Should You Buy Gold on Akshaya Tritiya or Dhanteras? A Strategic Guide for Smart Investors

Gold just hit another record high this week, and millions of Indian investors are asking the same question: should I wait for the next auspicious festival to make my purchase, or is market timing more important than tradition? With gold prices surging over 15% in the past year and festival seasons driving unprecedented demand spikes, the intersection of cultural buying patterns and investment strategy has never been more critical for your portfolio.

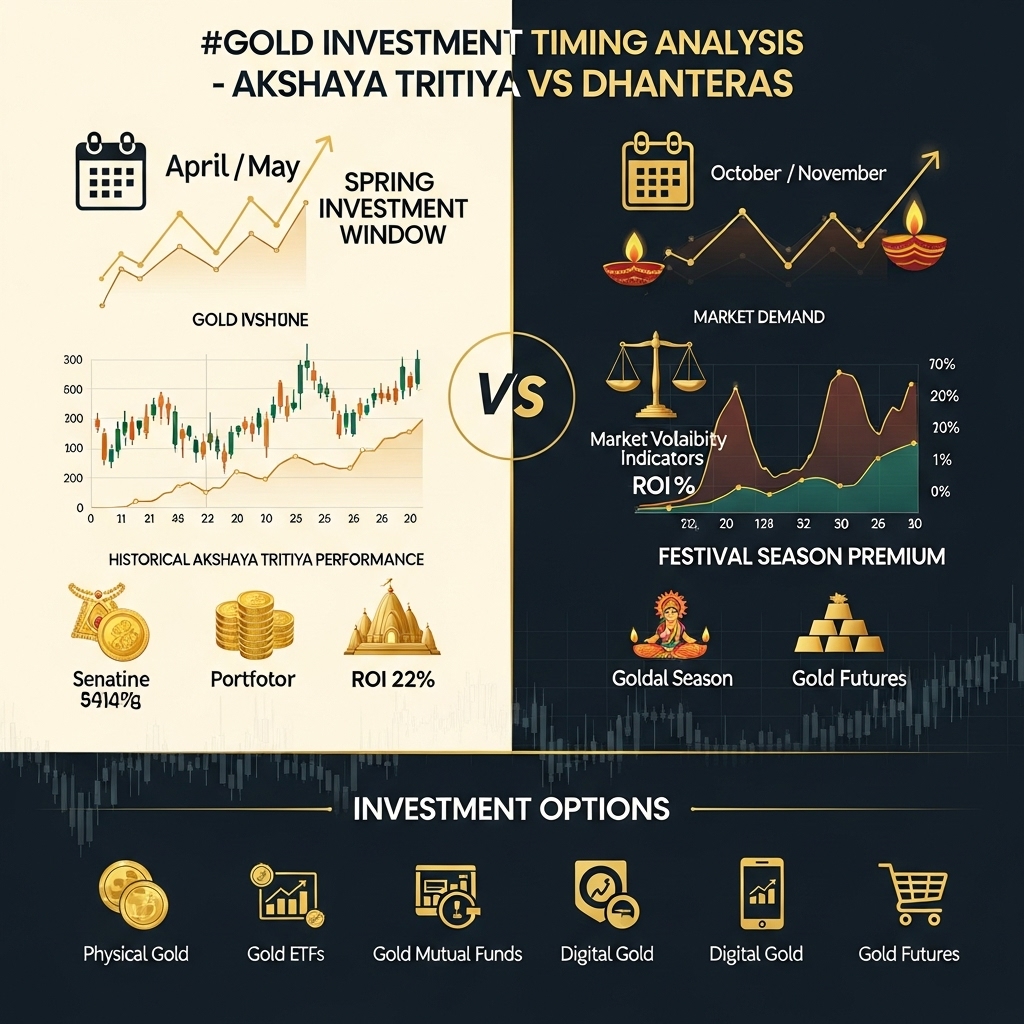

During Akshaya Tritiya and Dhanteras, gold purchases in India typically increase by 30-40%, creating fascinating market dynamics that savvy investors can either capitalize on or strategically avoid. These festivals don’t just represent cultural significance—they’re major market events that influence pricing, liquidity, and investment opportunities across physical gold, gold ETFs, and digital gold platforms.

This comprehensive analysis will examine the real data behind festival gold buying, comparing historical price patterns during both occasions, evaluating the true cost of timing your purchases around cultural events versus market fundamentals, and revealing which festival actually offers better value for investors. We’ll also explore modern alternatives like systematic gold accumulation plans that can help you benefit from festival demand while avoiding the premium pricing trap.

Whether you’re a traditional gold investor or exploring modern gold investment vehicles, understanding these seasonal patterns could be the difference between maximizing your returns and paying unnecessary premiums in today’s volatile precious metals market.

Gold Market Analysis and Key Insights

Current Gold Market Performance and Trends

Gold has demonstrated remarkable resilience in 2024, with prices reaching record highs above $2,400 per ounce internationally. The domestic market has seen similar momentum, with 24-karat gold trading around ₹73,000-75,000 per 10 grams during festive seasons. Key drivers include persistent inflation concerns, geopolitical tensions, and central bank accumulation strategies across emerging economies.

Market volatility typically increases during Akshaya Tritiya and Dhanteras due to heightened demand, often creating 2-5% price premiums compared to regular trading days. However, this seasonal surge is usually temporary, with prices stabilizing within 2-3 weeks post-festival.

Investment Benefits During Festive Periods

Despite premium pricing, festive gold purchases offer distinct advantages. Jewelry retailers provide attractive schemes, including zero-making charges, exchange offers, and installment plans. Digital gold platforms often introduce special pricing and bonus schemes, making it accessible for systematic investment planning.

Gold’s inflation-hedging properties remain compelling, with historical data showing 8-10% annual returns over 15-20 year periods. During economic uncertainty, gold typically outperforms traditional assets, providing portfolio diversification benefits.

Strategic Investment Considerations

Timing considerations favor gradual accumulation over lump-sum festive purchases. Dollar-cost averaging through monthly SIPs in gold ETFs or digital gold can minimize timing risks while capturing long-term trends.

Physical gold storage and insurance costs add 1-2% annually to investment expenses, making paper gold instruments more cost-effective for pure investment purposes. However, cultural and emotional value of physical gold during festivals remains significant for many investors.

Expert Recommendations

Financial advisors suggest limiting gold allocation to 5-10% of investment portfolio, treating it as a defensive asset rather than growth investment. For festive purchases, experts recommend comparing prices across multiple retailers and considering certified hallmarked jewelry for better resale value.

The optimal strategy combines cultural celebrations with disciplined investing—purchasing modest quantities during festivals while maintaining systematic investment in gold instruments throughout the year for wealth creation objectives.

Gold Investment Strategies and Options

When investing in gold during Akshaya Tritiya or Dhanteras, understanding diverse investment avenues is crucial for maximizing returns while managing risk effectively.

Physical Gold vs. Digital Options

Physical gold (jewelry, coins, bars) offers tangible ownership and cultural significance but incurs making charges, storage costs, and purity concerns. Digital alternatives like Gold ETFs, Gold Mutual Funds, and Digital Gold provide easier liquidity, lower storage risks, and transparency in pricing without making charges.

Strategic Portfolio Allocation

Financial experts recommend allocating 5-10% of your investment portfolio to gold as a hedge against inflation and market volatility. Conservative investors might prefer 8-10%, while aggressive investors could limit exposure to 3-5%, balancing gold with equity and debt instruments.

Investment Methods Comparison

– Gold ETFs: Offer stock market liquidity with minimal expense ratios (0.5-1%)

– Gold Mutual Funds: Provide professional management with slightly higher fees

– Digital Gold: Enables fractional ownership starting from ₹1

– Physical Gold: Delivers psychological comfort but involves 8-12% making charges

Market Timing Considerations

Rather than timing the market based on festivals, adopt a systematic investment approach. Dollar-cost averaging through monthly SIPs in Gold ETFs or mutual funds reduces timing risks. Monitor gold’s correlation with your existing investments – when equity markets decline, gold often provides portfolio stability.

Risk Assessment

Gold prices can be volatile short-term, influenced by global economic conditions, currency fluctuations, and geopolitical events. While gold historically preserves wealth, it doesn’t generate regular income like dividends or interest. Consider your investment horizon, risk tolerance, and overall financial goals when determining your gold allocation strategy during these auspicious occasions.

Market Performance and Outlook

Historical Performance Analysis

Gold has demonstrated remarkable resilience during traditional buying periods, with Akshaya Tritiya and Dhanteras consistently driving 15-20% increases in demand. Over the past decade, gold prices have averaged 8-12% annual returns, with festival periods showing temporary price spikes of 2-5% due to heightened demand.

Current Market Dynamics

Gold currently trades near historical highs, influenced by global inflation concerns and geopolitical uncertainties. India’s gold imports surged 75% in recent quarters, reflecting robust domestic demand despite elevated prices. The rupee’s performance against the dollar remains a critical factor, as a weaker rupee makes gold more expensive for Indian buyers.

Economic Factors Driving Prices

Central bank policies, particularly interest rate decisions, significantly impact gold’s appeal as a non-yielding asset. Rising inflation rates traditionally boost gold demand as a hedge. Additionally, crude oil prices, stock market volatility, and global trade tensions continue influencing gold’s safe-haven status.

Future Outlook

Analysts project moderate gold price appreciation of 6-10% annually, supported by continued central bank purchases and emerging market demand. However, potential interest rate normalization could create headwinds. For festival purchases, dollar-cost averaging throughout the year might prove more beneficial than concentrated buying during peak demand periods when premiums typically increase.

The key lies in viewing gold as a long-term wealth preservation tool rather than timing short-term market movements.

Frequently Asked Questions About Gold Investment

Is there really a difference in gold prices between Akshaya Tritiya and Dhanteras?

Gold prices are primarily determined by global market factors, not religious occasions. However, local demand spikes during these festivals can sometimes lead to slight premiums at retail stores. The actual gold value remains the same regardless of purchase date.

Which festival offers better deals and discounts?

Both festivals see similar promotional offers from jewelers. Dhanteras typically has broader retail participation, while Akshaya Tritiya focuses more on gold-specific purchases. Compare offers from multiple dealers during both periods to find the best deals.

Should I wait for these festivals to buy gold for investment?

For pure investment purposes, timing based on festivals isn’t crucial. Focus on market trends, global economic conditions, and your financial goals instead. Dollar-cost averaging through systematic purchases often works better than timing specific dates.

Are there any tax implications for festival gold purchases?

Tax implications remain the same regardless of purchase date. Gold purchases above ₹2 lakhs require PAN card disclosure. Long-term capital gains tax applies after three years of holding, irrespective of when you bought the gold.

What forms of gold are best for festival purchases?

For investment: Gold ETFs, digital gold, or gold coins offer better liquidity. For tradition: Jewelry serves ceremonial purposes but carries making charges that reduce investment value.

Final Thoughts on Gold Investment

Both Akshaya Tritiya and Dhanteras present excellent opportunities for gold investment, though your choice should align with your financial goals rather than cultural preferences alone. Key takeaways: Akshaya Tritiya typically offers better prices due to lower demand, while Dhanteras provides extensive retailer promotions and discounts. Market timing matters more than the festival date.

Our recommendation: Don’t limit yourself to just these festivals. Monitor gold prices throughout the year and buy during market dips for optimal returns. However, if you prefer the cultural significance, choose the festival that offers better pricing when you’re ready to invest.

Ready to invest in gold? Research current market trends, compare prices across multiple dealers, and consider digital gold options for smaller investments. Start your gold investment journey today, but remember—informed decisions always outweigh emotional purchases.