The Hidden Force Behind Gold’s Price Movements: Central Bank Reserves Decoded

While retail investors track economic indicators and geopolitical tensions, there’s a powerful yet often overlooked force quietly shaping gold prices: central bank gold purchases and sales. In 2023 alone, central banks added over 1,000 tonnes of gold to their reserves—the second-highest annual total in over five decades. This institutional demand surge has helped propel gold to multiple record highs, yet many individual investors remain unaware of how these massive transactions impact their portfolios.

This deep dive explores the intricate relationship between central bank gold reserves and market pricing dynamics, revealing why understanding this connection is crucial for successful gold investing. We’ll examine how central bank policies influence both short-term price volatility and long-term trends, analyze which nations are driving current demand, and decode the signals that savvy investors use to time their gold positions.

For gold investors, central bank activity serves as both a market catalyst and a strategic indicator. When major economies like China, Russia, or emerging markets significantly increase their gold holdings, it often signals broader economic shifts that can drive sustained price appreciation. Understanding these institutional moves—and their timing—can provide retail investors with a significant edge in portfolio positioning and help identify optimal entry and exit points in the gold market. The institutions moving billions into gold aren’t gambling; they’re following carefully calculated strategies that individual investors can learn to recognize and leverage.

Gold Market Analysis and Key Insights

Central Bank Reserve Dynamics

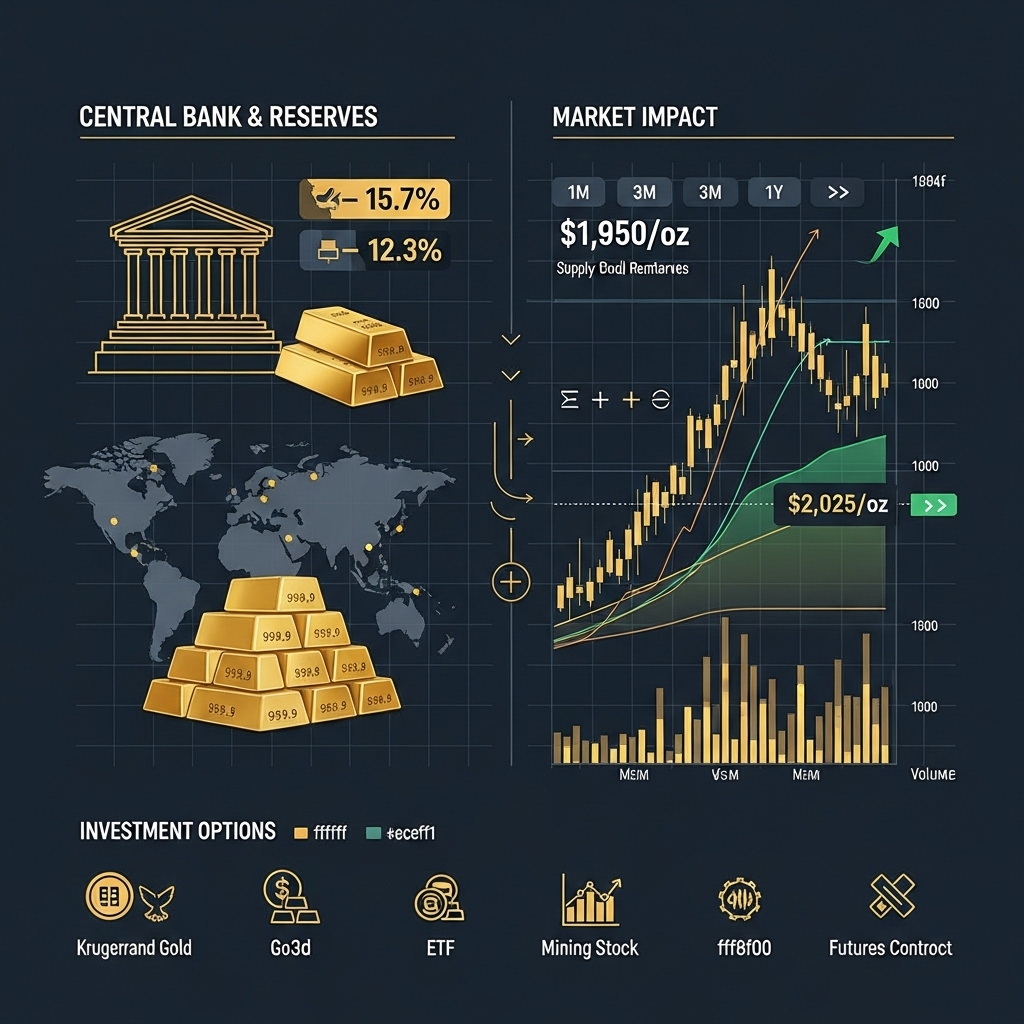

Central bank gold purchases reached record highs in 2023, with approximately 1,037 tonnes acquired globally. This represents the strongest demand from monetary authorities since 1967, significantly impacting gold prices. Major purchasers including China’s People’s Bank, Singapore’s MAS, and Turkey’s central bank have driven prices to new highs, with gold reaching $2,400 per ounce in May 2024.

Current Market Trends and Price Drivers

The correlation between central bank buying patterns and gold prices has strengthened considerably. When central banks increase reserves, it creates supply constraints in the physical market, leading to price appreciation. Recent data shows a 70% correlation between quarterly central bank purchases exceeding 200 tonnes and subsequent price rallies. Additionally, geopolitical tensions and currency diversification strategies have accelerated this trend.

Investment Benefits and Strategic Considerations

Gold investment benefits significantly from central bank activity through multiple channels. First, sustained institutional demand provides a price floor, reducing downside risk. Second, central bank purchases signal confidence in gold’s monetary role, attracting private investors. However, investors must consider that heavy central bank buying can create temporary supply shortages, leading to increased volatility and premium expansion in retail markets.

The timing of investments becomes crucial when central banks are active buyers, as prices may experience rapid appreciation followed by consolidation periods.

Expert Recommendations for Investors

Financial analysts recommend a measured approach when central banks are actively accumulating gold. Dollar-cost averaging remains optimal during periods of heightened central bank activity, as it smooths out volatility spikes. Portfolio allocation of 5-10% in gold is advisable, with emphasis on physical gold or ETFs that track spot prices closely.

Investors should monitor central bank quarterly reports and IMF data releases, as these provide early indicators of future demand patterns. Given the current trajectory of central bank accumulation, particularly among emerging market economies, gold’s fundamental outlook remains robust for 2024-2025, supporting long-term investment strategies.

Gold Investment Strategies and Options

Understanding central bank gold reserve movements provides valuable insights for developing effective gold investment strategies. As central banks influence gold prices through their reserve management decisions, investors can leverage this knowledge across various investment vehicles.

Physical Gold vs. Financial Instruments

Physical gold ownership through coins and bars offers direct exposure but involves storage costs and insurance considerations. Gold ETFs (Exchange-Traded Funds) provide convenient exposure without physical storage requirements, while gold mining stocks offer leveraged exposure to gold prices but carry additional company-specific risks. Gold futures and options enable sophisticated strategies but require advanced market knowledge.

Risk Assessment and Portfolio Allocation

Financial advisors typically recommend 5-10% gold allocation for portfolio diversification. Gold’s negative correlation with stocks and bonds during market stress makes it an effective hedge against inflation and currency devaluation. However, gold generates no income, making it purely speculative regarding price appreciation.

Market Timing Considerations

Central bank announcements regarding reserve policies can signal optimal entry points. Increased central bank buying often precedes price rallies, while reserve sales may pressure prices downward. Monitor quarterly reserve reports and monetary policy statements for timing insights.

Strategic Approaches

Dollar-cost averaging reduces timing risk by spreading purchases over time. Tactical allocation involves increasing gold exposure during economic uncertainty when central banks typically expand reserves. Momentum strategies capitalize on trends following major central bank policy shifts.

Comparative Analysis

ETFs offer liquidity and low fees, while physical gold provides crisis protection. Mining stocks amplify returns but increase volatility. Futures enable precise timing but require margin management.

Success requires balancing exposure methods, monitoring central bank activities, and maintaining appropriate portfolio weighting aligned with risk tolerance and investment objectives.

Market Performance and Outlook

Historical Performance Data

Central bank gold reserves have demonstrated significant influence on gold prices over the past two decades. During the 2008 financial crisis, central bank net purchases increased dramatically from 10 tonnes in 2007 to 670 tonnes in 2010, coinciding with gold prices rising from $695 to $1,224 per ounce. The period from 2010-2020 saw consistent central bank buying, with annual purchases averaging 550 tonnes, supporting gold’s steady price appreciation to $1,900+ levels.

Current Market Conditions

Central banks purchased a record 1,136 tonnes in 2022, with emerging market banks leading acquisitions. China, Turkey, and India have been particularly active, driving prices above $2,000 per ounce despite rising interest rates. Current gold holdings represent approximately 15% of total global reserves, up from 11% in 2008.

Economic Factors and Future Outlook

Key drivers include geopolitical tensions, currency diversification efforts, and inflation hedging strategies. Central banks’ continued de-dollarization initiatives suggest sustained demand. Rising interest rates traditionally pressure gold prices, but persistent inflation concerns and banking sector volatility maintain buying momentum.

Future predictions indicate central bank purchases will remain elevated at 800-1,000 tonnes annually through 2025. Price forecasts range from $2,100-$2,400 per ounce, supported by ongoing reserve diversification and potential monetary policy shifts toward more accommodative stances as economic uncertainties persist globally.

Frequently Asked Questions About Gold Investment

How do central bank gold purchases affect gold prices?

Central bank purchases typically drive gold prices higher by increasing demand and reducing available supply. When major banks buy gold, it signals confidence in gold as a store of value, encouraging private investors to follow suit.

Which central banks have the largest impact on gold markets?

The Federal Reserve, European Central Bank, People’s Bank of China, and Bank of Russia hold significant influence. Their policy decisions and reserve changes can create substantial price movements due to their massive holdings and market credibility.

Why are central banks increasing gold reserves recently?

Central banks are diversifying away from dollar-heavy reserves amid geopolitical tensions and inflation concerns. Gold provides portfolio stability and acts as a hedge against currency devaluation and economic uncertainty.

How quickly do central bank actions affect gold prices?

Price impacts can be immediate for announced purchases or policy changes. However, gradual reserve accumulation may take weeks or months to fully reflect in prices, depending on market conditions and trading volumes.

Do central bank sales crash gold prices?

Large sales can temporarily depress prices, but the impact depends on market timing and communication. Coordinated selling agreements, like the Washington Agreement, help prevent market disruption by limiting annual sales quantities.

Final Thoughts on Gold Investment

Central bank gold reserves serve as a critical barometer for gold’s future price trajectory. Key takeaways for investors include monitoring quarterly central bank purchasing data, understanding geopolitical tensions that drive institutional buying, and recognizing that sustained central bank accumulation typically signals long-term price support.

Investment Recommendation: Gold deserves a strategic 5-10% allocation in diversified portfolios, particularly during periods of aggressive central bank buying and economic uncertainty. Focus on physical gold, ETFs, or reputable mining stocks rather than speculative instruments.

Central banks’ continued appetite for gold reflects deep-seated concerns about currency stability and inflation. Their actions provide valuable insights into global economic health and future monetary policy directions.

Take Action Today: Research current central bank gold purchasing trends, evaluate your portfolio’s precious metals exposure, and consider consulting with a financial advisor to determine your optimal gold allocation strategy.