How Gold Influences the Indian Rupee and Inflation: What Every Investor Should Know

Gold prices are shining brighter than ever, with the precious metal recently hitting record highs amidst global economic uncertainty. For Indian investors, gold is more than just a safe-haven asset—it’s deeply entwined with the country’s financial system, shaping market trends, influencing the Indian rupee, and affecting inflation rates. With the rupee fluctuating against the dollar and inflationary pressures impacting spending power, understanding gold’s role in this dynamic equation has never been more critical for savvy investors seeking long-term value.

In this post, we’ll explore how gold prices interact with the strength of the Indian rupee, why inflation makes gold investing particularly attractive in India, and the financial benefits of making gold a core part of your portfolio. We’ll also discuss the latest trends in the gold market and share actionable insights for investors looking to navigate the evolving landscape.

Whether you’re a seasoned investor or just beginning your journey with gold, grasping the powerful influence gold exerts on the Indian economy can help you make smarter, more profitable investment decisions. Read on to discover why monitoring gold, the rupee, and inflation isn’t just a smart move—it’s essential for anyone aiming to secure and grow their wealth in the Indian market.

Gold Market Analysis and Key Insights

Rising Gold Demand in India

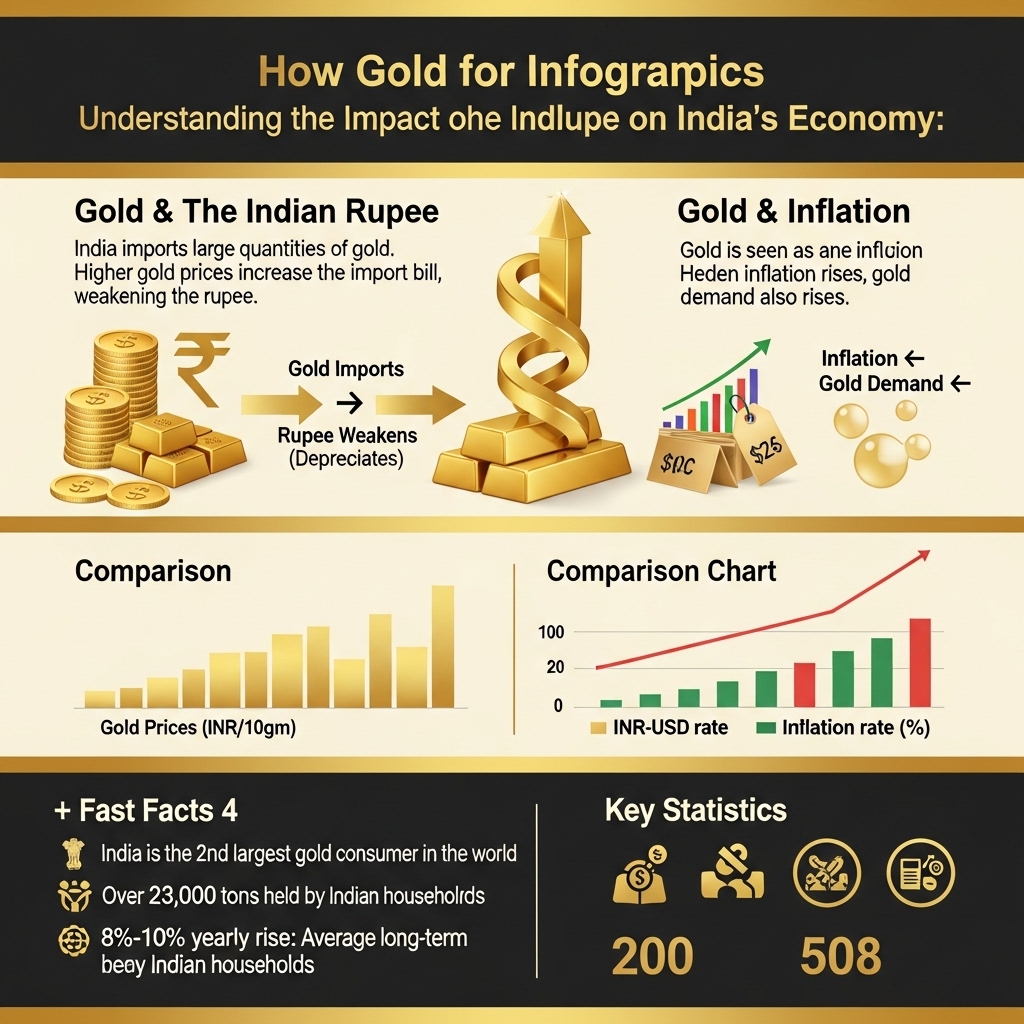

Gold holds deep cultural and economic significance in India, functioning as both a symbol of wealth and a traditional hedge against uncertainty. In recent years, World Gold Council data has shown consistently high demand; in 2023, India’s gold demand reached approximately 760 tonnes, positioning it as the second-largest gold consumer globally. The trend reveals that during periods of rupee depreciation and rising inflation, Indian households and investors often turn to gold for security. This cyclical surge in demand not only bolsters the price of gold but also boosts gold imports, putting pressure on the country’s current account and exacerbating rupee fluctuations.

Impact of Gold Investment on Rupee and Inflation

When Indian investors increase gold purchases, especially during inflationary phases or rupee weakness, currency outflows rise since most gold is imported. This amplifies the current account deficit and weakens the rupee further—creating a feedback loop of currency depreciation and rising import costs. Simultaneously, gold purchases provide a buffer for investors; unlike the rupee, gold has historically maintained value in inflationary climates. In 2023, for instance, domestic gold prices in India surged nearly 11% amid a weakening rupee and persistent global inflation.

Investment Benefits and Risks

Gold is praised for portfolio diversification and inflation protection. It generally exhibits low correlation with equity markets, and Indian investors often choose physical gold, gold ETFs, or sovereign gold bonds. However, gold investment is not without risk. Factors such as price volatility, storage concerns for physical gold, and government import duties affect returns. Moreover, excessive gold imports contribute to macroeconomic vulnerabilities, such as a wider current account deficit.

Expert Recommendations

Financial experts recommend disciplined allocation to gold—usually 5-10% of an investment portfolio. Diversifying between paper and physical gold can reduce liquidity and safety risks. Monitoring rupee trends, global gold prices, and government policies affecting gold duties is crucial. Experts advise avoiding impulsive purchases during price spikes, instead encouraging systematic investment to average out acquisition costs and minimize timing risks.

Gold Investment Strategies and Options

Investing in gold remains a popular strategy for mitigating currency and inflation risks in India. Understanding the varied options and strategies is key to optimizing returns and managing risks.

Gold Investment Options

Indian investors can access gold through physical forms—such as jewelry, coins, or bars—or via financial products like Gold Exchange Traded Funds (ETFs), Sovereign Gold Bonds (SGBs), and digital gold. Physical gold provides tangible ownership and is deeply rooted in Indian culture. However, storage, purity, and liquidity concerns persist. Gold ETFs and SGBs eliminate these drawbacks, offering easy trading, regulatory oversight, and—particularly for SGBs—additional interest income.

Strategies and Portfolio Allocation

Allocating 5-15% of investment portfolios to gold is widely recommended as a hedge against rupee depreciation and inflation. Conservative investors may prefer a higher allocation, while aggressive investors and those comfortable with risk might keep it minimal. Blending gold with equities and fixed income assets balances growth potential and risk, especially during periods of currency volatility or rising inflation.

Comparative Assessment

Physical gold, while culturally significant, involves additional costs like making and storage charges. Gold ETFs offer liquidity and easy tracking, while SGBs are government-backed, provide regular interest, and carry no storage hassle, though they have fixed lock-in periods. Digital gold offers flexibility for smaller investments but should be purchased via reliable platforms to avoid counterparty risk.

Market Timing Considerations

While timing the gold market is challenging, historical patterns show gold prices rise during periods of high inflation and rupee weakness. Investors may choose systematic investment plans (SIPs) in gold ETFs or digital gold, spreading purchases over time to average costs and reduce timing risks.

A well-structured gold investment strategy is an effective safeguard for Indian investors against economic uncertainty, currency fluctuations, and inflationary pressures.

Market Performance and Outlook

Historically, gold has played a critical role in influencing the Indian Rupee (INR) and the country’s inflation trends. Over the past decade, gold prices in India have exhibited steady growth, regularly reaching record highs, particularly during periods of economic uncertainty such as the global financial crisis of 2008 and the COVID-19 pandemic. In 2020, gold prices surged by over 25% year-on-year, closely mirroring a weakening rupee and rising inflation as investors flocked to the yellow metal as a safe haven.

Currently, the Indian gold market remains robust, with prices hovering around ₹60,000 per 10 grams in 2024. This is partially due to persistent global economic headwinds, fluctuating US dollar strength, and ongoing geopolitical tensions. The rupee, meanwhile, continues to face downward pressure due to a widening current account deficit, high crude oil prices, and persistent domestic inflation. Since gold imports significantly impact the demand for foreign currency, substantial gold buying often exerts additional pressure on the rupee.

Looking ahead, analysts predict sustained volatility in gold prices against the backdrop of global inflation, central bank policies, and shifting investment patterns. Any rise in gold prices could elevate inflation levels in India, given gold’s prominence in household savings and imports. Key economic factors influencing gold include international interest rates, monetary policy, rupee-dollar valuation, and import duties. Overall, gold will likely remain a vital indicator and driver of both rupee strength and inflationary trends in India.

Frequently Asked Questions About Gold Investment

How does gold impact the value of the Indian Rupee?

Gold has an inverse relationship with the Indian Rupee. India imports most of its gold, leading to higher demand for US dollars. When gold imports soar, the rupee can weaken due to increased dollar outflows, making gold more expensive domestically.

Why do Indians consider gold a hedge against inflation?

Gold traditionally retains its value when inflation rises. As inflation erodes the rupee’s purchasing power, gold often appreciates or remains stable, protecting investor wealth during economic uncertainty.

Can significant gold imports worsen inflation in India?

Yes, substantial gold imports can lead to a weaker rupee, raising the cost of all imports, including fuel. This can push up inflation as imported goods become more expensive.

What global factors influence gold prices and the rupee?

Global gold prices are influenced by the US dollar strength, international interest rates, and geopolitical events. These also affect the rupee’s exchange rate, linking gold price movements and rupee volatility.

Should investors buy gold during high inflation?

Many investors buy gold during high inflation to protect their wealth. However, they should consider gold’s price volatility, global trends, and diversification needs before investing.

Does government policy affect gold investments?

Yes, the Indian government often adjusts import duties, gold monetization schemes, and tax rules to manage gold demand. These policies can directly influence gold’s domestic price and investment attractiveness.

Final Thoughts on Gold Investment

In summary, gold plays a pivotal role in shaping the value of the Indian Rupee and influencing inflation trends. For investors, understanding these dynamics is crucial: gold often acts as a hedge against currency depreciation and inflationary pressures. With India’s unique cultural and economic connection to gold, its price movements are closely intertwined with broader macroeconomic factors. As an investor, diversifying your portfolio with gold can provide stability during times of financial uncertainty. We recommend considering gold as a long-term strategic asset, not just a short-term speculative play. Ready to secure your financial future? Stay informed, revisit your investment goals, and explore the benefits of adding gold to your portfolio today. Let gold be your shield against economic volatility—start investing wisely!