Investing in Gold for Your Child’s Future: Smart or Risky?

As global economies fluctuate and headlines warn of inflation, gold prices have once again surged to historic highs, capturing the attention of both seasoned investors and concerned parents alike. In the first half of 2024 alone, gold has outperformed major stock indices, shining as a resilient store of value amid uncertainty. With experts predicting continued volatility in traditional markets, many families are asking: could investing in gold be the wisest move to secure your child’s future?

In this post, we’ll examine both the promise and pitfalls of gold investing for long-term goals like education and financial stability. You’ll discover the latest gold market trends, compare gold’s historical performance to other assets, and weigh the key risks and rewards. We’ll also discuss practical ways to invest in gold—bullion, coins, ETFs, or even gold savings accounts—and the best strategies for balancing safety with growth potential.

Whether you’re a newcomer seeking to diversify your portfolio or a veteran investor considering the next generation, understanding gold’s potential role in your child’s future is more important than ever. Your investment choices today can pay dividends for decades, so let’s explore if gold really is the golden ticket to building lasting wealth for your family.

Gold Market Analysis and Key Insights

Current Gold Market Trends and Data

Gold has remained a coveted investment choice for centuries, often seen as a safe haven during economic uncertainty. Recent data shows that gold prices have experienced significant fluctuations over the past few years. In 2023 and early 2024, global gold prices reached historic highs, briefly surpassing $2,350 per ounce due to inflationary pressures, geopolitical instability, and central banks increasing their gold reserves. According to the World Gold Council, overall gold demand rose by 18% in 2023, driven largely by strong retail buying in Asian markets and robust central bank purchases.

Investment Benefits and Considerations

Benefits:

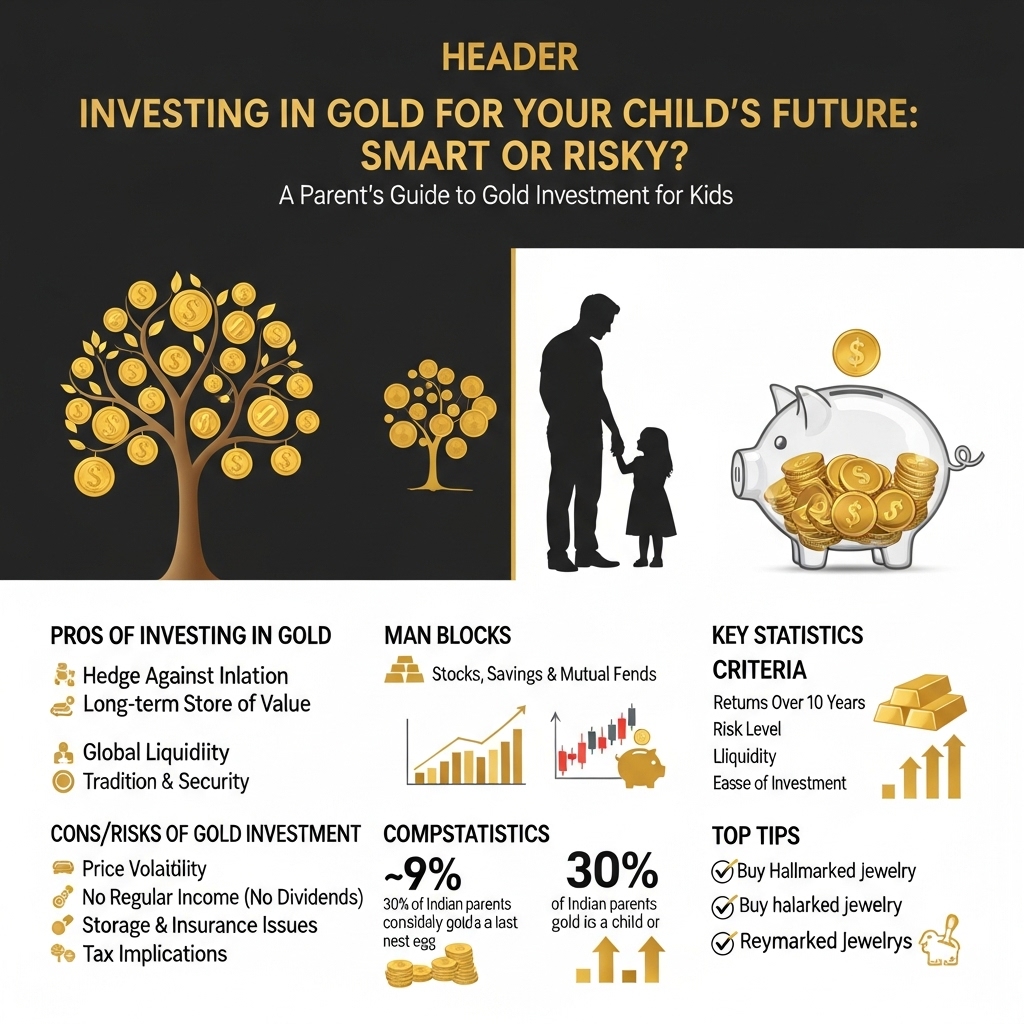

Gold is renowned for its ability to act as a hedge against inflation and currency devaluation, making it a popular choice for securing a child’s financial future. Its negative correlation with equity markets provides valuable portfolio diversification. Gold is also a highly liquid asset—relatively easy to buy and sell—which increases its appeal for those planning for long-term goals like education or marriage expenses.

Considerations:

However, gold investment is not without its risks. Historically, gold does not generate passive income like stocks or bonds—there are no dividends or interest payouts. Storage and insurance costs, especially for physical gold, also eat into returns. Moreover, gold prices can be volatile in the short term, influenced by global economic events, changing interest rates, and shifts in government policies.

Key Market Insights and Expert Recommendations

Experts suggest that while gold remains a useful component in a child-focused investment strategy, it should not be the sole asset. Most financial advisors recommend allocating no more than 10-15% of your overall portfolio to gold, balanced with equities, debt instruments, and other growth-oriented options. Consider starting with gold ETFs or sovereign gold bonds, which offer transparency, safety, and potential tax benefits over physical gold.

In conclusion, gold can be a smart addition to your child’s financial planning—provided you are mindful of market trends, invest in moderation, and integrate it with other assets for a robust, low-risk portfolio.

Gold Investment Strategies and Options

When considering gold as part of your child’s financial future, it’s essential to evaluate the diverse investment avenues and smart allocation tactics. The most prominent gold investment options are physical gold (bars, coins, jewelry), gold exchange-traded funds (ETFs), sovereign gold bonds, and gold mutual funds. Physical gold offers tangible value but brings concerns like storage, security costs, and risk of theft. In contrast, gold ETFs and mutual funds provide convenience—allowing investors to buy and sell seamlessly on stock exchanges while mitigating storage worries. Sovereign gold bonds, issued by governments, not only reflect gold price returns but also provide periodic interest, combining safety and potential appreciation.

A prudent investment strategy emphasizes risk assessment and balanced portfolio allocation. Historically, gold serves as a hedge against inflation and volatile equity markets—a stabilizer during economic downturns. However, its price can fluctuate, and it lacks the recurring income of interest or dividends. Experts usually recommend allocating 5%–15% of a long-term portfolio to gold, ensuring diversification without compromising growth opportunities from equities and bonds.

Comparing investment methods, physical gold involves making charges and liquidity constraints, whereas paper gold—ETFs and bonds—offers superior liquidity and transparency at lower transaction costs. Sovereign bonds, with government backing and interest payouts, are particularly attractive for long-term goals like a child’s future.

Market timing is challenging for gold. Prices often spike during crises and may stagnate in stable economies. Instead of lump-sum investments, consider systematic investing—buying in small, regular installments to average out price volatility and reduce market timing risks.

Ultimately, integrating gold thoughtfully—via efficient vehicles and prudent allocation—can help secure your child’s financial future, balancing potential rewards with the right level of risk.

Market Performance and Outlook

Historically, gold has been recognized as a reliable store of value, particularly during times of economic uncertainty. Over the past two decades, gold prices have climbed significantly—from around $300 per ounce in the early 2000s to all-time highs exceeding $2,000 per ounce in recent years. For long-term investors, this consistent appreciation highlights gold’s function as an effective hedge against inflation and currency devaluation.

Currently, the gold market remains robust, with continued investor interest amid global geopolitical instability and persistent inflation concerns. Central bank buying has also provided strong support to gold prices. In 2023, gold reached record highs as investors sought safety during banking sector disruptions and global tensions.

Looking ahead, the future outlook for gold is cautiously optimistic. Many analysts predict that, although there may be short-term volatility due to interest rate fluctuations and a strong dollar, longer-term demand will likely remain steady. The metal’s safe-haven status tends to attract investment during economic slowdowns or stock market corrections, making it a favored option for building a diversified portfolio for your child.

Key economic factors influencing gold prices include inflation rates, central bank policies, global political events, and real interest rates. A high inflation environment or financial uncertainty typically boosts gold demand, while rising interest rates or a strengthening dollar can dampen its appeal. For parents investing for their child’s future, gold offers both potential gains and a degree of risk tied closely to these broader economic trends.

Frequently Asked Questions About Gold Investment

What are the main benefits of investing in gold for my child’s future?

Gold is a historically stable asset, often used as a hedge against inflation and currency devaluation. It can help diversify your child’s future portfolio, protecting against market volatility. Gold is also highly liquid and can be sold worldwide.

Is gold a safe long-term investment for children?

Generally, gold is less volatile than stocks and provides safety during economic downturns. However, over long periods, gold’s returns may lag behind equities. It’s best used as a part of a diverse investment strategy rather than the sole asset.

What are the risks involved in gold investment?

Gold prices can fluctuate due to geopolitical events, changing interest rates, and shifts in demand. It doesn’t generate income like stocks or bonds (no dividends or interest), and storage/security for physical gold can add costs.

Should I invest in physical gold or gold-related financial products?

Both options have pros and cons. Physical gold (coins, bars) offers direct ownership but may have storage and insurance concerns. Gold ETFs or mutual funds are more convenient, secure, and easier to manage but involve some management fees.

How can I start investing in gold for my child?

You can buy physical gold from banks or authorized dealers, or invest via gold ETFs, sovereign gold bonds, or mutual funds. Research all options and consider fees and your investment horizon before deciding.

Final Thoughts on Gold Investment

In summary, investing in gold for your child’s future presents both safety and potential limitations. Gold is valued for its historical stability and ability to hedge against inflation, making it a reliable way to preserve wealth. However, its price volatility and lack of regular returns mean gold works best as part of a diversified investment strategy rather than your sole asset. Ultimately, gold can play a smart supporting role in your child’s future financial plan when balanced with stocks, bonds, and savings schemes. Before making any decision, consider your risk tolerance, long-term goals, and consult a financial advisor if needed. Ready to take the next step? Explore gold investment options today and secure a brighter future for your child!