Gold Investment Showdown: ETFs vs Physical Gold in Today’s Market

Gold just shattered the $2,000 barrier and continues its relentless climb, leaving investors scrambling to position themselves in this ancient store of value. With central banks accumulating gold reserves at their fastest pace in over 50 years and inflation concerns driving retail demand to record highs, the question isn’t whether to invest in gold—it’s how to invest in gold.

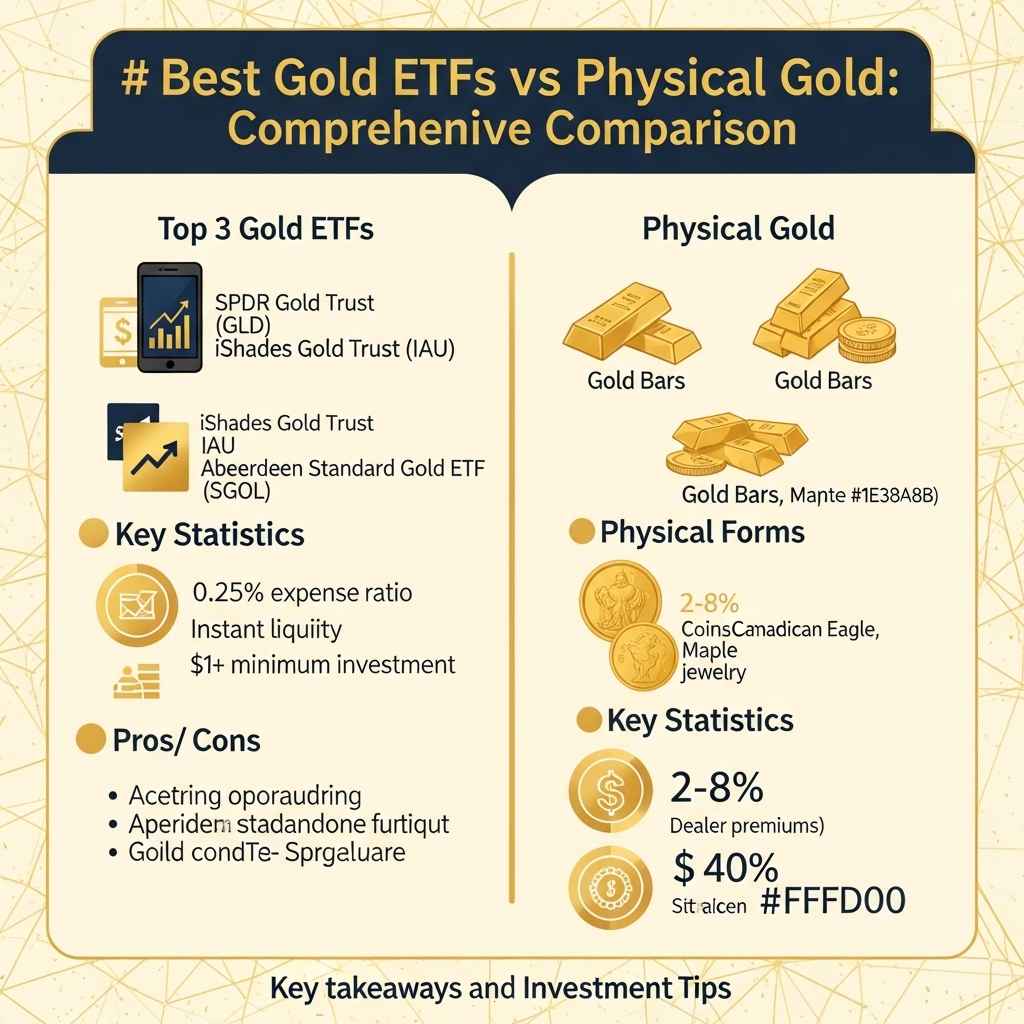

The choice between gold Exchange-Traded Funds (ETFs) and physical gold ownership represents one of the most critical decisions facing today’s precious metals investors. Each approach offers distinct advantages: ETFs provide liquidity and convenience with the click of a button, while physical gold delivers tangible ownership and ultimate portfolio insurance. Yet both come with hidden costs, tax implications, and storage considerations that can dramatically impact your returns.

In this comprehensive comparison, we’ll dissect the performance metrics, cost structures, and risk profiles of both investment vehicles. You’ll discover which option aligns with different investment goals—from short-term trading strategies to long-term wealth preservation. We’ll analyze real-world scenarios, examine current market dynamics affecting both sectors, and provide actionable insights to help you navigate the complexities of gold investing. Whether you’re a seasoned investor or exploring precious metals for the first time, understanding this fundamental choice could be the key to optimizing your portfolio’s golden potential.

Gold Market Analysis and Key Insights

Current Market Performance and Trends

Gold prices have demonstrated remarkable resilience in 2024, reaching near-record highs of $2,400 per ounce amid global economic uncertainty. Central bank purchases increased by 14% year-over-year, with emerging economies leading accumulation efforts. The Federal Reserve’s monetary policy shifts and persistent inflation concerns continue driving institutional and retail investor interest toward gold assets.

ETF vs Physical Gold Performance Metrics

Gold ETFs like SPDR Gold Shares (GLD) and iShares Gold Trust (IAU) have attracted $8.2 billion in net inflows this year, offering superior liquidity and lower storage costs. Physical gold, while maintaining its traditional appeal, faces premium spreads of 3-8% above spot prices. ETFs provide instant market exposure with expense ratios as low as 0.25%, whereas physical gold storage costs range from 0.5-2% annually.

Investment Considerations and Risk Factors

Physical gold offers tangible ownership and protection against systemic financial risks, making it attractive during market volatility. However, ETFs provide easier portfolio integration, tax efficiency, and fractional ownership capabilities. Storage security, insurance costs, and liquidity constraints remain primary concerns for physical gold investors. ETFs face counterparty risks and potential tracking errors, though these risks are minimal with established funds.

Expert Recommendations and Strategy

Financial advisors typically recommend 5-10% gold allocation within diversified portfolios. For investors prioritizing convenience and frequent trading, gold ETFs offer optimal solutions. Those seeking long-term wealth preservation and crisis hedging may favor physical gold allocation. Hybrid approaches, combining both ETFs (70%) and physical holdings (30%), provide balanced exposure while optimizing costs and accessibility.

Market analysts project continued gold strength through 2025, driven by geopolitical tensions and currency debasement concerns. Investors should consider their investment timeline, storage capabilities, and liquidity needs when choosing between ETFs and physical gold, as both serve distinct roles in comprehensive precious metals strategies.

Gold Investment Strategies and Options

Core Investment Approaches

Gold investors can pursue several strategic approaches depending on their objectives. Conservative allocation typically involves dedicating 5-10% of a portfolio to gold as a hedge against inflation and economic uncertainty. Tactical allocation involves increasing gold exposure during periods of market volatility or currency devaluation.

Dollar-cost averaging works effectively for both ETFs and physical gold, allowing investors to build positions gradually while minimizing timing risk. This strategy is particularly suitable for ETFs due to lower transaction costs and divisibility.

Risk Assessment and Portfolio Integration

Gold ETFs offer higher liquidity and easier portfolio rebalancing, making them ideal for tactical adjustments. They carry counterparty risk but eliminate storage concerns. Physical gold provides ultimate security during systemic crises but involves storage costs and liquidity challenges.

Risk-averse investors often prefer a hybrid approach: holding physical gold for long-term wealth preservation (60-70% of gold allocation) and ETFs for tactical trading and portfolio adjustments (30-40%).

Investment Method Comparison

| Strategy | ETFs | Physical Gold |

|———-|——|—————|

| Short-term trading | Excellent | Poor |

| Crisis hedge | Good | Excellent |

| Cost efficiency | High | Moderate |

| Storage requirements | None | Significant |

Market Timing Considerations

Gold typically performs well during inflationary periods, currency debasement, and geopolitical tensions. ETFs enable quick position adjustments during market shifts, while physical gold requires longer-term commitment due to transaction costs.

Successful gold investing often involves contrarian timing – accumulating positions when sentiment is negative and reducing exposure during euphoric phases. Regular rebalancing ensures gold allocation remains within target ranges regardless of market performance.

Market Performance and Outlook

Historical Performance Analysis

Gold has demonstrated resilient long-term performance, with the metal averaging approximately 8-10% annual returns over the past two decades. Leading gold ETFs like SPDR Gold Shares (GLD) and iShares Gold Trust (IAU) have closely tracked physical gold prices, typically within 0.25-0.40% annually due to management fees. During major market downturns, including the 2008 financial crisis and 2020 pandemic, gold ETFs provided easier liquidity access compared to physical gold, often trading at premiums during high-demand periods.

Current Market Dynamics

As of 2024, gold prices hover near historical highs around $2,000-2,100 per ounce, driven by persistent inflation concerns and geopolitical tensions. Gold ETFs have seen increased institutional adoption, with total assets under management exceeding $200 billion globally. Physical gold premiums have normalized to 3-5% above spot prices after experiencing elevated levels during supply chain disruptions.

Future Outlook

Economic factors supporting gold’s trajectory include ongoing monetary policy uncertainty, potential currency devaluation, and emerging market central bank accumulation. However, rising interest rates and dollar strength present headwinds. Analysts project moderate upside potential with increased volatility.

Gold ETFs are expected to maintain their tracking efficiency while benefiting from growing ESG-focused investing. Physical gold remains attractive for long-term wealth preservation, though storage costs and liquidity constraints may limit accessibility for smaller investors seeking tactical allocation strategies.

Frequently Asked Questions About Gold Investment

What are the main cost differences between gold ETFs and physical gold?

Gold ETFs typically charge annual expense ratios of 0.25-0.40%, while physical gold involves dealer premiums (3-8% over spot price), storage fees ($100-300 annually), and insurance costs. ETFs offer lower ongoing costs for most investors.

Which option provides better liquidity?

Gold ETFs offer superior liquidity, trading during market hours with tight bid-ask spreads. Physical gold requires finding buyers, authentication, and transportation, making it less liquid but tradeable 24/7 through dealers.

How do taxes differ between gold ETFs and physical gold?

Both are taxed as collectibles at 28% maximum rate for long-term gains. However, ETFs may generate taxable distributions, while physical gold is only taxed upon sale.

What are the storage considerations?

Physical gold requires secure storage (home safes, bank deposit boxes, or vault services), adding costs and security concerns. ETFs eliminate storage needs entirely, as gold is held by custodians.

Which option is better for portfolio diversification?

Both provide similar diversification benefits against market volatility and inflation. ETFs offer easier portfolio rebalancing, while physical gold provides complete independence from financial systems during extreme market stress.

Final Thoughts on Gold Investment

The choice between gold ETFs and physical gold ultimately depends on your investment goals and circumstances. Gold ETFs offer superior liquidity, lower storage costs, and easier portfolio integration, making them ideal for tactical allocation and beginner investors. Physical gold provides tangible ownership, crisis protection, and privacy, appealing to those seeking portfolio insurance and long-term wealth preservation.

Our recommendation: Start with gold ETFs for convenience and cost-effectiveness, then consider adding physical gold (5-10% allocation) for diversification benefits. Most investors benefit from a hybrid approach that captures both assets’ advantages.

Remember, gold should comprise 5-15% of a well-diversified portfolio. Before investing, assess your risk tolerance, investment timeline, and storage capabilities.

Ready to add gold to your portfolio? Research reputable ETF providers or precious metals dealers today, and consult with a financial advisor to determine the optimal allocation for your specific situation.