Understanding Global Tax Implications: Your Guide to Maximizing Gold Investment Returns Worldwide

Picture this: two investors each purchase $50,000 worth of gold bullion and watch it appreciate to $75,000 over three years. One walks away with a hefty tax bill that eats into their profits, while the other enjoys significantly lower tax obligations—sometimes even tax-free gains. The difference? Where they live and how well they understand their country’s gold taxation policies.

With gold recently hitting near-record highs and central banks worldwide continuing their aggressive buying spree, savvy investors are increasingly turning to the precious metal as a hedge against inflation and economic uncertainty. However, what many overlook is how dramatically different tax treatments across countries can impact their actual returns. From Singapore’s tax-free gold trading environment to Germany’s unique long-term holding exemptions, the jurisdiction where you invest—or relocate—can make the difference between modest gains and substantial wealth preservation.

In this comprehensive guide, we’ll navigate the complex landscape of gold taxation across major investment destinations, examining everything from capital gains rates and VAT implications to storage requirements and reporting obligations. Whether you’re a seasoned precious metals investor looking to optimize your portfolio’s tax efficiency or a newcomer seeking to understand the full cost of gold ownership, mastering these international tax considerations could save you thousands—or even tens of thousands—in unnecessary tax payments while ensuring full compliance with local regulations.

Gold Market Analysis and Key Insights

Gold investment continues to attract global investors seeking portfolio diversification and inflation hedging, though tax implications vary significantly across international markets.

Current Market Performance and Trends

Gold prices have demonstrated remarkable resilience, trading near $2,000 per ounce throughout 2024, supported by central bank purchases and geopolitical uncertainties. The World Gold Council reports that global gold demand reached 1,174 tonnes in Q3 2024, with investment demand accounting for approximately 25% of total consumption. Exchange-traded funds (ETFs) have seen renewed inflows, particularly in emerging markets where currency devaluation concerns persist.

Regional Tax Landscape Variations

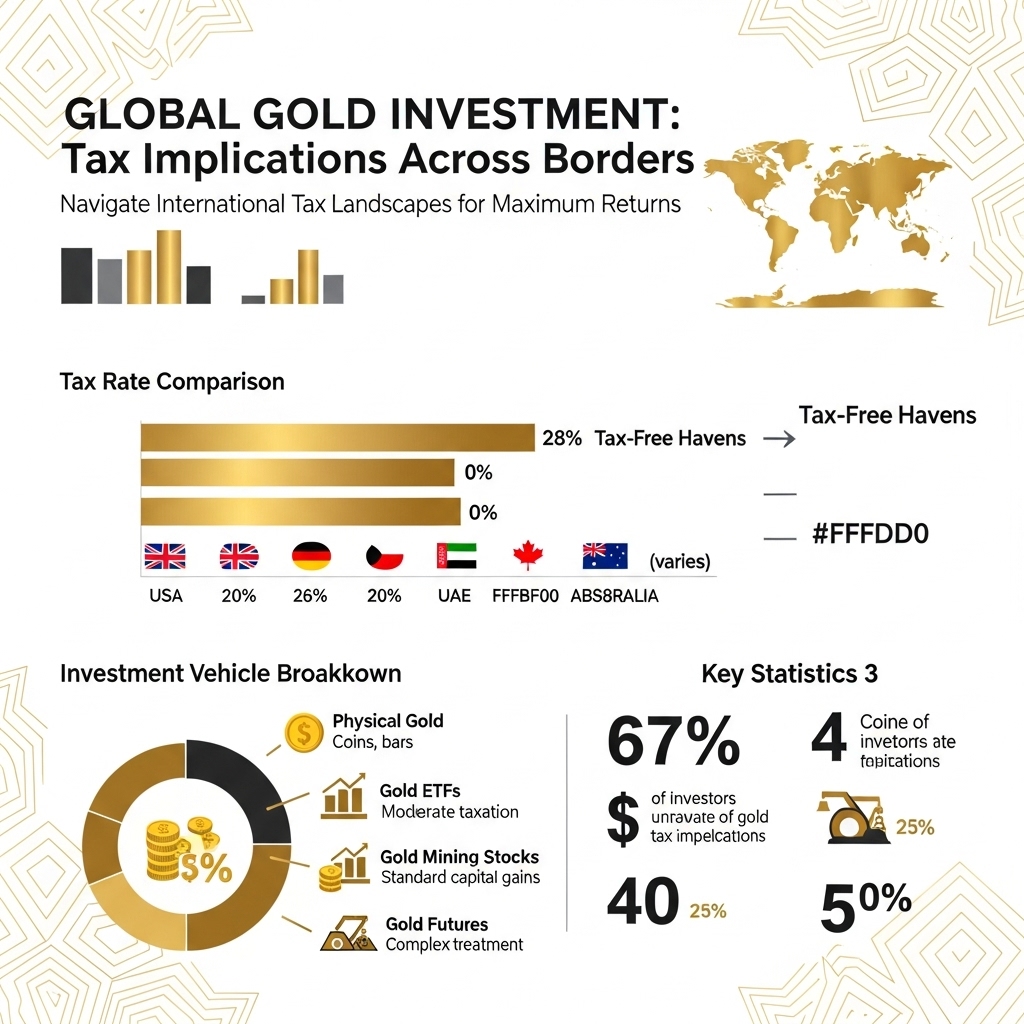

Tax treatment of gold investments differs substantially across jurisdictions. The United States treats gold as a collectible, subjecting gains to a maximum 28% tax rate, while India imposes a 20% long-term capital gains tax with indexation benefits. European Union countries vary widely—Germany offers tax-free sales after one-year holding periods, whereas the UK applies capital gains tax on gold investments exceeding annual allowances.

Investment Structure Considerations

Physical gold ownership, gold ETFs, mining stocks, and gold futures each carry distinct tax implications. Physical gold typically faces higher tax burdens due to collectible classifications, while gold ETFs may qualify for more favorable capital gains treatment in certain jurisdictions. Mining stocks often benefit from standard equity taxation rules, making them attractive alternatives for tax-conscious investors.

Strategic Recommendations

Experts recommend allocating 5-10% of portfolios to gold-related investments, emphasizing tax-efficient structures based on residency. Consider holding gold investments in tax-advantaged retirement accounts where permitted. For international investors, consulting local tax professionals is essential, as treaty provisions and reporting requirements can significantly impact net returns.

The optimal gold investment approach requires balancing desired exposure levels with jurisdiction-specific tax efficiency, timing strategies, and compliance obligations to maximize after-tax returns while maintaining portfolio diversification benefits.

Gold Investment Strategies and Options

Gold investment strategies vary significantly based on tax implications across different jurisdictions, requiring careful consideration of both financial and regulatory factors.

Physical Gold vs. Financial Instruments

Physical gold ownership, including coins and bars, often receives favorable tax treatment in many countries. The EU exempts investment-grade gold from VAT, while countries like Germany and Austria offer tax advantages for long-term holdings. However, storage costs and insurance must be factored into returns.

Gold ETFs and mutual funds provide liquidity and lower transaction costs but may face different tax treatments. In the US, gold ETFs are taxed as collectibles with higher capital gains rates, while some countries treat them as securities with standard capital gains taxation.

Portfolio Allocation Strategy

Conservative portfolios typically allocate 5-10% to gold as a hedge against inflation and currency devaluation. Risk-tolerant investors may increase allocation to 15-20% during economic uncertainty. Tax-advantaged accounts like IRAs or pension funds can shelter gold investments from immediate taxation in applicable jurisdictions.

Market Timing and Tax Optimization

Strategic timing involves understanding both market cycles and tax calendars. Harvesting losses before year-end can offset gains in countries with capital gains taxation. Some investors employ dollar-cost averaging to minimize tax impact while building positions gradually.

Risk Assessment Considerations

Gold’s volatility requires careful risk management. Currency exposure affects international investors, as gold prices fluctuate with USD strength. Counterparty risk exists with paper gold investments, while physical gold faces storage and authenticity risks.

Successful gold investment strategies must balance return potential with tax efficiency, considering jurisdiction-specific regulations, investment timeframes, and overall portfolio objectives to optimize after-tax returns.

Market Performance and Outlook

Gold has demonstrated remarkable resilience as an investment asset, delivering an average annual return of 10.6% over the past two decades. Historical data reveals gold’s strongest performance during periods of economic uncertainty, with notable peaks during the 2008 financial crisis (31% gain) and the COVID-19 pandemic (24% increase in 2020).

Current market conditions show gold trading near historic highs, supported by persistent inflationary pressures and geopolitical tensions. Central bank purchases reached record levels in 2022-2023, with emerging economies increasing their gold reserves to diversify away from dollar-denominated assets. Mining supply constraints and rising extraction costs continue to support price floors.

Several economic factors drive gold prices across international markets. Currency devaluation, particularly USD weakness, traditionally boosts gold demand. Interest rate policies significantly impact investment flows, with lower rates making non-yielding gold more attractive. Inflation expectations remain a primary driver, as investors seek hedges against purchasing power erosion.

Future outlook suggests continued volatility with long-term bullish sentiment. Analysts project gold reaching $2,400-2,600 per ounce by 2025, driven by ongoing monetary policy uncertainties and emerging market demand. However, investors must consider varying tax implications across jurisdictions when evaluating returns. Countries like Germany offer tax-free gold sales after one year, while others impose capital gains taxes that significantly impact net returns, making tax-efficient jurisdictions increasingly attractive for international gold investment strategies.

Frequently Asked Questions About Gold Investment

How are gold investments taxed in the United States?

In the US, gold is taxed as a collectible with a maximum capital gains rate of 28% for holdings over one year, higher than regular investment assets. Physical gold purchases may require sales tax depending on the state, while gold ETFs are generally treated as ordinary income.

What are the tax implications of gold investment in the UK?

UK investors face Capital Gains Tax on gold profits exceeding £6,000 annually. However, UK legal tender gold coins like Sovereigns and Britannias are exempt from CGT. VAT is charged on gold bars but not coins, making coins more tax-efficient.

How does Germany tax gold investments?

Germany imposes VAT on gold purchases but offers a significant advantage: physical gold held for over one year is completely exempt from capital gains tax. Gold ETFs and mining stocks remain subject to standard investment taxation.

Are there reporting requirements for international gold investments?

Yes, many countries require disclosure of foreign gold holdings above certain thresholds. US citizens must report foreign gold accounts exceeding $10,000 through FBAR filings. Always consult local tax authorities for specific reporting obligations.

Which countries offer the most favorable gold investment tax treatment?

Singapore, Switzerland, and several Middle Eastern nations offer attractive gold tax regimes with minimal or no capital gains taxes and reduced VAT rates, making them popular destinations for international gold investors.

Final Thoughts on Gold Investment

Navigating the tax landscape of gold investments requires careful consideration of your country’s specific regulations. Key takeaways include understanding that physical gold often faces higher tax rates than ETFs, capital gains treatment varies significantly by jurisdiction, and holding periods can dramatically impact your tax liability. Countries like Singapore and Switzerland offer more favorable tax environments, while others impose substantial premiums on precious metals transactions.

Our recommendation: Diversify your gold holdings across different investment vehicles and consider your local tax implications before making substantial purchases. Physical gold for long-term wealth preservation, combined with gold ETFs for liquidity, often provides the optimal balance.

Ready to optimize your gold investment strategy? Consult with a qualified tax advisor familiar with precious metals regulations in your jurisdiction. Download our free gold investment tax guide and subscribe to our newsletter for the latest updates on international gold taxation policies.