How to Use a Gold Scrap Price Calculator Accurately

A gold scrap price calculator is an online tool that gives you a quick, reliable estimate of your gold’s melt value. It takes the three most important factors, weight, purity, and the live market price, and does the math for you in seconds. Think of it as your personal cheat sheet for understanding the raw value of your gold before you even think about selling.

What Is a Gold Scrap Price Calculator?

Imagine trying to sell a used car without knowing its Kelley Blue Book value. You would be flying blind, right? A gold scrap price calculator is the Kelley Blue Book for your old jewelry, broken chains, and dental gold. It decodes the complexities of the precious metals market, turning confusing numbers into a straightforward dollar amount.

Instead of guessing what your items are worth, you get a data driven estimate based on real time market information. This knowledge is your biggest advantage. It levels the playing field, helping you spot a lowball offer from a mile away and negotiate with the confidence that comes from knowing your numbers.

How the Calculation Works

Behind the scenes, the calculator is running a simple but powerful formula. It takes three key inputs and multiplies them together to determine the melt value, the baseline price of your gold if it were melted down into its pure form.

Here are the essential ingredients:

- Weight: How heavy your gold is. This is usually measured in grams, but can also be in troy ounces or pennyweights.

- Purity: The amount of actual gold in your item, identified by its karat stamp like 10K, 14K, or 18K.

- Live Spot Price: The up to the minute market price for one troy ounce of pure, 24K gold. This price changes all day long.

By putting these pieces together, the calculator delivers a transparent valuation instantly. For example, if you know you have 10 grams of 14K gold, the tool calculates how much of that is pure gold and multiplies it by the current market rate to give you a precise figure.

A gold scrap price calculator is not just a handy gadget; it is a tool for financial clarity. It pulls back the curtain on the valuation process, turning what could be a confusing transaction into a clear, manageable one.

Why This Value Is a Starting Point

It is crucial to understand that the number you see on the calculator is the 100% melt value, not the final check you will receive from a buyer. Gold buyers, from local jewelers to large scale refiners, need to cover their own costs and make a profit. Because of this, they will typically offer a percentage of the melt value, usually somewhere between 70% and 95%.

This margin covers the complex and costly process of assaying (testing), melting, and refining the gold back into its pure form. The percentage they offer often depends on how much gold you are selling and how competitive they are.

Let’s look at how the calculator’s estimate translates into a real world offer. We will use an example of 10 grams of 14K gold with a spot price of $2,300 per troy ounce.

| Metric | Calculation and Value |

|---|---|

| Pure Gold Content | 10g of 14K gold is 5.83g of pure gold (14/24). |

| Melt Value Estimate | This translates to approximately $431.15. |

| Typical Low Offer (70%) | A buyer might offer around $301.81. |

| Typical High Offer (95%) | A competitive buyer might offer up to $409.59. |

See the difference? The calculator gives you that all important benchmark of $431.15. With that number in hand, you can immediately tell if an offer of $300 is on the low end or if an offer of $400 is a fair deal. It transforms an uncertain negotiation into an informed conversation backed by solid data.

The Four Factors Driving Your Gold's Value

To get the most out of a gold scrap calculator, it really helps to know what is going on behind the scenes. Think of it like a chef's recipe, four key ingredients come together to create the final price. Once you understand each one, you can value your gold with the same confidence as a seasoned pro.

These four factors are the universal standard for figuring out melt value: the spot price, purity, weight, and the buyer's fee. Let's break down each one so you know exactly what drives that number you see on the screen.

1. The Live Spot Price of Gold

The spot price is the live, minute by minute market price for one troy ounce of pure, 24 karat gold. It is basically the stock price for gold, always shifting based on global supply and demand, economic news, and investor mood. This is the foundational number every other calculation is built on.

This price is set on major commodities exchanges, and it is the same for everyone, everywhere. A good gold scrap calculator pulls this live data straight from the market, making sure your estimate is always based on the most current information.

2. Purity: How Much Gold Is Actually in Your Item?

Very few gold items are actually 100% pure gold. Pure gold, known as 24 karat, is just too soft for most jewelry. To make it durable enough for everyday wear, it is mixed with other metals like copper, silver, or zinc. This mixture is called an alloy, and its gold content is measured in karats.

A karat is simply a unit of purity, representing 1/24th of the whole piece. For example, 14k gold means that 14 parts are pure gold and the other 10 parts are different metals. That works out to 58.3% pure gold. The higher the karat, the more pure gold is in your item, and the more it is worth.

To make this crystal clear, here is a quick rundown of common gold purities and how they stack up.

Gold Karat Purity and Fineness Comparison

This table shows the relationship between common gold karats, their percentage of pure gold, and their fineness number, helping you quickly identify an item's purity.

| Karat (K) | Percentage of Pure Gold | Fineness (Parts Per 1000) |

|---|---|---|

| 24K | 100% | 999 |

| 22K | 91.7% | 917 |

| 18K | 75.0% | 750 |

| 14K | 58.3% | 583 |

| 10K | 41.7% | 417 |

Knowing your item's karat is the first critical step for an accurate calculation. You can usually find it stamped on the piece as a tiny hallmark, like "14K" or the fineness number "583." If you are not sure what you are looking at, our guide on gold purity testing methods can walk you through it.

3. Weight: The Foundation of Value

Right after purity, weight is the next crucial piece of the puzzle. When it comes to precious metals, accuracy is everything. While you might weigh food in regular ounces, gold is measured in more precise units to make sure the valuation is fair.

The industry standards for weighing gold are:

- Grams (g): This is the most common unit you will see used for scrap gold jewelry.

- Troy Ounces (ozt): A measurement dating back to the Middle Ages, the troy ounce is the global standard for precious metals. One troy ounce equals 31.1 grams, making it a bit heavier than a standard ounce (28.35 grams).

- Pennyweight (dwt): Another unit you will run into, especially in the United States. There are 20 pennyweights in one troy ounce.

Because gold is so valuable, even a fraction of a gram can make a real difference in the final price. This is why using a properly calibrated jeweler’s scale is a must for getting an accurate weight before you start calculating.

4. The Buyer’s Percentage or Refining Fee

Finally, it is crucial to understand the difference between the melt value your calculator shows you and the actual offer you will get. No buyer is going to pay 100% of the spot price for scrap gold. They have real business costs, including the complex and expensive process of melting, assaying, and refining the gold back into its pure 24k form.

A buyer's offer, typically between 70% and 95% of the melt value, accounts for their refining costs, operational overhead, and profit margin. A trustworthy buyer will be transparent about their payout percentage.

This deduction is often called a refining fee or simply the "buyer's take." Your gold scrap price calculator gives you the 100% market value, which serves as your negotiation benchmark. Knowing this baseline number empowers you to size up offers and decide if you are getting a fair deal for your gold.

Calculating Gold Value With Real-World Examples

Theory is great, but let's get our hands dirty. Seeing the math in action with a few real world items is the best way to make sense of how gold's value is calculated. We will walk through how a gold scrap price calculator, or you, with a simple calculator, can turn a piece of jewelry into a clear dollar amount.

The core formula is surprisingly simple: (Weight) x (Purity Percentage) x (Spot Price).

To keep our examples grounded, we will use a realistic spot price of $2,350 per troy ounce. Since a troy ounce is 31.1 grams, that breaks down to a pure gold value of about $75.56 per gram.

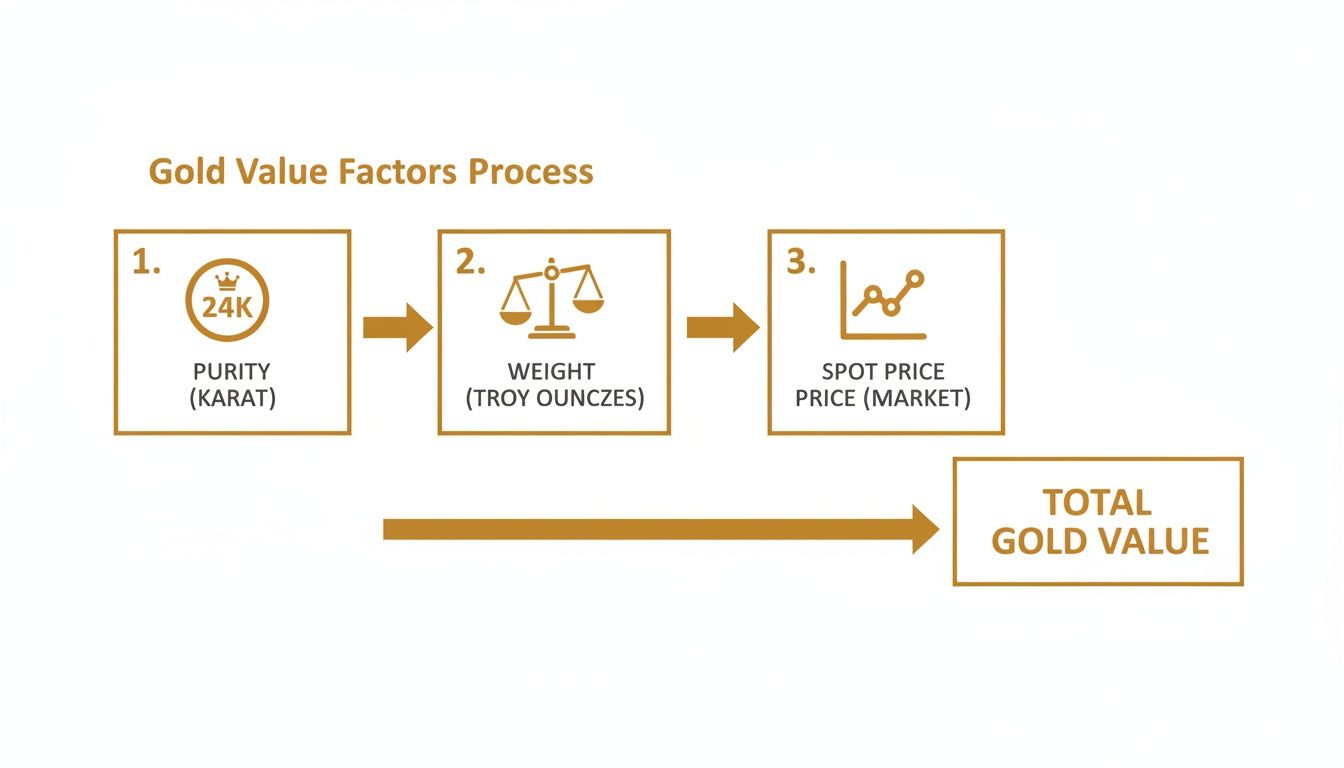

This flowchart breaks down the process visually. It is just a matter of combining these three key pieces of information.

As you can see, once you know your item's purity (karat), its weight, and the live spot price, you have everything you need to find its total melt value.

Example 1: The 18k Gold Necklace

Let's start with a classic: an 18k gold necklace that weighs 15 grams. The first step is figuring out how much of that weight is actual, pure gold.

- Find the Purity: An 18k stamp means the necklace is 75% pure gold (that is simply 18 divided by 24).

- Calculate Pure Gold Weight: Multiply the necklace's total weight by its purity. So, 15 grams x 0.75 = 11.25 grams of pure gold.

- Find the Melt Value: Now, just multiply that pure gold weight by our price per gram. 11.25 grams x $75.56/gram = $850.05.

The full melt value of your necklace is $850.05. A buyer will almost always offer a percentage of this, typically between 70% and 95%, which would be a payout of $595.04 to $807.55.

Example 2: The 14k Gold Rings

Next up, a handful of old 14k gold rings. We will say they weigh a total of 10 pennyweight (dwt). Many jewelers in the US still use pennyweight, so it is a handy conversion to know.

First, we need to convert pennyweight to grams. One pennyweight is 1.555 grams, so 10 dwt equals 15.55 grams.

- Find the Purity: 14k gold is 58.3% pure gold (14 divided by 24).

- Calculate Pure Gold Weight: 15.55 grams x 0.583 = 9.065 grams of pure gold.

- Find the Melt Value: 9.065 grams x $75.56/gram = $684.95.

So, the rings have a melt value of $684.95. Based on that, you could expect an offer somewhere between $479.47 (70%) and $650.70 (95%). You can see how knowing this baseline number gives you real power when negotiating a sale.

Example 3: The 22k Gold Coin

Finally, let's look at a 22k gold coin, like an American Gold Eagle or a Krugerrand, that weighs exactly one troy ounce.

- Find the Purity: 22k gold is 91.7% pure (22 divided by 24).

- Calculate Pure Gold Weight: The coin weighs one troy ounce, but the spot price is for pure gold. So, we need to find the actual gold content: 1 troy ounce x 0.917 = 0.917 troy ounces of pure gold.

- Find the Melt Value: 0.917 ozt x $2,350/ozt = $2,154.95.

The melt value for this coin is $2,154.95. It is important to remember that some coins also carry a numismatic (collector's) value that can be much higher than their melt value. For scrap purposes, though, this calculation is the industry standard.

These examples pull back the curtain on the valuation process. By following these simple steps, you can confidently estimate what any gold item is worth. And if you would rather skip the manual math, our live gold calculator does all the work for you using the latest market prices.

Here's a quick summary table to make comparing these scenarios a bit easier.

Melt Value Calculation Summary ($2,350 Spot Price)

This table provides a side by side look at our three examples, showing how different purities and weights result in different melt values.

| Item | Purity (Karat) | Total Weight | Pure Gold Weight | Estimated Melt Value (100%) |

|---|---|---|---|---|

| Gold Necklace | 18K (75%) | 15 grams | 11.25 grams | $850.05 |

| Gold Rings | 14K (58.3%) | 10 dwt (15.55 g) | 9.065 grams | $684.95 |

| Gold Coin | 22K (91.7%) | 1 troy ounce | 0.917 troy ounces | $2,154.95 |

Why Global Market Trends Affect Your Payout

That old necklace or forgotten ring tucked away in your jewelry box is far more connected to the global economy than you probably think. Its value is not a fixed number; it ebbs and flows with the tides of international markets. Understanding these bigger forces is the secret to knowing the best time to sell your scrap gold.

The price you see spit out by a gold scrap price calculator is directly linked to the live spot price of gold, which is in constant motion. But this movement is not random. It is a real time reaction to world events, economic news, and the collective mood of investors.

Think of gold as the world's financial barometer. When things feel unstable, investors tend to flock to gold as a “safe haven” asset, which drives its price up. On the flip side, when the economy is booming and confidence is high, the urgency to own gold can dip, causing its price to fall.

Key Drivers of the Gold Price

A few major global factors are always pulling the levers on the daily price of gold, and that directly impacts the estimate you get from a calculator. Keeping an eye on these trends can help you time your sale for a much better payout.

The most common drivers include:

- Economic Uncertainty: During recessions or when the stock market gets volatile, investors often sell off riskier assets and pour their money into gold, which is famous for holding its value through thick and thin.

- Inflation Rates: When a currency like the U.S. dollar weakens due to inflation, it simply takes more of those dollars to buy an ounce of gold. This dynamic typically pushes the price of gold higher.

- Geopolitical Events: Global conflicts, trade wars, and political instability create a cloud of uncertainty. That nervousness in the market often leads to a surge in gold prices as people seek financial security.

- Central Bank Policies: Decisions made by central banks, especially the U.S. Federal Reserve, about interest rates have a huge impact. Lower interest rates make holding gold more attractive than earning interest from bonds, which often gives its price a healthy boost.

A Growing Market Means More Opportunity

The link between these global trends and the items in your possession is clearer than ever, thanks to a booming recycling market. The global scrap gold recycling industry has absolutely exploded, growing from $13.50 billion in 2023 to $14.73 billion in 2024, that is a massive 9.1% compound annual growth rate (CAGR).

This surge is being fueled by fluctuating gold prices, stricter environmental rules on mining, and economic downturns pushing more people to recycle gold for quick cash. You can explore more data on this expanding market to get a feel for these trends.

This market growth is a clear signal that the value of your scrap gold is not just a personal matter, it is part of a massive, dynamic global industry. Using a real time gold scrap price calculator is no longer a one and done task; it is a way to monitor this market and choose the most profitable moment to sell.

Timing Your Sale with Market Knowledge

So, what does this all mean for you? It means timing can be everything. Watching market trends can help you decide when to sell. If you hear news about rising inflation or see stock markets taking a tumble, it might be the perfect time to check your gold’s value. The price could be on an upswing.

This table breaks down how different market conditions can create better, or worse, times to sell your gold.

Market Conditions and Their Impact on Selling Gold

| Market Condition | Impact on Gold Price | Seller's Opportunity |

|---|---|---|

| High Inflation | Tends to Increase | Favorable. Your gold's value rises with inflation. |

| Economic Recession | Tends to Increase | Favorable. "Safe haven" demand boosts prices. |

| Strong Stock Market | Tends to Decrease | Less Favorable. Investor money flows away from gold. |

| Rising Interest Rates | Tends to Decrease | Less Favorable. Gold becomes less attractive than bonds. |

By paying attention to these broader economic signals, you can shift from being a passive seller to a strategic one. A gold scrap price calculator becomes your personal market monitor, letting you track your gold's potential payout as global events unfold and sell when the timing is just right for you.

How to Get the Most Money for Your Scrap Gold

Knowing your gold's melt value from a calculator is step one. But the real game begins when you turn that number into cash in your hand. With a few smart moves, you can go from being just another seller to an empowered negotiator who walks away with the best possible price.

Separate Your Gold by Karat

Before you even think about getting a quote, do this one simple thing: organize your gold. Put all your 10K items in one pile, your 14K in another, and so on. This small step can have a surprisingly huge impact on your final offer.

Think about it from the buyer's perspective. If you hand them a jumbled mess of jewelry, they might base their offer on the lowest karat in the bunch. That means your valuable 18K pieces could get priced as if they were 10K. By separating them, you force an item by item assessment, making sure you get paid the correct value for every single piece.

Shop Around for the Best Offer

Never, ever take the first offer you get. Selling gold is a competitive business, and the single best way to maximize your payout is to get multiple quotes. Treat it like selling a car, you want to create a little competition for what you have.

Cast a wide net. Get quotes from different types of buyers, like local jewelers, precious metal dealers, and even Pawn Brokers. You will quickly see that offers can vary dramatically.

An offer is just that, an offer. By getting at least three different quotes, you establish a true market price for your items and gain serious negotiating leverage.

When you are talking to potential buyers, let them know you are shopping around. This simple tactic often encourages them to put their best foot forward right away to win your business. For a head start on who to call, check out our guide on where to sell gold for the highest price.

Negotiate with Confidence

Armed with your calculator estimate and a few competing offers, you are no longer guessing, you are in control. The number from the gold scrap price calculator is your benchmark, representing 100% of the melt value. Think of this as your North Star during any negotiation.

If a buyer comes in with a low number, do not be afraid to ask them to explain it. A great question is, "What percentage of the spot price are you offering?" Reputable dealers will be transparent about their payout rates and any refining fees they charge.

This is where knowing your numbers really pays off. The table below shows just how much the payout can swing for the exact same item based on what a buyer is willing to offer.

Payout Comparison for 10g of 14K Gold (at $430 Melt Value)

This table illustrates how the percentage of melt value a buyer offers drastically changes your final payout for the same item.

| Buyer Type | Typical Payout % | Your Final Payout |

|---|---|---|

| Low Offer Buyer | 70% of Spot | $301 |

| Average Offer Buyer | 80% of Spot | $344 |

| Competitive Offer Buyer | 90% of Spot | $387 |

When you know your melt value, you can spot a lowball offer from a mile away. It gives you the confidence to push for a fairer price and ensures you're the one who walks away with the most money in your pocket.

Common Questions About Selling Your Gold

Even after you have calculated your gold's value, a few questions might pop up before you are ready to sell. That is completely normal. Walking through the final steps can bring up some practical details, and getting clear answers is the last piece of the puzzle you need to feel confident.

Let's tackle some of the most common things sellers ask. These answers should clear up any lingering doubts and get you fully prepared to land the best possible price.

What Are Hallmarks and How Do I Find Them?

Hallmarks are tiny stamps pressed into gold items that certify their purity. Think of them as a quick reference guide straight from the manufacturer. You will usually find them tucked away in discreet spots, like the inside of a ring, on the clasp of a necklace, or on an earring post.

These marks typically show up in two main formats:

- Karat Stamps: Most common in the U.S., these look like "10K," "14K," or "18K."

- Fineness Numbers: You will see these more often on European jewelry. They are three digit numbers that represent purity in parts per thousand. For example, "585" is 58.3% pure gold (the same as 14K), and "750" is 75% pure gold (18K).

While hallmarks are the perfect starting point for using a gold scrap price calculator, it is always a good idea to have the purity professionally verified if you are not sure. Stamps can wear down over the years or, in rare cases, be misleading.

Why Do Buyers Pay Less Than the Spot Price?

This is probably the single most important thing to understand before you walk in the door. The value you see from a calculator is the 100% melt value, based on the live market price of pure gold. A buyer, however, will offer you a percentage of that value to cover their business costs and make a profit.

This margin is not just about padding their pockets; it covers the expensive and complex process of turning your old jewelry back into pure, usable gold. That process involves:

- Assaying: Precisely testing the purity of every piece you bring in.

- Melting: Firing up high temperature furnaces to melt everything down.

- Refining: A chemical process that strips out all the other alloys (like copper or silver) to isolate the pure gold.

A trustworthy buyer will be upfront about their payout rate, which usually lands somewhere between 70% to 95% of the melt value. Knowing your baseline value from a calculator is what gives you the power to judge whether their offer is fair.

Your calculator estimate is your private knowledge. It represents the full market value of your gold's raw content, giving you the power to assess offers and negotiate from a position of strength.

Does the Condition of My Scrap Gold Matter?

In a word? No. When you are selling gold for its melt value, its condition is completely irrelevant. A bent, broken, or tangled 14K gold chain has the exact same amount of pure gold as a brand new 14K chain of the same weight. Its value is tied only to its metallic content, not its design, brand, or appearance.

There is a reason it is called "scrap" gold, it is destined to be melted down and recycled anyway. So do not give a second thought to scratches, dents, or broken clasps. The only two things that matter are its purity (karat) and its weight.

Can I Use a Kitchen Scale to Weigh My Gold?

Using a kitchen scale is better than a wild guess, but it just is not accurate enough for something as valuable as gold. Most kitchen scales measure in whole grams and are not calibrated for the kind of precision precious metals demand. Because gold is so dense and valuable, even a fraction of a gram can swing the final price quite a bit.

Professionals use certified jeweler's scales that measure to at least one decimal place in grams, troy ounces, or pennyweights. To get the most accurate estimate from a gold scrap price calculator, you absolutely need a precise weight. Many jewelers or pawn shops will weigh your items for free, which gives you an accurate starting point for your own calculations.

Here is a quick look at why that tiny difference matters so much.

Impact of Scale Inaccuracy on 14K Gold Value

This table shows how a small weighing error can impact the estimated value of 14K gold, assuming a price of $43 per gram of pure gold.

| Actual Weight | Kitchen Scale Reading | Weight Difference | Potential Value Lost |

|---|---|---|---|

| 10.8 grams | 10 grams | -0.8 grams | $20.74 |

| 20.6 grams | 20 grams | -0.6 grams | $15.55 |

| 50.9 grams | 50 grams | -0.9 grams | $23.33 |

As you can see, those seemingly tiny fractions add up fast. Getting an accurate weight is not just a suggestion, it is a non negotiable step to make sure you get paid exactly what you deserve.

Ready to uncover the true value of your gold with precision and confidence? Use the free, real-time Gold Calculator at https://thegoldcalculator.com to get an instant estimate based on live market prices.