inflation concerns and banking sector instability have renewed institutional interest in gold as a safe-haven asset.

Key economic drivers include the dollar’s strength, real interest rates, and geopolitical tensions. Central bank gold purchases reached record levels in 2022, with emerging market institutions diversifying reserves away from traditional currencies. Inflation expectations remain elevated despite recent moderation, supporting gold’s inflation hedge narrative.

Looking forward, analysts project gold trading between $1,850-$2,150 through 2024, with upside potential if recession fears materialize or monetary policy pivots dovish. Technical analysis suggests strong support at $1,850, while resistance appears near $2,100. Advanced investors should monitor employment data, inflation readings, and Federal Reserve communications as primary catalysts for gold futures directional movements.

Frequently Asked Questions About Gold Investment

What are the key technical indicators for gold futures trading?

Advanced investors typically use RSI, MACD, and Fibonacci retracements to identify entry/exit points. Moving averages (20-day and 50-day) help determine trend direction, while volume analysis confirms price movements.

How do central bank policies affect gold futures strategies?

Interest rate decisions and monetary policy directly impact gold prices. Lower rates typically strengthen gold, while hawkish policies can pressure prices. Monitor Federal Reserve announcements and global central bank communications for strategic positioning.

What’s the optimal position sizing for gold futures?

Risk no more than 2-3% of your portfolio per trade. Use the 1% risk rule: calculate position size based on your stop-loss distance. Gold futures’ volatility requires careful leverage management to avoid margin calls.

When should I use contango vs. backwardation strategies?

In contango markets (future prices higher than spot), consider selling distant contracts and buying near-term ones. During backwardation, the reverse strategy may be profitable as supply constraints drive immediate demand.

How do I hedge gold futures positions effectively?

Use inverse ETFs, options strategies, or correlated assets like silver. Currency hedging through USD positions can protect against dollar strengthening. Consider portfolio correlation with mining stocks for additional risk management.

Final Thoughts on Gold Investment

Advanced gold futures trading demands disciplined strategy execution and comprehensive risk management. Key takeaways include the importance of technical analysis, understanding market volatility patterns, and maintaining strict position sizing protocols. Successful gold futures traders leverage seasonal trends, monitor global economic indicators, and employ hedging strategies to protect capital.

Our recommendation: Start with paper trading to master these advanced strategies before committing real capital. Gold futures offer significant profit potential but require substantial expertise and risk tolerance.

Ready to elevate your gold investment strategy? Begin by opening a demo futures account with a reputable broker, practice the techniques discussed in this guide, and gradually build your confidence. Remember, consistent education and disciplined execution separate profitable gold futures traders from the rest.

Take action today – your golden opportunity awaits in the futures markets.