What Is Scrap Gold And How Is Its True Value Calculated?

When you hear the term scrap gold, what comes to mind? For many, it conjures images of broken chains and mismatched earrings tossed into a drawer. And that’s a great start, but the definition is much broader.

At its core, scrap gold is any gold containing item that is valued for its raw metal content alone, not for its design, brand, or function. It’s gold destined to be melted down and recycled. This covers a surprisingly wide range of items, from that tangled necklace to old dental crowns and even tiny amounts of gold recovered from electronics.

Understanding What Is Scrap Gold

Here’s a simple analogy, think of a classic car that’s been sitting in a field for 30 years. It doesn’t run, the interior is shot, and it’s covered in rust. You wouldn’t buy it to drive, but it’s still valuable for the steel, chrome, and other metals you can salvage from it.

Scrap gold works the exact same way. That broken bracelet or ring with a missing stone is no longer a wearable piece of jewelry. Its value has shifted from a fashion accessory to the precious metal it’s made from. This is the fundamental principle that drives the entire scrap gold industry.

Buyers in this market aren’t concerned with the sentimental value, the brand name, or who designed it. They focus on just two things, the item’s weight and its purity or karat. These two factors determine its melt value, the baseline worth of the pure gold locked inside.

From Unwanted Items To Pure Gold

When you sell your unwanted gold items, you’re kicking off the first step in a massive global recycling process. Your pieces are bought, sorted with other items of the same purity, and eventually melted down in a furnace.

During this refining process, the pure gold is separated from the other metals like copper, silver, or zinc that were originally added to create the alloy. What’s left is refined back into its pure, 24 karat form. This recycled gold is then sold to manufacturers to create brand new jewelry, components for smartphones, or investment grade bullion bars.

The core idea is simple, the gold in your broken chain is just as valuable as the gold in a brand new one. Scrap value unlocks that intrinsic worth, turning forgotten items into liquid cash based on the current market price of gold.

Key Characteristics Of Scrap Gold

Knowing what qualifies as scrap can help you spot hidden cash in your own home. Here’s a quick comparison of how scrap gold stacks up against a piece of retail jewelry.

| Feature | Scrap Gold Value | Retail Jewelry Value |

|---|---|---|

| Primary Value Driver | Pure gold content by weight | Design, brand, and craftsmanship |

| Condition | Unimportant, broken, damaged, or outdated | Crucial, must be in wearable condition |

| Pricing Method | Based on live gold spot price and purity | Based on markup, labor, and brand name |

| Typical Items | Broken chains, single earrings, dental crowns | Engagement rings, designer necklaces |

Understanding this distinction puts you in the driver's seat as a seller. When you know your items will be valued based on their raw materials, you can set realistic expectations. It also shows why it's so critical to use a tool like TheGoldCalculator.com to get a transparent, real time melt value estimate before you even talk to a buyer. It’s the best way to start any negotiation from a position of confidence and knowledge.

Common Types Of Scrap Gold Hiding In Your Home

You’d be amazed at how much valuable scrap gold might be tucked away in your home right now. We're not talking about gold bars stashed in a safe, but forgotten items hiding in plain sight. Learning what to look for is the first real step toward unlocking their hidden value.

Most people immediately think of jewelry, and for good reason. It’s easily the most common source of scrap gold you'll find. But this category is much broader than just pieces you've decided you no longer want to wear.

Unwanted And Broken Jewelry

That jewelry box sitting on your dresser? It’s a potential treasure chest. Many of the items inside have quietly shifted from being fashion accessories to raw assets, valued purely for the precious metal they contain.

Think about how many of these you might have lying around:

- Single Earrings: The classic culprit. Once an earring loses its partner, it instantly becomes a prime candidate for the scrap pile.

- Tangled or Broken Chains: A snapped clasp or a hopelessly knotted necklace might make a piece unwearable, but it does absolutely nothing to diminish its gold value.

- Outdated or Unwanted Rings: Styles change. That old class ring or an inherited piece that just isn't your taste holds significant value based on its weight and purity alone.

- Bent or Damaged Pendants: A misshapen charm or a dented pendant has lost its aesthetic appeal, but not its intrinsic worth.

These items often feel worthless because their original purpose is gone. But in reality, their value is just waiting to be recalculated based on the actual gold inside.

The moment an item's primary value shifts from its design to its material, it becomes scrap gold. A broken clasp doesn't erase the worth of the gold, it just changes how that worth is measured.

Surprising Sources Beyond The Jewelry Box

While jewelry is the most obvious source, valuable scrap gold turns up in some pretty unexpected places. Two of the most significant categories are old dental work and electronics, each representing a unique and often overlooked form of recoverable gold.

Believe it or not, dental gold has been used for decades because it's incredibly durable and biocompatible. Old crowns, bridges, and inlays are often made from high purity gold alloys, typically ranging from 10K to 22K. When they're removed, these small pieces can be surprisingly valuable.

Another huge and growing source is electronic waste, or e waste. Gold is a fantastic conductor, making it a critical component in the circuit boards of smartphones, computers, and countless other gadgets. While the amount in a single device is tiny, the collective volume is massive.

This trend is a major driver in the global recycling industry. The scrap gold market has grown significantly thanks to e waste and sustainability pushes, with forecasts projecting growth from $14.56 billion to $21.62 billion by 2029. In fact, e waste often contains gold concentrations far richer than what’s found in natural ore, making recycling both profitable and better for the environment. You can find more insights on this growing market on einpresswire.com.

A Quick Guide To Finding Hidden Gold

To get you started on your treasure hunt, here’s a quick glance table of common items and where you're most likely to find them.

| Item Category | Common Examples | Typical Purity (Karat) | Where to Look |

|---|---|---|---|

| Jewelry | Broken necklaces, single earrings, old rings | 10K, 14K, 18K, 22K | Jewelry boxes, drawers, old purses |

| Dental Gold | Crowns, bridges, inlays, fillings | 10K to 22K | Dental records, old medical containers |

| Electronics | Old cell phones, computer CPUs, circuit boards | 24K (plating) | Storage closets, basements, electronic recycling bins |

| Decorative Items | Gold leaf frames, gold plated flatware | Varies (often plated) | Attics, display cabinets, antique stores |

By looking beyond the obvious, you can start to identify multiple sources of scrap gold you might already own. Every piece, no matter how small or damaged, contributes to a total value based purely on its weight and purity.

Understanding Gold Purity Karats And Hallmarks

The single most important factor driving your scrap gold's value is its purity. When a buyer looks at your items, they aren't just seeing the total weight, they're figuring out how much pure gold is actually locked inside each piece.

This is where knowing a little bit about karats and hallmarks pays off big time, turning you from a curious seller into an informed one.

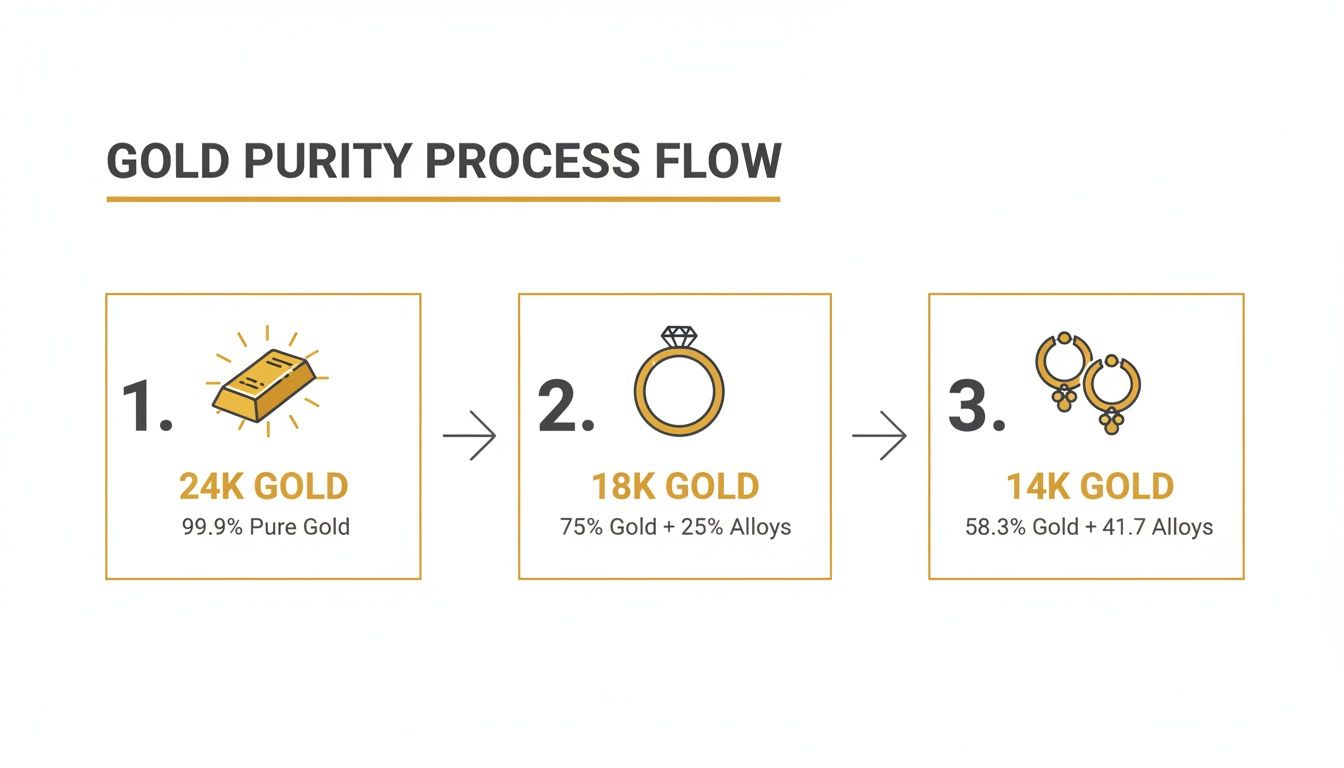

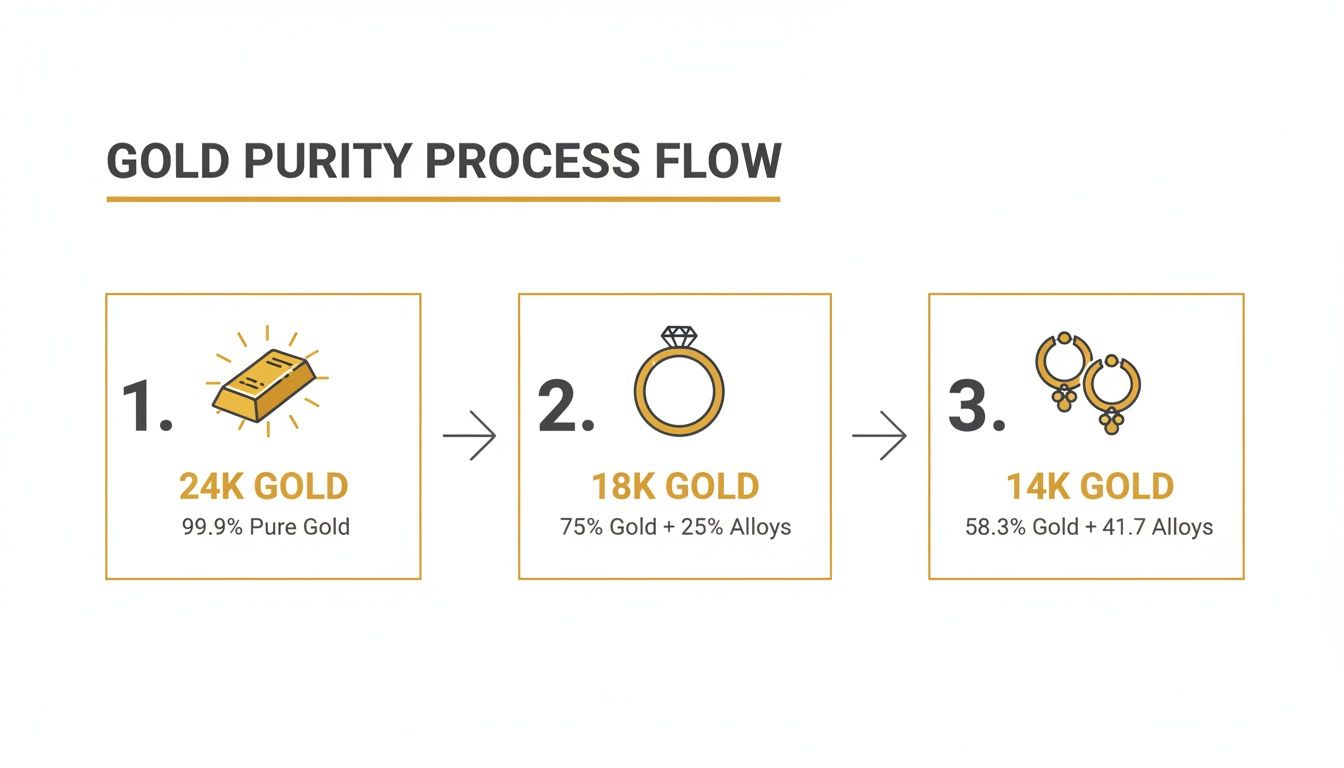

Think of it like mixing orange juice from concentrate. Pure, 24 karat gold is the thick, undiluted stuff, it’s 100% gold. While it’s incredibly valuable and beautiful, it's also really soft and impractical for jewelry that has to survive daily life.

To make gold strong enough for a ring or a necklace, jewelers mix it with other metals like copper, silver, or zinc. These added metals are called alloys. This process creates a much more durable product, and the karat system is simply a way to measure that ratio of pure gold to other metals.

Decoding The Karat System

The karat system is a straightforward scale based on 24 parts. One karat represents 1/24th of the whole mixture. So, 24 karat (24K) gold is the purest you can get, 24 out of 24 parts are pure gold, or 99.9% pure.

When you see a piece stamped "14K," it means it's made of 14 parts pure gold and 10 parts other metals. This is exactly why a 10 gram 14K chain has less pure gold, and a lower melt value, than a 10 gram 18K chain. It’s not about the total weight of the item, but the weight of the pure gold it contains.

The karat stamp on your jewelry is like an ingredient list. It tells you the exact recipe used to create the metal, revealing the proportion of pure gold to other alloys and directly influencing its scrap value.

Hunting For Hallmarks Like A Detective

So, how do you figure out the karat of your gold? You’ll need to do a little detective work and look for tiny stamps called hallmarks. Jewelers usually place these in discreet spots, like the inside of a ring's band, on the clasp of a necklace, or on an earring post.

These aren't just random numbers, they are a standardized code. While many pieces from the U.S. are stamped with their karat value like "14K" or "18K", a lot of European and other international jewelry uses a numerical system called fineness. Fineness simply represents gold purity in parts per thousand.

For example, 14K gold is 14 divided by 24, which equals 0.5833. As a three digit fineness mark, this is rounded and stamped as "585", meaning the item is 58.5% pure gold. In the same way, 18K gold (18 ÷ 24 = 0.75) is stamped with "750" to show it’s 75% pure gold. Finding these tiny engravings is a massive first step toward knowing what your scrap is really worth.

If you're curious about the different ways buyers confirm this information, you can learn more about professional gold purity testing methods and what they involve.

Gold Karat And Fineness Conversion Chart

To make this even clearer, here’s a simple chart that connects the dots between the karat, the hallmark you might find, and the actual percentage of pure gold in your item. This is the exact information buyers use to calculate their offers.

| Karat (K) | Fineness (Hallmark) | Pure Gold Percentage (%) | Common Uses |

|---|---|---|---|

| 24K | 999 | 99.9% | Investment bullion, coins, high end ceremonial jewelry |

| 22K | 916 or 917 | 91.6% | Traditional jewelry in Asia and the Middle East |

| 18K | 750 | 75.0% | Fine jewelry, high end watches, diamond settings |

| 14K | 583 or 585 | 58.3% | The most popular choice for jewelry in the U.S. |

| 10K | 417 | 41.7% | Durable and affordable jewelry, class rings |

| 9K | 375 | 37.5% | Common in the UK and Australia for entry level jewelry |

Once you identify the hallmark on your scrap gold, you can use this table to know its purity instantly. This knowledge gives you the power to calculate a solid melt value estimate on your own, long before you even talk to a buyer.

How Buyers Calculate Your Scrap Gold Payout

Ever wonder how a gold buyer looks at your items and comes up with a number? It can feel like a black box, but the truth is, it’s just simple math. Once you understand the formula they use, you're no longer just a seller, you're an informed negotiator who knows what your gold is really worth.

The entire process boils down to one thing: finding the true melt value of your gold. That’s the raw value of the pure gold inside your items, based on the live market price. Let's pull back the curtain and walk through the exact steps every reputable buyer takes, so you can see exactly how they build their offer.

The Core Formula, Step by Step

Every professional gold buyer uses the same fundamental, three step calculation. It always starts with the live price of gold and ends with their payout percentage, which covers their business costs.

- Start with the Spot Price: The starting point is always the current spot price of gold. This is the live market price for one troy ounce of pure, 24K gold, and it changes constantly throughout the day.

- Calculate Pure Gold Content: Next, the buyer figures out how much actual gold is in your jewelry. They'll weigh your item usually in grams and use its karat mark to find the weight of the pure gold. For example, a 10 gram necklace marked "14K" contains 5.83 grams of pure gold (10g x 0.583).

- Apply Their Payout Percentage: Finally, they take the total melt value and apply their payout rate. This percentage, typically between 70% and 95%, is what they keep to cover the costs of melting, refining, and assaying the gold, plus their profit.

As you can see, turning a pure 24K gold bar into an 18K ring or 14K earrings means mixing it with other metals. This directly changes its purity, which is the key to calculating its final melt value.

A Real World Calculation Example

Let's run the numbers on a common piece, a 10 gram, 14K gold necklace. To make it real, we'll use a hypothetical gold spot price of $2,300 per troy ounce.

First, we need the price per gram. Since there are 31.1 grams in a troy ounce, the price for one gram of pure 24K gold is $73.95 ($2,300 ÷ 31.1).

Next, we find the necklace's total melt value. We know 14K gold is 58.3% pure, so the math looks like this:

10 grams x 0.583 (purity) x $73.95 (price per gram) = $431.13

That $431.13 is the full, 100% melt value. A buyer who offers an 85% payout would hand you a check for $366.46 ($431.13 x 0.85).

The gap between the melt value and your final payout isn't random, it's the buyer's business model. It covers their operational costs, including the expensive and complex process of refining your old jewelry back into pure gold.

Why You Should Always Calculate First

Running these numbers yourself before you walk into a shop is the single most important thing you can do. It gives you a solid baseline, allowing you to instantly tell if an offer is fair, low, or actually competitive. The good news is, you don’t have to do all this math by hand.

Using a live tool gives you the same information the buyer has, right on your phone. It levels the playing field completely. You can use our simple and totally transparent selling gold calculator right now to see what your items are worth based on today's prices.

Knowing your numbers is crucial because buyers typically pay between 70% to 95% of the live spot price. For an extra layer of confidence, you might even consider getting a Free Jewellery Valuation from an independent source before you start shopping for offers. It's another piece of data that puts you firmly in control of the sale.

A Practical Guide to Selling Your Scrap Gold

Alright, you now understand what scrap gold is, how its purity works, and the math buyers use to figure out its value. It’s time to turn that knowledge into cash.

Following a clear plan is the key to turning those forgotten items into a nice payout. This guide is your actionable checklist to make sure the selling process is smooth, profitable, and stress free. A few minutes of prep work now can make a surprising difference in what you walk away with.

Your Pre Selling Checklist

Before you even think about stepping into a gold buyer’s shop, you need to know what you’re holding. This is about gathering your own data first.

- Gather and Sort Your Items: First things first, pull together all your potential gold items. Group them into piles based on their karat markings 10K, 14K, 18K, etc. This is exactly what a buyer will do, so you're already thinking like a pro.

- Weigh Everything: Grab a digital kitchen scale and weigh each karat pile separately. Make sure the scale is set to grams, as that's the universal standard in the gold business. Jot down the weight for each group.

- Take Clear Photos: Document your collection. Lay out each pile on a plain background and snap a few clear photos with your phone. This gives you a personal record of everything before it leaves your hands.

This whole process takes maybe ten minutes, but it's a game changer. You've just created a detailed inventory of your assets.

Your most powerful tool as a seller is information. Knowing the purity and weight of your items before you walk into a store transforms you from a passive seller into an active, informed negotiator.

Establish Your Baseline Value

This is, without a doubt, the most important step. You absolutely must have an independent, unbiased estimate of your gold’s melt value before you talk to a single buyer.

This number is your anchor. It’s the benchmark you'll use to judge every offer you get.

The simplest way to do this is with a live, transparent tool. Go to TheGoldCalculator.com and punch in the weights you just recorded for each karat group. The site uses real time market prices to give you an accurate melt value estimate instantly. Now you know the 100% value of your gold, the starting point for every buyer's calculation.

If you need a hand finding a reputable buyer, our guide on the best place to sell gold can help you compare your local and online options.

Comparing Offers and Spotting Red Flags

With your baseline value in hand, you're officially ready to get some quotes. Don't just go to one place. Try to get offers from at least two or three different buyers, maybe a local jeweler, a pawn shop, and a reputable online buyer.

As you shop your gold around, keep your eyes open for red flags that scream "bad deal."

| Red Flags to Watch For | What It Might Mean |

|---|---|

| Buyer doesn't weigh items in front of you. | Total lack of transparency. The weight could easily be misrepresented. |

| Uses a scale that isn't certified or visible. | The scale might be inaccurate in their favor, leading to a lower weight. |

| Gives a single lump sum price without showing the math. | They're likely hiding a very low payout percentage or fudging the numbers. |

| High pressure tactics to sell right now. | A classic move to stop you from comparing their weak offer with others. |

| Doesn't separate items by karat. | Lumping everything together almost always results in a lower overall payout. |

A trustworthy buyer will have no problem weighing your items in plain sight, confirming the purity of each piece, and walking you through how they got to their offer. When you're armed with your own calculated estimate and an eye for these warning signs, you can confidently pick the best offer and leave knowing you got a fair price.

The Bigger Picture: Why Scrap Gold Matters Globally

When you sell that old jewelry, you’re doing more than just pocketing some extra cash. You're actually plugging into a massive, interconnected global market. It might seem like a small act, but your scrap gold plays a surprisingly vital role in the world’s economy.

Recycled gold, sourced from items just like yours, makes up a huge and incredibly flexible slice of the total global gold supply. This isn't just a tiny trickle, it’s a major stream that keeps the entire market in balance. Think of it as a crucial buffer that helps stabilize prices whenever mining operations hit a snag or when demand for new gold suddenly shoots up.

The Balancing Act Of Gold Recycling

The relationship between gold prices and recycling is fascinating to watch. When gold prices climb, it gives everyone a powerful reason to cash in their old, unwanted items. This doesn't just happen on an individual level, it happens on a massive scale, injecting a fresh wave of gold back into the supply chain right when the market needs it most.

This dynamic creates a natural balancing force. High prices encourage more recycling, which in turn increases the available supply and helps cool down those very same high prices. It’s a self correcting loop that makes the entire precious metals economy more resilient and a lot less volatile.

By selling your scrap gold, you’re not just unlocking its stored value for yourself. You're contributing to a more stable and sustainable market, adding your drop to the supply that helps balance global economic forces.

A Sustainable Source For A Growing Demand

Recycled gold is also, by far, a more sustainable source of this precious metal. Pulling new gold out of the ground is an energy guzzling process with a significant environmental footprint. Recycling gold that's already in circulation reduces the need for new mining, which helps conserve natural resources and lowers the overall environmental impact. On a broader scale, consider how recycling circuit boards from electronic waste also contributes valuable materials, including gold, back into the global market.

One of the most defining traits of scrap gold is its vital role in the global supply, contributing about 28% of the total. This recycled gold flexes with market prices to help balance demand. In a recent quarter, global gold recycling hit 344 tonnes, a 6% jump year over year, which helped push the total supply to a record 1,313 tonnes, a 3% increase from the prior year. You can dig into the full report over on scrapmonster.com.

Your Scrap Gold Questions, Answered

When you're thinking about selling scrap gold, a few questions always pop up. Getting straight answers is the key to feeling confident about the process and making sure you get a fair deal for what your items are truly worth.

Where Is The Best Place To Sell Scrap Gold?

Figuring out where to sell can feel like a maze, but your choices generally boil down to three main spots: pawn shops, local jewelers, and online mail in buyers.

Pawn shops are known for offering cash on the spot, but they almost always give the lowest payouts. Local jewelers can be a solid choice, especially if you already have a trusted relationship with one, they might offer a more competitive price.

However, reputable online mail in services often provide the highest returns, typically paying between 80% and 95% of the melt value. Their business model has less overhead, which allows them to pass more of that value directly to you. The golden rule? Always get multiple offers before making a decision.

How Much Is My Scrap Gold Really Worth?

The value of your scrap gold hinges entirely on its melt value, that’s the raw worth of its pure gold content based on the day's market price. As a seller, you can realistically expect to get somewhere between 70% to 95% of that total melt value.

The final percentage you receive depends on who you sell to, their refining costs, and how much gold you’re selling. It’s common to get a better percentage if you’re selling a larger quantity.

It's crucial to understand that retail price and scrap value are two completely different things. A retail price tag includes the cost of labor, the designer's brand, and artistic value, none of which count when you're selling for scrap. The only thing that matters is the raw, recyclable precious metal inside.

Can I Sell Gold With No Stamps Or Hallmarks?

Yes, absolutely. You can definitely sell gold items that don't have any visible stamps or hallmarks. Any legitimate buyer won't just take a stamp at face value anyway.

They use professional tools, like an acid scratch test or a high tech electronic gold tester, to find out the exact purity of your items. This is precisely why it’s so important to weigh your items and get a pre calculated estimate on your own. It gives you a solid baseline to compare against the buyer's assessment and keeps the entire transaction transparent.

Ready to discover the true value of your items with confidence? TheGoldCalculator.com provides instant, transparent melt value estimates based on live market prices. Visit https://thegoldcalculator.com to get your free calculation today.