Introduction and Overview

Gold just hit another record high, but here’s the trillion-dollar question every smart investor is asking: Should you be holding actual gold bars in your hands or digital gold certificates in your portfolio? With gold prices soaring past $2,400 per ounce in late 2024 and institutional demand reaching unprecedented levels, the way you choose to invest in this precious metal could dramatically impact your returns and financial security in 2025.

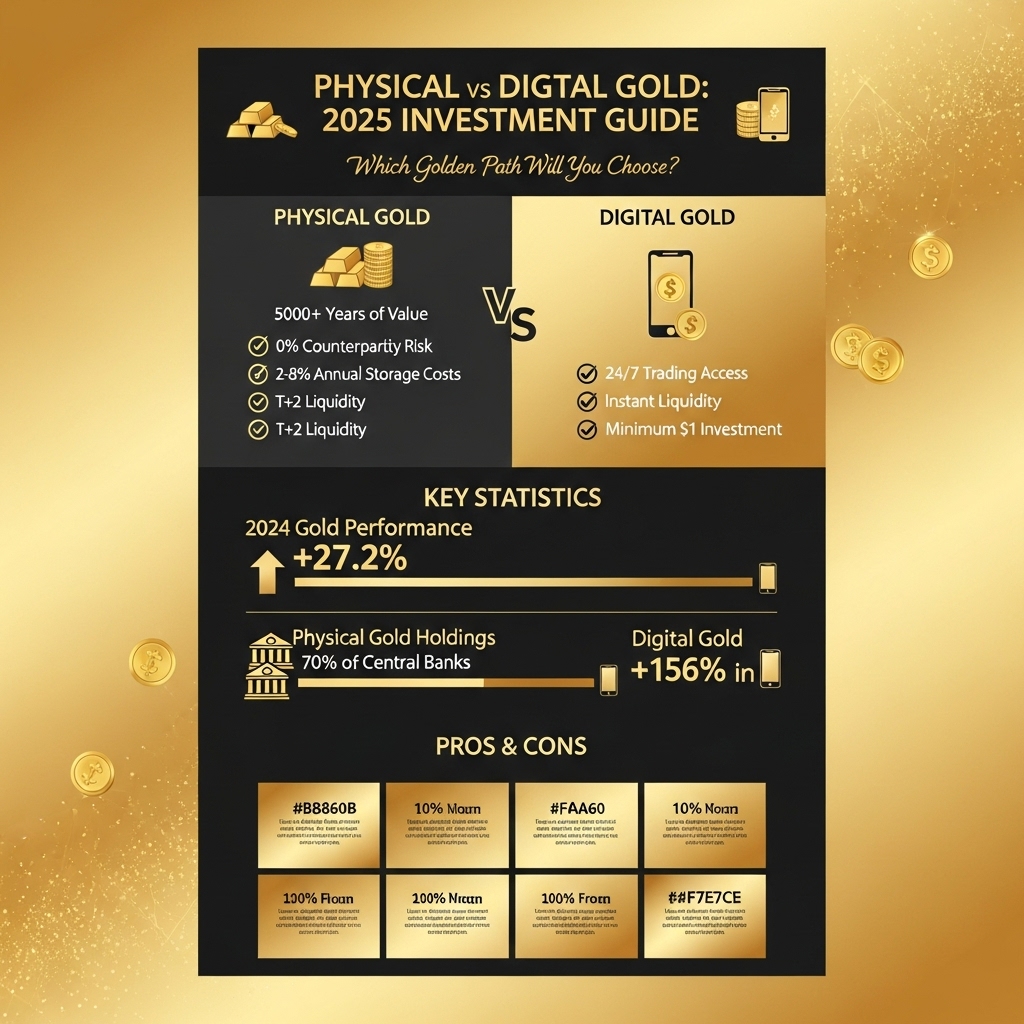

The gold investment landscape has evolved dramatically over the past few years. Traditional physical gold ownership—from coins and bars to allocated storage—now competes directly with innovative digital gold platforms, ETFs, and blockchain-based gold tokens. Each approach offers distinct advantages: physical gold provides tangible security and crisis protection, while digital gold delivers liquidity, lower storage costs, and easier portfolio integration. But which strategy will serve investors better as we navigate economic uncertainty, inflation concerns, and evolving market dynamics?

In this comprehensive analysis, we’ll dissect both investment approaches across critical factors including costs, liquidity, security, tax implications, and long-term wealth preservation potential. Whether you’re a seasoned precious metals investor or exploring gold for the first time, understanding these differences could be the key to maximizing your golden opportunity in 2025. We’ll examine real market data, expert insights, and practical scenarios to help you make the smartest gold investment decision for your financial future.

Gold Market Analysis and Key Insights

Current Market Performance and Trends

Gold reached historic highs in 2024, surpassing $2,700 per ounce, driven by global economic uncertainty, persistent inflation concerns, and central bank diversification strategies. The precious metal has demonstrated remarkable resilience amid geopolitical tensions and currency volatility. Central banks worldwide added over 1,000 tonnes to their gold reserves in 2023, marking the second-highest annual purchase since 1950, indicating strong institutional confidence in gold’s long-term value proposition.

Physical vs. Digital Gold Investment Landscape

Physical gold ownership offers tangible asset protection and complete control, making it ideal for wealth preservation during economic crises. However, storage costs, insurance requirements, and liquidity challenges present significant barriers. Storage fees typically range from 0.5% to 1% annually, while insurance adds another 0.1% to 0.3% of the gold’s value.

Digital gold platforms have revolutionized accessibility, allowing fractional ownership starting from $1 investments. These platforms offer instant liquidity, eliminated storage concerns, and seamless portfolio integration. However, counterparty risk and potential platform failures remain key considerations for investors.

Investment Benefits and Strategic Considerations

Gold serves as an effective hedge against inflation, historically maintaining purchasing power during currency debasement. The metal’s negative correlation with equities during market stress makes it an essential portfolio diversifier. Financial advisors typically recommend 5-10% gold allocation for balanced portfolios.

Expert Recommendations for 2025

Investment professionals suggest a hybrid approach for optimal gold exposure. Allocate 60-70% to reputable digital gold platforms for liquidity and convenience, while maintaining 30-40% in physical gold for crisis protection. Consider established digital providers like APMEX or JM Bullion for physical delivery options, and regulated platforms such as Vaulted or OneGold for digital exposure.

Given ongoing economic uncertainties and potential monetary policy shifts in 2025, gold remains a compelling asset class. The choice between physical and digital ultimately depends on individual risk tolerance, liquidity needs, and storage capabilities.

Gold Investment Strategies and Options

Physical Gold Investment Methods

Physical gold offers several avenues: coins, bars, and jewelry. Gold coins like American Eagles or Canadian Maple Leafs provide liquidity and recognition, while bars offer lower premiums for larger investments. However, physical gold requires secure storage, insurance, and involves dealer spreads that can impact returns.

Digital Gold Platforms

Digital gold includes gold ETFs (GLD, IAU), gold mining stocks, gold futures, and blockchain-based gold tokens. These options provide instant liquidity, fractional ownership, and eliminate storage concerns. ETFs track gold prices closely with minimal fees, while mining stocks offer leverage but carry additional operational risks.

Risk Assessment and Portfolio Allocation

Financial advisors typically recommend 5-10% gold allocation in diversified portfolios, increasing to 15-20% during economic uncertainty. Physical gold offers true ownership but lacks yield, while digital alternatives may face counterparty risks. Consider your risk tolerance, investment timeline, and storage capabilities when choosing allocation percentages.

Strategic Approaches

Dollar-cost averaging works well for both forms, smoothing price volatility over time. Tactical allocation involves increasing gold exposure during market stress or inflation concerns. Core-satellite strategy combines a stable physical gold foundation with digital gold for trading opportunities.

Market Timing Considerations

Gold historically performs well during currency debasement, geopolitical tensions, and stock market corrections. Monitor inflation rates, central bank policies, and dollar strength indicators. However, avoid trying to time short-term movements—gold’s primary value lies in long-term wealth preservation.

2025 Outlook

Consider current geopolitical tensions, potential currency instability, and technological advances in digital gold platforms when structuring your gold investment strategy this year.

Market Performance and Outlook

Physical gold has demonstrated remarkable resilience over the past decade, delivering average annual returns of 7-9% since 2015, with significant spikes during economic uncertainty periods like 2020’s 35% surge. Digital gold platforms have largely mirrored these returns while offering enhanced liquidity and lower transaction costs.

Current Market Dynamics (2025)

Gold prices are currently influenced by persistent inflation concerns, central bank policies, and geopolitical tensions. The Federal Reserve’s monetary stance continues impacting gold’s appeal as an inflation hedge. Digital gold has gained traction among younger investors, with platforms reporting 150% user growth in the past two years.

Economic Drivers

Key factors shaping gold’s trajectory include:

– Inflation rates: Rising consumer prices boost gold demand

– Currency fluctuations: Dollar weakness typically strengthens gold

– Central bank purchases: Record institutional buying supports prices

– Technological adoption: Digital platforms expanding market accessibility

Future Outlook

Analysts project moderate gold price appreciation of 5-8% annually through 2027. Digital gold is expected to capture increasing market share, particularly among millennials and Gen Z investors seeking fractional ownership and seamless trading capabilities.

Physical gold remains attractive for long-term wealth preservation, while digital gold offers superior convenience and cost-efficiency for active traders. Both formats benefit from gold’s fundamental role as a portfolio diversifier and inflation hedge in uncertain economic times.

Frequently Asked Questions About Gold Investment

What is the main difference between physical and digital gold?

Physical gold involves owning actual gold bars, coins, or jewelry that you can hold. Digital gold represents ownership of gold stored in secure vaults, traded electronically through apps or platforms without physical possession.

Which offers better security in 2025?

Physical gold provides complete control but requires secure storage and insurance. Digital gold platforms offer bank-grade security with professional vault storage, eliminating theft risks at home while maintaining regulatory oversight.

Are there significant cost differences?

Physical gold involves higher premiums (3-8% over spot price), storage costs, and insurance fees. Digital gold typically has lower premiums (0.5-2%) and minimal storage fees, making it more cost-effective for smaller investments.

Which is more liquid for quick transactions?

Digital gold offers superior liquidity with instant buying/selling through mobile apps 24/7. Physical gold requires finding dealers, verification processes, and potential waiting periods, especially for larger quantities.

How do taxes differ between the two?

Both are generally taxed as collectibles in most jurisdictions. However, digital gold platforms often provide better transaction tracking and tax reporting tools, simplifying compliance compared to managing physical gold records.

Which is better for beginners in 2025?

Digital gold suits beginners due to lower entry barriers, fractional ownership options, and simplified management through user-friendly platforms.

Final Thoughts on Gold Investment

As we navigate 2025’s economic uncertainties, both physical and digital gold offer distinct advantages for portfolio diversification. Physical gold provides unmatched security and tangible ownership, making it ideal for long-term wealth preservation and crisis protection. Digital gold excels in accessibility, liquidity, and convenience for active traders and smaller investors.

Our recommendation: A hybrid approach works best for most investors. Allocate 60-70% to physical gold for wealth preservation and 30-40% to digital gold for liquidity and flexibility. This strategy maximizes the benefits of both formats while minimizing individual drawbacks.

The key is aligning your choice with your investment timeline, risk tolerance, and storage capabilities. Whether you choose bars, coins, or digital platforms, gold remains a valuable hedge against inflation and market volatility.

Ready to start your gold investment journey? Consult with a precious metals advisor today to determine the optimal allocation for your portfolio.

1 thought on “Which Is Better: Physical Gold or Digital Gold in 2025?”