Unlocking Gold’s Future: Why India’s Demand Holds the Key

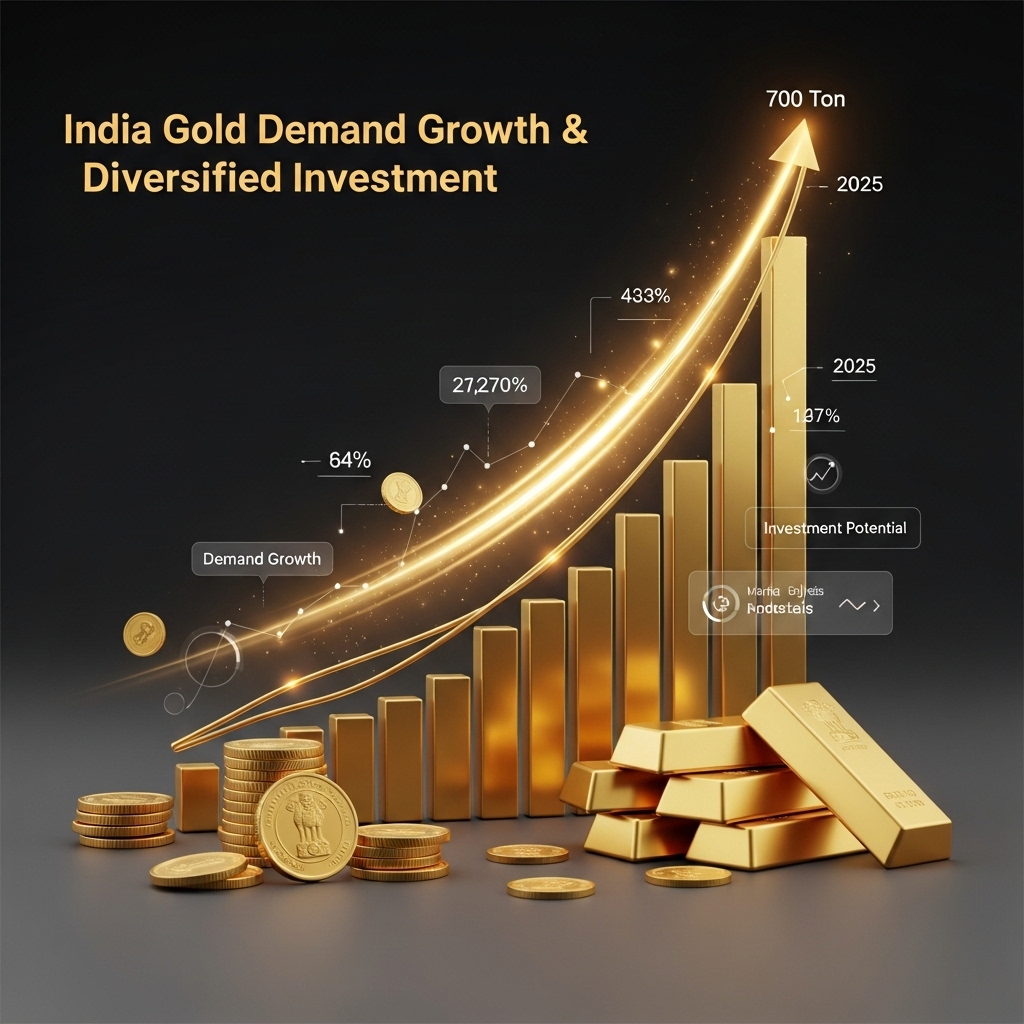

In an era defined by persistent market volatility, inflationary pressures, and a looming global economic slowdown, gold has once again proven its mettle as a quintessential safe haven. Yet, amidst this widespread uncertainty, a fascinating paradox emerges: could India, the world’s second-largest gold consumer, defy global trends and drive its demand to an astonishing 700 tons by 2025? For savvy investors, understanding this powerful potential isn’t just intriguing—it’s absolutely critical for navigating the future of precious metals.

This deep dive will explore the unique confluence of cultural, economic, and demographic factors poised to fuel India’s insatiable appetite for gold, even as other economies falter. We’ll unpack the intricate dynamics enabling this surge: from evolving consumer preferences and rising disposable incomes to gold’s strategic importance in Indian households. This analysis will detail how these internal forces could act as a significant counterweight to global headwinds, profoundly shaping gold prices and offering vital insights for your investment strategy.

For gold investors, grasping the magnitude of India’s potential demand is paramount. A sustained increase to 700 tons would not only provide robust support for gold prices but could also signal a new era of market stability and growth for the yellow metal. Monitoring India’s gold consumption isn’t just about market trends; it’s about identifying a potentially transformative catalyst for your portfolio, offering unique financial benefits in the years to come.

Gold Market Analysis and Key Insights

India’s unwavering affinity for gold, deeply rooted in cultural tradition and its perception as a tangible asset, positions it uniquely to sustain high demand despite global economic slowdowns. The drive towards a 700-ton gold demand in 2025 will be significantly propelled by evolving investment patterns.

Cultural Affinity and Wealth Preservation

Gold in India is not merely an ornament; it’s a primary vehicle for savings and wealth preservation, especially for households in rural and semi-urban areas. This intrinsic trust ensures a consistent underlying demand, viewing gold as a critical asset for security and intergenerational transfer of wealth.

Inflation Hedge and Economic Resilience

In an environment of fluctuating global markets and inflationary pressures, gold consistently acts as a reliable hedge. India’s robust domestic economic growth, coupled with rising disposable incomes, empowers consumers to continue allocating a portion of their savings to gold, safeguarding their purchasing power.

Evolution of Investment Avenues

The market has seen a significant shift from purely physical gold to more financialized products. Sovereign Gold Bonds (SGBs), Gold Exchange Traded Funds (ETFs), and digital gold platforms have broadened access, appealing to younger, digitally-savvy investors and providing a secure, liquid, and often tax-efficient alternative to physical holdings.

Current Gold Market Trends and Data:

Despite global economic uncertainties and a strong US dollar, India’s gold demand has shown remarkable resilience. World Gold Council (WGC) data consistently places India among the top global consumers, with significant investment demand persisting even during periods of high international prices. This sustained interest underscores gold’s role as a preferred asset class, particularly during festival seasons and wedding purchases that often involve significant investment.

Investment Benefits and Considerations:

Investing in gold offers diversification, acting as a buffer against equity and currency volatility. It is a long-term store of value, providing stability to investment portfolios. Considerations include price volatility influenced by global economic data and geopolitical events, potential storage costs for physical gold, and understanding the taxation aspects of different gold investment products.

Expert Recommendations:

Financial advisors often recommend a strategic allocation of 5-15% of a diversified portfolio to gold. For Indian investors, leveraging Sovereign Gold Bonds (SGBs) is highly recommended due to their sovereign backing, interest payouts, and capital gains tax exemptions if held to maturity. Gold ETFs offer liquidity and convenience, while physical gold remains a traditional choice. A long-term investment horizon is crucial to navigate market fluctuations and capitalize on gold’s intrinsic value appreciation.

Gold Investment Strategies and Options

To achieve a 700-ton gold demand, strategic investment avenues are crucial for Indian consumers and investors. Diverse options cater to varying preferences. Physical gold (jewellery, coins, bars) remains culturally significant, though it incurs making charges, GST, and storage risks. For modern investors, Digital gold platforms offer convenience, allowing purchases in small denominations with secure vault storage. Financial market instruments include Gold Exchange Traded Funds (ETFs), providing liquidity and transparent pricing on exchanges, tracking gold prices closely. Sovereign Gold Bonds (SGBs), issued by the RBI, are highly attractive due to government backing, annual interest payments, and tax exemptions on maturity, offering a safe, non-physical way to own gold. Gold Mutual Funds also offer indirect exposure.

Risk assessment is vital for any portfolio. Gold typically serves as a hedge against inflation and currency depreciation, offering crucial portfolio diversification. A prudent portfolio allocation generally suggests dedicating 5-15% of one’s total investment to gold, balancing its non-yielding nature with its role as a safe-haven asset during economic uncertainties and geopolitical volatility.

Comparing investment methods, physical gold carries high transaction costs and storage concerns. Digital gold and ETFs offer ease of transaction and no storage issues, but the former might involve counterparty risk, and the latter requires a demat account. SGBs provide unmatched safety and tax benefits but have a lock-in period until maturity.

Market timing considerations are crucial. Global economic slowdowns, geopolitical tensions, and interest rate movements typically influence gold prices. Within India, the festival season (e.g., Diwali, Akshaya Tritiya) historically boosts demand. While large purchases can be timed during market dips, systematic investment plans (SIPs) in gold ETFs or SGBs mitigate timing risks by averaging costs over time, ensuring consistent demand growth for India.

Market Performance and Outlook

Historically, India’s gold demand has shown remarkable resilience, fluctuating between 600-800 tonnes annually over the past decade. For instance, after reaching 857 tonnes in 2013, demand saw temporary dips due to policy changes and high prices, yet consistently recovered, demonstrating gold’s deep cultural roots. In 2023, demand stood robustly around 747 tonnes, underscoring its underlying strength despite global volatility.

Currently, global economic headwinds and an appreciating US dollar present challenges, potentially impacting local affordability. However, India’s unique market conditions, driven by strong cultural affinity, festive seasons, and wedding demand, provide significant counter-cyclical support. Despite global slowdown concerns, domestic consumption remains a primary driver, buoyed by a young demographic and increasing urbanization.

The future outlook for India hitting 700 tonnes by 2025 appears achievable, predicated on sustained economic growth and an expanding middle class. Predictions suggest resilient consumer sentiment, especially if inflation moderates and disposable incomes rise.

Key economic factors influencing this trajectory include inflation, which often makes gold an attractive hedge against eroding purchasing power. Interest rate movements, both global and domestic, also play a role; while higher rates elsewhere can make non-yielding gold less appealing, India’s unique investment landscape mitigates some of this effect. Crucially, a stable Indian Rupee against the dollar and robust GDP growth are essential to maintain affordability and drive the aspirational demand necessary to reach the 700-ton target.

Frequently Asked Questions About Gold Investment

How can India’s gold demand grow amidst a global slowdown?

India’s gold demand is deeply rooted in cultural factors, festivals, and weddings. Gold acts as a traditional inflation hedge and store of wealth, especially in rural areas, making its demand resilient to global economic downturns.

What role do Indian government policies play in this demand?

Government initiatives like Sovereign Gold Bonds (SGBs) provide easy investment avenues. Stable import policies and strategic adjustments can also foster formal market growth and influence overall consumption patterns.

Is gold a safe investment during a global slowdown?

Gold traditionally acts as a safe-haven asset. During economic uncertainty or market volatility, investors often turn to gold for wealth preservation, which typically boosts demand and can support its value.

What specific factors could drive Indian gold demand to 700 tons?

Key drivers include enduring cultural affinity, consistent festive and wedding purchases, gold’s role as an inflation hedge, and increasing disposable incomes, particularly in rural and semi-urban segments.

Are there any risks to achieving this demand target?

Risks include sharp increases in international gold prices impacting affordability, unforeseen adverse changes in import duties, or a severe, prolonged domestic economic downturn affecting purchasing power.

Final Thoughts on Gold Investment

India’s projected 700-ton gold demand in 2025, even amidst a global slowdown, underscores gold’s enduring appeal as a safe-haven asset and a significant cultural investment. For Indian investors, this presents a compelling opportunity. Key takeaways highlight the resilience of domestic demand, driven by cultural affinity and a growing middle class, which can buffer against international market volatility. Furthermore, the increasing adoption of digital gold and ETFs offers accessible and convenient ways to participate.

Given these factors, we recommend a strategic allocation to gold within your portfolio. Its diversification benefits and potential for capital appreciation make it a prudent choice. Don’t miss out on this opportune moment. Explore your gold investment options today and secure your financial future.