Why Gold Prices Are Rising Despite Interest Rate Hikes: A Golden Opportunity for Investors

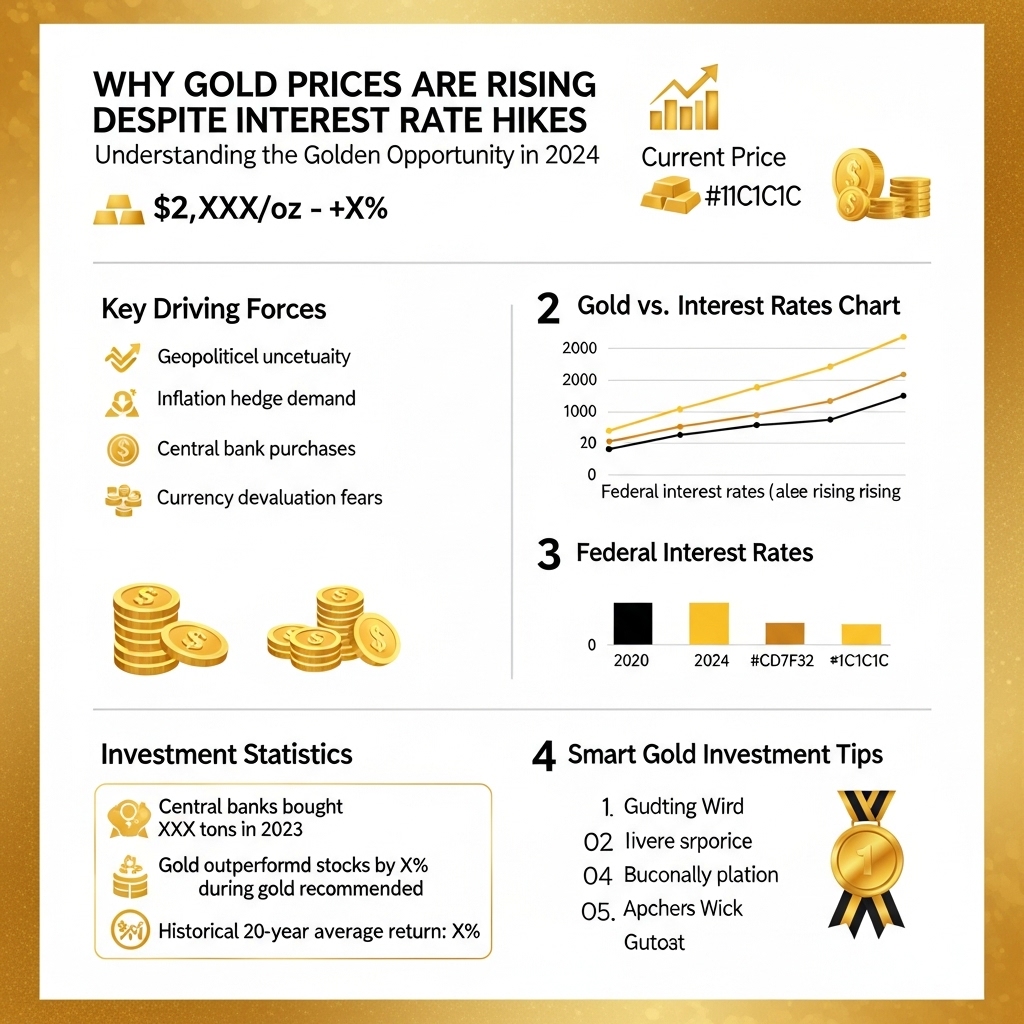

Picture this: While financial experts predicted gold would tumble as interest rates soared, the precious metal has defied conventional wisdom, posting impressive gains throughout 2023 and continuing its upward trajectory into 2024. When the Federal Reserve aggressively raised rates to combat inflation, traditional investment theory suggested gold—a non-yielding asset—would lose its luster. Instead, gold has demonstrated remarkable resilience, leaving many investors puzzled and others counting their profits.

This unexpected market behavior represents more than just an anomaly—it’s a fundamental shift that savvy investors can’t afford to ignore. In this comprehensive analysis, we’ll uncover the hidden forces driving gold’s surprising strength during a high-rate environment, explore how geopolitical tensions and central bank policies are reshaping precious metals markets, and reveal why smart money is flowing into gold despite competing yields from bonds and savings accounts.

Understanding this counterintuitive trend is crucial for building a robust investment portfolio in today’s volatile economic landscape. Whether you’re a seasoned precious metals investor or considering your first gold purchase, the insights we’ll share could help you capitalize on one of the most compelling investment stories of our time. We’ll examine the specific catalysts behind gold’s performance and provide actionable strategies to help you navigate this evolving market dynamic.

Gold Market Analysis and Key Insights

Central Bank Demand Drives Market Momentum

Despite aggressive interest rate hikes, gold prices have demonstrated remarkable resilience, largely driven by unprecedented central bank purchases. The World Gold Council reports that central banks accumulated over 800 tonnes in 2023, the second-highest annual total in decades. This institutional demand has created a solid price floor, with spot gold maintaining levels above $1,950 per ounce despite traditional headwinds.

Inflation Hedge Characteristics Remain Strong

Gold’s traditional role as an inflation hedge has proven more valuable than interest rate sensitivity in the current economic environment. Real interest rates—adjusted for inflation—remain relatively low, making gold an attractive store of value. Historical data shows that when real rates fall below 2%, gold typically outperforms other asset classes, explaining its current strength despite nominal rate increases.

Geopolitical Tensions Support Safe-Haven Demand

Ongoing global uncertainties, including the Russia-Ukraine conflict and US-China trade tensions, have amplified gold’s safe-haven appeal. Investment flows into gold ETFs have increased by approximately 15% year-over-year, indicating sustained institutional and retail interest in precious metals allocation.

Investment Considerations and Portfolio Allocation

Financial advisors recommend maintaining 5-10% portfolio allocation to gold as a diversification strategy. While rising rates typically pressure non-yielding assets, gold’s negative correlation with equities during market stress provides valuable portfolio insurance. However, investors should consider gold’s volatility and lack of income generation when making allocation decisions.

Expert Recommendations for Strategic Positioning

Market analysts suggest a balanced approach to gold investment, combining physical holdings with ETF exposure for liquidity. Goldman Sachs maintains a 12-month price target of $2,100 per ounce, citing continued central bank buying and potential Federal Reserve policy pivots. Experts recommend dollar-cost averaging for retail investors and emphasize gold’s role as a long-term wealth preservation tool rather than a short-term trading vehicle.

Current market dynamics suggest gold’s fundamental drivers remain robust despite interest rate headwinds.

Gold Investment Strategies and Options

Investment Vehicles and Allocation Strategies

Investors can access gold through multiple investment vehicles, each offering distinct advantages. Physical gold (coins, bars) provides direct ownership but involves storage costs and insurance considerations. Gold ETFs offer liquidity and lower transaction costs while maintaining price exposure. Gold mining stocks provide leveraged exposure but carry additional equity market risks and company-specific factors.

Portfolio allocation experts typically recommend 5-10% gold allocation during uncertain economic periods, potentially increasing to 15-20% during significant monetary policy shifts or inflationary environments.

Risk Assessment and Method Comparison

Physical gold eliminates counterparty risk but requires secure storage and insurance, adding 1-2% annual costs. ETFs like GLD or IAU offer convenience and fractional ownership but carry management fees (0.25-0.40% annually) and potential tracking errors. Mining equities provide higher return potential but introduce operational risks and market volatility beyond gold prices.

Futures contracts enable leveraged exposure but require sophisticated risk management and margin requirements, making them suitable primarily for experienced traders.

Market Timing Considerations

Current macroeconomic conditions suggest strategic accumulation during market dips rather than attempting precise timing. Dollar-cost averaging proves particularly effective in volatile gold markets, reducing average purchase costs over time.

Key timing indicators include Federal Reserve policy pivots, real interest rate movements, and geopolitical tension escalation. Historical data suggests gold performs strongest during the 6-18 months following peak interest rates, making current positioning potentially advantageous.

Consider rebalancing triggers at 25% deviation from target allocation, ensuring disciplined profit-taking during gold rallies while maintaining strategic exposure during market uncertainty.

Market Performance and Outlook

Gold has demonstrated remarkable resilience in 2023-2024, gaining approximately 15% year-to-date despite aggressive Federal Reserve interest rate hikes. Historically, gold typically underperforms during rising rate environments, as higher yields make non-yielding assets less attractive. However, this cycle has proven different.

Historical Context: During the 2004-2006 rate hiking cycle, gold initially declined but later surged 180% through 2011. Similarly, current conditions show gold breaking traditional correlations, supported by central bank purchases reaching 1,136 tons in 2022—the highest level since 1967.

Current Market Dynamics: Key drivers include persistent inflation concerns, geopolitical tensions, and currency debasement fears. The dollar’s relative weakness despite higher rates has particularly benefited gold, as major economies face their own monetary challenges. ETF flows remain mixed, but institutional demand continues growing.

Economic Factors: Supply constraints from major producers, declining mine grades, and ESG concerns limiting new exploration support long-term price floors. Additionally, BRICS nations’ de-dollarization efforts are increasing gold’s strategic importance as an alternative reserve asset.

Future Outlook: Analysts project gold could reach $2,300-2,500 per ounce by 2025, driven by eventual Fed pivot, continued central bank accumulation, and structural inflation pressures. However, any significant dollar strengthening or unexpected economic resilience could temporarily pressure prices. The key inflection point remains employment data and Fed policy shifts.

Frequently Asked Questions About Gold Investment

Why is gold performing well with higher interest rates?

Gold traditionally struggles with rising rates due to opportunity costs, but current geopolitical tensions, inflation concerns, and central bank purchases are overriding this relationship. Investors view gold as a safe haven amid global uncertainties.

Should I buy gold during rate hikes?

Dollar-cost averaging into gold during rate hikes can be strategic. While short-term volatility may occur, gold’s fundamental drivers—inflation hedging and crisis protection—remain intact regardless of interest rate environments.

How do central banks affect gold prices?

Central banks have been net buyers of gold, adding over 1,000 tons annually. This institutional demand, particularly from emerging economies seeking dollar alternatives, provides significant price support despite rising rates.

Will gold crash when rates peak?

Historical data shows mixed results. Gold’s performance depends more on real interest rates (nominal rates minus inflation) and crisis sentiment than absolute rate levels. Persistent inflation concerns may continue supporting prices.

What percentage of portfolio should be in gold?

Financial advisors typically recommend 5-10% portfolio allocation to precious metals. During uncertain economic periods, some investors increase this to 15-20% for enhanced portfolio diversification and risk management.

Final Thoughts on Gold Investment

Despite conventional wisdom suggesting rising interest rates should pressure gold prices, multiple factors are driving the precious metal’s resilience. Key takeaways include gold’s role as an inflation hedge, central bank accumulation trends, geopolitical uncertainty, and weakening dollar dynamics that collectively outweigh higher borrowing costs.

Investment Recommendation: Consider allocating 5-10% of your portfolio to gold as a strategic hedge against market volatility and currency debasement. Dollar-cost averaging into gold ETFs or physical gold can help smooth entry points during this transition period.

The current environment presents a compelling case for gold ownership, but timing and allocation matter. Don’t wait for perfect market conditions – they rarely exist.

Ready to diversify with gold? Consult with a qualified financial advisor to determine the optimal gold allocation for your specific investment objectives and risk tolerance. Start building your precious metals position today.