How to Buy Gold Without Paying Making Charges: Smart Hacks

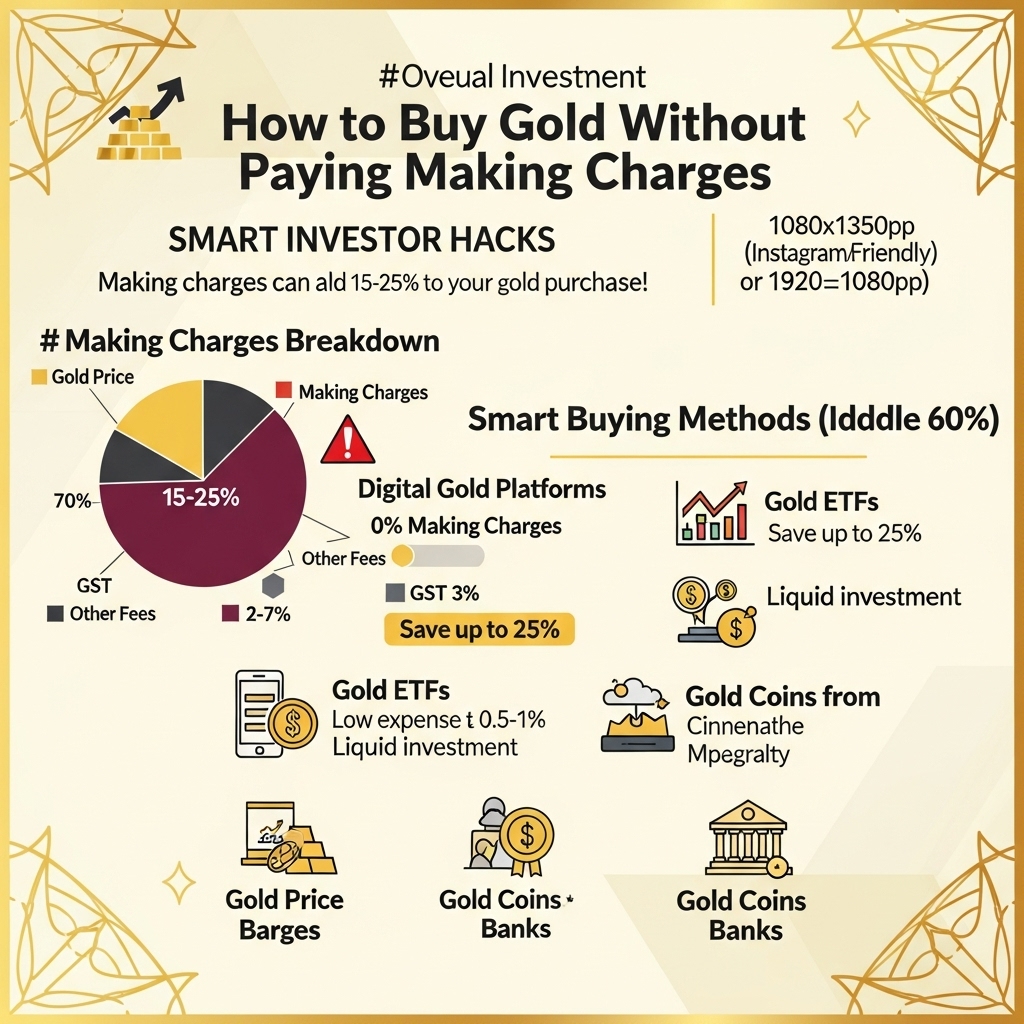

Gold has surged past $2,000 per ounce in 2024, marking one of its strongest performances in recent years as investors seek refuge from market volatility and inflation concerns. Yet many gold enthusiasts unknowingly surrender 8-15% of their investment value to making charges – fees that can significantly erode returns over time. What if you could capture gold’s wealth-preserving power without these hidden costs eating into your portfolio?

This comprehensive guide reveals proven strategies to acquire physical gold while completely bypassing traditional making charges and premiums. We’ll explore alternative purchasing methods, wholesale market access, timing strategies, and lesser-known investment vehicles that maximize your gold exposure per dollar invested. From leveraging gold ETFs and sovereign coins to accessing institutional pricing, these smart hacks can save serious investors thousands annually.

Understanding how to eliminate making charges isn’t just about saving money – it’s about optimizing your gold allocation in an uncertain economic climate. With central banks worldwide increasing their gold reserves by 800+ tons in 2023 and geopolitical tensions driving safe-haven demand, every percentage point matters in building wealth through precious metals. Master these techniques, and you’ll position yourself to benefit from gold’s potential upside while keeping more money working for your financial future instead of enriching dealers and middlemen.

Gold Market Analysis and Key Insights

Current Market Performance and Price Trends

Gold has demonstrated remarkable resilience in 2024, with prices hovering near historic highs of $2,000-2,100 per ounce. The precious metal continues to benefit from global economic uncertainty, persistent inflation concerns, and geopolitical tensions. Central bank purchases have reached unprecedented levels, with institutions acquiring over 1,100 tonnes in 2023, signaling strong institutional confidence in gold’s long-term value proposition.

Digital Gold Revolution and Investment Accessibility

The emergence of digital gold platforms has transformed traditional investment approaches, offering fractional ownership without physical storage concerns. Gold ETFs (Exchange-Traded Funds) have gained significant traction, managing over $200 billion in assets globally. These instruments eliminate making charges entirely while providing liquidity comparable to stocks, making gold accessible to retail investors with minimal entry barriers.

Strategic Investment Benefits and Risk Considerations

Gold serves as an effective portfolio diversifier, typically exhibiting negative correlation with equity markets during stress periods. Historical data indicates gold maintains purchasing power over extended timeframes, with average annual returns of 7-8% over the past two decades. However, investors should consider opportunity costs, as gold generates no income and may underperform during strong economic growth phases.

Expert Recommendations for Smart Gold Investing

Financial advisors recommend allocating 5-10% of investment portfolios to gold as a hedge against inflation and currency devaluation. The most cost-effective strategies include:

– Gold ETFs and mutual funds for maximum liquidity and zero making charges

– Digital gold platforms offering SIP (Systematic Investment Plan) options

– Gold bonds providing additional interest income alongside price appreciation

– Bulk purchases during market dips to maximize rupee-cost averaging benefits

Market experts suggest avoiding jewelry purchases for investment purposes due to high making charges (15-25%) and poor liquidity. Instead, focus on pure investment-grade options that track actual gold prices without additional premiums, ensuring optimal returns while maintaining portfolio diversification benefits.

Gold Investment Strategies and Options

Successfully investing in gold while minimizing making charges requires understanding diverse investment vehicles and strategic approaches that align with your financial goals.

Digital Gold Platforms offer the most cost-effective entry point, with minimal making charges and fractional ownership starting from ₹1. These platforms provide instant liquidity and eliminate storage concerns while maintaining gold’s underlying value appreciation potential.

Gold ETFs and Mutual Funds represent another low-cost strategy, charging only expense ratios (typically 0.5-1% annually) without making charges. These instruments offer excellent liquidity and professional management while tracking gold prices accurately.

Gold Bonds (SGBs) provide unique advantages with 2.5% annual interest plus capital appreciation, zero making charges, and tax benefits on maturity. However, they carry 8-year lock-in periods and limited liquidity during tenure.

Risk Assessment and Portfolio Allocation suggest limiting gold exposure to 5-15% of total portfolio. Gold serves as a hedge against inflation and currency devaluation but doesn’t generate regular income like stocks or bonds. Younger investors might allocate 5-10%, while those nearing retirement could increase to 10-15%.

Market Timing Considerations favor systematic investment approaches over lump-sum purchases. Dollar-cost averaging through monthly SIPs in gold ETFs or digital platforms reduces volatility impact. Historical data suggests accumulating during economic uncertainty, geopolitical tensions, or when gold trades below its 200-day moving average.

Comparative Analysis reveals digital gold and ETFs as most suitable for beginners, offering flexibility and low costs. SGBs work best for long-term investors seeking additional returns, while physical gold suits those prioritizing tangible assets despite higher making charges.

The optimal strategy combines multiple vehicles based on investment horizon, risk tolerance, and liquidity requirements.

Market Performance and Outlook

Gold has demonstrated remarkable resilience over the past decade, with prices rising from approximately $1,200 per ounce in 2014 to over $2,000 in 2024, representing a 67% increase. This precious metal consistently outperformed traditional investments during periods of economic uncertainty, including the 2020 pandemic and recent inflationary pressures.

Currently, gold markets reflect mixed signals. Central bank purchases reached record highs in 2023, with emerging economies diversifying reserves away from dollar-denominated assets. ETF holdings remain stable, while physical demand from India and China continues supporting price floors around $1,950-2,000 per ounce.

Key Economic Drivers:

– Interest rates: Inverse correlation with gold prices; lower rates increase appeal

– Inflation expectations: Rising consumer prices boost gold’s hedge value

– Currency fluctuations: Dollar weakness typically strengthens gold

– Geopolitical tensions: Uncertainty drives safe-haven demand

Future Outlook (2024-2026):

Analysts project gold trading between $2,000-2,400, driven by persistent inflation concerns and potential interest rate cuts. Central bank diversification and emerging market growth support long-term bullish sentiment.

Investment Timing Strategy:

Monitor monthly inflation data, Federal Reserve announcements, and global economic indicators. Dollar-cost averaging through systematic investment plans minimizes timing risks while reducing making charges through bulk purchases or promotional periods offered by dealers.

Understanding these market dynamics helps investors optimize entry points while implementing cost-reduction strategies.

Frequently Asked Questions About Gold Investment

What are gold making charges and why should I avoid them?

Making charges are fees jewelers add to cover crafting costs, typically 8-25% of gold’s value. These charges represent pure cost without adding investment value, significantly reducing your returns when selling gold back.

Which gold investment options have zero making charges?

Gold ETFs, digital gold platforms, gold mutual funds, and government gold bonds eliminate making charges entirely. These options let you buy pure gold at market rates without additional crafting fees.

Is digital gold as secure as physical gold?

Yes, reputable digital gold platforms store your gold in secure, insured vaults with third-party auditing. You can convert to physical gold anytime or sell at current market rates without making charge deductions.

How do Gold ETFs compare to buying jewelry?

Gold ETFs track gold prices accurately without making charges, storage costs, or purity concerns. Unlike jewelry, ETFs offer high liquidity and can be traded instantly during market hours.

Can I avoid making charges when buying physical gold?

Yes, purchase gold coins or bars from banks, authorized dealers, or government mints. These come with minimal premiums (1-3%) compared to jewelry’s high making charges.

What’s the minimum investment for charge-free gold buying?

Digital gold platforms allow investments starting from ₹1, while Gold ETFs require around ₹1,000 minimum. This makes charge-free gold accessible to all investors.

Final Thoughts on Gold Investment

Avoiding making charges when buying gold can significantly boost your investment returns over time. The key strategies include purchasing gold coins instead of jewelry, buying directly from refineries or authorized dealers, timing purchases during promotional periods, and considering digital gold platforms that eliminate physical handling costs.

Remember that gold remains a valuable portfolio diversifier and inflation hedge, but the way you acquire it matters tremendously for your bottom line. Even saving 3-10% on making charges can translate to substantial savings on larger investments.

Our recommendation: Start with small denomination gold coins or digital gold to minimize costs while building your position gradually.

Ready to make your first smart gold purchase? Research reputable dealers in your area, compare their making charges, and begin with a small investment to test their service quality. Your future self will thank you for choosing the cost-effective path to gold ownership.