How Much Is Scrap Gold Worth? A Practical Guide

Figuring out what your old gold jewelry is actually worth comes down to three key things: its purity (also known as its karat), its weight, and the current market price of gold, which is often called the spot price. When a gold buyer makes an offer, they are calculating it as a percentage of your item’s “melt value,” a figure that comes directly from those three factors. Explore our practical guide to find out the value of your scrap gold.

Understanding the Core Value of Your Gold

Before you can determine what your scrap gold is worth, it helps to understand the basics. That tangled necklace or single earring has real value, but the journey to getting cash for it begins with knowing why it’s valuable. It is not just about how heavy it feels; the actual amount of pure gold in the item is the most important part.

For instance, a 14K gold ring is not 100% pure gold. It is actually 58.3% gold that has been mixed with other metals, called alloys, like copper or silver. These alloys make the ring strong enough to survive daily wear. On the other hand, a 24K gold item is as pure as it gets. This percentage of pure gold content is the key to the entire valuation.

Karat Purity and What It Means

The karat system is just a straightforward way to describe gold’s purity. Each karat represents 1/24th of the whole. This is why 24K is considered pure gold, it is 24 out of 24 parts gold. You can usually find a tiny stamp, known as a hallmark, somewhere on your jewelry that tells you its karat value.

If you are looking for a quick, reliable estimate, using a free online tool like our scrap gold calculator can show you exactly how purity impacts the price in real time.

Gold Karat Purity and Fineness Chart

To help you get started, here’s a quick breakdown of the most common gold karat markings you will find on jewelry and what they actually mean in terms of pure gold content.

| Karat (K) | Purity Fineness (Hallmark) | Pure Gold Content |

|---|---|---|

| 24K | 999 | 99.9% |

| 22K | 916 | 91.6% |

| 18K | 750 | 75.0% |

| 14K | 583 or 585 | 58.3% |

| 10K | 417 | 41.7% |

Getting familiar with these numbers is your first real step toward getting a fair price. It puts you in a position of knowledge, letting you know what you have before you even talk to a buyer. This is the single best way to avoid a lowball offer.

Finding the Purity of Your Gold Items

Before you can figure out what your scrap gold is worth, you first need to know exactly what you are holding. The single most important factor is the purity of your gold, which is measured in karats (K). This is not just a minor detail, it is the entire foundation of the valuation.

Think of it this way: 24K gold is the pure, unadulterated stuff. But that 18K gold chain you have? It is actually only 75% gold. The other 25% is made up of different metals like copper or silver. These alloys are mixed in to make jewelry tough enough for everyday wear, but they also dilute the pure gold content and, as a result, lower its melt value.

Understanding Hallmarks and Karat Stamps

Most commercially made jewelry has a tiny stamp, known as a hallmark, tucked away somewhere inconspicuous. You will usually find it on the clasp of a necklace, inside the band of a ring, or on the post of an earring. This little mark tells you the item’s purity. You will probably need a magnifying glass to see it clearly, but it is absolutely worth the effort.

These markings typically come in two different formats. You might see the karat value written out directly (like 14K), or you might find a three digit number that represents its fineness.

| Karat Marking (U.S. Standard) | Fineness Marking (European Standard) | Meaning (Pure Gold Content) |

|---|---|---|

| 10K | 417 | 41.7% pure gold |

| 14K | 585 (sometimes 583) | 58.3% pure gold |

| 18K | 750 | 75.0% pure gold |

| 22K | 916 | 91.6% pure gold |

So, if you spot a “750” stamped on a bracelet, you know it is made of 18K gold. This simple number gives you the exact data needed to start calculating its real scrap value. If you want to dive deeper into how these purities affect everything from durability to color, you can explore the differences between 14k, 18k, and 24k gold in our detailed guide.

What If There Is No Mark?

Do not panic if you cannot find a hallmark. Older pieces, custom made jewelry, or items from countries without strict stamping laws might not have one. It also does not automatically mean your item is not real gold.

When an item is unmarked, a professional buyer will need to verify its purity. This is usually done with a non invasive XRF scanner or a traditional acid test. The acid test involves scratching a tiny, unseen part of the item on a special stone and applying specific acids to determine its karat.

This verification step is crucial for both you and the buyer. It makes sure you get paid for the actual gold content, and the buyer knows exactly what they are getting. Once the purity is locked in, you are ready for the next step: getting an accurate weight.

How to Weigh Your Gold Accurately

Once you have figured out the purity of your gold, the next critical step is getting an accurate weight. This is where many people make a costly mistake. Do not use your kitchen scale, as being off by even a few grams can seriously reduce your final payout. When it comes to gold, precision is everything.

You need a digital jeweler’s scale or a high precision gram scale for a reliable measurement. These are built to register very small increments, which is exactly what is needed for something as valuable as gold. Always place your scale on a flat, stable surface and make sure it is set to zero (a process called calibrating) before you begin.

The Right Units for the Job

One of the biggest sources of confusion, and where some less than honest buyers might try to take advantage, is the unit of measurement. Your scale will almost certainly weigh in grams, but the global gold market price (the spot price) is almost always quoted in troy ounces.

It is critical to know that a troy ounce is not the same as the standard ounce you use for groceries. A troy ounce is a bit heavier.

A key conversion fact is that 1 troy ounce is equal to exactly 31.1034768 grams. For most calculations, rounding to 31.1 grams is perfectly fine and will give you a spot on estimate.

Forgetting this single conversion is a classic mistake that leads people to undervalue their gold. Knowing the difference empowers you to check any buyer’s math and ensures you are calculating the real value right from the start.

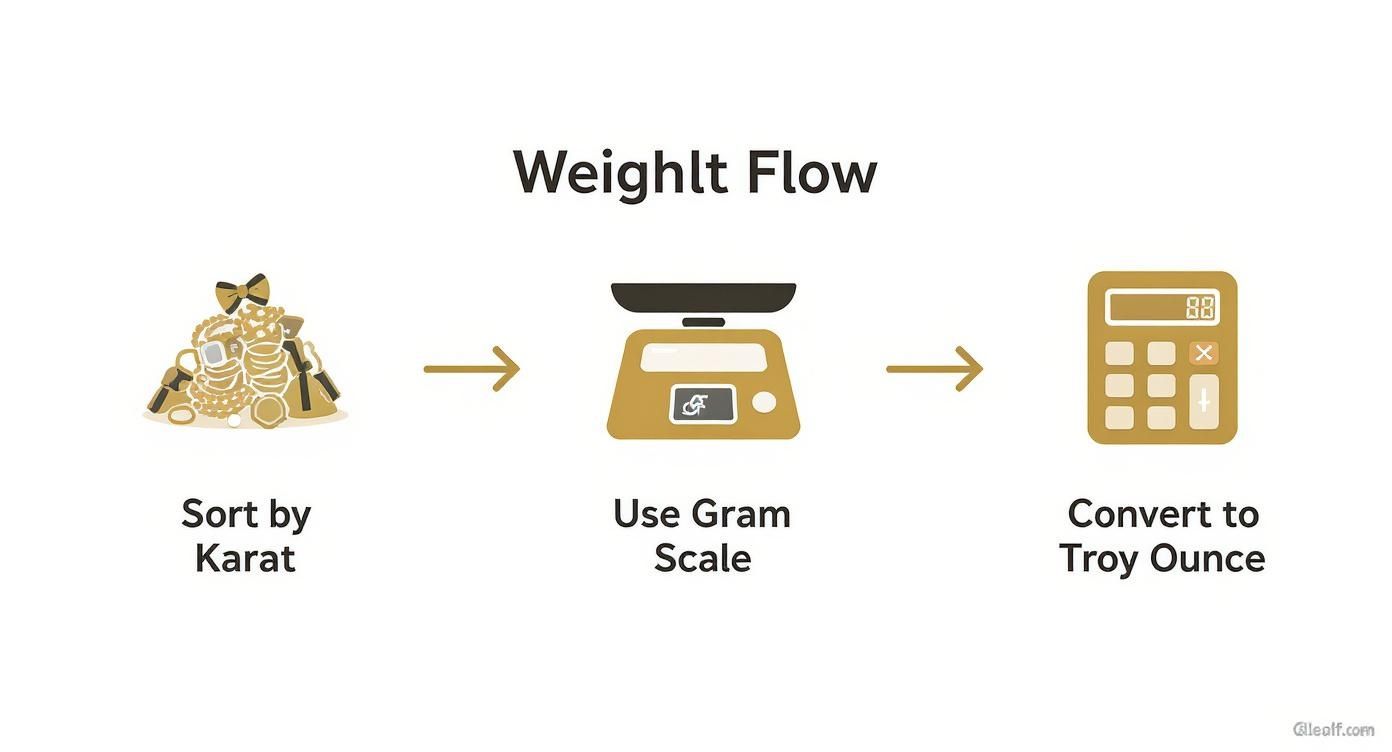

A Practical Weighing Strategy

Before placing a single piece of gold on the scale, do this one simple thing: sort everything by its karat. Make a pile for your 10K items, another for your 14K pieces, and so on. Weighing each karat group separately is the only way to get a truly accurate total value.

Mixing a 10K ring with an 18K earring will throw your entire calculation off because their pure gold content is worlds apart. By weighing each purity level on its own, you can apply the correct percentage to the correct weight. This little bit of organization is your best defense against costly errors.

Here is a quick rundown of the units you might come across.

| Measurement Unit | Equivalent in Grams (g) | Commonly Used For |

|---|---|---|

| Gram (g) | 1 gram | The standard unit for weighing scrap jewelry. |

| Troy Ounce (ozt) | 31.1 grams | The official unit for pricing precious metals. |

| Pennyweight (dwt) | 1.555 grams | An older unit still used by some jewelers. |

By taking these simple steps, you are setting yourself up for an accurate valuation and a much more confident selling experience.

Calculating the True Melt Value

Alright, you have determined your gold’s purity and you have an accurate weight. Now it is time to put those pieces together and find out what you are really working with.

This is where we calculate the melt value, which is the baseline worth of the pure gold in your items. To get this number, you will need the live spot price of gold, a value that is constantly shifting throughout the day due to global market activity.

The formula itself is pretty simple. You just multiply your gold’s weight by its purity percentage, then multiply that result by the current spot price per gram. This calculation gives you the raw value of the gold content before any refiner’s fees or a buyer’s profit margin gets factored in.

A Real World Calculation Example

Let’s make this crystal clear with a practical scenario. Imagine you have a small pile of broken 14K gold jewelry that weighs exactly 10 grams.

Here is how the calculation works:

- Find the Current Spot Price: First, you check a reliable source and see the live spot price of gold is $75 per gram.

- Convert Karat to Purity: You already know that 14K gold is 58.3% pure (which is 0.583 as a decimal).

- Do the Math: The calculation looks like this: $75 (spot price/gram) x 0.583 (purity) x 10 (grams).

The result comes out to $437.25. That is the melt value for your 10 grams of 14K gold. Knowing this number is incredibly empowering. It gives you a solid, data backed starting point before you even think about approaching a buyer. For a more detailed walkthrough, check out our guide on how to calculate gold value.

This visual guide quickly recaps the process: sort your gold by karat, weigh it precisely, and then convert the units to get an accurate calculation.

Following these simple organizational steps is the best way to avoid errors and ensure you land on a precise valuation.

Understanding Market Price Volatility

The spot price is not just a number pulled out of thin air; it is the result of intense global trading activity. Gold prices can change dramatically. For example, recent economic trends have sometimes caused prices to jump significantly in short periods.

This volatility is a worldwide phenomenon, with major trading hubs like the OTC London market, the US COMEX futures market, and the Shanghai Gold Exchange driving the action. These price changes are often fueled by economic uncertainty, inflation fears, and strong demand from both private investors and central banks.

About half of the world’s gold is used for jewelry, and another 40% goes toward investments. These fluctuating prices directly impact what your scrap gold is worth on any given day. As prices climb, the incentive to recycle old gold grows, making even small amounts surprisingly valuable.

This constant change is exactly why using a real time online tool is so helpful. It takes the guesswork out of the equation and eliminates the chance of human error, giving you an estimate based on the most current data. When you walk in armed with an accurate melt value, you are in a much stronger position to negotiate a fair deal.

Why Buyers Offer Less Than Melt Value

This is a very common question from sellers. You have done the math and calculated your gold’s melt value is $500, but the buyer offers you $400. It can feel like you are being shortchanged, but this difference is a standard and necessary part of the gold buying business. Understanding why helps you know what to expect and, more importantly, how to spot a genuinely fair offer.

When you sell scrap gold, you are not selling a finished product. You are selling a raw material that must be melted, purified, and eventually turned back into new gold products. That entire journey is known as refining, and it comes with very real operational costs.

The Business of Buying Gold

Think of a gold buyer as the first step in a longer supply chain. They are a business with typical overhead costs: rent, employee salaries, insurance, security, and marketing. To stay in business and turn a profit, they must buy your gold for less than its final market value.

After a buyer purchases your items, they do not just magically turn it into cash. They accumulate gold from many sellers and ship it to a large scale refinery. The refiner then melts everything down, using a complex process to remove the other metals and impurities to produce pure gold bullion.

This service is not free. Refiners charge fees for their labor, the chemicals used, and the massive amount of energy consumed during the process. Those costs are passed down the line and are factored into the initial offer you receive from the buyer.

Typical Payout Percentages

So, what should you expect? A reputable buyer will typically offer you between 70% and 85% of the melt value. The exact percentage often depends on how much gold you are selling and its purity. An offer below this range should be a major red flag, while anything higher is an excellent deal you should seriously consider.

The global scrap gold recycling market is a massive industry, valued at over $16.15 billion and still growing. This growth is driven by things like volatile gold prices and more people realizing the value locked in their old jewelry, making the whole recycling process more vital than ever. With so much money changing hands, understanding the margins is crucial for getting a fair shake. You can learn more about the forces driving this market in this detailed scrap gold recycling market report.

Remember, the offer you get is not just for the gold itself. It is a price that accounts for the entire journey your old jewelry will take, from the buyer’s scale to the refinery’s furnace and back into the market as pure, usable gold.

To make this crystal clear, here’s a table showing what you might realistically be offered for an item with a $1,000 melt value.

| Payout Percentage | Offer Amount | Buyer’s Margin | What This Means for You |

|---|---|---|---|

| 70% | $700 | $300 | A common starting offer, especially for smaller quantities. |

| 80% | $800 | $200 | This is a competitive and fair price from a solid, reputable dealer. |

| 90% | $900 | $100 | An excellent offer, usually reserved for very large volumes of gold. |

When you walk in with this knowledge, you can approach the selling process with realistic expectations. Your goal is not to get 100% of the melt value, it is to find a buyer who operates on a fair, transparent margin and gives you a price that reflects the true costs of the business.

Frequently Asked Questions About Selling Scrap Gold

When you decide it is time to sell your scrap gold, a few questions almost always come up. Getting straight answers is the difference between a great sale and a confusing one. Let’s tackle some of the most common things people wonder about.

What About the Gemstones in My Jewelry?

This is a big one. What happens to the little diamonds or other stones set in your rings and necklaces?

For the most part, scrap gold buyers are only interested in the metal. Their business is based on the weight and purity of the gold itself, so they will almost always remove any stones before weighing your items. Unless a stone is a large, high quality diamond with a GIA certificate, it is unlikely to add anything to your payout.

If you have a piece with significant gemstones you believe have standalone value, it is smart to have a professional jeweler appraise and remove them before you go to sell the gold.

Do I Have to Pay Taxes on This?

It is definitely something to be aware of. The IRS considers physical gold a capital asset. If you sell your gold for more than you originally paid for it, that profit is a capital gain and, yes, it is subject to taxes.

Gold held for over a year is considered a “collectible,” and any gain is taxed at a maximum rate of 28%. If you have owned it for less than a year, the profit is taxed just like your regular income.

While the dealer is not required to report most small scrap jewelry sales, you, as the seller, are legally obligated to report any capital gains on your tax return. This is where keeping purchase receipts can be a huge help in figuring out your actual profit.

How Can I Find a Reputable Buyer?

Finding a trustworthy buyer is the most critical part of the whole process. A fantastic offer means nothing if it is coming from a shady source. What you are looking for is simple: transparency.

A professional dealer is not trying to confuse you. They should:

- Explain Their Pricing: A good buyer will tell you their payout percentage upfront and show you how they got their number based on the live spot price.

- Use Proper Tools: Look for a certified, calibrated digital scale. They should be willing to test your gold’s purity right in front of you.

- Have Good Reviews: A quick search online for reviews from past customers says a lot. A long history of fair deals is the best sign.

- Never Pressure You: You should feel totally comfortable walking away. A reputable buyer provides a no obligation quote and gives you the time to think about it.

To put it in perspective, here is what separates a professional from a less than ideal option.

| Feature | Professional Dealer | Pawn Shop or Unverified Buyer |

|---|---|---|

| Pricing | Based on live market rates; offers 70-85% of melt value. | Often makes lowball offers, sometimes 50% or less. |

| Testing | Uses precise methods like XRF scanners or acid tests. | May rely on visual inspection or less accurate methods. |

| Transparency | Clearly explains the weight, purity, and calculation process. | Often lacks clear explanations; the price can feel arbitrary. |

| Reputation | Has a track record of positive reviews and industry standing. | May have mixed reviews or focus on quick, low value loans. |

Ultimately, choosing a professional ensures you are dealing with an expert who values accuracy and fairness. It is the best way to get a better payout and have a positive experience.

Ready to see what your scrap gold is really worth without the guesswork? The Gold Calculator provides instant, transparent valuations based on live market prices.