Central Banks’ Historic Gold Rush: What It Means for Your Investment Portfolio

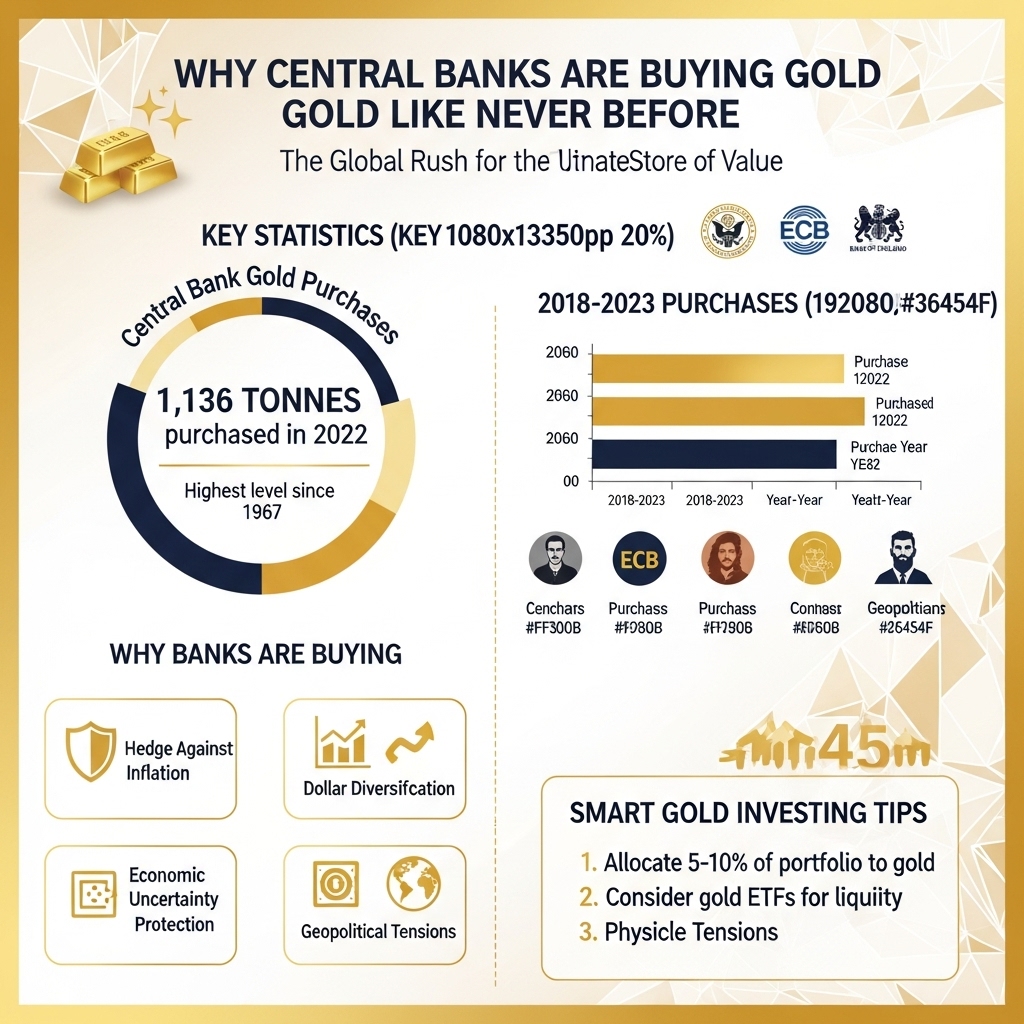

Picture this: while retail investors debate cryptocurrencies and tech stocks, the world’s most sophisticated financial institutions are quietly orchestrating the largest gold-buying spree in over half a century. Central banks added a staggering 1,136 tons of gold to their reserves in 2022 alone – the highest annual purchase since 1967 – and 2023 data shows this trend accelerating at an unprecedented pace.

This isn’t mere coincidence or nostalgic preference for the yellow metal. Central banks from China and Russia to Turkey and India are strategically diversifying away from dollar-dominated assets, signaling a fundamental shift in global monetary confidence that smart gold investors cannot afford to ignore. When the institutions that literally print money choose to convert that paper into physical gold, it sends a powerful message about where they see true value and stability in an increasingly uncertain economic landscape.

In this comprehensive analysis, we’ll explore the driving forces behind central banks’ aggressive gold accumulation, examine how this institutional demand is reshaping precious metals markets, and most importantly, uncover what these moves mean for individual investors seeking to protect and grow their wealth. From geopolitical tensions and inflation hedging to currency diversification strategies, we’ll decode the central banking playbook and reveal how you can position your portfolio to benefit from this historic monetary realignment that’s quietly transforming the global financial system.

Gold Market Analysis and Key Insights

Record-Breaking Central Bank Accumulation

Central banks purchased a staggering 1,136 tonnes of gold in 2022, marking the highest annual acquisition since 1967. This unprecedented buying spree continued into 2023, with institutions like the People’s Bank of China, Turkey’s central bank, and Singapore’s Monetary Authority leading the charge. The World Gold Council reports that central banks now hold approximately 36,700 tonnes collectively, representing nearly 17% of all above-ground gold.

Driving Forces Behind the Gold Rush

Multiple factors are fueling this institutional appetite for gold. Primary motivations include diversification away from US dollar reserves, hedge against persistent inflation concerns, and geopolitical tensions that have intensified following global conflicts. Central banks view gold as a crisis-resistant asset that maintains purchasing power during economic uncertainty, with many institutions citing concerns over potential currency debasement and mounting sovereign debt levels.

Investment Implications and Market Dynamics

This institutional demand has created a robust price floor for gold, with spot prices maintaining resilience despite interest rate fluctuations. The combination of central bank buying and growing retail investor interest through gold ETFs has reduced available supply, potentially supporting higher price levels long-term. Current market dynamics suggest limited downside risk, even as monetary policies shift.

Strategic Considerations for Investors

Gold offers portfolio diversification benefits, typically exhibiting low correlation with traditional assets during market stress. However, investors should consider gold’s lack of yield generation and storage costs. Financial advisors generally recommend allocating 5-10% of portfolios to precious metals, with options including physical gold, ETFs, mining stocks, or gold futures.

Expert Outlook and Recommendations

Market analysts project continued central bank accumulation through 2024, particularly from emerging market institutions seeking reserve diversification. Goldman Sachs maintains a bullish gold outlook, citing structural demand shifts and limited mine supply growth. Experts recommend dollar-cost averaging for retail investors, emphasizing gold’s role as portfolio insurance rather than a growth investment, especially during periods of currency volatility and economic uncertainty.

Gold Investment Strategies and Options

Central banks’ unprecedented gold accumulation signals important opportunities for individual investors, but success requires understanding various investment approaches and their risk profiles.

Physical Gold vs. Financial Instruments

Physical gold ownership through coins, bars, or allocated storage offers direct exposure but involves storage costs and insurance considerations. Gold ETFs provide liquidity and convenience while tracking spot prices closely. Mining stocks amplify gold price movements but introduce company-specific risks and operational variables.

Strategic Portfolio Allocation

Financial advisors traditionally recommend 5-10% gold allocation for portfolio diversification, though some suggest increasing this to 15-20% given current monetary uncertainties. Dollar-cost averaging helps mitigate timing risks, allowing investors to build positions gradually regardless of short-term price volatility.

Risk Assessment Framework

Gold investments carry unique risks: price volatility, storage costs, and opportunity costs versus yield-bearing assets. However, gold historically preserves purchasing power during currency debasement and provides crisis insurance when traditional assets falter.

Market Timing Considerations

While timing markets perfectly is impossible, certain indicators suggest favorable gold entry points: rising inflation expectations, weakening dollar trends, geopolitical tensions, and central bank dovishness. Conversely, rising real interest rates and strong economic growth may pressure gold prices.

Implementation Strategies

Conservative investors might favor physical gold or ETFs, while aggressive investors could consider mining stocks or leveraged instruments. Geographic diversification through international gold storage or foreign mining companies adds another risk management layer.

The key lies in aligning gold investments with personal risk tolerance, investment timeline, and overall portfolio objectives while recognizing gold’s primary role as wealth preservation rather than growth speculation.

Market Performance and Outlook

Gold has demonstrated remarkable resilience over the past decade, with prices surging from $1,200 per ounce in 2015 to peaks exceeding $2,400 in 2024. This 100% appreciation reflects both monetary debasement concerns and geopolitical instability driving institutional demand.

Central bank purchases reached record levels in 2022-2023, with global institutions adding over 1,000 tonnes annually—the highest levels since the 1960s. This institutional buying has created a price floor, supporting gold during periods when traditional retail and ETF demand weakened. China and Russia led purchases, accumulating reserves to reduce dollar dependency.

Current market conditions show gold maintaining elevated levels despite rising real interest rates, traditionally a headwind for the precious metal. This anomaly suggests structural changes in demand patterns, with central banks providing consistent buying pressure regardless of short-term rate movements.

Looking forward, several factors support continued strength: persistent inflation concerns, mounting government debt burdens globally, and ongoing geopolitical tensions. The Federal Reserve’s eventual pivot toward monetary easing could accelerate gold’s advance, particularly if inflation proves sticky.

Economic factors including currency debasement through quantitative easing, banking sector instability, and deglobalization trends favor gold’s monetary role. Technical analysts project potential targets of $2,600-$2,800 by 2025, supported by central bank demand and portfolio diversification needs. However, aggressive rate hikes or deflation could temporarily pressure prices.

Frequently Asked Questions About Gold Investment

Why are central banks increasing their gold purchases now?

Central banks are buying gold at record levels due to economic uncertainty, inflation concerns, and geopolitical tensions. They’re diversifying away from dollar-dependent assets and seeking safe-haven reserves that maintain value during market volatility.

How do central bank purchases affect gold prices?

Central bank buying creates sustained upward pressure on gold prices by increasing demand while reducing available supply. These institutional purchases often signal confidence in gold’s long-term value, attracting additional private investment.

Should individual investors follow central bank gold strategies?

While central banks have different objectives than individual investors, their gold accumulation validates gold’s role as a portfolio diversifier and inflation hedge. Individual investors should consider their risk tolerance and investment timeline.

What percentage of a portfolio should be in gold?

Financial advisors typically recommend 5-10% portfolio allocation to precious metals. This provides diversification benefits without overexposure to any single asset class.

Is physical gold better than gold ETFs?

Physical gold offers direct ownership and crisis protection but requires storage and insurance. Gold ETFs provide liquidity and convenience but involve counterparty risk. The choice depends on investment goals and storage capabilities.

How does gold perform during recessions?

Gold historically performs well during economic downturns, often maintaining or increasing value when stocks decline, making it an effective portfolio hedge.

Final Thoughts on Gold Investment

The unprecedented surge in central bank gold purchases sends a clear signal: institutional investors are positioning for economic uncertainty and currency debasement. Key takeaways for gold investors include recognizing gold’s role as the ultimate portfolio hedge, understanding that central bank demand creates a powerful price floor, and acknowledging that geopolitical tensions are driving this institutional flight to safety.

Our recommendation: Allocate 5-15% of your investment portfolio to physical gold and gold-backed securities. Current central bank buying patterns suggest this bull market has significant room to run, particularly as inflation concerns persist and dollar dominance faces challenges.

Ready to protect your wealth? Don’t wait for the next crisis to strike. Research reputable gold dealers, explore precious metals IRAs, and consider dollar-cost averaging into gold positions. Your financial future may depend on the moves you make today.