The Golden Opportunity: Why Smart Investors Are Turning to Collectible Gold Coins

While gold prices recently surged past $2,000 per ounce—marking a dramatic 15% increase over the past year—savvy investors are discovering that traditional gold bars and ETFs aren’t the only game in town. The collectible gold coin market is experiencing unprecedented growth, with rare American Eagles and historical pieces commanding premiums that far exceed their melt value. This dual-value proposition of precious metal content plus numismatic worth is creating extraordinary opportunities for diversification-minded investors.

In this comprehensive guide, we’ll explore how gold coin collecting can serve as both a hedge against inflation and a pathway to potentially superior returns. You’ll discover which types of gold coins offer the best investment potential, how to evaluate market premiums, and the key factors that drive collectible coin values beyond simple gold content. We’ll also examine storage considerations, liquidity factors, and tax implications that every gold investor should understand before entering this specialized market.

This topic represents a critical evolution in gold investing strategy. As central banks continue unprecedented monetary policies and economic uncertainty persists, investors need assets that can outperform basic commodity exposure. Collectible gold coins offer the foundational security of physical gold ownership while providing additional upside potential through historical significance, rarity, and collector demand—making them an increasingly attractive option for sophisticated portfolios seeking both preservation and growth.

Gold Market Analysis and Key Insights

Current Market Performance and Trends

Gold has demonstrated remarkable resilience in 2024, with prices reaching near-record highs of $2,400+ per ounce. Central bank purchases have increased by 14% year-over-year, while retail investment demand has grown 28% globally. The precious metals market shows strong fundamentals driven by inflation hedging and geopolitical uncertainties.

Historical Performance and Volatility Patterns

Over the past decade, gold has delivered an average annual return of 7.2%, outperforming many traditional assets during market downturns. Gold coins specifically have shown lower volatility compared to gold ETFs, with collectible premiums providing additional value appreciation potential. The 20-year rolling returns demonstrate gold’s effectiveness as a portfolio diversifier.

Investment Benefits of Gold Coins

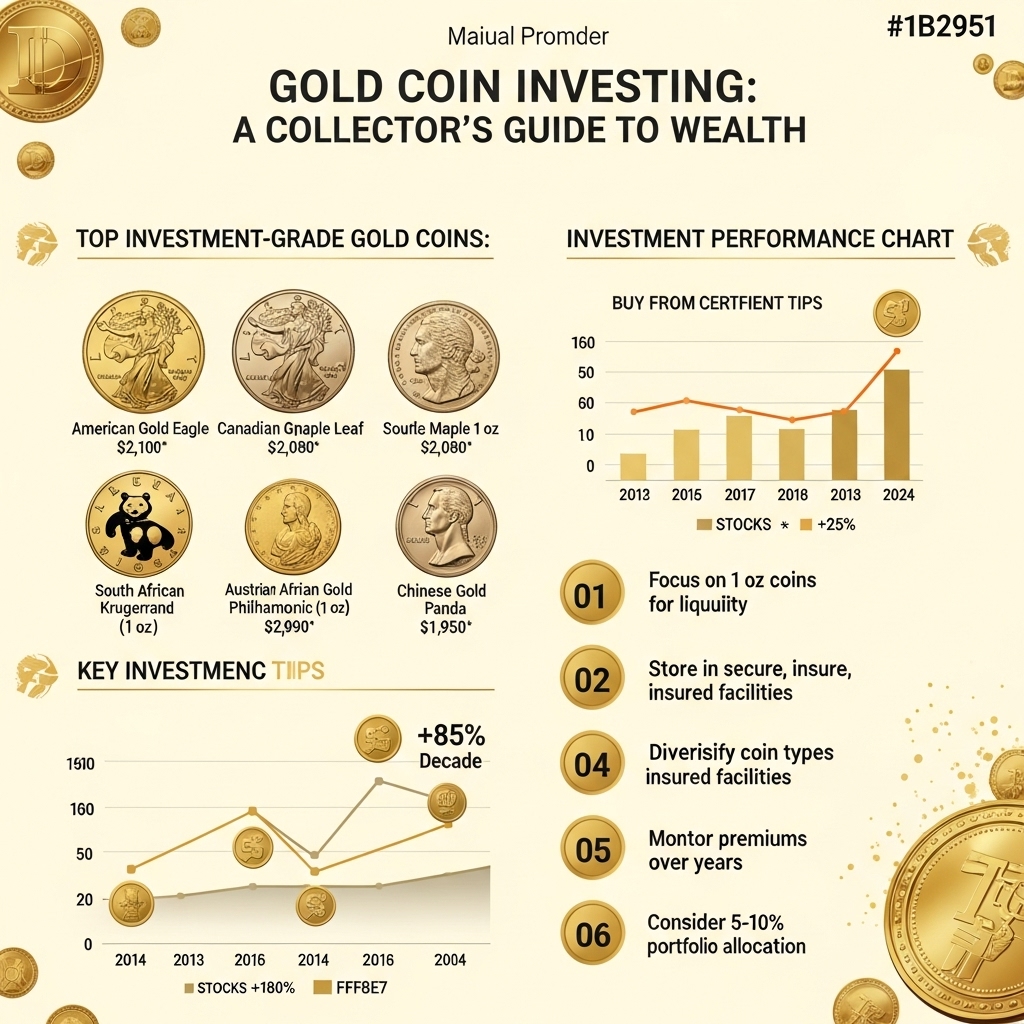

Physical gold coins offer unique advantages including tangible asset ownership, no counterparty risk, and potential numismatic premiums. Popular investment-grade coins like American Eagles and Canadian Maples maintain strong liquidity with dealer networks worldwide. Unlike paper gold investments, physical coins provide crisis-resistant wealth preservation with 5,000+ years of historical value retention.

Risk Considerations and Storage Requirements

Gold coin investing requires careful consideration of storage costs, insurance, and dealer premiums ranging from 3-8% above spot price. Market timing risks and lack of dividend income present challenges, while authentication concerns necessitate purchasing from reputable dealers. Investors should budget for secure storage solutions and understand tax implications in their jurisdiction.

Expert Investment Recommendations

Financial advisors typically recommend allocating 5-10% of portfolios to precious metals, with gold coins comprising 60-80% of that allocation. Focus on government-minted coins for maximum liquidity and avoid rare collectibles unless numismatically knowledgeable. Dollar-cost averaging through regular purchases helps mitigate price volatility. Consider gold coins as long-term wealth preservation rather than short-term speculation, particularly during periods of currency debasement or economic uncertainty.

Gold Investment Strategies and Options

Gold coin collecting offers diverse investment approaches, each with distinct risk-reward profiles and strategic considerations for building a robust precious metals portfolio.

Investment Strategies and Options

Physical gold coins provide tangible ownership with strategies ranging from systematic dollar-cost averaging to opportunistic purchases during market dips. Popular approaches include focusing on government-minted bullion coins (American Eagle, Canadian Maple Leaf) for liquidity, or collecting numismatic coins for potential premium appreciation. Gold ETFs and mutual funds offer easier liquidity and lower storage costs, while gold mining stocks provide leveraged exposure to gold prices with additional company-specific risks.

Risk Assessment and Portfolio Allocation

Financial advisors typically recommend 5-10% gold allocation in diversified portfolios, though this may increase during economic uncertainty. Physical coins carry storage, insurance, and liquidity risks, while paper gold investments face counterparty risk. Numismatic coins add collectible premium volatility beyond gold price movements.

Comparative Analysis

Physical coins offer no counterparty risk and potential numismatic premiums but require secure storage and have higher transaction costs. ETFs provide instant liquidity and professional storage but lack physical ownership. Mining stocks offer growth potential but correlate with equity markets during crises.

Market Timing Considerations

Gold typically performs well during inflation, currency devaluation, and geopolitical instability. Dollar-cost averaging reduces timing risk, while tactical allocation adjustments can capitalize on market cycles. Key indicators include real interest rates, USD strength, and central bank policies.

Successful gold coin investing requires balancing physical ownership benefits against practical considerations, aligning strategy with investment timeline, risk tolerance, and overall portfolio objectives while maintaining disciplined allocation limits.

Market Performance and Outlook

Historical Performance Analysis

Gold coins have demonstrated remarkable long-term appreciation, with prices rising from $35 per ounce in 1971 to over $2,000 in 2023. Premium collectible coins have often outperformed bullion, with rare American Eagles and Morgan dollars showing annual returns of 8-12% over the past two decades. During economic crises like 2008 and 2020, gold coins provided significant portfolio protection, gaining 25-30% when traditional assets declined.

Current Market Dynamics

Today’s market reflects heightened demand driven by inflation concerns and geopolitical tensions. Supply constraints from major mints have created premiums of 15-25% above spot prices for popular coins. The collector market remains robust, with auction houses reporting strong sales for high-grade specimens.

Economic Driving Forces

Federal Reserve monetary policy significantly influences gold prices, with lower interest rates typically boosting demand. Currency devaluation fears, particularly regarding the US dollar, continue supporting precious metals. Global uncertainty from trade disputes and regional conflicts maintains gold’s safe-haven appeal.

Future Projections

Analysts predict continued strength in gold coin investments, citing persistent inflation risks and central bank purchasing. The growing acceptance of precious metals in retirement portfolios suggests sustained demand. However, potential interest rate increases and economic stabilization could moderate short-term gains. Long-term outlook remains positive for both bullion and numismatic coins.

Frequently Asked Questions About Gold Investment

What are the best gold coins for investment?

American Gold Eagles, Canadian Gold Maple Leafs, and South African Krugerrands are top choices due to their government backing, high liquidity, and global recognition. These coins typically carry lower premiums over spot gold prices compared to rare collectibles.

How do investment-grade coins differ from collectible coins?

Investment-grade coins are valued primarily for their gold content and trade close to spot prices. Collectible coins derive value from rarity, condition, and historical significance, often carrying higher premiums and requiring specialized knowledge to evaluate properly.

What should I pay above spot price?

Expect premiums of 3-8% above spot gold prices for popular bullion coins from reputable dealers. Avoid excessive markups exceeding 10% unless purchasing rare or limited mintage coins with specific collecting appeal.

How should I store gold coins safely?

Use bank safety deposit boxes, home safes, or professional vault storage. Ensure proper insurance coverage and consider climate-controlled environments to prevent damage. Never store coins in PVC holders, which can cause chemical damage over time.

When is the best time to sell?

Monitor gold prices and sell during peak market conditions. Consider tax implications, as coins held over one year qualify for long-term capital gains treatment, potentially reducing tax liability compared to short-term holdings.

Final Thoughts on Gold Investment

Gold coin collecting represents a unique intersection of passion and profit, offering investors tangible assets with enduring value. Key takeaways include focusing on government-issued coins with high gold purity, understanding premium costs, and prioritizing proper storage and authentication. Unlike paper investments, gold coins provide portfolio diversification, inflation protection, and the satisfaction of owning physical precious metals.

Our recommendation: Start conservatively with 5-10% of your investment portfolio allocated to gold coins, beginning with widely recognized options like American Eagles or Canadian Maple Leafs. Always purchase from reputable dealers and maintain detailed records for tax purposes.

Ready to build your gold coin portfolio? Research current market prices, connect with established precious metals dealers, and consider consulting a financial advisor to determine the optimal allocation for your investment goals. Your golden opportunity awaits—take the first step today.