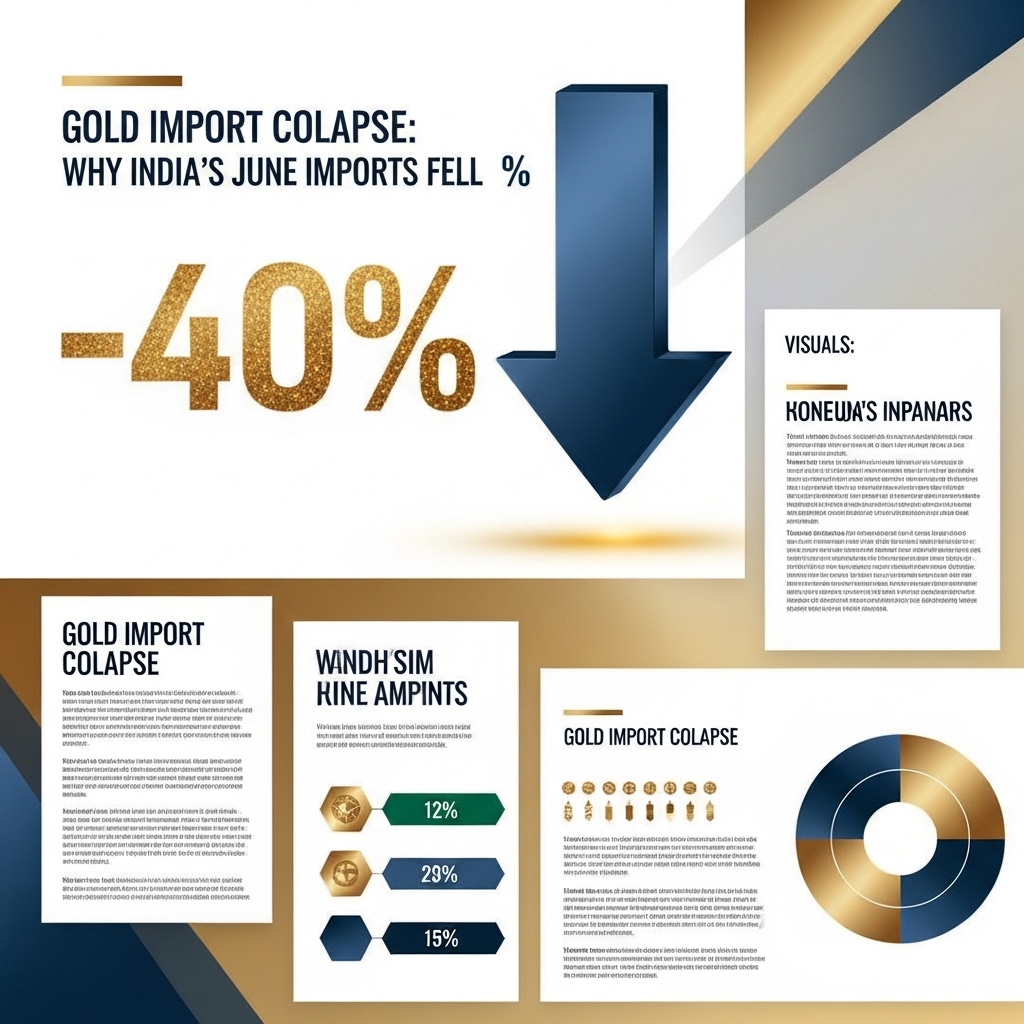

Gold Import Collapse: Why India’s June Imports Fell 40% – What it Means for Your Gold Investments

In a world grappling with persistent inflation, geopolitical uncertainties, and volatile stock markets, gold has once again shone brightly, cementing its reputation as a reliable safe haven. As investors flock to the yellow metal, eyeing its potential for capital preservation and growth, one recent development stands out: India’s gold imports plummeted by a staggering 40% in June. This isn’t merely a statistical anomaly; it’s a significant shift in the landscape of global gold demand, raising critical questions for anyone focused on strategic gold investing.

India, as one of the world’s largest consumers of physical gold, plays an unparalleled role in shaping global market dynamics. A sharp contraction in its imports sends ripples across the international gold market, potentially influencing everything from supply-demand equilibrium to future price trajectories. For astute gold investors, understanding the underlying causes and implications of this dramatic drop is crucial for navigating current market trends and optimizing their financial benefits. Is this a temporary blip, or does it signal a more fundamental change in consumer behavior or economic conditions that could redefine gold’s performance?

This post will delve deep into the factors behind India’s sudden reduction in gold imports, exploring how domestic policies, economic conditions, and global price movements converged to create this unique situation. We will analyze the immediate and long-term consequences for gold investing, examining whether this signals a temporary blip or a more fundamental shift in market forces. Join us as we unpack this critical market signal, offering insights that can empower your investment decisions and help you capitalize on the evolving opportunities within the gold sector.

Gold Market Analysis and Key Insights

India’s significant drop in June gold imports, a 40% decline, offers crucial insights into evolving gold investment dynamics within the nation and globally. This sharp reduction reflects a confluence of factors, including elevated domestic prices and shifting investor sentiment, rather than a diminished long-term appeal of gold itself.

Domestic Price Sensitivity & Demand Dynamics

The primary driver behind the import collapse was undoubtedly the surge in domestic gold prices, propelled by strong international rates, a weakening Indian Rupee, and increased import duties. This confluence made gold significantly more expensive for Indian consumers and investors, leading to deferred purchases and a preference for liquidating existing holdings over new acquisitions. This trend highlights the price-elastic nature of gold demand in India, particularly for physical forms. Investors are increasingly evaluating the optimal entry and exit points, indicating a more sophisticated approach to gold as an asset.

Global Price Volatility & Safe-Haven Appeal

Globally, gold has demonstrated remarkable resilience, often trading near historical highs or consolidating after significant rallies. Its safe-haven status has been reinforced by persistent inflationary pressures, geopolitical uncertainties, and slowing global economic growth. While India’s physical imports decreased, the underlying global sentiment towards gold as a hedge against volatility and currency debasement remains strong. This divergence suggests that while physical demand may fluctuate locally, the strategic rationale for gold investment endures.

Investment Benefits & Considerations

Gold remains a cornerstone for portfolio diversification, acting as a reliable hedge against inflation and market volatility. For Indian investors, Sovereign Gold Bonds (SGBs) and Gold ETFs offer compelling alternatives to physical gold, mitigating issues like storage costs, making charges, and liquidity concerns, while still providing exposure to gold price appreciation. Investors should consider their time horizon and risk appetite, balancing the tangible security of physical gold with the convenience and potentially higher returns of paper gold.

Expert Recommendations: Diversification is paramount. Financial advisors recommend allocating a modest portion (typically 5-15%) of a portfolio to gold for wealth preservation. For those eyeing long-term capital appreciation, a staggered investment approach into SGBs or ETFs can be beneficial, leveraging rupee-cost averaging. Continuous monitoring of global economic indicators and central bank policies is crucial to inform investment decisions.

Gold Investment Strategies and Options

The recent 40% drop in India’s gold imports signifies a dynamic shift in the market, presenting both challenges and opportunities for investors. Understanding various gold investment avenues and strategic approaches is crucial in this evolving landscape.

Gold Investment Options: India offers a diverse range of gold investment options. Physical gold, in the form of coins, bars, and jewelry, remains a popular choice, particularly for cultural significance. However, it incurs costs like making charges and storage risks. Gold Exchange Traded Funds (ETFs) offer a convenient way to invest in gold without holding physical metal, with units tracking the price of gold and traded on stock exchanges. Sovereign Gold Bonds (SGBs), issued by the Reserve Bank of India, provide interest payments in addition to capital appreciation, offering a government-backed, paperless investment with tax benefits. Gold mutual funds invest in gold ETFs or companies involved in gold mining and production.

Risk Assessment and Portfolio Allocation: Gold is often considered a safe-haven asset, typically performing well during economic uncertainty and inflation. However, its price can be volatile. Diversification is key; allocating a portion of one’s portfolio to gold, typically between 5-10%, can mitigate overall risk. The optimal allocation depends on an individual’s risk tolerance and financial goals. For instance, a more conservative investor might lean towards SGBs for their stability and interest component, while a growth-oriented investor might consider gold mining stocks, albeit with higher risk.

Comparison of Investment Methods: Physical gold offers tangible ownership but lacks liquidity and incurs additional costs. ETFs provide liquidity and ease of trading, mirroring gold prices closely. SGBs offer an attractive yield and capital appreciation, along with tax benefits, making them a strong contender for long-term holding. Gold mutual funds can provide exposure to the broader gold industry, but their performance can be influenced by company-specific factors.

Market Timing Considerations: While timing the market is notoriously difficult, the recent import slump might present an opportune moment for strategic accumulation, particularly for those with a long-term view. Monitoring global economic indicators, inflation trends, and central bank policies can provide insights into potential price movements. For investors seeking regular exposure, Dollar-Cost Averaging (DCA) through ETFs or SGBs can smooth out volatility and capitalize on potential dips.

Market Performance and Outlook

India’s June gold imports plummeted 40% year-on-year, a significant deviation from its historical position as a voracious consumer, often importing over 700 tonnes annually. This sharp decline reflects current market headwinds rather than a long-term erosion of demand. Globally, gold has demonstrated resilience, hovering near multi-month highs despite aggressive interest rate hikes by central banks like the U.S. Federal Reserve, which typically strengthen the dollar and weigh on gold.

The import collapse in June is largely attributable to record-high domestic gold prices, softened rural demand due to the monsoon season’s early stages, and potential inventory adjustments by jewelers. Economic factors critically influencing gold include the dollar’s trajectory, inflation expectations, and global geopolitical uncertainties. A stronger dollar makes gold more expensive for non-dollar holders, while high inflation often boosts gold’s appeal as a hedge, but rising real interest rates can deter investment.

Looking ahead, the outlook for Indian gold imports remains mixed. While the upcoming festive and wedding seasons are expected to revive demand, global economic slowdown fears and continued monetary tightening pose risks. Gold’s safe-haven appeal could persist amidst geopolitical tensions, potentially supporting international prices. However, sustained high domestic prices and a weaker rupee could continue to suppress import volumes, maintaining a delicate balance between local demand drivers and global economic pressures.

Frequently Asked Questions About Gold Investment

Why did India’s gold imports fall by 40% in June?

The sharp decline was primarily driven by record-high domestic gold prices, which significantly curbed consumer demand. Contributing factors included a weaker Indian rupee making imports more expensive, and a recent increase in the gold import duty from 7.5% to 12.5%, further escalating costs for buyers.

Does this significant drop in Indian imports affect global gold prices?

While India is a major gold consumer, a single month’s import data typically has a limited immediate impact on global gold prices. Global prices are more influenced by broader macroeconomic factors like interest rate outlooks, inflation concerns, geopolitical stability, and the strength of the US dollar. A sustained, multi-month decline, however, could exert more noticeable pressure.

What does this import collapse signify for gold demand in India?

It indicates a temporary slowdown in physical gold demand, largely due to price sensitivity and policy changes. It doesn’t necessarily suggest a fundamental long-term shift away from gold’s inherent value or cultural importance in India, but rather a pause in purchasing as consumers react to the increased cost.

How might this impact Indian gold investors and consumers?

For consumers, the higher domestic prices and increased import duties mean gold is more expensive to acquire. For investors, it could lead to reduced liquidity in the domestic market if fewer transactions occur. Existing gold holdings, however, retain their value based on prevailing market rates, but the barrier to new entry has risen.

Is this decline a temporary phenomenon or a long-term trend?

This decline is largely viewed as a temporary adjustment to the current high prices and duty hikes. India’s cultural affinity for gold and its role as a hedge against inflation suggest that underlying demand remains strong. A significant correction in gold prices or future policy changes could lead to a rebound in imports as pent-up demand resurfaces.

Final Thoughts on Gold Investment

India’s significant drop in June gold imports highlights localized market dynamics, primarily driven by high domestic prices and seasonal demand shifts, rather than a global decline in gold’s appeal. For investors, this underscores the importance of understanding regional nuances, while reinforcing gold’s enduring role as a vital safe-haven asset. It serves as a reminder that gold’s value proposition often transcends immediate trade figures, offering crucial protection against broader economic uncertainties and inflation.

Our final investment recommendation remains clear: gold deserves a strategic allocation within a well-diversified portfolio. Do not let short-term import data overshadow gold’s long-term protective qualities. We encourage you to continue monitoring global economic trends and consult with a qualified financial advisor to ensure your gold investments align with your overall financial strategy.