Introduction: The Precious Metals Solar Revolution

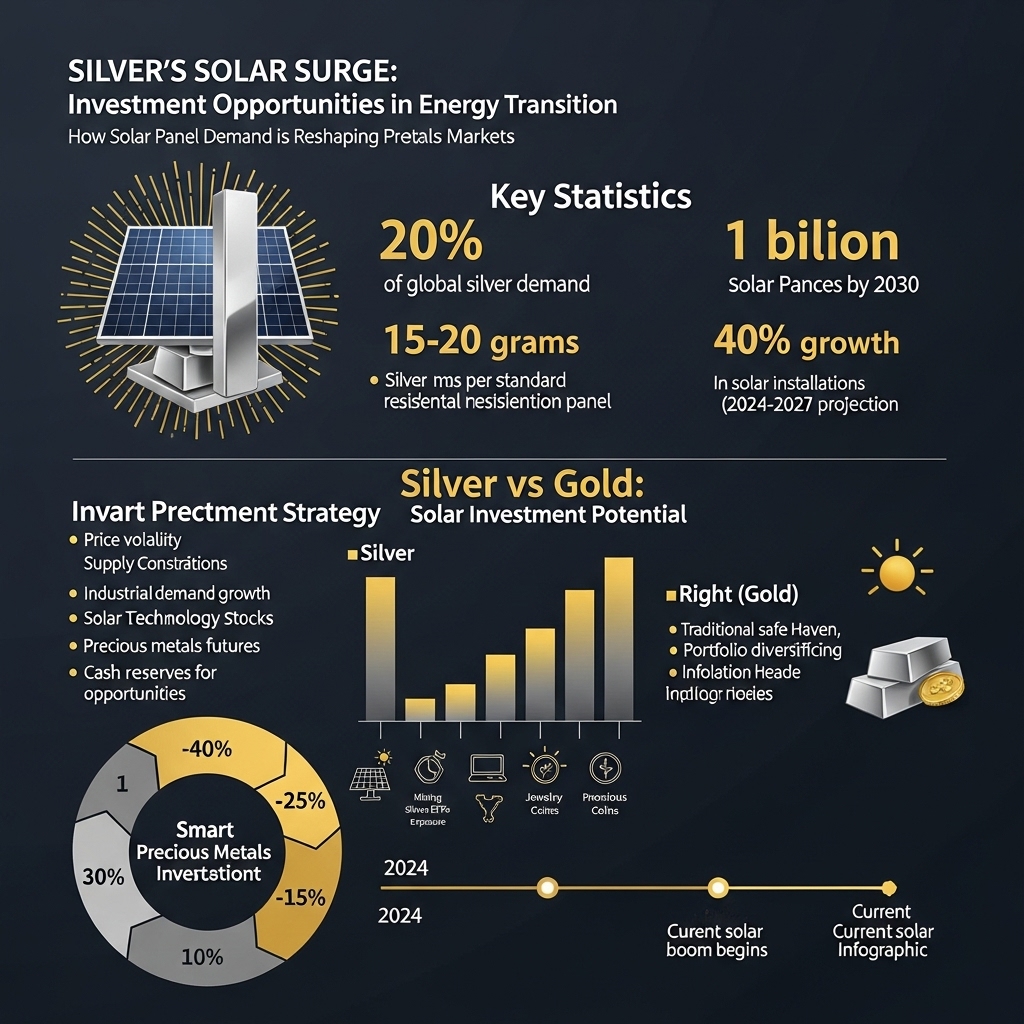

While gold prices have surged over 20% in the past year, reaching near-record highs above $2,000 per ounce, savvy precious metals investors are increasingly turning their attention to a parallel opportunity that could reshape the entire sector: silver’s explosive demand in the solar energy revolution. As global renewable energy installations are projected to triple by 2030, the industrial demand for silver—already consuming over 50% of annual silver production—is poised to create unprecedented market dynamics that could significantly impact gold investment strategies.

This comprehensive analysis will explore how silver’s critical role in photovoltaic solar panels is creating a supply crunch that’s reverberating throughout the precious metals market. We’ll examine the technological drivers behind silver’s irreplaceable position in solar manufacturing, analyze supply-demand forecasts that have industry experts predicting potential shortages, and most importantly, decode what this means for gold investors seeking to optimize their precious metals portfolios.

Understanding silver’s solar trajectory isn’t just about diversification—it’s about recognizing how industrial demand shifts can create arbitrage opportunities between gold and silver that astute investors can leverage. As central banks continue their gold accumulation amid inflationary pressures, the silver-solar nexus presents a unique opportunity to capitalize on both monetary metals demand and the green energy transition that’s reshaping global commodity markets.

Gold Market Analysis and Key Insights

Current Gold Market Performance and Silver Correlation

Gold has demonstrated remarkable resilience in 2024, trading above $2,000 per ounce for most of the year, driven by central bank purchases and inflation hedging demand. While silver’s industrial applications in solar technology create unique demand dynamics, gold’s relationship with its sister metal remains significant. Historically, gold-to-silver ratios have fluctuated between 50:1 and 80:1, currently sitting at approximately 75:1, suggesting potential opportunities for strategic allocation adjustments.

Investment Portfolio Diversification Benefits

As silver demand intensifies through renewable energy expansion, gold provides essential portfolio stability that complements silver’s volatility. Gold’s lower correlation with industrial cycles makes it an ideal hedge against silver’s price swings driven by solar panel manufacturing fluctuations. Current market conditions favor a 70-30 gold-to-silver allocation for conservative investors, while aggressive portfolios might consider 60-40 ratios to capitalize on silver’s industrial growth potential.

Monetary Policy Impact on Precious Metals

Federal Reserve policy shifts significantly influence both metals, but gold typically shows greater sensitivity to interest rate changes. With potential rate adjustments anticipated through 2025, gold’s safe-haven characteristics become increasingly valuable. Central bank gold reserves reached record levels in 2023, with purchases exceeding 1,000 tonnes, providing fundamental support for future price appreciation.

Strategic Investment Recommendations

Expert analysis suggests maintaining core gold positions while tactically increasing silver exposure during solar industry expansion phases. Physical gold investments through coins and bars offer direct commodity exposure, while gold ETFs provide liquidity advantages. Mining stocks present leveraged plays, though they carry additional operational risks.

Consider dollar-cost averaging into gold positions during market uncertainty, as historical data shows consistent long-term appreciation. The current geopolitical environment and currency debasement concerns support gold’s investment thesis, making it an essential component alongside silver investments. Investors should monitor inflation indicators and solar industry growth metrics to optimize precious metals allocation strategies for maximum portfolio protection and growth potential.

Gold Investment Strategies and Options

Note: This section appears to focus on gold rather than silver’s role in solar panels as indicated in the title.

Investment Vehicle Options

Physical Gold offers direct exposure through coins, bars, and jewelry, providing tangible asset ownership but requiring secure storage and insurance. Gold ETFs deliver convenient market exposure without storage concerns, offering high liquidity and lower transaction costs.

Gold Mining Stocks provide leveraged exposure to gold prices while adding operational and management risks. Gold Futures enable sophisticated traders to use leverage and hedge positions but require substantial market knowledge and risk tolerance.

Risk Assessment and Portfolio Allocation

Conservative portfolios typically allocate 5-10% to gold as a hedge against inflation and market volatility. Aggressive investors may increase allocation to 15-20% during economic uncertainty. Gold’s negative correlation with stocks and bonds enhances portfolio diversification, particularly during market downturns.

Key risks include price volatility, storage costs for physical gold, counterparty risk with paper gold products, and opportunity costs during bull equity markets.

Investment Method Comparison

Physical gold offers maximum security but involves storage costs and lower liquidity. ETFs provide optimal balance of accessibility and cost-effectiveness for most investors. Mining stocks offer highest potential returns but carry operational risks beyond gold price movements. Futures suit experienced traders seeking leverage but require active management.

Market Timing Considerations

Gold historically performs well during inflationary periods, currency devaluation, and geopolitical tensions. Dollar-cost averaging reduces timing risk for long-term investors. Technical analysis helps identify entry points, while monitoring Federal Reserve policy, inflation data, and global economic indicators guides strategic allocation adjustments.

Recommendation: Most investors benefit from a core position in gold ETFs supplemented by selective mining stock exposure.

Market Performance and Outlook

Silver has demonstrated remarkable resilience in recent years, driven significantly by its expanding role in solar panel manufacturing. Historically, silver prices averaged $15-20 per ounce from 2015-2020, but surged to over $28 per ounce in 2021-2022, reflecting both industrial demand growth and monetary policy impacts.

Current market conditions show silver trading in the $22-25 range, with solar panel production consuming approximately 100-130 million ounces annually—roughly 10-12% of total global silver demand. This industrial consumption has created a fundamental floor for silver prices, distinguishing it from purely speculative precious metals investments.

Future projections indicate solar energy installations could triple by 2030, potentially driving silver demand to 200 million ounces annually for photovoltaic applications alone. The International Energy Agency forecasts solar capacity additions of 85GW annually through 2030, requiring substantial silver inputs for efficient energy conversion.

Key economic factors affecting silver prices include Federal Reserve monetary policy, inflation rates, and renewable energy subsidies. Unlike gold, which responds primarily to monetary concerns, silver benefits from both safe-haven demand and industrial applications. Supply constraints from major producers like Mexico and Peru add additional price support.

Investment implications suggest silver offers dual exposure to precious metals appreciation and renewable energy growth themes. However, price volatility remains significant, with industrial demand providing stability while monetary factors driving shorter-term fluctuations in this critical clean energy commodity.

Frequently Asked Questions About Silver Investment in Solar Technology

How much silver is actually used in solar panels?

Each solar panel contains approximately 15-20 grams of silver, primarily in photovoltaic cells where silver paste creates electrical connections. With global solar installations exceeding 200 gigawatts annually, this translates to roughly 100-130 million ounces of silver demand yearly from the solar industry alone.

Will solar demand significantly impact silver prices?

Solar applications now represent about 12-15% of total silver demand, making it the fastest-growing industrial use. As countries accelerate renewable energy adoption to meet climate goals, solar silver demand could double by 2030, creating substantial upward pressure on prices.

Are there alternatives to silver in solar panels?

While researchers explore copper and aluminum alternatives, silver’s superior electrical conductivity remains unmatched. Current substitutes reduce panel efficiency by 2-5%, making them economically unviable for most applications. Silver’s role appears secure for the foreseeable future.

How should investors position for solar-driven silver demand?

Consider physical silver holdings, silver ETFs, or mining stocks focused on primary silver production. Solar demand provides long-term structural support, but investors should diversify across multiple silver demand drivers including electronics, jewelry, and industrial applications.

What risks could affect solar silver demand?

Potential risks include breakthrough alternative technologies, economic slowdowns reducing solar installations, or significant increases in silver prices forcing efficiency improvements that reduce per-panel silver content.

Final Thoughts on Gold Investment

While silver’s growing demand in solar technology presents compelling investment opportunities, gold remains the cornerstone of precious metals portfolios. The solar industry’s silver consumption creates potential supply constraints that could drive precious metals prices higher, benefiting gold investors through sector-wide momentum and inflation hedging.

Smart gold investors should monitor silver market dynamics as an early indicator of broader precious metals trends. However, gold’s superior liquidity, universal recognition, and proven store-of-value characteristics make it the more reliable long-term investment choice.

Our recommendation: Maintain gold as your primary precious metals allocation (70-80%), while considering a modest silver position (20-30%) to capitalize on solar industry growth.

Ready to strengthen your portfolio? Consult with our precious metals specialists today to develop a balanced gold and silver investment strategy tailored to your financial goals and risk tolerance.