The Hidden Gold Investment Opportunity That’s Reshaping Luxury Markets

While savvy investors have watched gold prices surge past $2,000 per ounce in recent years, many are missing a crucial piece of the precious metals puzzle: green gold. This isn’t about environmentally sustainable mining practices—it’s about a unique gold alloy that’s quietly revolutionizing the jewelry industry and creating new investment opportunities that most portfolio managers haven’t even heard of.

Green gold, a naturally occurring alloy of gold and silver, is experiencing unprecedented demand among luxury consumers and collectors worldwide. As traditional yellow gold faces market saturation and younger demographics seek distinctive alternatives, green gold jewelry has emerged as both a style statement and a store of value. For precious metals investors, this trend represents more than just changing fashion preferences—it signals a diversification opportunity within gold investments that could offer enhanced returns and portfolio protection.

In this comprehensive analysis, we’ll explore what green gold actually is, examine the market forces driving its popularity, and reveal why smart investors are beginning to allocate portions of their precious metals holdings to this overlooked segment. We’ll also uncover the supply dynamics, pricing trends, and investment vehicles that make green gold an intriguing addition to any gold-focused portfolio. Whether you’re a seasoned precious metals investor or exploring gold as an inflation hedge, understanding green gold could unlock new opportunities in an evolving market landscape.

Gold Market Analysis and Key Insights

Current Market Performance and Trends

Gold prices have demonstrated remarkable resilience in 2024, with spot gold reaching near-record highs above $2,400 per ounce. Market volatility driven by geopolitical tensions and inflation concerns has reinforced gold’s traditional safe-haven status. Central bank purchases reached 1,037 tonnes in 2023, the second-highest annual total on record, indicating strong institutional confidence in precious metals.

Investment Benefits of Gold Assets

Gold offers portfolio diversification benefits that extend beyond traditional securities. Historical data shows gold maintains purchasing power during inflationary periods, with a negative correlation to stock markets during crisis periods. Physical gold provides tangible asset ownership without counterparty risk, while gold ETFs offer liquidity and lower storage costs. The precious metal typically performs well when real interest rates decline and currency devaluation concerns arise.

Green Gold Investment Considerations

Green gold alloys present unique investment dynamics compared to traditional yellow gold. While containing the same gold content, green gold jewelry may command premium prices due to specialized craftsmanship and growing consumer preference for distinctive pieces. However, resale values can vary significantly based on alloy composition and market demand for specific colors.

Expert Investment Recommendations

Financial advisors typically recommend allocating 5-10% of investment portfolios to precious metals. For jewelry investors, focus on pieces with higher gold purity (18k or above) and classic designs that transcend fashion trends. Consider certified pieces from reputable manufacturers to ensure authenticity and resale value.

Storage and insurance costs should factor into total return calculations. Dollar-cost averaging through regular purchases can help mitigate price volatility. Investors should monitor Federal Reserve policy decisions, as interest rate changes significantly impact gold pricing.

Market experts suggest treating gold jewelry as both an aesthetic investment and portfolio hedge. While green gold offers unique appeal, traditional yellow gold typically provides better liquidity. Consider professional appraisals for valuable pieces and maintain detailed documentation for insurance and resale purposes.

Gold Investment Strategies and Options

When incorporating gold into your investment portfolio, understanding various approaches ensures optimal returns while managing risk effectively.

Physical Gold Options

Green gold jewelry represents one physical investment avenue, combining aesthetic appeal with intrinsic value. However, consider storage costs, insurance, and liquidity challenges. Gold bars and coins typically offer better investment efficiency due to lower premiums over spot prices.

Paper Gold Investments

Exchange-traded funds (ETFs) like GLD provide gold exposure without physical ownership complexities. Gold mining stocks offer leveraged exposure but carry additional company-specific risks. Futures contracts suit sophisticated investors seeking short-term price speculation.

Risk Assessment and Allocation

Financial advisors traditionally recommend 5-10% portfolio allocation to precious metals as portfolio insurance. Gold’s negative correlation with stocks and bonds provides diversification benefits during market volatility. However, gold produces no income, making it unsuitable as a primary investment vehicle.

Investment Method Comparison

Physical gold offers tangible ownership but involves storage costs averaging 1-2% annually. ETFs provide liquidity and low fees (typically 0.25-0.40%) but lack physical possession. Mining stocks potentially amplify returns but introduce operational risks and market volatility.

Market Timing Considerations

Gold historically performs well during inflation, currency devaluation, and geopolitical uncertainty. Dollar-cost averaging reduces timing risk, while lump-sum investments require careful market analysis. Monitor Federal Reserve policies, inflation indicators, and global economic stability when making allocation decisions.

Smart gold investing balances physical and paper assets while maintaining appropriate portfolio percentages. Whether choosing green gold jewelry for dual aesthetic-investment purposes or traditional bullion, align strategies with your risk tolerance and financial objectives for optimal portfolio protection.

Market Performance and Outlook

Gold has demonstrated remarkable resilience as an investment asset, with prices rising from approximately $300 per ounce in 2000 to over $2,000 in recent years—a compound annual growth rate exceeding 6%. This precious metal has consistently outperformed during economic uncertainty, providing a reliable hedge against inflation and currency devaluation.

Current Market Conditions

Today’s gold market reflects global economic volatility, with prices supported by persistent inflation concerns and geopolitical tensions. Central bank purchases have reached multi-decade highs, while jewelry demand—particularly for unique variants like green gold—continues growing in emerging markets. Supply constraints from major mining operations have further tightened market dynamics.

Economic Factors and Future Outlook

Several key factors influence gold’s trajectory: Federal Reserve policy decisions, inflation rates, dollar strength, and global economic stability. Rising interest rates typically pressure gold prices, while economic uncertainty drives demand higher.

The jewelry sector, including green gold pieces, benefits from both investment demand and fashion trends. As consumers seek distinctive, sustainable luxury items, green gold’s unique aesthetic positions it advantageously.

Predictions

Analysts project continued volatility with an upward bias through 2025, driven by ongoing monetary policy uncertainty and deglobalization trends. Green gold jewelry specifically shows promising growth potential as customization and alternative precious metal alloys gain popularity among younger, environmentally-conscious consumers seeking differentiated luxury products.

Frequently Asked Questions About Gold Investment

What exactly is green gold and how is it made?

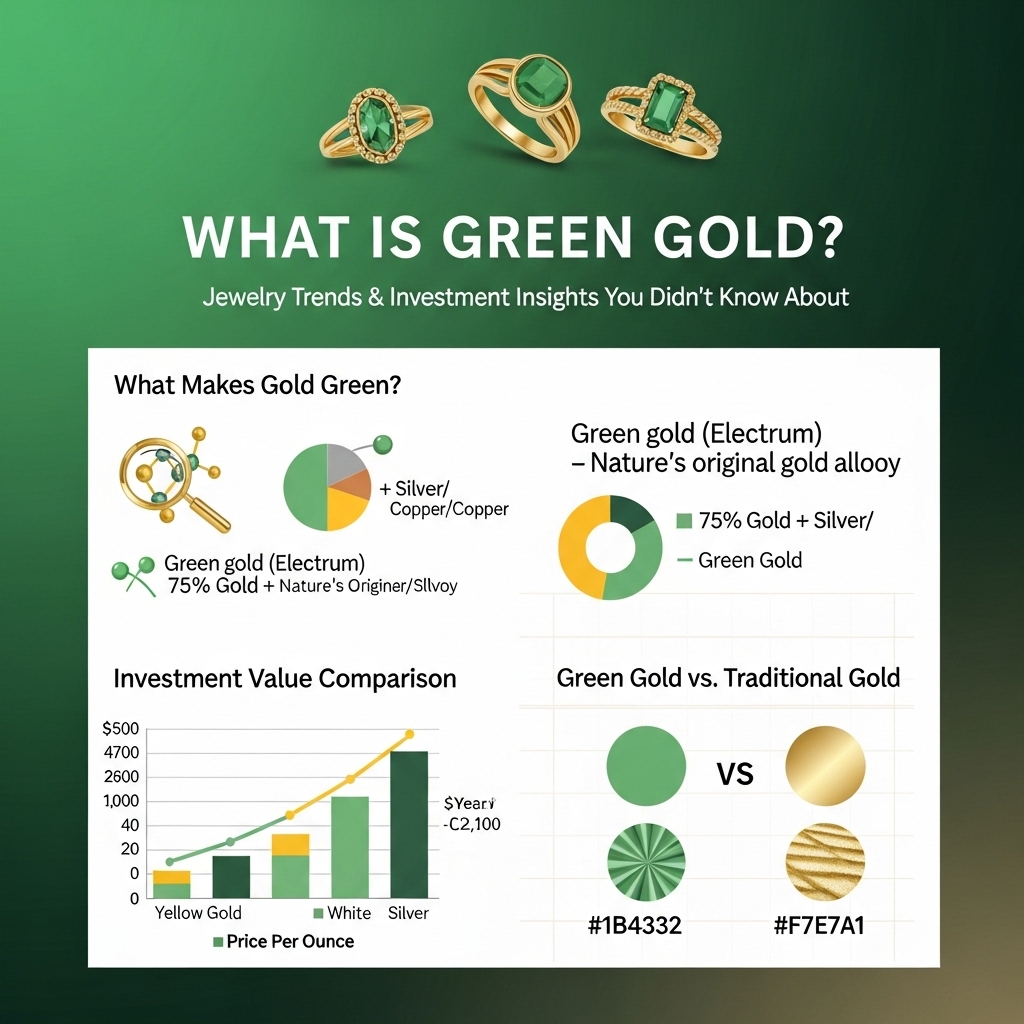

Green gold is a real gold alloy created by mixing pure gold with silver, copper, and sometimes zinc or cadmium. The silver content gives it a distinctive greenish hue, with 18k green gold typically containing 75% gold and 25% silver/copper alloys.

Is green gold a good investment compared to traditional yellow gold?

Green gold has similar intrinsic value to yellow gold of the same karat, as both contain identical gold content. However, yellow gold generally offers better liquidity and market recognition for investment purposes.

Does green gold hold its value over time?

Yes, green gold maintains value based on its gold content. Market premiums may vary due to rarity and craftsmanship, but the base value follows standard gold pricing.

Can I easily sell green gold jewelry if needed?

While possible, green gold may have limited resale markets compared to traditional gold. Collectors and specialty jewelers typically offer the best prices for unique gold alloys.

Are there any risks with investing in green gold jewelry?

Main risks include lower liquidity, potential skin reactions (from copper/nickel), and manufacturing quality variations. Always verify karat marking and purchase from reputable dealers.

How can I authenticate green gold purchases?

Request hallmark certification, conduct acid tests, or use electronic gold testers. Professional appraisal ensures authenticity and accurate karat assessment.

Final Thoughts on Gold Investment

Green gold represents more than just a jewelry trend—it’s a strategic opportunity for savvy investors. As eco-conscious consumers increasingly demand sustainable luxury goods, green gold investments position you at the forefront of this growing market. Key takeaways include understanding that green gold’s unique copper-silver alloy composition creates distinctive value propositions, while its limited supply and rising demand suggest strong appreciation potential.

Investment Recommendation: Consider allocating 5-10% of your precious metals portfolio to green gold pieces, focusing on certified sustainable sources and established designers.

The intersection of environmental responsibility and luxury investing has never been more relevant. Don’t let this emerging opportunity pass you by—green gold could be the diversification your portfolio needs.

Ready to explore green gold investments? Contact our precious metals specialists today for personalized portfolio recommendations and access to exclusive sustainable gold collections.