Understanding the Gram of Gold Price and How to Calculate Its True Value

Thinking of selling some old jewelry? If so, the price per gram of gold is the single most important number you need to get your head around. It’s the basic building block for valuing everything from a tiny earring to a heavy gold chain. It’s the raw, baseline worth of the metal itself. Understanding this helps you know exactly what your items are worth.

How the Price Per Gram of Gold Is Really Determined

To get to the price per gram, you first have to start with something much bigger: the live spot price of gold. This is the global benchmark price for one troy ounce of pure, 24 karat gold, and it’s constantly shifting based on what’s happening in international markets. You can think of it as the wholesale price before any other factors come into play.

But here’s the thing, nobody weighs a ring in troy ounces. That unit is for big bars in a vault. Your jewelry is weighed in grams, a much smaller and more practical unit for everyday items.

Since a troy ounce is significantly heavier than a gram, one troy ounce equals exactly 31.1035 grams, we need to break that big price down into a smaller one. This simple conversion is what gives us the fundamental price per gram of gold.

From Global Markets to Your Jewelry Box

The journey from a massive global market price to the value of the piece in your hand is pretty straightforward once you see the steps. It all starts with the live spot price.

First, the global standard for large scale bullion trading is the spot price, which is always quoted in troy ounces. For jewelry, however, grams are the standard for weighing smaller, more personal items like necklaces, rings, and bracelets. To find the price for a single gram of pure, 24k gold, all you have to do is divide the live spot price by 31.1035.

The melt value of a single gram of gold is the key metric for anyone looking to sell old or scrap jewelry. For example, if the spot price is $2,300 USD per troy ounce, the math works out to roughly $73.95 USD per gram.

Why This Actually Matters to You

Getting a grip on this starting point is crucial. It pulls back the curtain on the whole valuation process, showing you that the price isn’t just some random number a buyer pulls out of thin air. It’s based on a transparent, global figure that you can check yourself.

This basic knowledge is incredibly empowering. It helps you understand any quote you’re given and gives you the confidence to know what your gold is really worth. If you want to dive deeper, you can learn more about how to determine how much gold is worth today in our detailed guide.

From Troy Ounces to Grams: A Simple Conversion Guide

When you first start looking up the price of gold, you’ll see it quoted almost everywhere per troy ounce. This can be a little confusing since most of us think in the standard ounces we use for groceries. But in the world of precious metals, the troy ounce is the undisputed king.

Think of it like the difference between miles and kilometers. They both measure distance, but you absolutely need to know which one you’re using to get an accurate picture. The troy ounce is slightly heavier than a regular ounce, and getting your head around this is the very first step to valuing your gold correctly. You can learn more about the specific differences in our detailed explainer on the gold troy ounce vs a regular ounce.

Since the jewelry you own is weighed in grams, you need a simple way to translate that big troy ounce price into a smaller, more practical per gram price.

The Magic Number for Gold Conversion

Luckily, converting the price per troy ounce to the price per gram is surprisingly simple. You just need one key number to make it all work.

One troy ounce is equal to exactly 31.1035 grams. This isn’t just a close guess; it’s the precise, internationally recognized standard used for weighing precious metals.

This number is your bridge, connecting the global market price to the real value of the gold you’re holding in your hand. With it, you can take any live gold price and break it down into a number that makes sense for your jewelry.

The formula is incredibly straightforward: just divide the spot price per troy ounce by 31.1035. The result is the current market value for a single gram of pure, 24 karat gold.

Putting the Formula into Action

Let’s walk through a quick example to see just how easy this is. Imagine the live spot price of gold is $2,300 per troy ounce.

First, start with the spot price of $2,300.00. Next, divide by the magic number: $2,300.00 / 31.1035. This will give you the price per gram, which is approximately $73.95 per gram.

This simple bit of math instantly tells you the base value for one gram of pure gold. The table below shows a few more examples to illustrate how the per gram value shifts with the spot price.

| Spot Price (per Troy Ounce) | Calculation | Price Per Gram (Approximate) |

|---|---|---|

| $2,250 | $2,250 / 31.1035 | $72.34 |

| $2,350 | $2,350 / 31.1035 | $75.55 |

| $2,400 | $2,400 / 31.1035 | $77.16 |

Mastering this single step is fundamental. It gives you the true starting point for your gold’s value before other critical factors, like its purity, are even considered.

Understanding How Purity (Karat) Impacts Value

The price per gram for pure gold is our starting line, but it’s not the finish line. The single most important factor that determines what your gold jewelry is actually worth is its purity, which we measure in karats.

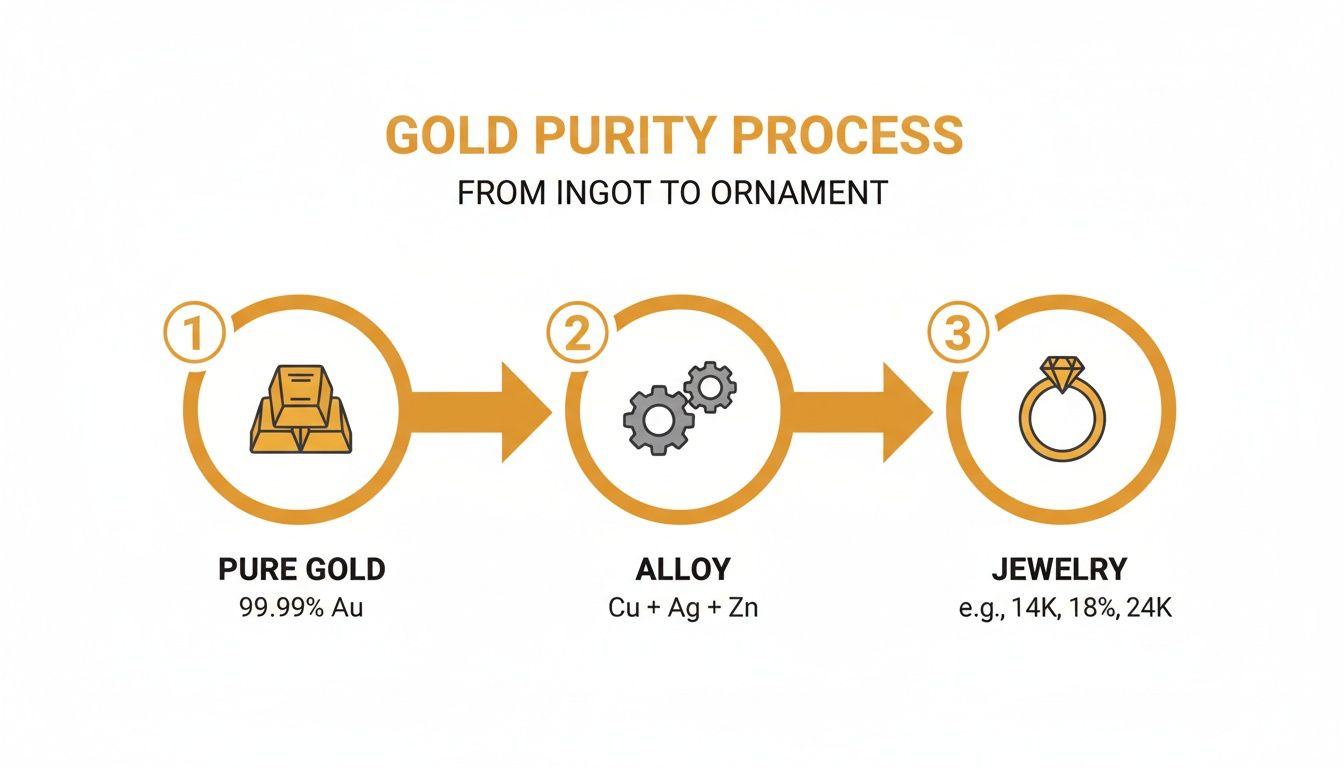

You’ll almost never find jewelry made from pure, 24 karat gold. Why? Because it’s just too soft for everyday wear. To solve this, jewelers mix pure gold with other metals, called alloys, to make it stronger and more durable. Think of it like mixing orange juice concentrate with water. Pure, 24K gold is the full strength concentrate, while alloys like copper, silver, or zinc are the water. The more water you add, the less “orangey” the juice becomes. The same principle applies to your gold.

What Karats and Fineness Really Mean

The karat system is just a simple way to describe how much pure gold is in your item. It’s a scale that goes up to 24, where 24 karats (24K) represents 100% pure gold. Most jewelry you’ll come across is made from 18K, 14K, or 10K gold.

Another way refiners and jewelers talk about purity is with a fineness mark. This is a three digit number stamped on the gold, which tells you the gold content in parts per thousand. For example, a stamp of “750” means the item is 750 parts pure gold out of 1,000, which is just another way of saying it’s 75% pure gold. This is the exact same purity as 18 karat gold. Getting familiar with these marks is a huge step, and you can learn more about finding them through various gold purity testing methods.

To make this crystal clear, here’s a quick chart that translates the most common karat marks into their actual pure gold content.

Gold Purity Conversion Chart From Karats to Fineness

Use this chart to quickly see the relationship between common gold Karat marks, their corresponding fineness numbers, and the actual percentage of pure gold in an item.

| Karat (K) | Fineness (Hallmark) | Pure Gold Percentage (%) |

|---|---|---|

| 24K | 999 | 99.9% |

| 22K | 916 or 917 | 91.7% |

| 18K | 750 | 75.0% |

| 14K | 583 or 585 | 58.3% to 58.5% |

| 10K | 417 | 41.7% |

As you can see, the connection between purity and value is direct and simple. A lower karat number means less pure gold, which directly translates to a lower price per gram for that item.

The karat stamp on your gold tells you the percentage of pure gold it contains. The value of your item is based only on this pure gold content, not the total weight of the piece.

Calculating Value Based on Purity

Let’s put this into practice with a real example. Imagine the spot price for a gram of pure 24K gold is $75.00. How does that change the value for a gram of 14K gold?

First, find the purity percentage. Looking at our chart, we see 14K gold is 58.5% pure gold. Next, convert the percentage to a decimal. To use this in a calculation, 58.5% becomes 0.585. Finally, multiply by the pure gold price: $75.00 per gram x 0.585 = $43.88 per gram.

And there you have it. A gram of 14K gold is worth significantly less than a gram of 24K gold because it contains much less of the precious metal. This simple multiplication is the core of how every gold buyer determines the base value of your items before factoring in any other fees.

A Step by Step Example of Calculating Gold Melt Value

Theory is great, but let’s get our hands dirty and see how these numbers actually work in the real world. We’ll walk through a common scenario from start to finish: figuring out the melt value of an old 14K gold necklace. This practical example will tie together everything we’ve covered about the price of gold per gram.

Let’s imagine you’ve found a 14K gold necklace in your jewelry box. You’ve popped it on a digital scale, and it weighs exactly 15 grams. A quick check online shows that the live spot price of gold is currently $2,350 per troy ounce.

That’s all we need. With these three little pieces of information, we can calculate its true melt value.

Step 1: Find the Price Per Gram of Pure Gold

First things first, that troy ounce price isn’t very helpful for weighing jewelry. We need to break it down into a price per gram. As we know, there are 31.1035 grams in a single troy ounce.

The math is simple: $2,350 / 31.1035 = $75.55 per gram.

This number, $75.55, is the baseline. It’s the going rate for one gram of pure, 24K gold on the open market right now. Every other calculation we do starts here.

This infographic gives a great visual of how pure gold is alloyed and turned into the jewelry we all know and wear.

As you can see, the final value is all about how much pure gold is left in the mix after other metals are added for strength and color.

Step 2: Adjust for the Purity of Your Gold

Now, our necklace is 14K, not pure 24K gold. This means we have to adjust the price to reflect its actual gold content. We know that 14K gold is 58.5% pure gold.

The math for this is $75.55 (price per gram of 24K) x 0.585 (14K purity) = $44.20 per gram.

So, the actual value of the gold in your 14K necklace is $44.20 per gram. This is a critical step that a lot of people miss, leading them to think their jewelry is worth much more than it is.

Step 3: Calculate the Total Melt Value

Okay, this is the easy part. We just multiply the per gram value of our 14K gold by the total weight of the necklace.

The math is as follows: $44.20 per gram x 15 grams = $663.00.

And there it is. $663.00 is the total melt value of your necklace. This figure represents the raw, intrinsic worth of the pure gold it contains, based on today’s live market price.

The melt value is the full market price of the gold in your item. The offer you receive from a gold buyer will be a percentage of this value, typically between 70% and 95%. This difference covers their costs for testing, refining, and business operations.

Of course, you can skip the manual math by using a tool like TheGoldCalculator.com. You just enter your item’s weight in grams, select its fineness, and you’ll see real time values in any currency you want.

Knowing what buyers typically pay (70% to 95% of the spot melt value) and understanding market history can give you a real edge in negotiations. For instance, remembering the 2011 peak near $2,000 per ounce (roughly $64 per gram) gives you context for today’s prices. You can explore more historical gold price charts over at BullionVault.com to get a better feel for market trends.

Why the Daily Price of Gold Is Always Changing

If you’ve ever tracked gold prices, you’ve noticed they’re anything but static. The price per gram moves every single day, sometimes every minute. This constant motion isn’t random; it’s the result of powerful global economic forces at work.

Think of gold as a global barometer for economic health. When the world feels uncertain, investors flock to gold. It’s what’s known as a ‘safe haven’ asset because it has a long history of holding its value, or even climbing, when other investments like stocks are in a nosedive.

Major world events can ripple through the markets and directly impact the value of the gold in your jewelry box. The 2008 financial crisis is a classic example. As stock markets crashed and people lost faith in the banking system, a wave of investors turned to gold, pushing its price to record highs.

Key Economic Drivers of Gold Prices

So, what’s actually pulling the levers behind the daily gram of gold price? A few major factors are constantly interacting, creating the price movements we see every day.

Inflation and interest rates are major drivers. When inflation kicks up, the value of cash like the US dollar starts to erode. Gold, on the other hand, tends to hold its ground, making it a popular shield against inflation. But there’s a flip side. When central banks raise interest rates to cool down inflation, savings accounts and bonds suddenly look more attractive because they pay you interest. Gold doesn’t, which can sometimes make it less appealing.

Geopolitical instability also plays a role. Wars, trade disputes, and political turmoil make financial markets nervous. During these shaky times, gold’s reputation as a stable and reliable store of value shines. Investors seeking security often pour money into gold, which drives demand and prices upward.

The strength of the US dollar has an impact as well. Gold and the US dollar have an inverse relationship. Because gold is priced in dollars all over the world, a weaker dollar makes gold cheaper for buyers holding other currencies. This often sparks a jump in demand, pushing the dollar price of gold higher.

Tracking the gram price of gold reveals its role as a currency warrior, heavily swayed by the mighty US dollar. When the greenback weakens, gold per gram becomes a bargain for global buyers, lifting demand and prices. You can see this clearly after the 2008 financial crisis when gold climbed from around $25.70 per gram to over $61 per gram by 2011. Explore more about these powerful market movements and view historical gold price data to see the trends for yourself.

This table breaks down how different economic scenarios typically influence the price of gold, giving you a clearer picture of these cause and effect relationships.

| Economic Condition | Typical Impact on Gold Price | Why It Happens |

|---|---|---|

| High Inflation | Rises | Gold is seen as a store of value when cash loses purchasing power. |

| Rising Interest Rates | Falls | High interest investments become more attractive than non yielding gold. |

| Global Uncertainty | Rises | Investors seek gold as a safe haven asset during turbulent times. |

| Strong US Dollar | Falls | Gold becomes more expensive for foreign buyers, reducing demand. |

Answering Your Top Questions About Gold Value

Once you start digging into the factors that determine the price of a gram of gold, a few practical questions always seem to surface. It’s one thing to understand the theory, but it’s another thing entirely when you’re actually holding a piece of gold and trying to figure out what it’s worth.

Let’s clear up some of the most common points of confusion. Think of this as the final check in to make sure you feel completely confident in what you’ve learned.

How Can I Weigh My Gold Accurately at Home?

For a quick, back of the napkin estimate, a digital kitchen scale can get you in the ballpark. But let’s be honest, those scales are designed for flour, not precious metals, and they often aren’t precise enough for something as valuable as gold.

For real accuracy, you need a dedicated jeweler’s scale that measures to at least a tenth of a gram. If you don’t have one, don’t sweat it. Any reputable jeweler or gold buyer will have a properly calibrated scale and should be more than happy to weigh your items for you, right on the counter where you can see it. Just make sure the scale is set to grams and reads zero before they place your item on it.

Why Is a Buyer’s Offer Always Lower Than the Spot Price?

This is probably the most crucial concept to grasp. The offer you get for your gold is based on the spot price, but it will never be 100% of that number. Why? Because gold buyers are running a business, and that comes with real costs.

Here’s what’s happening behind the scenes. Refining costs are a factor, as your old jewelry has to be melted down and purified to get to the pure gold. That process isn’t free. There are also assaying fees, as buyers pay experts to verify the exact purity of the gold they purchase. Operational overheads like rent, insurance, high level security, and employee salaries also must be considered. Finally, at the end of the day, a gold buyer has to make a profit to keep the lights on.

A fair offer from a legitimate buyer will typically land somewhere between 70% and 95% of your item’s melt value. That range is the industry standard and accounts for all the work and risk involved on their end.

The spot price is the live, “right now” price for an ounce of pure gold. A futures price is a price agreed upon today for gold that will be delivered later. When you’re selling scrap jewelry, the spot price is the only number that really matters.

Does the Brand or Condition of My Jewelry Affect the Price?

For most gold items, the simple answer is no. A buyer is interested in the intrinsic melt value, which boils down to just two things: its weight and its purity. A scratched up gold chain with a broken clasp is worth the same as a pristine one if they have the same weight and karat.

However, there’s a huge exception. If your item is a signed piece from a famous designer like Cartier, Tiffany & Co., or Van Cleef & Arpels, it could be worth far more than its weight in gold. The same goes for rare antiques or pieces with exceptional, one of a kind craftsmanship. In these cases, the item has resale value as a finished piece of jewelry, which can eclipse its melt value. It’s always smart to check for designer markings before you decide to sell for scrap.

Ready to skip the math and get an instant, accurate valuation for your gold? The free tool from Gold Calculator uses live market data to give you a transparent estimate in seconds. Just enter your gold’s weight and purity to see what it’s worth right now. Try the Gold Calculator today and sell with confidence.