Gold’s New Frontier: How Indian Jewellery Micro-Entrepreneurs Use 3D Printing with Recycled Gold

The gold market continues its fascinating dance, recently bolstered by inflation concerns and geopolitical shifts that underscore its timeless appeal as a safe haven asset. But what if the next significant shift in gold’s value isn’t solely from macroeconomic forces, but from how it’s crafted? This post unveils a revolutionary trend: how Indian jewellery micro-entrepreneurs are strategically integrating 3D printing with recycled gold to redefine their craft and market presence, offering profound implications for investors.

We’ll delve into this innovative synergy, exploring how these nimble businesses leverage advanced manufacturing for intricate designs with unparalleled precision and speed. This adoption significantly streamlines production, drastically reduces material waste by utilizing recycled gold, and lowers operational costs, fostering a more efficient and financially sustainable model. For the discerning gold investor, understanding this trend is paramount. It offers crucial insights into evolving global gold supply chains, the burgeoning demand for sustainably sourced precious metals, and potential new investment opportunities. This micro-level innovation points to macro-level shifts: increased efficiency enhances overall market liquidity, while the embrace of recycled gold adds significant ESG appeal, subtly influencing the broader gold market’s financial landscape and long-term investment appeal.

Gold Market Analysis and Key Insights

The integration of 3D printing with recycled gold by Indian micro-entrepreneurs significantly intersects with the broader gold investment landscape. Gold has long been an intrinsic part of Indian culture, serving not only as adornment but primarily as a critical investment, a store of wealth, and a hedge against economic instability.

Traditional Value and Economic Role

In India, gold’s cultural significance as a primary form of savings and investment is unparalleled. Often inherited or purchased for life events like weddings, it functions as an accessible, tangible asset for millions, particularly in rural areas without access to formal banking. Its role as a reliable safe haven during economic downturns further solidifies its position in household portfolios.

Current Market Trends and Data

The global gold market has seen significant volatility, with prices recently reaching near-record highs driven by inflation concerns, geopolitical tensions, and depreciating currencies. India remains one of the world’s largest gold consumers, with demand influenced by festivals, weddings, and investment sentiment. The increasing adoption of recycled gold, facilitated by technologies like 3D printing, taps into a growing market for sustainable and cost-efficient precious metal, impacting supply dynamics and potentially stabilising prices for local buyers.

Investment Benefits and Considerations

Investing in gold offers portfolio diversification, acting as a buffer against equity market fluctuations and currency devaluation. Its high liquidity ensures easy conversion to cash. For micro-entrepreneurs, using recycled gold reduces input costs, potentially enhancing profit margins and making gold jewellery more affordable for investors seeking physical assets. However, gold is non-yielding and susceptible to price volatility. Storage and security are also critical considerations for physical gold holdings.

Expert Recommendations

Financial experts advise a diversified investment approach, with gold typically constituting 5-15% of a portfolio. Investors should monitor macroeconomic indicators and global interest rates, which influence gold prices. The trend towards recycled gold offers an ethical investment avenue, aligning with ESG principles and potentially attracting a younger, socially conscious investor base. Understanding the fabrication costs and purity standards, especially with new technologies, remains paramount for informed investment decisions.

Gold Investment Strategies and Options

For Indian jewellery micro-entrepreneurs utilizing 3D printing with recycled gold, strategic investment in gold is paramount, as it serves both as a core raw material and a vital wealth-preservation asset. Understanding various gold investment options and integrating them into a comprehensive financial strategy can significantly enhance business resilience and growth.

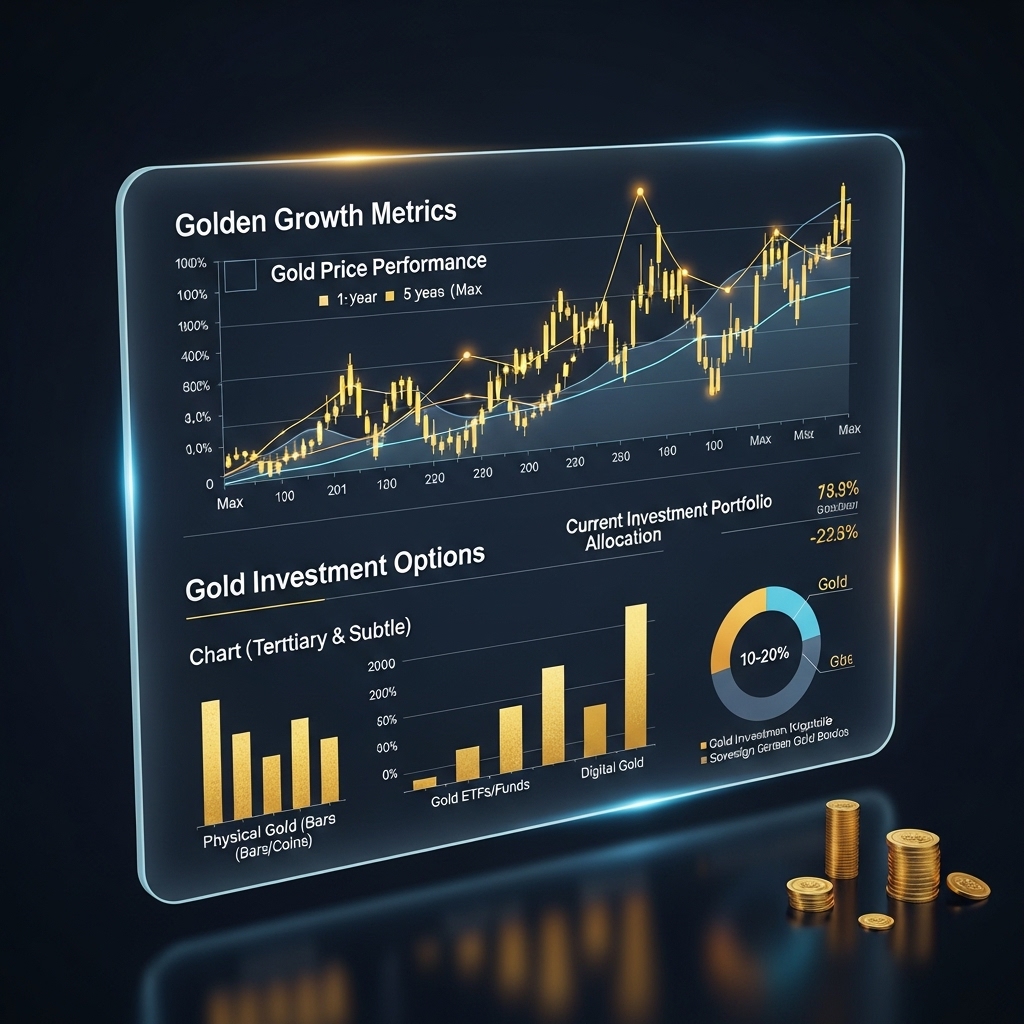

Investment options range from direct physical gold to more liquid digital forms. Physical gold includes the recycled gold purchased for production, as well as gold coins or bars. This offers direct utility for business operations and a tangible asset, but carries risks related to storage, security, and verification. Alternatively, digital gold options like Gold Exchange Traded Funds (ETFs) and Sovereign Gold Bonds (SGBs) provide liquidity, transparent pricing, and eliminate storage concerns. SGBs further offer periodic interest, making them attractive for long-term hold, though they cannot be directly used for manufacturing without redemption.

Risk assessment and portfolio allocation are crucial. Entrepreneurs should consider a balanced portfolio: maintaining sufficient physical recycled gold for operational needs, while allocating surplus capital to digital gold assets. Diversifying across physical and digital forms mitigates risks associated with market fluctuations and operational demands. Gold is often viewed as a long-term hedge against inflation; therefore, a patient, long-term perspective is advisable, rather than short-term speculation.

Comparing methods, physical gold directly supports production but involves higher handling costs. Digital options offer ease of transaction and security but lack direct utility. Market timing considerations involve strategies like dollar-cost averaging, where regular, smaller investments smooth out price volatility. Opportunistic buying during market dips can be beneficial, particularly for acquiring recycled gold for production at lower costs. Ultimately, an integrated approach, balancing working capital with strategic investment in gold, empowers these entrepreneurs to navigate market dynamics effectively.

Market Performance and Outlook

Historically, Indian jewellery micro-entrepreneurs largely operated within traditional frameworks, facing significant capital demands and material waste. The past decade has seen a notable shift: while traditional methods still dominate, there’s been a steady uptake of recycled gold, driven by cost-effectiveness and increasing sustainability awareness. The integration of 3D printing is a more recent, yet rapidly accelerating, development. It allows micro-entrepreneurs to innovate beyond traditional constraints, offering design complexity and reducing waste, making it particularly effective for recycled gold.

Currently, the market thrives on robust domestic gold demand and a rising consumer preference for sustainable products. Recycled gold, appealing for its lower environmental footprint and often more stable pricing, is highly attractive. Micro-entrepreneurs, leveraging 3D printing, capitalize on these trends by producing intricate, customized pieces efficiently. Economic factors such as global gold price volatility, interest rate fluctuations, and inflation concerns directly influence the value and availability of recycled gold, often making it a more attractive input than newly mined gold. The future outlook is highly promising. Continued technological advancements in 3D printing, coupled with growing environmental consciousness and the digital empowerment of small businesses, will likely propel significant expansion in this niche. We predict sustained growth, offering personalized, eco-friendly jewellery, though challenges like initial technology investment and skill development require ongoing attention.

Frequently Asked Questions About Gold Investment

How does using recycled gold impact the purity and investment value?

Recycled gold, when processed properly, yields gold of the same purity as newly mined gold (e.g., 24-karat). This means its intrinsic investment value, based on its gold content, remains unaffected. Reputable micro-entrepreneurs ensure rigorous testing and refining to guarantee purity.

Is 3D printed jewellery made with recycled gold a good investment compared to traditional gold bars or coins?

While traditional bars and coins are pure bullion investments, 3D printed jewellery offers a blend of intrinsic gold value and artisanal craftsmanship. Its investment appeal lies in both the gold content and the unique design. For pure capital growth, bullion is preferred. For a more tangible, aesthetically pleasing asset with gold’s inherent security, 3D printed recycled gold can be attractive.

What are the potential risks of investing in 3D printed recycled gold jewellery?

Key risks include ensuring the seller’s credibility, verifying the gold purity, and understanding the market value of the craftsmanship versus the gold content. Buyers should seek transparent suppliers who provide certificates of authenticity for both the gold and the 3D printing process.

How can I verify the authenticity and purity of recycled gold in 3D printed jewellery?

Look for reputable micro-entrepreneurs who clearly state their sourcing and refining processes. Ask for assay certificates or documentation proving the gold’s purity. Reputable jewellers often use laser inscription to denote the gold’s karat and origin.

Does the 3D printing process itself add or subtract from the gold’s inherent value as an investment?

The 3D printing process is a manufacturing technique. It adds value through intricate design possibilities and customisation, which can increase the jewellery’s market price beyond its scrap gold value. However, the fundamental investment value remains tied to the weight and purity of the gold itself.

Final Thoughts on Gold Investment

For discerning gold investors, the story of Indian micro-entrepreneurs leveraging 3D printing with recycled gold offers pivotal insights. It powerfully demonstrates gold’s enduring adaptability and its promising future within a circular economy, driven by technological innovation and sustainable practices. This highlights a burgeoning, ethically-conscious demand segment, solidifying gold’s continued relevance far beyond its traditional safe-haven status.

Our final recommendation is unequivocal: gold remains an indispensable asset, now further enhanced by its embrace of cutting-edge technology and a commitment to responsible sourcing. Consider gold not just for its stability, but for its evolving utility and its pivotal role in a more sustainable financial landscape. We urge you to explore these transformative trends further and strategically incorporate gold into your diversified investment portfolio for long-term resilience.