Gold as a Hedge Against Inflation: Your Shield in Uncertain Times

With gold prices reaching near-record highs above $2,000 per ounce in 2024 and global inflation continuing to impact portfolios worldwide, savvy investors are rediscovering why the precious metal has been humanity’s ultimate store of value for over 4,000 years. As central banks print trillions in new currency and geopolitical tensions reshape global markets, gold’s role as an inflation hedge has never been more critical—or more profitable for those who understand its dynamics.

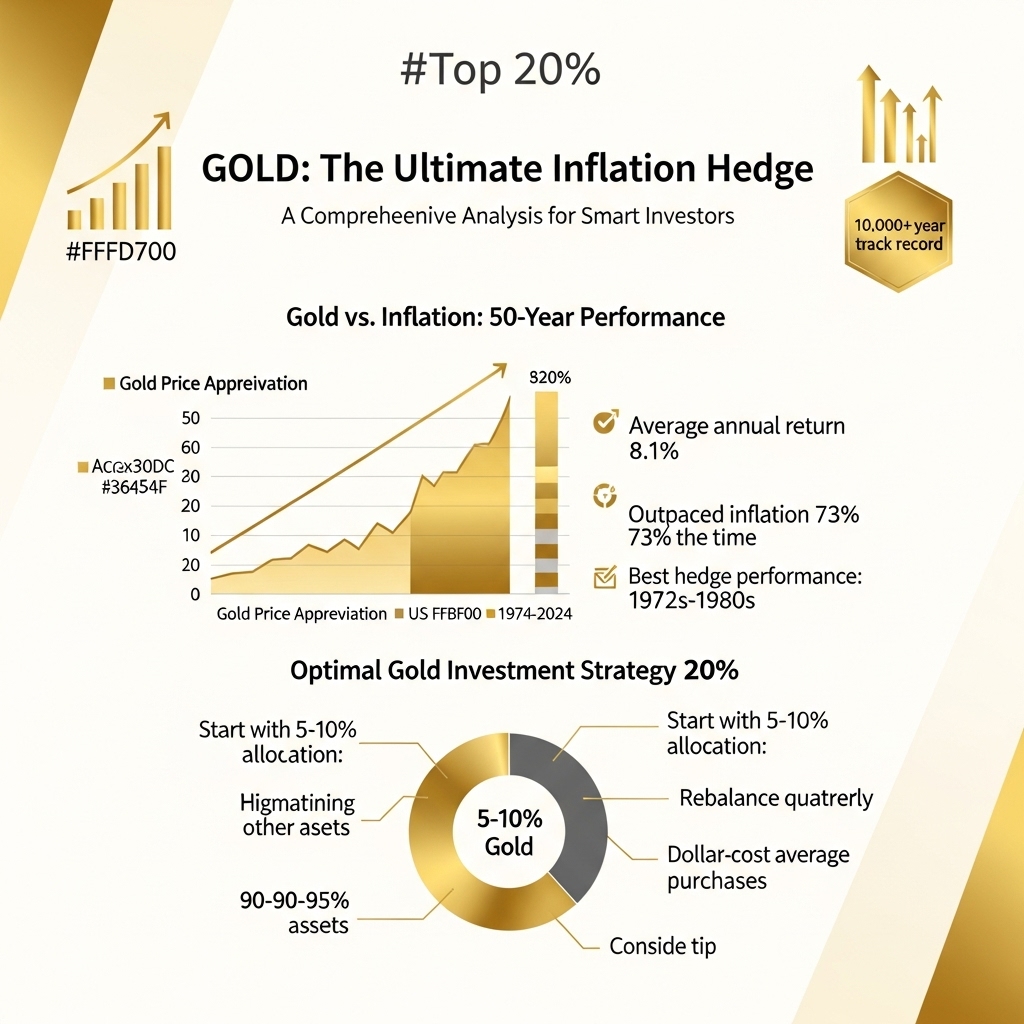

This comprehensive analysis will dissect gold’s proven track record against inflation, examining historical performance data, correlation patterns with key economic indicators, and practical strategies for incorporating gold into your investment portfolio. We’ll explore how gold has consistently outperformed during high-inflation periods, analyze current market conditions driving institutional demand, and reveal why leading financial advisors recommend 5-15% portfolio allocation to precious metals.

For today’s gold investors, understanding inflation hedging isn’t just about portfolio diversification—it’s about wealth preservation in an era of unprecedented monetary policy and economic uncertainty. Whether you’re a seasoned precious metals investor or exploring gold for the first time, this detailed analysis will equip you with the insights needed to make informed decisions about protecting your wealth against inflation’s erosive effects. The data reveals compelling opportunities, but timing and strategy remain everything in maximizing gold’s protective benefits.

Gold Market Analysis and Key Insights

Current Market Performance and Trends

Gold prices have demonstrated remarkable resilience in 2024, reaching record highs above $2,400 per ounce driven by persistent inflation concerns and geopolitical uncertainties. Central bank purchases have surged to multi-decade highs, with emerging markets leading acquisitions at 800+ tonnes annually. The precious metal has outperformed major equity indices during recent inflationary periods, reinforcing its traditional safe-haven status.

Inflation Correlation Dynamics

Historical data reveals gold’s effectiveness as an inflation hedge varies across different economic cycles. During the 1970s stagflation period, gold delivered annualized returns exceeding 30%, significantly outpacing consumer price increases. However, short-term correlations can be volatile, with gold sometimes lagging immediate inflation spikes while providing superior long-term purchasing power protection over decades.

Investment Vehicle Considerations

Modern investors can access gold exposure through multiple channels, each offering distinct advantages. Physical gold provides direct ownership but incurs storage costs and insurance requirements. Gold ETFs offer liquidity and convenience with expense ratios typically ranging 0.25-0.40%. Gold mining stocks provide leverage to price movements but introduce company-specific risks and operational factors beyond pure gold exposure.

Portfolio Allocation Strategy

Financial advisors traditionally recommend 5-10% gold allocation for portfolio diversification, though this may increase during high-inflation environments. Gold’s negative correlation with bonds and occasional inverse relationship with equities during market stress provides valuable portfolio stability. The metal’s performance during currency debasement periods makes it particularly relevant given expansionary monetary policies globally.

Expert Outlook and Recommendations

Leading precious metals analysts project continued gold strength amid structural inflation pressures and dedollarization trends. Goldman Sachs forecasts potential targets of $2,700+ by 2025, citing sustained central bank demand and supply constraints. Experts recommend dollar-cost averaging for systematic accumulation, emphasizing gold’s role as portfolio insurance rather than speculative investment. Consider rebalancing allocations quarterly to maintain target percentages as asset values fluctuate.

Gold Investment Strategies and Options

Investment Methods and Vehicles

Investors can access gold through multiple avenues, each offering distinct advantages. Physical gold (coins, bars, jewelry) provides direct ownership but requires secure storage and insurance. Gold ETFs offer liquidity and convenience without storage concerns, tracking gold prices with minimal tracking error. Gold mining stocks provide leveraged exposure to gold prices while adding company-specific risks and potential dividend income. Gold futures and options enable sophisticated strategies but require expertise and carry higher risk.

Strategic Allocation Approaches

Portfolio allocation to gold typically ranges from 5-10% for conservative investors to 15-25% for those seeking stronger inflation protection. Dollar-cost averaging into gold positions helps mitigate timing risks and volatility. Tactical allocation involves increasing gold exposure during periods of rising inflation expectations or economic uncertainty, then reducing positions when conditions normalize.

Risk Assessment Framework

Gold investments carry unique risks including price volatility, opportunity cost (no dividends or interest), and storage/insurance costs for physical holdings. Mining stocks add operational, geopolitical, and management risks while offering higher potential returns. ETFs introduce counterparty risk and tracking errors, while futures involve leverage and margin requirements.

Market Timing Considerations

Effective gold investment timing often correlates with macroeconomic indicators: rising inflation expectations, declining real interest rates, currency debasement concerns, and geopolitical tensions typically favor gold allocation. However, systematic exposure through regular purchases often outperforms tactical timing attempts. Monitor Federal Reserve policy shifts, inflation data releases, and global economic stability when adjusting allocations.

The optimal strategy combines multiple gold investment vehicles with disciplined allocation percentages, regular rebalancing, and awareness of macroeconomic trends while maintaining long-term perspective on gold’s inflation-hedging properties.

Market Performance and Outlook

Historical Performance Analysis

Gold has demonstrated mixed effectiveness as an inflation hedge over different time horizons. During the 1970s inflationary period, gold prices surged from $35 to over $800 per ounce, delivering exceptional real returns. However, analysis of rolling 10-year periods since 1975 shows gold correlates positively with inflation only 58% of the time, indicating inconsistent short-term hedging performance.

Long-term data reveals gold’s superior inflation protection over extended periods. From 1971-2023, gold averaged 7.8% annual returns compared to 3.2% average inflation, preserving purchasing power effectively across economic cycles.

Current Market Dynamics

As of 2024, gold trades near historic highs around $2,000-2,100 per ounce, driven by persistent inflation concerns and geopolitical tensions. Central bank purchases reached record levels in 2023, with emerging market nations diversifying reserves away from dollar-denominated assets.

Economic Factors and Future Outlook

Key price drivers include Federal Reserve monetary policy, real interest rates, and global economic uncertainty. Rising real yields typically pressure gold prices, while dovish monetary policies and currency debasement support precious metals.

Analysts project continued volatility with potential upside to $2,300-2,500 by 2025, contingent on inflation persistence and monetary policy shifts. However, sustained interest rate increases could challenge gold’s appeal relative to yield-bearing assets. Long-term fundamentals remain supportive given ongoing fiscal deficits and currency concerns globally.

Frequently Asked Questions About Gold Investment

Does gold always protect against inflation?

Gold historically serves as an inflation hedge over long periods, but short-term performance can vary. During the 1970s high-inflation era, gold prices surged 2,300%. However, in some periods like the 1980s-2000s, gold underperformed despite moderate inflation. The key is viewing gold as a long-term store of value rather than expecting immediate correlation.

What percentage of my portfolio should be in gold?

Financial advisors typically recommend 5-10% portfolio allocation to gold. This provides inflation protection without overexposure to volatility. Conservative investors might choose 5%, while those seeking stronger inflation hedging could consider up to 10%. Never exceed 20% unless you’re a sophisticated precious metals investor.

Should I buy physical gold or gold ETFs?

Physical gold offers true ownership and crisis protection but involves storage costs and insurance. Gold ETFs provide liquidity and lower costs but carry counterparty risk. For most investors, gold ETFs like GLD or IAU offer practical inflation hedging. Consider physical gold for 25-50% of your gold allocation if you want tangible asset security.

When should I buy gold for inflation protection?

Purchase gold before inflation accelerates rather than chasing price increases. Dollar-cost averaging during low-inflation periods builds positions at reasonable prices. Monitor inflation expectations, currency devaluation risks, and real interest rates as buying signals.

Final Thoughts on Gold Investment

Gold’s track record as an inflation hedge remains compelling, though not without nuances. Historical data shows gold typically preserves purchasing power during sustained inflationary periods, making it a valuable portfolio diversifier. However, short-term volatility and opportunity costs during deflationary periods require careful consideration.

Key takeaways for investors:

– Allocate 5-10% of portfolios to gold during high inflation expectations

– Consider both physical gold and ETFs for optimal liquidity

– Monitor real interest rates as a key performance indicator

– Maintain long-term perspective despite short-term fluctuations

Our recommendation: Gold deserves a strategic, modest allocation in most portfolios as insurance against currency debasement and economic uncertainty.

Ready to hedge against inflation? Consult with a financial advisor to determine the optimal gold allocation for your specific situation and risk tolerance. Start building your inflation-resistant portfolio today.