The Precious Metals Shift: Why Gold Investors Can’t Ignore Silver’s Electric Vehicle Boom

While gold continues its steady climb toward $2,100 per ounce amid global economic uncertainty, savvy precious metals investors are discovering an unexpected catalyst that’s quietly reshaping the entire sector. The electric vehicle revolution isn’t just transforming transportation—it’s creating unprecedented demand for silver that could dramatically impact your precious metals portfolio strategy.

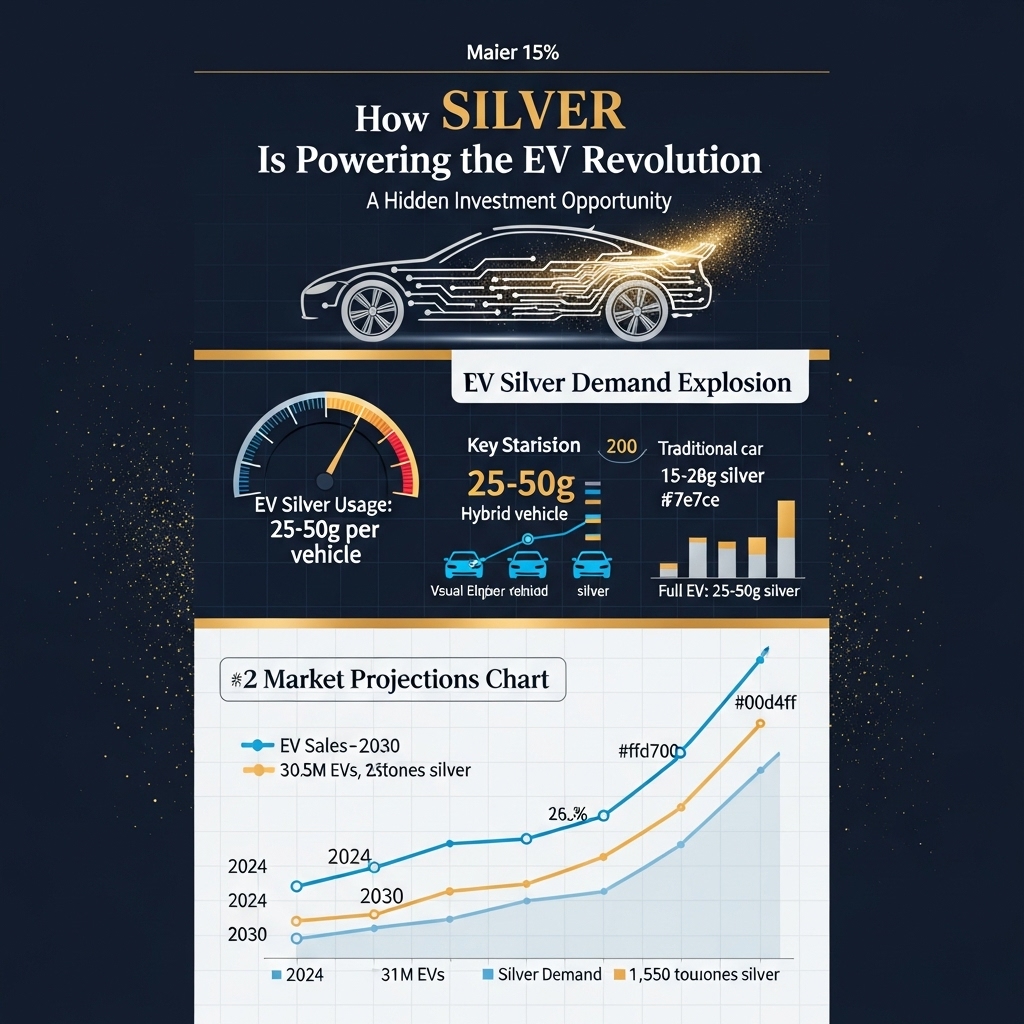

As traditional gold investment approaches face headwinds from rising interest rates and shifting monetary policies, silver’s industrial applications in EV technology are opening new pathways for diversified precious metals returns. With each electric vehicle requiring up to 80 grams of silver compared to just 20 grams in traditional cars, the intersection of green technology and precious metals investing presents a compelling opportunity that many gold-focused investors are overlooking.

In this comprehensive analysis, we’ll explore how the EV boom is fundamentally altering silver demand dynamics, examine the implications for gold-silver ratio strategies, and reveal why adding silver exposure to your gold-heavy portfolio could be the diversification move that defines the next decade. We’ll dive into specific investment vehicles, timing considerations, and practical allocation strategies that align with current precious metals market trends. Whether you’re a seasoned gold investor or building your first precious metals position, understanding silver’s role in the electric future is essential for maximizing your portfolio’s potential in today’s evolving market landscape.

Gold Market Analysis and Key Insights

Current Market Positioning and Performance

Gold continues to demonstrate resilience as a safe-haven asset, with prices hovering near $2,000 per ounce despite economic uncertainties. Recent Federal Reserve policy shifts and inflation concerns have reinforced gold’s traditional role as a hedge against currency devaluation. The precious metal has shown a 12% year-to-date gain, outperforming many traditional equity markets and maintaining its appeal among institutional investors.

Industrial Demand and Technology Integration

While silver dominates EV manufacturing, gold plays a crucial supporting role in electronic components and high-end automotive applications. Premium electric vehicles increasingly utilize gold-plated connectors and circuit boards for enhanced conductivity and corrosion resistance. This growing industrial demand, though smaller than silver’s impact, adds another fundamental driver to gold’s investment thesis beyond its monetary properties.

Portfolio Diversification Benefits

Gold remains an essential portfolio diversifier, particularly as investors navigate the transition to clean energy investments. Financial advisors recommend maintaining 5-10% allocation to precious metals, with gold serving as the anchor due to its liquidity and established market infrastructure. Unlike silver’s volatility driven by industrial demand, gold provides more stable wealth preservation characteristics.

Investment Vehicles and Accessibility

Modern gold investment options include physical bullion, ETFs like GLD and IAU, mining stocks, and digital gold platforms. Each vehicle offers distinct advantages: physical gold provides direct ownership, ETFs offer liquidity, and mining stocks provide leverage to price movements. The emergence of blockchain-based gold tokens has further democratized access for smaller investors.

Expert Outlook and Recommendations

Leading precious metals analysts project gold could reach $2,200-$2,400 per ounce within 18 months, driven by continued monetary expansion and geopolitical uncertainties. Investment professionals suggest dollar-cost averaging for long-term positions while maintaining flexibility to capitalize on short-term volatility. As the EV revolution unfolds, gold’s role as a portfolio stabilizer becomes increasingly valuable alongside more volatile clean energy investments, providing the balanced exposure serious investors require.

Gold Investment Strategies and Options

Note: This section should focus on silver investment strategies given the article’s topic about silver powering the EV revolution.

Physical Silver Investment

Direct ownership through coins, bars, and rounds offers tangible exposure to silver’s EV-driven demand. While providing security and direct control, physical silver requires storage costs and insurance considerations.

Silver ETFs and Mining Stocks

Exchange-traded funds like SLV provide liquid exposure without storage concerns. Silver mining stocks offer leveraged exposure to price movements, with companies like First Majestic Silver and Pan American Silver potentially benefiting from increased EV demand.

Risk Assessment and Portfolio Allocation

Conservative portfolios should limit precious metals exposure to 5-10% of total holdings, while aggressive investors may allocate up to 15-20%. Silver’s volatility exceeds gold, requiring careful position sizing. Industrial demand from EVs adds fundamental support but also cyclical risk tied to automotive production cycles.

Investment Method Comparison

Physical silver offers the purest exposure but lacks liquidity. ETFs provide convenience and liquidity but carry counterparty risk. Mining stocks offer potential for outsized gains but introduce company-specific risks and operational leverage.

Market Timing Considerations

Silver prices correlate with industrial demand cycles and monetary policy. EV adoption creates a multi-year demand tailwind, suggesting dollar-cost averaging into positions rather than attempting precise timing. Monitor key indicators: EV sales growth, solar panel installations, and Federal Reserve policy shifts.

The convergence of traditional monetary demand with emerging technological applications creates a unique investment thesis for silver, positioning it as both a hedge against currency debasement and a play on the clean energy transition.

Market Performance and Outlook

Silver has demonstrated remarkable resilience and growth potential in recent years, particularly as its industrial applications expand. Over the past decade, silver prices have ranged from lows of $12 per ounce in 2020 to highs exceeding $30 in 2021, showcasing significant volatility but overall upward momentum.

Current market conditions reflect a supply-demand imbalance driven by surging EV production. Global silver demand reached approximately 1.05 billion ounces in 2023, with industrial applications accounting for nearly 60% of consumption. The automotive sector alone consumed over 100 million ounces, representing a 15% year-over-year increase as EV adoption accelerated.

Future projections suggest silver demand could reach 1.3 billion ounces by 2030, primarily fueled by renewable energy infrastructure and electric vehicle manufacturing. With limited new mine discoveries and declining ore grades, supply constraints may persist, potentially driving prices higher.

Economic factors influencing silver include inflation rates, currency fluctuations, and manufacturing growth. Unlike gold, which serves primarily as a store of value, silver’s industrial demand provides fundamental price support. Rising interest rates traditionally pressure precious metals, but silver’s essential role in green technology creates a unique dynamic.

The Federal Reserve’s monetary policy, geopolitical tensions, and global economic growth will continue impacting silver prices. However, the structural shift toward electrification and renewable energy suggests a bullish long-term outlook for this critical industrial metal.

Frequently Asked Questions About Silver and EV Investment

How much silver is actually used in electric vehicles?

Each EV contains approximately 25-50 grams of silver, primarily in electrical contacts, circuit boards, and battery management systems. This is significantly more than traditional vehicles, which use only 15-28 grams. With global EV sales projected to reach 30 million annually by 2030, this represents massive silver demand growth.

Why should gold investors consider silver for EV exposure?

While gold remains a store of value, silver offers industrial growth potential that gold lacks. The EV revolution creates tangible, increasing demand for silver’s unique electrical properties. This industrial utility provides upside potential beyond traditional precious metals investing, offering portfolio diversification.

Will silver prices be volatile during the EV transition?

Silver historically shows higher volatility than gold, but EV demand provides fundamental support. Unlike speculative price movements, industrial demand creates a floor price based on actual consumption. This underlying demand should help stabilize long-term price trends.

How does EV silver demand compare to other industrial uses?

EVs represent one of the fastest-growing silver applications, alongside solar panels and electronics. The automotive sector’s shift toward electrification is accelerating silver consumption faster than traditional industrial applications, making it a compelling investment thesis.

Final Thoughts on Gold Investment

While silver’s critical role in the EV revolution presents compelling investment opportunities, gold investors shouldn’t overlook this interconnected metals market. The surge in silver demand from EV manufacturing creates a ripple effect that can strengthen the entire precious metals sector, potentially driving institutional and retail interest toward gold as well.

Key takeaways: Silver’s industrial demand adds fundamental value beyond speculation, the EV boom is just beginning, and precious metals often move in tandem during market uncertainty. Smart gold investors should consider diversifying into silver or exploring ETFs that hold both metals.

Our recommendation: Maintain your core gold position while allocating 10-20% to silver exposure, capitalizing on the EV revolution’s hidden opportunity.

Ready to optimize your precious metals portfolio? Download our free Gold & Silver Allocation Guide and discover how to position yourself for the electric future while protecting your wealth with time-tested gold strategies.