How much is 10k gold worth: A Guide to Value, Purity, and Price

Have you ever looked at a piece of 10k gold jewelry and wondered what it’s really worth? You’re not alone. The simple answer is that its value is based on the amount of pure gold it contains, which for 10k gold is always 41.7%. This means the price you can get is directly tied to the live market price of gold and the weight of your item.

Understanding the True Value of 10K Gold

When you see “10K” stamped on a piece of jewelry, it’s a precise measure of its gold content. Think of it like a recipe. Pure, 24k gold is very soft, making it less than ideal for everyday wear. To make it more durable, other metals are mixed in, creating what’s known as an alloy.

The 10k gold “recipe” uses 10 parts pure gold and 14 parts other metals like silver, copper, or zinc. This specific blend makes the item 41.7% pure gold (which is simply 10 divided by 24). This percentage is the key to figuring out its base value, often called its “melt value.”

The Basic Math Behind the Value

At its core, the calculation is pretty straightforward. You multiply the item’s weight by its purity percentage, then multiply that result by the current market price of gold. This gives you the melt value, which is the starting point for any cash offer a buyer will make.

The melt value is the raw, intrinsic worth of the pure gold in your item if it were melted down. It doesn’t include any value from the brand name, craftsmanship, or gemstones.

Let’s walk through a quick example. If the spot price of gold is $70 per gram, a 10 gram piece of 10k gold would have a melt value of about $291.90 USD.

Here’s the math: (10 grams × 0.417 purity) × $70 per gram = $291.90. You can always check live market data from sources like COMEX to see how these numbers are changing in real time.

This is why tools like 10k Gold price per gram calculator are so helpful. Instead of tracking market prices and doing the calculations yourself, you can get an instant, transparent estimate based on live data. It provides a solid baseline so you know what your gold is worth before you even consider selling it.

How to Calculate the Melt Value of Your Gold

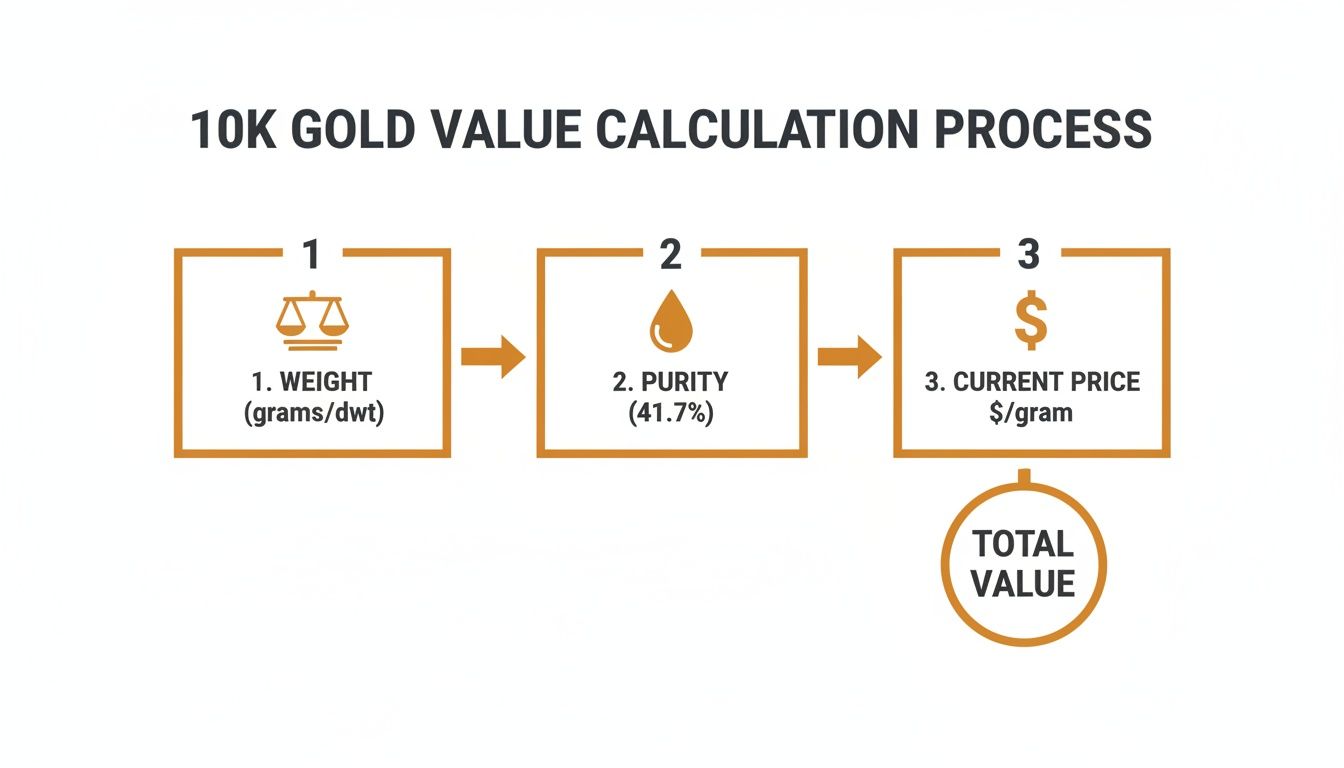

Ready to figure out what your 10k gold is really worth? You can calculate its baseline “melt value” in three simple steps. This is the exact process a professional buyer uses, so knowing it puts you in a powerful position and strips away all the guesswork.

This simple flowchart breaks down the entire process into its three core parts: weight, purity, and price.

Master these three steps, and you’ll be able to confidently determine the raw value of any gold item you own.

Step 1: Weigh Your Gold Accurately

First things first, you need to know how much your gold weighs. While a kitchen scale can give you a rough idea, it’s not ideal. Gold is valued in tiny increments, so precision is key. A jeweler’s scale is the best tool for the job.

These scales measure in grams, pennyweights (dwt), and troy ounces, the standard units in the precious metals industry. Accuracy here is critical. Even a small miscalculation can significantly change the final value, especially on heavier items like a thick chain or bracelet.

Step 2: Find the Current Spot Price of Gold

Next, you need to find the current spot price of gold. Think of this as the live, up to the minute market price for one troy ounce of pure, 24k gold. This number fluctuates constantly based on global trading, and you can easily find it on any major financial news site or a dedicated gold price website.

Just remember, the spot price is for 100% pure gold. Since you’re dealing with 10k, we’ll adjust for its 41.7% purity in the next step.

Key Takeaway: The spot price is your baseline. It’s the raw material cost before any other factors come into play. Knowing this number is the single most important part of understanding any offer you receive.

Step 3: Put It All Together with the Melt Value Formula

Now for a little bit of simple math. The formula looks like this:

(Weight of Your Item) x (Purity Percentage) x (Current Gold Price) = Melt Value

Let’s walk through a real world example. Say you have a 10k gold ring that weighs 5 grams, and the current spot price of gold is $70 per gram.

- Calculation: 5 grams x 0.417 x $70 per gram = $145.95

That’s it! The actual gold in your ring has a raw melt value of $145.95.

Let’s try a heavier piece to see how it scales up.

- Item: A 20 gram 10k gold chain

- Spot Price: $70 per gram

- Calculation: 20 grams x 0.417 x $70 per gram = $583.80

Of course, you don’t have to do the math by hand. For instant, transparent estimates that pull live market data, you can use an online gold scrap price calculator. It does all the heavy lifting for you. This ensures your estimate is always based on the most current prices, giving you the clearest picture of your gold’s value.

Why Your Cash Offer Is Less Than the Melt Value

So, you’ve done the math and figured out the melt value of your gold. You’re feeling pretty good about the number on your calculator, but when you get a cash offer, there’s a disconnect. Why is the buyer’s price always lower than the melt value you just calculated?

This is easily the most misunderstood part of selling gold, but it’s not as mysterious as it seems.

Think of it like selling a used car to a dealership. The car might have a Kelley Blue Book value of $10,000, but the dealer isn’t going to hand you a check for that full amount. They have to inspect it, clean it up, handle the paperwork, and cover their own business costs before they can resell it for a profit. The melt value of your gold is that $10,000 sticker price; it’s the raw, theoretical maximum, not the final payout.

The Business of Buying Gold

Gold buyers, whether they’re your local jeweler or a major online refiner, are running a business. They have real world costs involved in taking your old jewelry and turning it back into pure, usable gold. The gap between your item’s melt value and their cash offer is where they cover those costs and make a small profit.

A fair offer for 10k gold will typically land somewhere between 70% and 95% of its melt value. This range accounts for the buyer’s expenses and ensures they can stay in business while still giving you a competitive price.

When you understand the deductions, you see the offer not as a lowball tactic, but as a simple reflection of the process. A good, transparent buyer will be happy to explain this.

Common Deductions from Melt Value

What exactly are these costs that come out of your gold’s value? The deductions are pretty standard across the industry and cover the entire journey from your scrap jewelry to a refined gold bar.

Here’s a breakdown of what a buyer has to cover, which ultimately shapes the percentage they can offer you:

| Cost Factor | Description | Why It Affects Your Offer |

|---|---|---|

| Refining Fees | The cost of the industrial process to melt down scrap and chemically separate pure gold from the other metals. | This is the biggest operational expense for any buyer, requiring specialized facilities and equipment. |

| Assaying Costs | The process of scientifically testing the gold to confirm its exact purity (i.e., making sure it's really 10k). | Buyers have to verify purity before sending items to a refinery, and that requires time, tools, and expertise. |

| Overhead | Basic business costs like rent, employee salaries, insurance, secure shipping, and marketing. | These are the fundamental costs of running any legitimate business, and they get factored into the pricing. |

| Market Risk | The price of gold can fluctuate and even drop between the moment they buy from you and when they sell the refined gold. | Buyers build in a small buffer to protect themselves against the daily volatility of the global gold market. |

Knowing about these built in costs demystifies the whole process. It gives you realistic expectations and helps you spot a fair offer when you see one.

Key Factors That Affect Your Final Payout

So, you’ve calculated the melt value—that’s your baseline. But the cash offer you actually get can swing quite a bit based on a few real world factors. Think of the melt value as the sticker price of a used car; it's the starting point for negotiation, but the final price depends on the car's actual condition, mileage, and brand.

A buyer isn't just looking at the raw gold. They're sizing up your item to see if it's simple scrap or something more. Knowing what they're looking for is the key to understanding your payout.

Hallmarks and Official Stamps

The very first thing any experienced buyer does is hunt for a hallmark. This tiny stamp, usually hidden on a clasp or the inner band of a ring, is the official confirmation of its gold purity. For 10K gold, you'll want to look for stamps like '10K', '10KT', or the number '417'.

This stamp is like a certificate of authenticity packed into a few characters. If it's missing or unreadable, the buyer has to do more work to verify the gold, which can sometimes affect their confidence and, in turn, their offer. You can learn more about verifying purity in our detailed guide on gold purity testing.

Scrap vs. Resellable Jewelry

Is your piece a broken chain destined for the furnace, or is it a beautiful ring someone else would love to wear? This is a crucial distinction for a buyer. They need to decide if they're buying scrap gold or a piece of jewelry they can polish up and sell in their display case.

A beautiful, intact ring from a well known brand might fetch a higher price because the buyer can sell it directly to a new owner, adding value for its craftsmanship and design. In contrast, a damaged or outdated piece will almost always be valued purely on its gold content.

Resellable items often command a premium over the melt value because they have value beyond their raw materials.

Gemstones and Other Materials

What about the diamonds or other gems sparkling in your ring? When you're selling for melt value, those stones are usually not part of the deal. A gold buyer's business is gold, so they will almost always remove the stones before weighing the metal.

The weight of those gems gets subtracted from the item's total weight to figure out how much gold is actually there. While some valuable stones can be sold separately, their value won't be included in your gold payout.

How Different Buyers Pay

Where you choose to sell your gold will have a massive impact on your final check. A pawn shop, a local jeweler, and an online refiner all have different business models, overhead costs, and customer bases. These differences directly translate into how much of the melt value they can afford to offer you.

Here's a general idea of what to expect from different types of buyers.

Typical Payout Percentages for 10K Gold by Buyer Type

This table breaks down the typical payout ranges you might see. As you can see, who you sell to matters a lot.

| Buyer Type | Typical Payout Range of Melt Value | Primary Considerations |

|---|---|---|

| Online Gold Refiners | 80% to 95% | High volume and low overhead allow for top tier payouts. The focus is purely on melt value. |

| Local Jewelers | 65% to 85% | Might pay more for resellable designer pieces but often pay less for scrap due to overhead. |

| Pawn Shops | 40% to 70% | Offer immediate cash but pay the lowest percentage due to high operational costs and risk. |

The takeaway is simple: online refiners who deal in high volumes can usually offer the most competitive rates because their entire business is built around efficiently processing scrap gold. Pawn shops, on the other hand, offer convenience but at a significant cost to your payout.

Gold Price Trends and What They Mean for You

Knowing today’s gold price is just the starting line. The true value of your 10k gold isn’t a fixed number; it’s a living asset, constantly shifting with the currents of the global economy. A quick look back at gold’s journey can give you a much better sense of its future potential and help you decide the best time to sell.

For centuries, gold has earned its reputation as a “safe haven” asset. What does that mean? In simple terms, when the economy gets shaky and other investments start to look risky, investors often flock to gold, pushing its price higher. We’ve seen this play out time and again during major events like the 2008 financial crisis and the 2020 pandemic. As stocks stumbled, gold climbed, proving its stability.

This historical track record has a direct impact on your 10k gold items. Even though they’re 41.7% pure gold, their value has been riding the same upward wave as pure gold bullion, likely appreciating significantly over the years.

A Look at Historical Growth

To really understand what your 10k gold is worth, it helps to see where it’s been. Think back to 2011 during the Eurozone debt crisis. Gold prices shot up to nearly $2,000 per ounce. At that point, the melt value for 10k gold was around $27 per gram. Today, that same gram is worth much more, showing just how much value has been packed into it over the last decade and a half.

This trend reveals a crucial insight: timing your sale can dramatically change your payout. Selling at a market peak isn’t just a fantasy; it’s a strategy that could add a significant amount to your bottom line.

By tracking gold price trends, you’re not just selling an old piece of jewelry; you’re capitalizing on an asset that has likely grown in value since you first acquired it.

Market Trends and Consumer Goods

The ripple effect of gold’s fluctuating price doesn’t stop at scrap value. It also shapes the cost and worth of luxury goods. High end brands that use precious metals in their products are constantly adjusting to these market shifts, which, in turn, influences the resale value of those items.

For a deeper dive into how market movements affect precious metals in consumer goods, you can explore detailed analyses like these gold price trends in luxury watches. This gives you a bigger picture of gold’s economic footprint beyond just its raw value.

By keeping an eye on these historical patterns and current trends, you can elevate your approach from simply selling some old gold to making a sharp, informed financial move that puts market conditions in your favor.

Common Questions About Selling 10K Gold

As we wrap things up, let’s go over some of the most common questions people have when they’re thinking about selling 10k gold. Getting quick, clear answers to these can make all the difference, helping you feel confident and prepared. The goal here is to clear up any lingering doubts you might have.

Think of this as the final checklist before you head out. Understanding these practical details will help you navigate the selling process and make sure you walk away with a fair deal.

Is 10K Gold Considered Real Gold?

Yes, absolutely. 10k gold is real gold and it definitely has value. The “10k” stamp means the item is an alloy made of 41.7% pure gold, while the rest is a mix of other metals added for strength and durability.

While it has less pure gold than 14k or 18k pieces, it’s still a precious metal with a solid intrinsic worth based entirely on that gold content. Don’t let anyone tell you otherwise.

Do Pawn Shops Pay a Fair Price for 10K Gold?

Pawn shops offer one major benefit: instant cash. But that convenience almost always comes at a steep price. In most cases, pawn shops pay the lowest percentage of an item’s actual melt value, often somewhere between 40% to 70%. Their business model has to account for high overhead and the risk of people never returning for their items.

If your main goal is to get the highest possible payout for your gold, you’ll almost always do better with specialized online refiners or a trusted local jeweler.

What Is the Difference Between 10K and 14K Gold Value?

The main difference comes down to purity, which directly impacts the value. As we’ve covered, 10k gold is 41.7% pure gold. By comparison, 14k gold is 58.3% pure gold (that’s 14 parts gold out of 24).

This means a 14k gold item will always be worth more than a 10k gold item of the exact same weight, simply because it contains more of the good stuff. For instance, if a 10 gram 10k ring is worth $275, an identical 10 gram 14k ring would be worth around $385 in the same market.

When buying new jewelry, people often balance durability against color and value. But when you’re selling, it’s simple: higher purity always fetches a higher price.

Does the Brand of My Jewelry Affect Its Value?

For most gold buyers, especially those buying scrap gold to melt down, the brand is completely irrelevant. They only care about two things: the weight and the purity of the gold itself. A broken 10k gold chain from a generic brand has the exact same melt value as a broken 10k chain from a famous designer, as long as they weigh the same.

However, there’s one major exception to this rule.

- Designer or Luxury Brands: If your piece is from a high end, sought after brand like Cartier or Tiffany & Co., it might have a resale value that’s much higher than its melt value. In these situations, you’re better off selling the item to a jeweler or a specialized reseller who values the brand name and craftsmanship, not just the raw gold.

Knowing where to sell is just as crucial as knowing what your gold is worth. For a deeper dive, check out our guide on finding the best place to sell your gold, which can help you match the right buyer to your specific items.

Ready to stop guessing and find out the true, real time value of your gold? With TheGoldCalculator.com, you get an instant, transparent estimate based on live market prices. Know what you have before you sell. Use our free tool today at https://thegoldcalculator.com.