Gold Melt Value Calculator Your Accurate Pricing Guide

A gold melt value calculator tells you the raw, intrinsic value of your gold items. It’s a powerful tool that strips away any value from design, branding, or sentiment and focuses purely on what the gold itself is worth based on its weight and purity.

This is the number you need to know for scrap gold, think broken jewelry, single earrings, or tangled chains, before you even think about selling.

Why You Need a Gold Melt Value Calculator

Ever stared at a drawer of old, mismatched, or broken gold jewelry and wondered, “What is this stuff actually worth?” You can’t wear it, but the precious metal it’s made from still holds real, tangible value. This is where a gold melt value calculator becomes your best friend, helping you uncover the hidden cash in items you have long forgotten.

Imagine you have a beautifully carved antique chair. The chair’s market price is a mix of craftsmanship, history, and design. But its “melt value” is just the price of the raw lumber it’s made from. A gold calculator does the exact same thing, it ignores the artistry and memories to give you the fundamental worth of the gold alone.

Who Benefits from Knowing Melt Value?

This isn’t just a niche tool for one type of person. Anyone who handles gold, from individuals to professionals, relies on this core calculation. It provides a clear, data driven starting point for any valuation.

- Individuals: If you’re finally cleaning out that jewelry box, a calculator gives you an instant, no nonsense idea of your potential payout. No guessing required.

- Investors: Anyone holding gold bullion, coins, or even scrap as part of a portfolio can use it to track the real time value of their physical assets.

- Jewelers and Pawn Shop Owners: Professionals use these calculations every single day to make fair, profitable, and consistent offers to customers.

Setting a Realistic Baseline for Selling

Here’s the most important reason to use a gold melt value calculator: it arms you with knowledge before you talk to a buyer. By calculating the melt value first, you establish a factual baseline. This number represents the 100% market value of the raw gold in your items.

When you know your gold’s melt value, you walk into any negotiation with confidence. You can instantly spot a fair deal from a lowball offer, all because you did your homework.

A buyer might offer you anywhere from 70% to 95% of the melt value. They have to cover their own costs for refining, testing, and running their business. Knowing that 100% figure allows you to understand their offer in context. Without it, you’re just guessing whether their price is reasonable. This simple calculation is your first and most critical step toward getting a fair price for your precious metal.

Understanding the Gold Melt Value Formula

Behind every great gold melt value calculator is a surprisingly simple formula. It’s not magic, just a logical process that combines a few key variables to figure out your gold’s raw worth. Getting a handle on these components is the first step toward seeing your gold items not just as old jewelry, but as the valuable assets they truly are.

At its core, the calculation stands on three pillars: the current market price of gold, the purity of your specific item, and its exact weight. Think of it like a recipe. Each ingredient has to be measured precisely for the final dish to come out right. If you miss one, or get one wrong, the final value could be way off.

Each piece of this puzzle plays a distinct and crucial role, from global market dynamics all the way down to the tiny stamp on your jewelry clasp. Let’s break these elements down one by one.

The Role of Gold Spot Price

The spot price of gold is the live, up to the minute market price for one troy ounce of pure, 24 karat gold. This price is the foundation of every single calculation. It’s always in flux, changing throughout the day based on global supply and demand, economic news, and investor sentiment.

A reliable gold melt value calculator has to pull this data from a live feed to give you an accurate estimate. A price that’s even a day old could be outdated, which is why a real time calculator is essential for getting a true snapshot of your gold’s current worth.

For example, large scale purchases by central banks can significantly influence this price. According to the World Gold Council, central banks bought a net total of 1,037 tonnes of gold in 2023, just shy of the record set in 2022. This kind of sustained demand from major players strengthens gold prices, which directly affects the value you see in a gold melt value calculator.

This infographic shows how a calculator uses these inputs to determine the value of all sorts of gold items.

As you can see, it doesn’t matter if you have broken jewelry, gold bars, or even dental gold, the calculator processes each item using the same core valuation principles.

Purity and Weight: The Personal Factors

While the spot price is the same for everyone, the next two components are specific to your item: its purity (karat) and its weight. Gold purity is just a measure of how much actual gold is in your item versus other metal alloys. We typically measure this in karats.

Pure gold is 24 karats (24K), which is 99.9% pure. The thing is, 24K gold is way too soft for most jewelry, so it’s mixed with other metals like copper, silver, or zinc to make it more durable.

Here’s a quick breakdown of common karat values and what they mean in terms of purity:

- 18 Karat (18K): This is 75% pure gold (18 parts gold, 6 parts alloy).

- 14 Karat (14K): This is 58.3% pure gold (14 parts gold, 10 parts alloy).

- 10 Karat (10K): This is 41.7% pure gold (10 parts gold, 14 parts alloy).

Finally, the weight of your item is measured precisely, usually in grams or troy ounces. A calculator takes this weight, multiplies it by the purity percentage to find the amount of pure gold, and then multiplies that by the current spot price. For a deeper dive into how it all works, you can explore our detailed guide on the gold calculation formula. This clear, step by step process removes all the guesswork, giving you a transparent value based entirely on data.

A Practical Guide to Using the Calculator

Alright, now that you know the ingredients that go into your gold’s value, it’s time for the fun part: plugging those numbers into a gold melt value calculator. The whole process is surprisingly simple and takes just a few moments. We’ll walk through it step by step to make sure you get a fast, accurate estimate with total confidence.

The goal is to give the tool just two key pieces of information about your gold item, its weight and its purity. With those two inputs, the calculator does all the heavy lifting by pulling the live spot price and running the formula for you. Think of it like giving a contractor the basic dimensions of a room; they can then figure out the total square footage for you.

Step 1: Weigh Your Gold Item

First things first, you need to get an accurate weight for your gold. You don’t need a fancy lab grade scale for this; a standard digital kitchen scale or a small jewelry scale will work just fine. Precision is key here, so make sure the scale is zeroed out before you place your item on it.

A crucial point: be sure to weigh only the gold parts. If your item has gemstones or other non gold elements, their weight will inflate the measurement and throw off the valuation. If you can’t remove them, a professional jeweler can help you estimate the gold’s net weight.

For the most accurate result, use grams as your unit of measurement. While our calculator supports various units, grams are the industry standard for jewelry and provide the fine detail needed for a correct calculation.

Step 2: Find the Karat Marking

Next up, you need to figure out your gold’s purity, which is usually stamped directly onto the item. This tiny marking, called a hallmark, tells you what percentage of pure gold is in your piece. You’ll want to look closely in a well lit area, as these stamps can be very small.

You’ll typically find them on the clasp of a necklace, the inner band of a ring, or the post of an earring. The markings might show up in two common ways:

- Karat Value: Look for a number followed by “K” or “KT,” such as 10K, 14K, or 18K.

- Fineness Number: You might see a three digit number like 417 (for 10K), 585 (for 14K), or 750 (for 18K). This number represents the gold’s purity in parts per thousand.

This table breaks down the most common markings you’ll run into and what they actually mean.

| Karat Value | Fineness Stamp | Percentage of Pure Gold |

|---|---|---|

| 10 Karat | 417 | 41.7% |

| 14 Karat | 585 | 58.3% |

| 18 Karat | 750 | 75.0% |

| 22 Karat | 916 | 91.6% |

| 24 Karat | 999 | 99.9% |

If you can’t find a marking, don’t sweat it. Your item might still be gold. A professional jeweler can do a quick acid test to determine its exact purity for you.

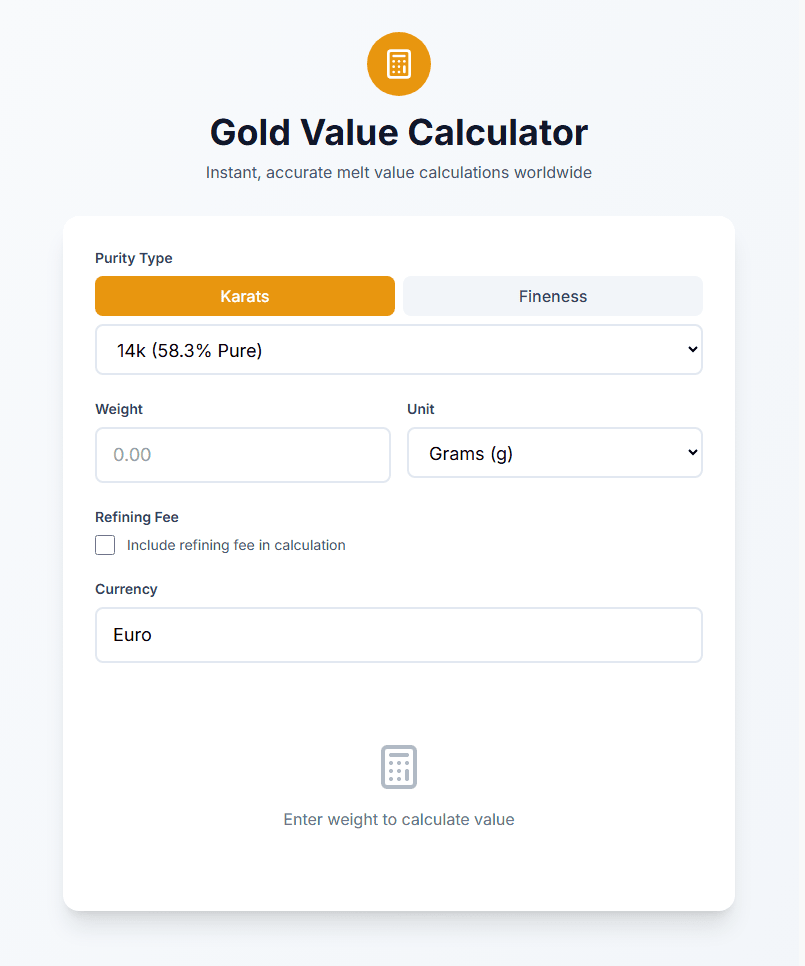

Step 3: Enter Your Data into the Calculator

With your weight and purity info in hand, you’re ready to use the online gold melt value calculator. The interface is designed to be completely straightforward and easy to use.

The screenshot at the end of this article shows the simple layout of TheGoldCalculator.com, with clear fields for each piece of data.

As you can see, you just select the gold purity from the dropdown menu, choose your unit of weight, and type in the number from your scale.

Once you pop in your information, the calculator instantly gives you the real time melt value of your gold based on the current market price. This whole process, from weighing your item to getting your final estimate, often takes less than a minute. You’re now armed with a powerful piece of information, giving you a clear starting point for any potential sale.

Decoding Gold Purity, Karats, and Weight

When you’re ready to use a gold melt calculator, there are two crucial details you’ll need to get right: your item’s purity and its weight. Nailing these two numbers is the absolute foundation for getting a valuation you can trust. Let’s break down exactly what these measurements mean so you can feel confident about the numbers you’re plugging in.

Think of it like making a cup of coffee. You need to know both how much coffee to use (the weight) and how strong it is (the purity). Both are equally important for the final result. For gold, getting both weight and purity right ensures your calculation is spot on.

Understanding Gold Purity and Karats

Gold in its purest form, known as 24 karat (24K), is surprisingly soft. It’s too delicate for most everyday jewelry, which is why it’s usually mixed with stronger metals like copper, silver, or zinc. This blend is called an alloy, and the karat system is a simple way of telling us how much pure gold is in that mix.

The system works on a scale of 24 parts. For example, 14K gold means the item is made of 14 parts pure gold and 10 parts other metals. This ratio is everything when it comes to melt value because the calculation only considers the amount of pure gold in your item.

The higher the karat number, the more pure gold your item contains, and the higher its melt value will be. An 18K ring of the same weight will always be worth more than a 10K one.

To make this even clearer, we can translate karats into simple percentages. This percentage is called “fineness”, and you’ll often see it stamped on gold as a three digit number. For example, 18K gold is 75% pure, so its fineness stamp is “750.” You can learn more about how these levels affect durability and appearance by exploring the difference between 14k, 18k, and 24k gold.

To help you quickly identify what you have, here’s a guide to the most common karat values you’ll likely find on your jewelry.

Gold Karat Purity and Fineness Guide

This table breaks down common gold karat purities, their percentage of pure gold (fineness), and typical uses, helping you identify your item’s value.

| Karat Value | Fineness (Percentage Pure Gold) | Commonly Used For |

|---|---|---|

| 10K | 41.7% (Stamped “417”) | Durable and affordable jewelry like class rings or items for daily wear. |

| 14K | 58.3% (Stamped “585”) | The most popular choice for fine jewelry in the U.S., offering a great balance of durability and gold content. |

| 18K | 75.0% (Stamped “750”) | A popular standard for high end jewelry in Europe, with a rich, yellow hue. |

| 22K | 91.6% (Stamped “916”) | Very soft and often used for intricate jewelry in Eastern cultures and for some investment coins. |

| 24K | 99.9% (Stamped “999”) | Pure gold, primarily used for investment grade bullion bars and coins. |

This simple chart is a great starting point for figuring out just how much gold is in your piece before you even get to the scale.

The Critical Importance of Accurate Weight

Once you have figured out the purity, the next step is getting an accurate weight. When you’re dealing with precious metals, every single gram matters. A tiny miscalculation can throw off the final value, especially with heavier pieces.

The most common units you’ll see are grams and troy ounces. While a standard “food” ounce is 28.35 grams, a troy ounce, the industry standard for gold, is roughly 31.1 grams. That’s almost a 10% difference, which is huge! Most gold calculators let you choose your unit, but grams are the typical go to for weighing jewelry.

For the best results, use a calibrated digital kitchen or jewelry scale. One last tip: make sure you’re only weighing the gold. If your item has gemstones or other non gold parts, their weight needs to be subtracted to get the net weight of the gold. This ensures the calculator is only pricing the precious metal, giving you a true estimate of its melt value.

What Goes Into Your Gold Valuation? Getting an Accurate Picture

Think of a gold melt value calculator as the perfect starting point, a tool that gives you a quick, data driven estimate of what your gold is worth. But it’s crucial to know that the number you see is a “perfect world” figure. A handful of real world factors come into play, and understanding them will help you set realistic expectations for what a buyer will actually offer.

The calculator provides the gross melt value, which is essentially 100% of your item’s raw material worth based on live market prices. This is your baseline. The final check you get will almost always be a percentage of this number, and the factors below explain why.

The Ever Changing Price of Gold

The single biggest variable in your gold’s value is the live spot price. This price isn’t set in stone; it’s constantly in motion, reacting to global economic news, investor sentiment, and geopolitical shifts. A calculator using data that’s even a few hours old can throw off your valuation.

Just look at recent market trends. Gold prices have been on a significant upward trend, with an average price of $2,075 per ounce in 2023. This movement is driven by factors like economic uncertainty and central bank purchases. These kinds of market swings are exactly why any reliable calculator must pull from a frequently updated price feed to give you a number you can trust.

The Human Element: Purity and Weight

While the calculator does all the heavy lifting on the math, its output is only as good as the information you feed it. The two most critical inputs are your gold’s purity (karat) and its weight. A simple mistake in either of these can dramatically skew the result.

Your calculator’s output is a direct reflection of your input. Ensuring your weight and purity measurements are as precise as possible is the best way to get a trustworthy estimate.

For example, if you weigh a 14K ring but accidentally select 18K in the calculator, you’ll inflate its value by nearly 30%. Likewise, an inaccurate scale can easily add or subtract dollars from the final figure. If you’re ever in doubt about an item’s authenticity or karat, it’s always smart to have it professionally checked. For a head start, our guide on how to test gold purity has some useful tips.

From Melt Value to Payout: What Buyers Deduct

This is maybe the most important concept to get your head around: the difference between the calculated melt value and a buyer’s offer. The number on your screen is the total market value of the pure gold in your item. But a buyer, whether it’s a local pawn shop or a large online refiner, is running a business with overhead.

Here’s a look at the typical deductions that bridge the gap between that shiny melt value and the cash in your hand:

| Deduction Type | Why It’s Deducted and How It Affects Your Payout | Typical Percentage Range |

|---|---|---|

| Buyer’s Margin | This is the buyer’s profit. It covers their operating costs like rent, staff, insurance, and marketing. | 5% to 20% |

| Refining Fees | This is the cost to actually melt your item down and purify the gold back to its 24K state. | 1% to 5% |

| Assaying Costs | A small fee for professionally testing and verifying the exact purity of your gold before it’s melted. | Often bundled into the margin |

| Total Deduction | The combined percentage a buyer will likely subtract from the spot melt value to arrive at their offer. | 5% to 30% |

Understanding this structure gives you power. A fair offer from a reputable buyer will generally land somewhere between 70% and 95% of the melt value you calculated. Knowing this helps you spot a good deal and walk away from a bad one with confidence.

Common Questions About Gold Melt Value

Once you’ve plugged your numbers into a gold melt value calculator, you’ll have a solid figure in hand. But it’s completely normal for that number to spark a new round of questions. An initial valuation is a great start, but what does that number really mean when it’s time to sell? This section is here to clear up the most common questions that come up after you get your estimate.

We’ll bridge the gap between the calculator’s result and what you can actually expect in the real world. From understanding a buyer’s offer to figuring out what to do with unmarked pieces, these answers will give you a much clearer picture of the road ahead.

Is Melt Value What a Pawn Shop Will Offer?

This is easily the most common question we get, and the short answer is no. A gold melt value calculator gives you the 100% intrinsic market value of the pure gold in your item. It’s best to think of this as the “sticker price” for the raw material itself.

A pawn shop, jeweler, or online gold buyer is a business, and like any business, they have overhead. To cover their costs for testing, melting, refining, and to make a profit, they have to purchase gold for less than its full market value. Their offer will always be a percentage of the total melt value, not the full amount.

A fair offer typically lands between 70% and 95% of the calculated melt value. Where an offer falls in that range depends on the buyer’s business model, how much gold you’re selling, and the day’s market conditions.

So, if the calculator shows your gold’s melt value is $500, a realistic offer would be somewhere in the $350 to $475 range. An offer below that is probably a lowball, and one at or near the full melt value is practically unheard of. Knowing this helps you manage your expectations and spot a fair deal.

How Can I Test Gold Purity If It Is Not Marked?

Finding a piece of jewelry with no hallmark or stamp can be a head scratcher. It might still be real gold, but the lack of a marking means you’ll need to do a little detective work. A few simple at home tests can give you a clue, but just remember, they aren’t foolproof.

The magnet test is a great first step. Gold isn’t magnetic, so if your item snaps firmly to a strong magnet, it’s almost certainly not real gold or has very low gold content. Another quick visual check is to look for discoloration, especially around the edges where plating might have rubbed off. If you see a different colored metal underneath, you’re likely looking at a plated item.

For more reliable results, you have a couple of solid options:

- Acid Test Kits: You can buy these online. The process involves making a tiny scratch on a test stone and applying a drop of nitric acid to see how the metal reacts. Different acids correspond to different karats.

- Professional Testing: This is the most accurate method by far. A jeweler or precious metals dealer can use an XRF (X ray fluorescence) scanner, which analyzes the item’s exact metallic makeup without damaging it.

While home tests are useful for a quick check, getting a professional opinion is always the best move for unmarked items before you decide to sell.

Does This Calculator Work for Gold Coins?

Yes and no. A gold melt value calculator will perfectly determine the value of the gold content of the coin, which is known as its bullion value. For common bullion coins like the American Gold Eagle or Canadian Maple Leaf, their value is almost entirely tied to their gold weight, making the melt value extremely relevant.

However, many gold coins are worth far more than just their weight in gold. This extra value comes from factors the calculator simply can’t measure.

It’s absolutely critical to understand the difference between a coin’s scrap value and any premium value it might carry.

Factors Beyond Melt Value for Coins

This table breaks down what gives a coin value beyond its raw metal.

| Value Type | Description | Example |

|---|---|---|

| Bullion Value | The base value of the coin’s precious metal, which a gold melt value calculator determines. | A one ounce American Gold Eagle contains one troy ounce of pure gold. |

| Numismatic Value | The value a coin holds for collectors, based on rarity, historical importance, condition, and demand. | A rare 1933 Double Eagle coin fetched over $18 million, while its gold was worth less than $2,000. |

| Premium | The amount over the spot price a buyer will pay, covering minting, distribution, and dealer costs. | Bullion coins usually have a small premium of 3% to 8% over their melt value. |

So, while our calculator is ideal for scrap gold and provides a solid baseline for bullion coins, it should never be the final word for potentially collectible coins. If you think your coin might be rare or have numismatic value, get it appraised by a professional coin dealer before even thinking about selling it for its melt value alone.

Ready to discover the true value of your gold with a tool trusted by thousands? At Gold Calculator, we provide a free, real time calculator that gives you an accurate and transparent estimate in seconds. Empower yourself with knowledge before you sell. Visit TheGoldCalculator.com to get your instant valuation now!