The Psychology Behind Gold Buying in Indian Households

For generations, gold has shimmered not just as a precious metal but as a beacon of security for millions of Indian households. As global uncertainties and inflation fears push gold prices to new highs in 2024, Indian investors—both seasoned and new—are paying closer attention than ever to this timeless asset. Recent surges in demand reveal a fascinating pattern: even as digital investments grow and markets evolve, the allure of gold in India remains as magnetic as ever.

In this article, we delve deep into the psychological factors driving gold buying in Indian families. We’ll explore how cultural beliefs, emotional connections, and financial motivations intertwine in shaping investment choices. You’ll gain insights into the latest market trends, understand why gold stands strong amid economic volatility, and discover the unique financial and emotional benefits that make gold a staple in Indian wealth-building strategies.

Understanding the mindset behind India’s gold obsession isn’t just intriguing—it’s crucial for investors seeking smarter decisions. By decoding these psychological drivers, gold investors can anticipate market movements, align with long-standing traditions, and uncover hidden opportunities for growth and security. Whether you’re a long-time investor or considering your first gold purchase, this exploration will empower your investment journey with knowledge rooted in tradition and proven by markets.

Gold Market Analysis and Key Insights

Growing Demand and Market Trends

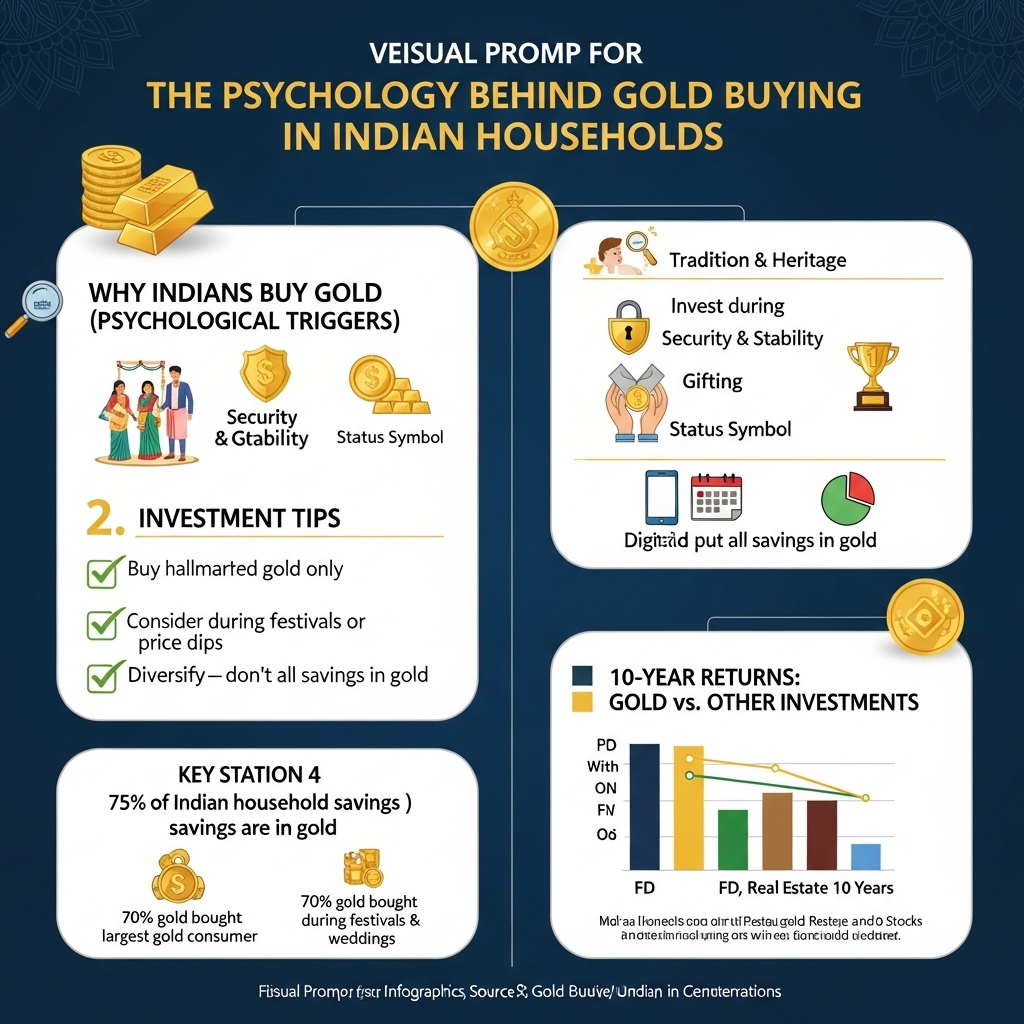

Gold remains an intrinsic part of Indian culture, with households collectively holding more than 25,000 tonnes of gold—the highest in the world, as per 2023 estimates by the World Gold Council. This demand surged recently, with Indian gold imports reaching over 800 tonnes in 2023, driven by wedding seasons, festivals, and heightened economic uncertainty. Notably, gold prices have consistently trended upward, peaking at over ₹63,000 per 10 grams in early 2024, making it an attractive investment proposition amid global inflation and rupee volatility.

Investment Benefits and Behavioral Drivers

For Indian households, gold is regarded not just as an ornament but as a secure, liquid asset—often considered a ‘safe haven’ during market volatility. Key psychological drivers behind gold investment include risk aversion, desire for financial security, and social status. Gold’s tangible nature appeals to families, providing intergenerational wealth transfer and serving as collateral for loans in times of need. Moreover, with increased financial literacy, younger investors are exploring gold ETFs, sovereign gold bonds, and digital gold products, diversifying beyond physical jewelry.

Considerations and Risks

Even as gold offers long-term appreciation and portfolio diversification, investors must weigh factors such as price volatility, making charges for jewelry, and storage costs for physical gold. Unlike equities or mutual funds, gold generates no income (like dividends), and gains are realized only upon sale. Government interventions, such as import duties and regulatory changes, can also impact prices and availability.

Expert Recommendations

Market experts suggest that gold should comprise 10–15% of a household’s investment portfolio, balancing safety and return. Diversifying across asset classes—physical gold, ETFs, and bonds—can mitigate risks. Experts also recommend purchasing during market corrections, festive offers, or through systematic investment plans (SIPs) in gold funds, thereby averaging costs and harnessing long-term value appreciation.

In sum, while gold investment remains deeply entrenched in Indian households, a balanced, informed approach is crucial to optimizing returns and managing associated risks.

Gold Investment Strategies and Options

Indian households have traditionally viewed gold as both a cultural asset and a financial safeguard. Modern investment strategies now offer an expanded array of options beyond physical gold, allowing investors to tailor their approaches based on risk tolerance, liquidity needs, and market outlook.

Gold Investment Options and Strategies:

The most common gold investment methods include physical forms like jewelry, coins, and bars, often preferred for their tangibility and sentimental value. However, pitfalls like making charges, storage risks, and lack of standardization persist. Alternatively, financial products such as Gold Exchange Traded Funds (ETFs), Sovereign Gold Bonds (SGBs), and digital gold provide exposure to gold’s price movements without the complications of handling physical gold. While ETFs offer liquidity and market tradability, SGBs additionally pay out annual interest, making them attractive for long-term holdings.

Risk Assessment and Portfolio Allocation:

In portfolio construction, gold acts as a diversifier, tending to perform well during market volatility or inflationary periods. Financial planners often suggest allocating 5–15% of a diversified portfolio to gold, correlating the percentage with overall risk appetite. Conservative investors may prefer stable, government-backed options like SGBs, while those seeking quick entry and exit might opt for ETFs or digital gold platforms.

Comparison of Investment Methods:

Physical gold offers emotional and cultural satisfaction, but with issues of purity, theft, and liquidity. Financial products are safer, easily tradable, and free from such concerns, though they lack physical possession. Cost efficiency generally favors ETFs and SGBs over jewelry or coins due to lower overheads.

Market Timing Considerations:

Timing gold purchases can be challenging amidst fluctuating prices influenced by macroeconomic and geopolitical developments. Rupee-cost averaging—regularly investing fixed amounts—can help Indian households mitigate timing risks and benefit from long-term appreciation.

In essence, harmonizing traditional beliefs with modern instruments, risk assessments, and disciplined investment strategies can yield optimal outcomes for gold investors in India.

Market Performance and Outlook

Gold has historically played a dual role in Indian households: as a traditional store of value and an essential investment during uncertain times. Over the past two decades, gold prices in India have shown a robust upward trajectory, with an average annual growth rate of around 8-10%. Notably, during economic downturns, such as the global financial crisis of 2008 and the COVID-19 pandemic, gold prices surged, reflecting its status as a safe haven asset.

Currently, the Indian gold market is experiencing high demand, driven by cultural factors, persistent inflation, and currency volatility. In 2023, gold prices touched record highs, surpassing ₹60,000 per 10 grams in many cities, propelled by global uncertainties and strong domestic buying, especially during the wedding and festival seasons.

Looking ahead, the outlook for gold remains bullish. Analysts predict continued upward movement, underpinned by geopolitical tensions, elevated inflation, and a weaker rupee. Additionally, technological advancements—such as digital gold platforms—are likely to expand gold’s market accessibility and appeal among younger investors.

Economic factors like inflation, interest rates, and rupee-dollar fluctuations considerably influence gold prices in India. As global inflationary pressures persist and central banks pursue dovish monetary policies, gold is expected to retain its allure as a hedge and a symbol of financial security in Indian households.

Frequently Asked Questions About Gold Investment

What are the main psychological reasons Indian households buy gold?

Gold buying is deeply rooted in Indian culture due to its association with security, tradition, and social status. Families view gold as a symbol of wealth and prosperity, and it often plays a major role in rituals, weddings, and festivals. The sense of pride and emotional value attached to gold makes it more than just an investment.

How does gold provide a sense of financial security?

Gold is perceived as a ‘safe haven’ asset during economic uncertainty. Indian households invest in gold to protect their wealth from inflation, currency fluctuations, and changing market conditions. Owning physical gold gives a tangible assurance that wealth is preserved for emergencies.

Why do many prefer physical gold over digital gold?

Physical gold, such as jewelry, coins, and bars, provides emotional satisfaction and immediate usability. It can be touched, gifted, or pledged in times of need, which digital gold cannot replicate. Many also associate physical gold with family traditions and lasting legacy.

Is gold a good investment for long-term goals?

Gold is generally seen as a stable, long-term investment. It doesn’t provide regular income like stocks but serves as an effective portfolio diversifier and wealth preserver. Over generations, Indian families have relied on gold to safeguard assets and pass on wealth.

What concerns should investors keep in mind when buying gold?

Investors should consider factors like purity (hallmark certification), making charges, storage safety, and resale options. Understanding the difference between investment-grade gold and ornamental gold is important, as jewelry often involves higher costs and lower resale value due to making charges.

Final Thoughts on Gold Investment

In summary, gold buying in Indian households is deeply rooted in cultural traditions, emotional significance, and a desire for financial security. Understanding these psychological factors can help investors make more informed decisions and recognize gold’s enduring appeal beyond its monetary value. For those considering adding gold to their portfolios, it remains a reliable hedge against inflation and economic uncertainty, while also fulfilling sentimental and societal purposes. As you navigate your investment journey, blend your emotional motivations with practical strategies for a balanced approach. Are you ready to leverage the unique power of gold in your financial planning? Start by evaluating your goals and exploring the right gold investment options today—your future self will thank you!