Gold IRA Rollover Process and Benefits Explained

While traditional retirement accounts have weathered significant volatility in recent months, gold has maintained its reputation as a reliable store of value, with prices demonstrating remarkable resilience amid economic uncertainty. As inflation concerns persist and geopolitical tensions continue to influence global markets, savvy investors are increasingly turning to precious metals as a hedge against currency devaluation and market instability. This shift has sparked renewed interest in Gold Individual Retirement Accounts (IRAs), particularly among those seeking to diversify their retirement portfolios beyond conventional stocks and bonds.

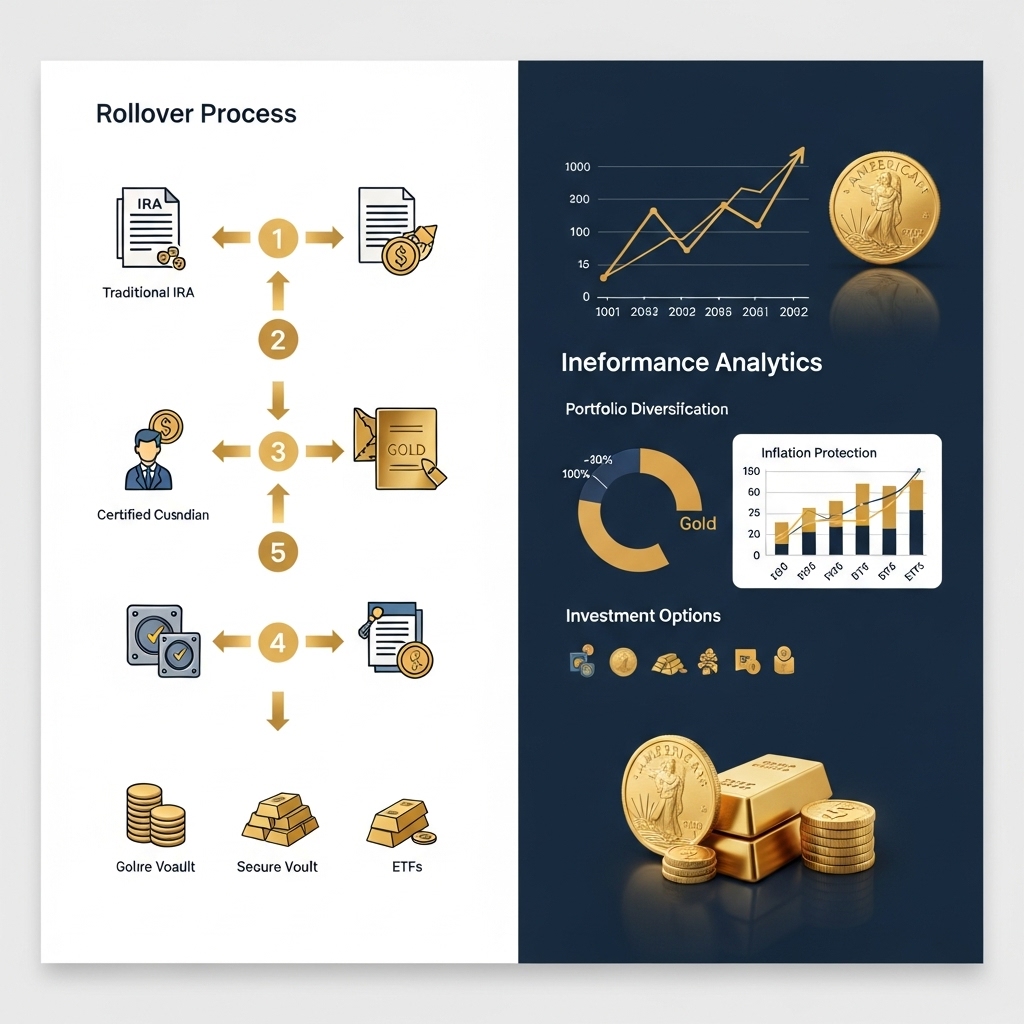

Understanding the Gold IRA rollover process has become crucial for investors looking to protect and potentially grow their retirement wealth. This comprehensive guide will walk you through the step-by-step rollover procedure, explore the significant tax advantages available, and examine the long-term benefits of incorporating physical gold into your retirement strategy. We’ll also address common misconceptions, regulatory requirements, and practical considerations that every potential Gold IRA investor should understand.

The timing for exploring Gold IRA options has rarely been more relevant. With central banks worldwide continuing to expand their gold reserves and institutional investors increasing their precious metals allocations, the strategic value of gold in retirement planning extends far beyond simple portfolio diversification. Whether you’re approaching retirement or planning decades ahead, understanding how to leverage Gold IRAs could be instrumental in safeguarding your financial future against economic volatility.

Gold Market Analysis and Key Insights

Current Gold Performance Trends

Gold continues to demonstrate its resilience as a portfolio diversifier, with prices showing sustained strength amid global economic uncertainties. Recent data indicates gold has maintained its position above the $2,000 per ounce threshold, reflecting increased investor confidence in precious metals during inflationary periods. The metal’s performance has been particularly robust during market volatility, reinforcing its traditional safe-haven status.

Economic Factors Driving Gold Demand

Several macroeconomic indicators support gold’s investment appeal within retirement portfolios. Central bank purchasing remains at historic highs, with institutions adding over 1,000 tons annually to reserves. Persistent inflation concerns, coupled with geopolitical tensions, have strengthened gold’s position as an inflation hedge. Currency debasement fears and low real interest rates continue to make non-yielding assets like gold more attractive to investors.

Gold IRA Investment Benefits

Gold IRAs offer unique advantages for retirement planning, including portfolio diversification beyond traditional stocks and bonds. Physical gold ownership provides tangible asset protection against market crashes and currency fluctuations. The tax-deferred growth potential within IRA structures allows investors to accumulate precious metals without immediate tax implications. Additionally, gold’s historical performance during economic downturns offers potential downside protection for retirement savings.

Strategic Considerations and Expert Recommendations

Financial advisors typically recommend allocating 5-10% of retirement portfolios to precious metals, with gold serving as the cornerstone allocation. When executing gold IRA rollovers, investors should prioritize established custodians with transparent fee structures and secure storage facilities. Timing considerations suggest dollar-cost averaging into gold positions rather than lump-sum investments to mitigate price volatility.

Expert analysis emphasizes the importance of understanding IRS-approved gold products, including specific purity requirements and approved coins or bars. Successful gold IRA strategies focus on long-term wealth preservation rather than short-term speculation, aligning with retirement planning objectives and risk tolerance levels.

Gold Investment Strategies and Options

When implementing a Gold IRA rollover, investors can choose from several precious metals investment strategies, each offering distinct advantages and risk profiles.

Investment Options and Allocation Strategies

Physical gold remains the most popular choice, including coins (American Eagles, Canadian Maple Leafs) and bars meeting IRS purity requirements of 99.5%. Gold ETFs provide easier liquidity but don’t offer physical possession benefits. Gold mining stocks offer leverage to gold prices but carry additional company-specific risks.

Portfolio allocation typically follows the 5-10% rule for precious metals, though some experts recommend up to 20% during economic uncertainty. Conservative investors often start with 5-7% allocation, while those seeking inflation hedging may increase to 10-15%.

Risk Assessment and Comparison

Gold investments serve as portfolio diversification tools and inflation hedges, but carry unique considerations. Physical gold provides tangible asset security but involves storage costs and lower liquidity. ETFs offer instant trading but lack physical ownership benefits. Mining stocks provide potential for higher returns but introduce operational and geopolitical risks.

Market Timing Considerations

Dollar-cost averaging proves effective for gold accumulation, reducing timing risk through systematic purchases regardless of price fluctuations. Key timing factors include:

– Economic uncertainty periods often favor increased gold allocation

– Inflation expectations drive demand and pricing

– Currency debasement concerns support strategic positioning

Rebalancing strategies should account for gold’s volatility and correlation with other assets. During market stress, gold often moves inversely to stocks, providing valuable portfolio stabilization.

Success requires balancing immediate liquidity needs, long-term wealth preservation goals, and risk tolerance while maintaining appropriate diversification across precious metals types and investment vehicles.

Market Performance and Outlook

Gold has demonstrated remarkable resilience as an investment asset over the past two decades. From 2000 to 2024, gold prices increased from approximately $280 per ounce to over $2,000, representing a compound annual growth rate of roughly 8.5%. During major economic crises, including the 2008 financial meltdown and the 2020 pandemic, gold provided crucial portfolio protection when traditional assets declined.

Current market conditions reflect heightened investor interest in precious metals amid persistent inflation concerns and geopolitical tensions. Gold has maintained strong performance in 2024, supported by central bank purchases and continued monetary uncertainty. The Federal Reserve’s monetary policy decisions continue to significantly impact gold pricing, with lower interest rates typically favoring precious metals investments.

Several economic factors drive gold price movements: inflation rates, currency fluctuations (particularly USD strength), global political stability, and supply-demand dynamics. Rising inflation historically correlates with increased gold demand as investors seek inflation hedges.

Looking forward, analysts project continued gold strength driven by ongoing monetary policy uncertainty, potential currency devaluation, and increasing institutional adoption. Climate change impacts on mining operations may constrain future supply, while growing Asian market demand supports long-term price appreciation.

However, investors should note that gold doesn’t generate income like dividend-paying stocks or bonds. Market volatility remains a factor, making gold most effective as a portfolio diversification tool rather than a primary investment vehicle.

Frequently Asked Questions About Gold Investment

What is a Gold IRA rollover?

A Gold IRA rollover involves transferring funds from an existing retirement account (401k, traditional IRA, or Roth IRA) into a self-directed IRA that holds physical precious metals. This process allows you to diversify your retirement portfolio with gold, silver, platinum, or palladium while maintaining tax-advantaged status.

What are the main benefits of investing in Gold IRAs?

Gold IRAs offer portfolio diversification, protection against inflation, and a hedge against economic uncertainty. Precious metals historically maintain value during market volatility and currency devaluation. Additionally, Gold IRAs provide the same tax advantages as traditional retirement accounts while adding tangible asset security.

Which gold products are IRA-eligible?

Only specific gold products meet IRS requirements for IRA inclusion. Eligible items include American Eagle coins, Canadian Maple Leaf coins, and gold bars with 99.5% purity or higher. Collectible coins, jewelry, and numismatic pieces are prohibited in retirement accounts.

How long does the rollover process take?

Typical Gold IRA rollovers take 7-14 business days when executed as direct transfers. The timeline includes account setup, fund transfer, precious metals selection, and secure storage arrangement. Indirect rollovers must be completed within 60 days to avoid penalties.

Are there storage requirements for Gold IRAs?

Yes, IRS regulations require IRA-held precious metals to be stored in approved depositories. Personal storage or home safes are prohibited. Qualified custodians arrange secure storage with insured, segregated facilities that maintain detailed records for tax reporting purposes.

Final Thoughts on Gold Investment

A Gold IRA rollover offers savvy investors a powerful strategy to diversify retirement portfolios while maintaining tax advantages. Key takeaways include the ability to transfer existing 401(k) or traditional IRA funds into precious metals without penalties, protection against inflation and market volatility, and the tangible security that only physical gold provides.

The rollover process, while requiring careful attention to IRS regulations and custodian selection, can significantly strengthen your retirement foundation. Gold’s historical performance as a store of value makes it an essential component of any well-balanced portfolio.

Our recommendation: Consider allocating 10-20% of your retirement assets to gold, especially during times of economic uncertainty.

Ready to secure your financial future? Contact a reputable precious metals IRA specialist today to discuss your rollover options and take the first step toward a more resilient retirement strategy.