A Practical Guide to How Much is 10k Gold Price Per Gram

Figuring out how much is 10k gold price per gram is actually pretty simple once you pull back the curtain. The whole thing boils down to two key ingredients: your gold’s purity and the live market price of gold, which is known as the spot price.

Bottom line? Your 10k gold’s base value is just 41.7% of whatever pure, 24k gold is selling for per gram right now.

The Real Value of Your 10k Gold Explained

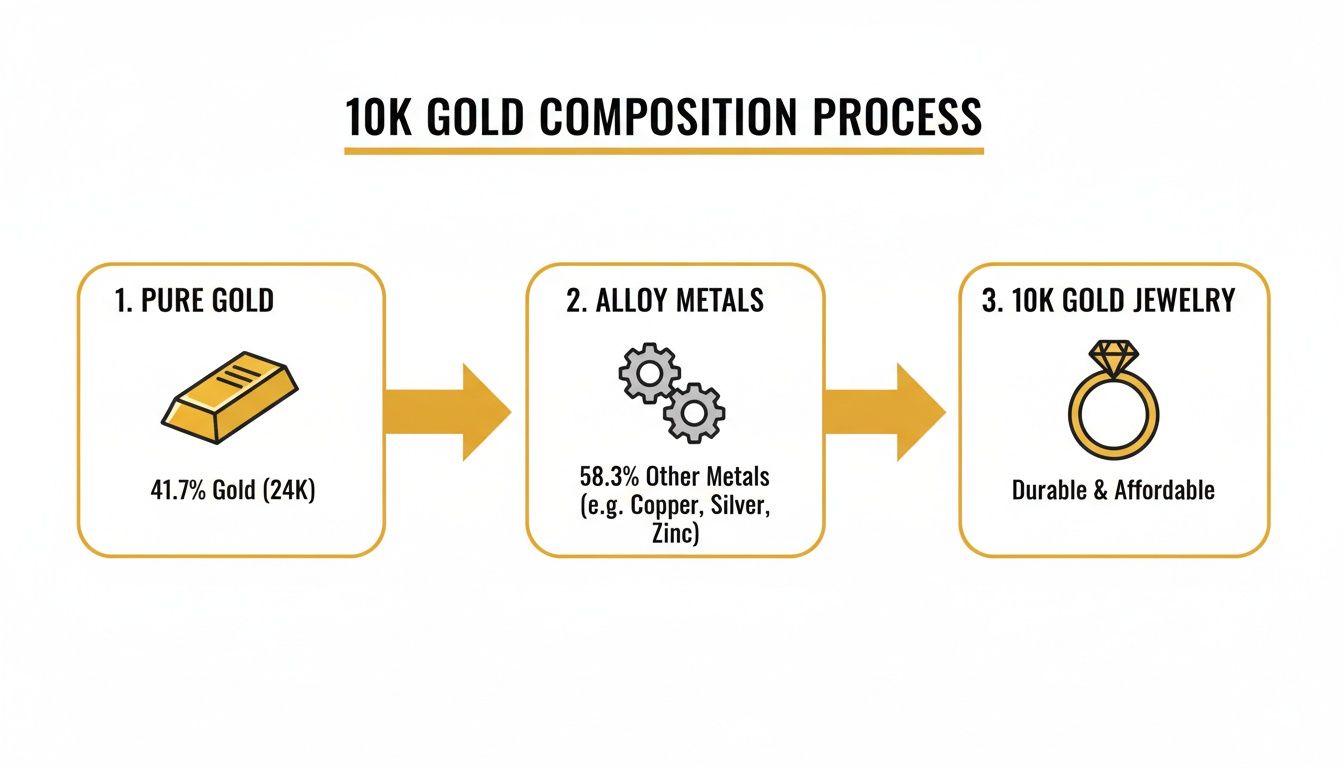

Let’s get right to it. You want to know what your 10k gold is worth, and the answer starts with two concepts: its purity and the live market price. The “10k” label simply means your item is made of 10 parts pure gold and 14 parts other metals—think copper, silver, or zinc.

This specific recipe creates an alloy that is 41.7% pure gold. You’ll often see this stamped on jewelry as “.417”. The other 58.3% is made up of stronger metals that give the piece its durability, making it tough enough for everyday wear.

Tying Purity to Price

So, how does that percentage turn into a dollar amount? It’s directly tied to the global “spot price” of gold, a figure that’s constantly moving based on market trading. Just think of the spot price as the day’s wholesale cost for one gram of pure, 24k gold.

Since your 10k gold is 41.7% pure, its base melt value per gram is exactly 41.7% of that live spot price. This is the starting point for every gold buyer on the planet.

Key Takeaway: The melt value of 10k gold is the weight of its pure gold content multiplied by the current spot price. This is the raw, intrinsic value of the metal itself, completely separate from the piece’s design, brand, or sentimental worth.

Getting a firm grip on this calculation is the first step toward getting a fair deal. It demystifies the whole process and gives you a solid baseline for your item’s value. Before you even think about selling, knowing this core number helps you walk into any negotiation with confidence.

To see how this stacks up against other types of gold, you can get more details on the price of scrap gold and see how much purity really impacts the final payout. This guide will keep building on these ideas, showing you exactly how to lock in your gold’s true value.

What 10k Gold Actually Means for Your Jewelry

Ever wondered why that beautiful gold ring on your finger isn’t made of pure, 24k gold? The reason is actually pretty simple and it all comes down to strength. Pure gold is surprisingly soft. If your jewelry were made from it, daily life would quickly leave it bent, scratched, and warped.

That’s where the Karat system saves the day.

Think of it like baking. Pure gold is your main ingredient, but to get the perfect result, you need to add other things. For jewelry, those “other things” are metal alloys like copper, silver, and zinc. They add strength, tweak the color, and make the final piece durable enough to wear every single day.

The Specific Recipe for 10k Gold

When you see “10k” stamped on a piece of gold, it’s not just a random number, it’s a specific recipe. It tells you the item is made of 10 parts pure gold and 14 parts other metals. Do the math, and that blend works out to 41.7% pure gold. You’ll often see this number stamped on jewelry as “.417”.

This particular ratio is what gives 10k gold its signature toughness. It’s built to resist scratches and scuffs far better than its higher karat cousins like 18k or 24k gold, which makes it a fantastic choice for pieces you never take off, like a favorite ring or a go to bracelet. If you’re curious about confirming your jewelry’s authenticity, you can learn more about the different methods for gold purity testing and what those stamps really mean.

Key Insight: The alloys mixed with gold aren’t just filler; they are essential ingredients that give jewelry its functional strength. Understanding this “recipe” is the first step in knowing why the 10k gold price per gram is calculated the way it is.

The specific alloys used also determine the final color of the gold. The table below breaks down how different metal combinations create the classic shades we all recognize.

| Gold Color | Primary Alloys Used | Resulting Characteristic |

|---|---|---|

| Yellow Gold | Silver and Copper | This classic mix keeps the traditional warm, golden hue while adding serious strength. |

| White Gold | Palladium or Nickel | These white metals bleach the natural yellow of the gold, creating a sleek, modern, silver like look. |

| Rose Gold | Higher Copper content | Bumping up the amount of copper in the alloy mix gives the gold its beautiful pink or reddish tint. |

Ultimately, the makeup of 10k gold hits a sweet spot between value and practicality. You’re getting a piece with a meaningful amount of real gold, but you also get the resilience needed for an item that will last for years. This unique blend is the foundation of its market value.

How to Calculate the 10k Gold Price Per Gram

Alright, now that you know what 10k gold really is, let’s connect that knowledge to a real dollar amount. Calculating the 10k gold price per gram isn’t some complex financial formula; it’s a simple, three step process anyone can master. This gives you the baseline melt value—the raw, intrinsic worth of the gold in your jewelry.

Knowing this number puts you in the driver’s seat. Before you even talk to a buyer, you’ll have a clear idea of your item’s value, allowing you to negotiate from a position of strength. All you need to get started is the current market price of gold.

Step 1: Find the Current Spot Price of Gold

First things first, you need the live market price of pure gold, known in the industry as the spot price. This price is almost always quoted in troy ounces, a specific unit of weight for precious metals that’s a bit heavier than a standard ounce. A quick online search will give you the current spot price, which changes constantly throughout the day.

For this walk-through, let’s assume the live spot price of gold is $2,300 per troy ounce.

Step 2: Convert the Price from Ounces to Grams

Since your jewelry is weighed in grams, our next job is to translate that troy ounce price into a per gram price. It’s a simple conversion: there are precisely 31.103 grams in one troy ounce. To get the price per gram, we just divide the spot price by that number.

- The Math: Spot Price ÷ 31.103 = Price Per Gram

- Our Example: $2,300 ÷ 31.103 = $73.95 per gram for pure, 24k gold.

This number, $73.95, tells you what a single gram of pure, unadulterated gold is worth on the global market at this exact moment.

This visual shows how pure gold is combined with other metals to create durable 10k gold jewelry.

The takeaway here is that an item’s value comes directly from its pure gold content, not the alloys it’s mixed with for strength.

Step 3: Adjust for 10k Gold Purity

The final step is to account for the fact that 10k gold isn’t pure. As we covered, it contains 41.7% pure gold. In the gold world, this is also expressed as a 0.417 fineness. To find the specific melt value for 10k gold, we multiply the pure gold price per gram by this percentage.

- The Math: Price Per Gram × 0.417 = 10k Gold Price Per Gram

- Our Example: $73.95 × 0.417 = $30.84 per gram for 10k gold.

And there you have it. That final number, $30.84, is the current melt value for one gram of your 10k gold, based on our example spot price.

To make it even clearer, here is the entire process broken down in a simple table.

From Live Spot Price to 10k Gold Value Per Gram

| Step | Action Required | Example Calculation (Assuming $2300/oz Spot Price) |

|---|---|---|

| 1 | Find the current spot price of gold per troy ounce. | $2,300.00 |

| 2 | Divide the spot price by 31.103 to get the price per gram. | $2,300 ÷ 31.103 = $73.95 |

| 3 | Multiply the per gram price by 0.417 for 10k purity. | $73.95 × 0.417 = $30.84 |

This three step calculation gives you the foundational value of your gold. Think of this number as the starting block for any offer you might receive from a buyer.

If you’d rather skip the math, you can get an instant and accurate valuation using our free 10k gold calculator. It pulls live market data to give you the most up to the minute price. With this knowledge in hand, you’re fully prepared to understand what a fair offer truly looks like.

Why a Buyer’s Offer Is Always Lower Than the Melt Value

You’ve done the math. You’ve calculated the exact melt value of your gold down to the penny. Feeling prepared, you walk into a buyer’s shop, only to get an offer that’s noticeably lower. What gives?

It’s a common, and often frustrating, experience. But it’s not because the buyer is trying to pull a fast one. The simple truth is that gold buying is a business, and just like any other business, it has overhead costs and needs to turn a profit to keep the lights on.

Think of it this way: the melt value you calculated is the raw commodity price for pure gold on the open market. A buyer’s offer is that price, minus the real world costs of turning your old jewelry back into that pure, raw commodity.

Breaking Down a Gold Buyer’s Costs

When a gold buyer purchases your 10k gold necklace, they aren’t buying a piece of jewelry they can polish and resell. They’re buying scrap gold. Its only value to them lies in the 41.7% pure gold locked inside the other alloy metals. Getting it out is an industrial process, and that process isn’t free.

Here are the main expenses that get baked into their offer:

- Refining Fees: This is the big one. The buyer has to pay a specialized refinery to melt your items at extreme temperatures and use complex chemical processes to separate the pure 24k gold from the other metals.

- Operational Overhead: These are the standard costs of doing business. We’re talking rent for the storefront, employee salaries, insurance, high-tech security systems, and marketing to bring in customers.

- Market Risk: Gold prices are notoriously volatile. A buyer might purchase your gold at today’s price, but by the time they’ve gathered enough scrap to ship to the refinery, the spot price could have dropped, eating into their margins.

- Profit Margin: After all those costs are covered, the business has to make a small profit. This isn’t just about getting rich; it’s what allows them to stay in business and continue offering their services.

Seeing it from this angle helps reframe the situation. A buyer isn’t just pulling a number out of thin air; they’re making a business calculation where your melt value is the starting point, not the final payout.

So, What’s a Realistic Payout Percentage?

Knowing that buyers have costs, the real question is: what should you actually expect to get? The industry standard is to pay a percentage of the item’s total melt value. While it can vary, a reputable buyer will typically offer somewhere between 70% to 95% of the melt value.

A fair offer from a transparent gold buyer will almost always fall in the 70% to 95% range of the calculated melt value. Any offer that comes in significantly below this range should be a major red flag.

The exact percentage you’re offered isn’t random, either. It often hinges on a few key factors.

| Factor Influencing Payout | Why It Matters |

|---|---|

| Quantity of Gold | Selling a large batch of gold (say, 100 grams) will almost always get you a higher percentage payout. The buyer’s fixed costs are spread over a more valuable transaction, so they can offer you a better rate. |

| Buyer’s Business Model | An online only buyer with minimal overhead can often afford to offer a higher percentage than a local jeweler or pawn shop with steep retail rent. |

| Market Competition | In a city with dozens of gold buyers, fierce competition can drive payout percentages up. This is why it always pays to get more than one quote. |

When you understand these business realities, you can walk into a negotiation with realistic expectations for the 10k gold price per gram you’ll be offered. This knowledge is your best tool for spotting a fair deal and having the confidence to turn down a bad one.

A Real-World Gold Selling Scenario

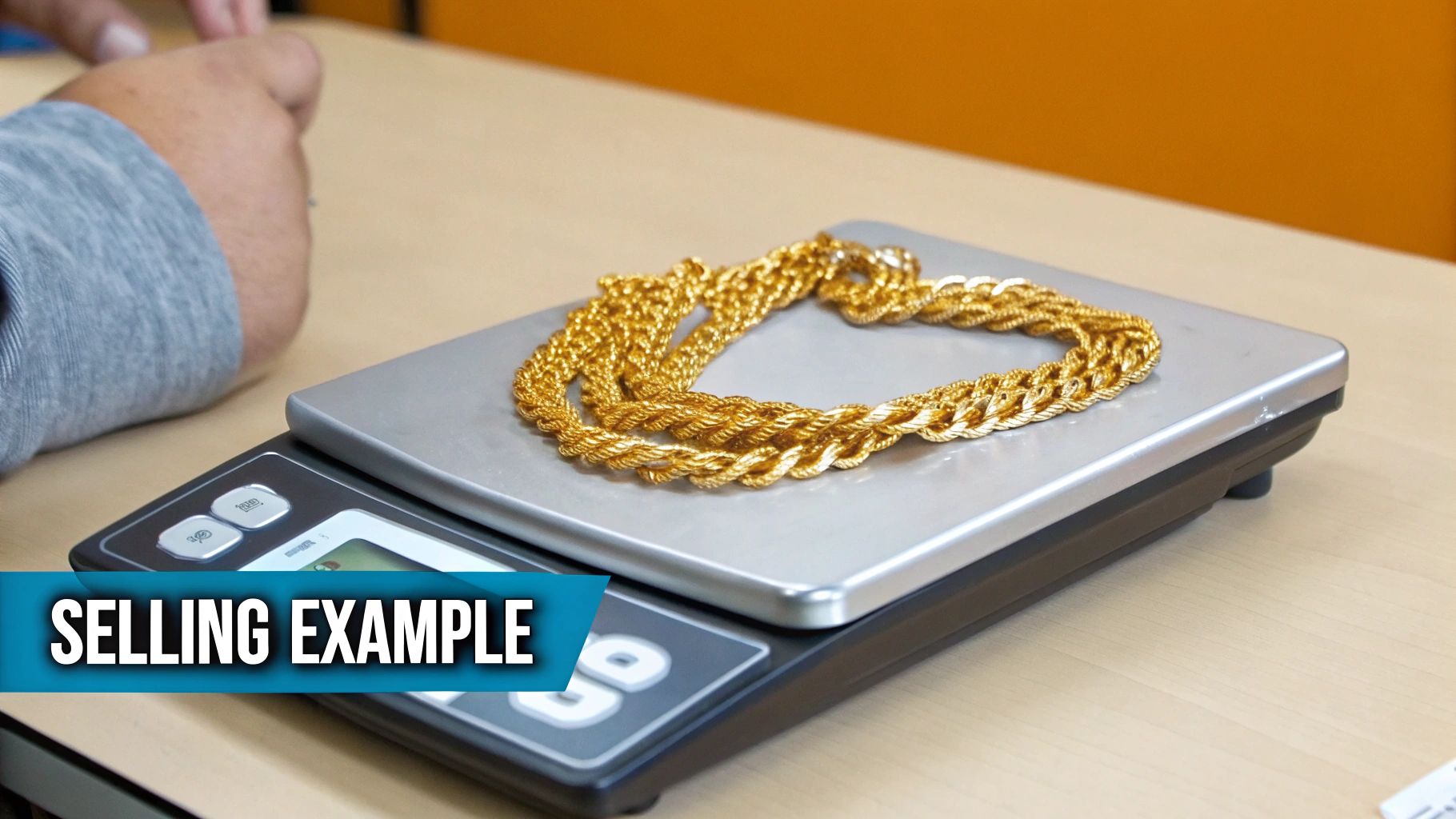

Let’s put all this theory into practice. Imagine you’re cleaning out an old jewelry box and find a 10k gold chain you haven’t worn in years. This is where the numbers stop being abstract and start turning into actual cash in your pocket.

First thing’s first: you need to know how much it weighs. A simple digital kitchen scale will do the trick. You place it on the scale, and it reads exactly 20 grams. That’s the first piece of the puzzle, and it’s a big one.

Calculating the Chain’s Melt Value

Now that we have the weight, we can run the numbers using the three step formula we just covered. To keep things consistent, we’ll stick with our example spot price of $2,300 per troy ounce.

- Get the 24k Price Per Gram: We take the spot price and divide it by 31.103 (the number of grams in a troy ounce). That gives us $73.95 per gram for pure, 24k gold.

- Find the 10k Price Per Gram: Next, we multiply that pure gold price by 10k’s fineness, 0.417. This brings the price down to $30.84 for one gram of 10k gold.

- Calculate the Total Melt Value: Finally, multiply the 10k price per gram by your chain’s weight. So, $30.84 × 20 grams = $616.80.

This figure, $616.80, is your chain’s raw melt value. Think of it as your baseline—the most important number to have in your head before you even think about walking into a buyer’s shop.

Estimating a Realistic Cash Offer

Okay, so what can you actually expect to get for this chain? As we’ve discussed, buyers don’t pay 100% of the melt value; they need to cover their own costs and make a profit. How much they offer depends heavily on who you’re dealing with.

Remember, a fair and reputable buyer will typically offer between 70% to 95% of the melt value. Anything in this window is considered a solid offer.

Let’s see what that looks like for your 20 gram chain across different types of buyers.

| Buyer Type | Typical Payout % | Estimated Offer for Your Chain |

|---|---|---|

| Local Pawn Shop | 70% to 80% | $431.76 to $493.44 |

| Local Jeweler | 80% to 90% | $493.44 to $555.12 |

| Online Gold Buyer | 85% to 95% | $524.28 to $585.96 |

The difference is stark, isn’t it? We’re talking a potential swing of over $150 between the lowest and highest offers for the exact same chain. This simple example makes it crystal clear why doing your homework and shopping around is so critical. When you walk in armed with this knowledge, you’re no longer guessing—you’re negotiating.

Common Questions About 10k Gold

Even after breaking down all the calculations, it’s natural to have a few more questions pop up. Getting comfortable with the details is the best way to build confidence, so let’s walk through some of the most common things people ask when looking into the 10k gold price per gram.

Think of this as the final piece of the puzzle, giving you clear, straightforward answers to round out your knowledge.

Is 10k Gold Actually “Real” Gold?

Absolutely. While it’s not pure, 10k gold is very much real and has significant value. It’s a precious metal alloy that contains 41.7% pure gold, which is what gives it its intrinsic worth. The other metals in the mix are what provide the strength and durability needed for jewelry that can handle the bumps and scrapes of daily life.

The bottom line is that its value is always tied directly to the amount of pure gold it contains. So yes, that “10k” stamp means you’re holding genuine gold.

How Can I Be Sure My Jewelry Is 10k Gold?

The easiest and most reliable way is to look for the hallmark—a tiny stamp from the manufacturer that certifies the gold’s purity. Think of it as a quality control stamp.

You’ll want to search for one of two common markings:

- 10k or 10kt: This is the standard American marking for Karat purity.

- 417: This is the European equivalent, which directly signifies the 41.7% gold content.

These stamps are often incredibly small, so you might need a magnifying glass or the zoom on your phone’s camera. You can usually find them on the inside of a ring, near the clasp of a necklace or bracelet, or on an earring post.

Does Tarnish Lower the Value of My 10k Gold?

Not at all. Tarnish has zero effect on your gold’s melt value. It’s simply a surface level discoloration that happens when the other metals in the alloy like copper or silver react to air and moisture. It’s a natural chemical process that doesn’t harm the gold underneath.

When a buyer evaluates your item, they’re only interested in the weight of the pure gold inside. The refining process uses extreme heat to melt everything down, which completely burns away any tarnish, dirt, or other impurities, leaving only the pure, valuable gold behind.

Key Takeaway: The condition of your scrap gold doesn’t change its value. Whether it’s shiny, tarnished, broken, or bent, buyers are purchasing the raw gold content, not the item’s appearance.

To make it even clearer, here’s a simple breakdown of what matters and what doesn’t when you’re getting a price.

| Factors That DO Affect the Price | Factors That DO NOT Affect the Price |

|---|---|

| The item’s total weight in grams | Whether the item is tarnished or dirty |

| The gold’s Karat purity (e.g., 10k) | If the jewelry piece is broken or bent |

| The current live spot price of gold | The design, style, or brand of the piece |

Grasping these distinctions helps you zero in on what truly drives the value of your gold. At the end of the day, the 10k gold price per gram is all about three things: weight, purity, and the live market price. With this complete picture, you’re now fully equipped to understand your gold’s worth and sell it with total confidence.

Ready to skip the manual math and get a real time valuation for your gold? The Gold Calculator provides a free, instant, and transparent estimate based on live market data. See what your gold is worth right now.