How Much Is 14k Gold Worth? Quick Guide to Its Value

The price of 14k gold moves with the live market every single day, but a solid rule of thumb is that it’s worth 58.3% of the current price of pure gold. For instance, if pure gold is trading at $4,600 per troy ounce, the actual gold in your 14k item is worth about $86.20 per gram.

Understanding What 14k Gold Really Means

Before you can figure out what your gold is worth, it is helpful to understand what “14k gold” actually is. Think of it like a recipe. While pure gold also known as 24k is the star ingredient, it is far too soft and delicate for making jewelry that can stand up to daily life.

To get a final product that is both beautiful and durable, jewelers mix that pure gold with stronger metals like copper, silver, or zinc. This mixture is called an alloy, and the karat system is simply how we measure the purity of that blend.

The Karat Purity Scale

The karat system is a straightforward scale that measures gold purity out of 24 parts. So, when you see “14k gold,” it means the item is a blend of 14 parts pure gold and 10 parts other metals.

This means any item stamped “14k” contains exactly 58.3% pure gold, a figure you get by dividing 14 by 24. This percentage is the single most important factor in determining your gold’s base value.

This concept of purity is absolutely critical. A heavy 14k gold chain is not automatically worth more than a lighter 18k gold bracelet. Why? Because the 18k piece has a higher concentration of pure gold (75%), which could easily make it more valuable despite weighing less. You can dive deeper into these differences in our detailed guide comparing 14k gold vs 24k gold.

To make it even clearer, here is a quick breakdown of the common gold purity levels you are likely to come across:

| Karat Value | Pure Gold Parts (out of 24) | Purity Percentage | Common Hallmarks |

|---|---|---|---|

| 24k Gold | 24 | 100% | 999 |

| 18k Gold | 18 | 75% | 750 |

| 14k Gold | 14 | 58.3% | 585 or 583 |

| 10k Gold | 10 | 41.7% | 417 |

Recognizing these hallmarks, the tiny stamps usually found on a clasp or inside a ring, is the first step to identifying your item’s purity. These marks have a long and storied history; learning about famous examples like Fabergé gold hallmarks can offer a fascinating glimpse into authentic marks and master craftsmanship. Nailing down this foundation is the first real step to accurately valuing your items.

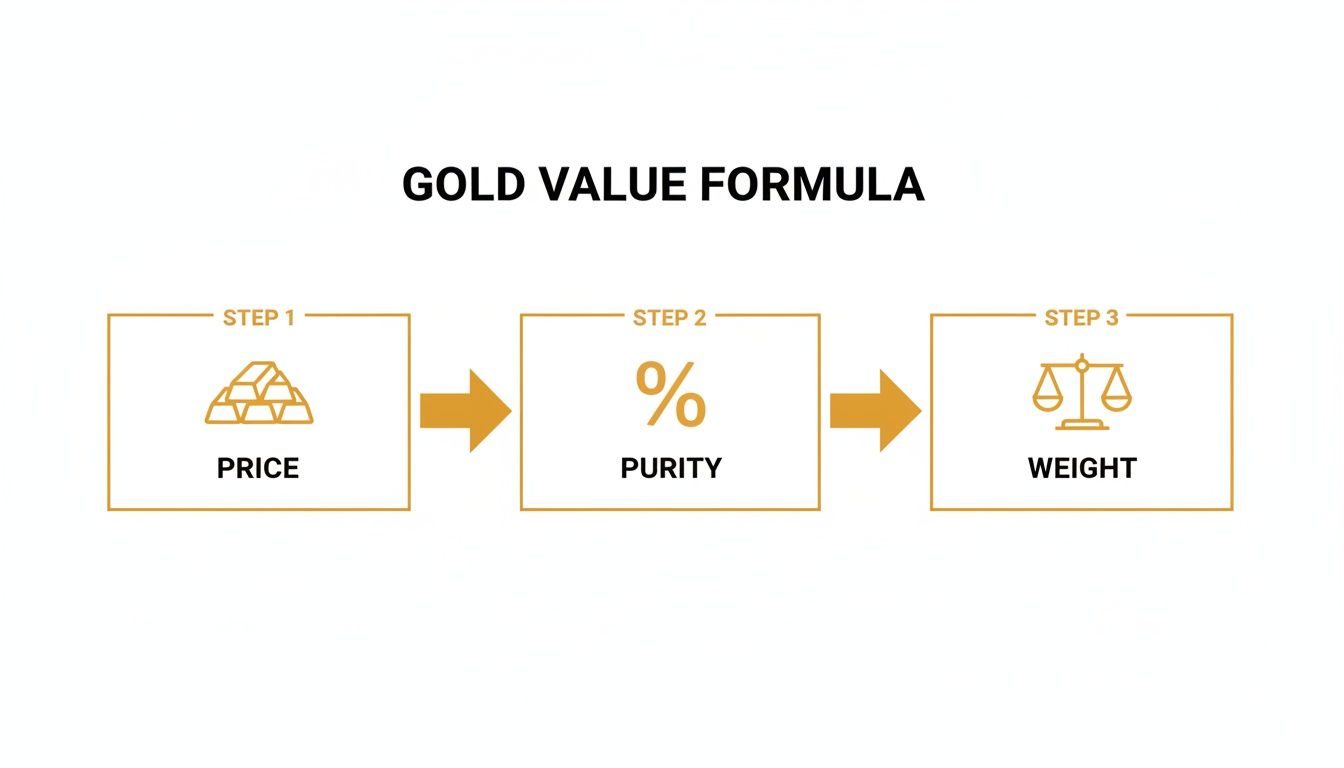

The Key Factors That Determine Gold Value

The price you are offered for a piece of 14k gold is not just a random number. It is calculated using a clear, consistent formula built on three core pillars. Think of them as the ingredients in a recipe, get them right, and you will understand the true worth of your item.

First up is the most dynamic piece of the puzzle: the gold spot price. This is the live market price for one troy ounce of pure, 24k gold. Just like stocks, this price is constantly moving, reacting to global economic news, investor sentiment, and currency fluctuations.

The value of your jewelry is directly tied to this fluctuating price. The pure gold market is a dynamic environment, with prices that can shift based on global events. You can see these trends for yourself; gold has seen a remarkable 65.60% year over year increase, a fact you can verify by checking out gold’s recent performance on Trading Economics.

Purity and Weight: The Foundation of Value

Next, we look at the item’s purity. As we have covered, 14k gold is 58.3% pure gold, and this percentage is a non negotiable constant in the value equation. Without this number, you cannot figure out how much actual gold you are holding.

The third and final element is weight, which is almost always measured in grams for jewelry. This is where an accurate digital scale becomes essential. Even a tenth of a gram can make a real difference in the final payout.

Put them all together, live spot price, purity, and weight, and you get the melt value of your gold. This is the raw, intrinsic worth of the pure gold inside your item, completely separate from its design, brand, or any sentimental value.

Now, it is a common misconception that you will get paid this full 100% melt value. Buyers have to cover their own costs, which include everything from running their business to the complex process of refining your 14k gold back into its pure 24k form.

This is exactly why knowing your gold’s purity from the get go is so powerful. If you are ever unsure about the stamps or hallmarks on your jewelry, getting it professionally checked is a smart move. You can learn more about how it is done in our guide to gold purity testing methods. This knowledge gives you a transparent look at how the industry works and empowers you to know what a fair offer really looks like.

How To Calculate The Value Of Your 14k Gold

Figuring out what your 14k gold is actually worth can feel a little mysterious, but it all comes down to a surprisingly simple and transparent formula. Once you understand the moving parts, you can get a very solid estimate of its “melt value” right from your kitchen table. This knowledge is your single best tool for making sure you get a fair offer when you decide to sell.

The entire process boils down to one core calculation. Do not worry, we will walk through each piece of the puzzle so it makes perfect sense.

The Melt Value Formula: (Current Gold Spot Price ÷ 31.1035) × 0.583 × (Your Item’s Weight in Grams)

Let us unpack that. First, you take the live spot price of gold, which is always quoted per troy ounce, and divide it by 31.1035. This little step is crucial, it converts the price from the market standard (troy ounces) to the unit we use for jewelry (grams).

Next up, you multiply that price per gram by 0.583. This is the magic number for 14k gold, adjusting the value to account for its 58.3% purity. Finally, just multiply that number by the weight of your item in grams. The result is the 100% melt value, the raw value of the pure gold hiding inside your jewelry.

A Practical Example, Step By Step

Let us make this real. Say you have a 14k gold chain that weighs exactly 12 grams on your digital scale. For this example, let us pretend the current spot price for gold is a nice round $2,300 per troy ounce.

Here is how the math plays out:

- Price per Gram: First, we figure out the price of pure, 24k gold per gram: $2,300 ÷ 31.1035 = $73.95 per gram.

- 14k Price per Gram: Now, we adjust that for 14k purity: $73.95 × 0.583 = $43.11 per gram. This is what a single gram of your 14k gold is worth.

- Total Melt Value: Finally, multiply by your chain’s weight: $43.11 × 12 grams = $517.32.

And there you have it. The total melt value of your 12 gram chain is $517.32. This number is your baseline, the figure you should have in your head before you ever walk up to a buyer’s counter.

To give you an even quicker reference point, we have put together a handy table showing the estimated melt value for some common weights of 14k gold.

Sample 14k Gold Melt Value Calculations

This table shows the estimated melt value for common weights of 14k gold based on a sample live spot price of $2,300 per troy ounce. Use this for a quick reference.

| Weight of 14k Gold | Calculation Steps (at $2,300/oz) | Estimated Melt Value |

|---|---|---|

| 5 grams | ($73.95 per gram × 0.583) × 5g | $215.55 |

| 10 grams | ($73.95 per gram × 0.583) × 10g | $431.10 |

| 15 grams | ($73.95 per gram × 0.583) × 15g | $646.65 |

| 20 grams | ($73.95 per gram × 0.583) × 20g | $862.20 |

This gives you a great ballpark idea of what your items are worth. Remember, this is the full market value before any buyer fees.

Of course, doing these calculations by hand can be a bit of a chore, especially since the spot price of gold is constantly changing. This is where automated tools like a gold calculator really shine.

For instance, using a tool like The Gold Calculator, you can skip the math completely.

As you can see, you just select “14K” for the purity, type in the weight, and the calculator instantly shows you the real time value based on the live market price. No formulas, no conversions, just a clear, immediate answer.

From Melt Value To Your Actual Payout

Now that you know how to calculate the full “melt value” of your 14k gold, let us talk about the most important part: turning that number into a real cash offer. This is where expectations meet reality, and understanding this gap is key to knowing a good deal when you see one.

Here is the bottom line: no buyer, whether it is a local jeweler, pawn shop, or an online refiner, will pay 100% of the melt value. It is just not how the business works. Instead, you should expect offers that land somewhere between 70% and 95% of that calculated value.

This simple formula is what establishes your gold’s baseline worth before any buyer’s costs are factored in.

Think of that melt value as the starting point. The final offer comes after the buyer accounts for their side of the equation.

Why You Do Not Get 100 Percent

That percentage based payout is not a scam; it is the fundamental business model of buying and refining precious metals. Imagine a farmer selling apples to a grocery store. The store has to pay for shipping, employees, and rent, plus make a profit, so it cannot pay the farmer the full price you see on the shelf.

Gold buyers operate the exact same way. Their offer reflects several real world costs:

- Refining Costs: Turning old 14k jewelry back into pure 24k gold is a complex and expensive industrial process involving heat and chemicals to separate the alloys.

- Operational Expenses: This covers everything from rent and employee salaries to security, insurance, and all the other bills that come with running a legitimate business.

- Market Risk: Gold prices are notoriously volatile. A buyer takes on the risk that the spot price could plummet between the moment they buy your gold and when they sell it.

- Profit Margin: At the end of the day, a gold buyer is a business. They need to generate revenue to stay open, pay their team, and continue serving customers.

Seeing it from this perspective helps you understand that an offer is not an attempt to lowball you, but a reflection of the very real costs of doing business in the precious metals industry.

Your goal as a seller is to find a reputable buyer offering a high percentage of the melt value. That’s the sign of an efficient, transparent operation. This is precisely why getting multiple quotes is so important.

The demand for 14k gold can fluctuate based on market trends and consumer behavior. For example, some data shows that many people trade in old gold to fund new jewelry purchases, especially when prices are high. This context is crucial; it shows just how substantial a fair payout on your 14k gold can be right now.

Practical Steps Before You Sell Your Gold

Before you ever walk up to a buyer’s counter, a few simple but powerful steps can completely change the game. Taking the time to do a little homework does not just help you understand what your 14k gold is worth; it ensures you get an offer that truly reflects that value. Think of it as preparing for a big negotiation, you would not go in blind.

First things first, you need to verify what you have. Flip your jewelry over and look for the tiny stamps known as hallmarks. They are usually hiding on the clasp of a necklace, inside the band of a ring, or on the post of an earring.

For 14k gold, you are searching for one of two common marks:

- 14k or 14kt: The standard stamp used in the United States.

- 585 or 583: This is the European equivalent, representing its 58.3% gold content.

If you cannot find a stamp, do not panic. It does not automatically mean your item is not real gold, but it is a strong signal to get it professionally tested by a jeweler before you try to sell it.

Get Your Numbers Straight

Next up: weigh your items yourself. A calibrated kitchen scale or a small jewelry scale will work perfectly. The key here is to measure in grams, because that is the universal language of the gold buying industry. This single piece of information is your most important tool, giving you a baseline number before anyone makes an offer.

Knowing the weight in advance prevents any “surprises” and lets you check a buyer’s math on the spot. It is a quick and easy way to tell if you are dealing with someone honest.

Walking into a negotiation with your own verified weight and an understanding of the hallmark puts you squarely in the driver’s seat. It transforms you from a passive seller into an informed partner in the transaction.

Finally, never, ever take the first offer. The gold buying market is competitive, and the percentage of the melt value that buyers are willing to pay can vary wildly. Your goal should be to get at least a few different quotes to see who is offering the best deal.

Comparing Potential Gold Buyers

Different buyers offer very different experiences and, more importantly, different payout rates. Getting quotes from at least two of these categories will give you a much clearer picture of what a fair price for your gold actually looks like.

| Buyer Type | Typical Payout Range (% of Melt Value) | Pros | Cons |

|---|---|---|---|

| Local Jewelers | 70% to 85% | Convenient, trustworthy relationships | May offer lower rates than specialists |

| Pawn Shops | 60% to 80% | Quick cash, accessible | Often offer the lowest percentages |

| Online Gold Buyers | 80% to 95% | Highest potential payouts, transparent | Requires shipping items, wait times |

Shopping your gold around gives you leverage and a real sense of the current market rate. This simple act of comparison can easily add a significant amount of cash to your final payout.

Why An Online Gold Calculator Is Your Best First Step

After walking through the formula, it is pretty clear that figuring out your gold’s value has a few moving parts. Trying to track the constantly changing spot price and crunching the numbers yourself can be a real headache.

This is where a good online gold calculator becomes your most valuable tool. It handles all the complex math for you, cutting out the guesswork and any risk of manual errors. You get an instant, accurate answer to the question “how much is 14k gold worth?” without any of the legwork. The best calculators pull in live spot prices every few minutes, so you know your valuation is always based on the most current market data.

Get An Instant And Unbiased Benchmark

The real power of a gold calculator is the complete transparency it gives you. When you plug in your item’s weight and purity, it instantly calculates the 100% melt value. This gives you an incredibly powerful, unbiased benchmark to work from.

Think of this number as your starting line. It represents the full market value of the pure gold in your item before any buyer applies their fees or profit margin. Knowing this empowers you to walk into any negotiation with total confidence.

Having this figure is especially critical in a strong market. For example, the price of 14K gold can see dramatic growth during periods of high demand. Data shows that the price per gram can experience significant jumps in relatively short time frames. This kind of upward trend shows exactly why an accurate, real time valuation is so important for sellers.

To see how this works in real time, get an immediate valuation using our live gold calculator. It supports every common weight unit and works with any currency, giving you a crystal clear picture of what your gold is worth today so you can negotiate the best possible price.

Common Questions About Valuing 14k Gold

When it comes to figuring out what your 14k gold is really worth, a few questions always seem to pop up. Getting straight answers is the key to selling your gold with confidence and without getting taken for a ride.

Is 14k Gold Considered High Quality?

Absolutely. In fact, for fine jewelry, 14k gold is the undisputed king in the United States and many other parts of the world. It hits the perfect sweet spot between durability, a rich gold color, and real precious metal value.

Sure, 18k and 24k gold are purer, but that purity comes with a catch, they are incredibly soft. This makes them impractical for rings, bracelets, or anything you plan on wearing regularly. That is why 14k gold remains the go to standard for quality jewelry that is meant to be worn and enjoyed.

How Can I Be Sure My Gold Is Real?

The quickest and easiest way to check is to look for a hallmark. These are tiny little stamps on the metal, often tucked away on a clasp or the inside of a ring band. You will be looking for markings like “14k,” “14kt,” or sometimes “585,” which is the European equivalent.

If you cannot find a mark or just want to be 100% certain, a professional jeweler is your best bet. They have tools that can confirm the gold content in seconds without leaving a scratch, like a simple acid test or a more advanced XRF scanner.

Does the Brand or Condition Affect My Payout?

This is a critical point that trips up a lot of sellers. When you are selling gold for its melt value, often called scrap value, the brand, original price, and condition have zero impact on the offer. The payout is based purely on two things: the weight of your item and the amount of pure gold it contains.

However, there is one major exception to this rule.

If you have pieces from iconic luxury brands like Cartier or Tiffany & Co., or if you own a rare antique, their resale value can be significantly higher than their melt value. It’s always smart to get these items appraised by a specialist before you even think about selling them as scrap.

This table breaks it down simply:

| Item Type | Primary Valuation Method | Why It Matters |

|---|---|---|

| Damaged or Generic Jewelry | Melt Value | The value is tied directly to the raw gold content alone. |

| Designer or Antique Piece | Resale or Appraisal Value | The craftsmanship, history, and brand name add significant value beyond the metal. |

Ready to skip the guesswork and find out the exact melt value of your gold with total transparency? The Gold Calculator uses live market prices to give you an instant, accurate valuation of your 14k gold. Empower yourself with real data before you even talk to a buyer.

Try it for free today at https://thegoldcalculator.com.