How to Use a Scrap Silver Calculator to Find Your Silver’s True Worth

Got a drawer full of old silver coins, jewelry, or flatware and find yourself wondering what it is really worth? You are not just looking at old metal; you are trying to figure out its hidden cash value. A scrap silver calculator is the tool that cuts through the guesswork, giving you a solid, market based estimate in seconds.

So, What is Your Scrap Silver Actually Worth?

This guide is here to pull back the curtain on the whole process. We will show you exactly how to figure out what your items are worth by breaking down the three things that matter most: the silver’s purity, its weight, and the live market “spot price.” Think of this as your personal roadmap to selling smart.

By the time you’re done reading, you will get the numbers, know how the tools work, and be ready to get a fair and honest price. More importantly, you will know how to spot and sidestep the common traps that lead to lowball offers.

Why You Absolutely Need an Estimate First

Getting a solid estimate before you even think about selling is the single most important step you can take. It gives you a powerful baseline, so you can walk into any negotiation with confidence. Without that number, you are flying blind, forced to take a buyer’s word for it.

An online scrap silver calculator provides this critical information instantly. It handles all the complex math for you, blending real time market data with the specific details of your silver.

This gives you a starting point backed by actual data. Knowing the purity and authenticity of your silver is just as crucial as learning how to tell real gold jewelry.

A reliable estimate transforms you from a passive seller into an informed, active participant. It is the difference between just accepting whatever is offered and knowing you are getting a fair deal.

The Core Ingredients of Silver Value

To really see the magic behind a calculator, it helps to understand the variables it is crunching. It is like a recipe with three main ingredients that need to be measured perfectly to get the right outcome.

Here is exactly what determines the final value of your scrap silver:

- Purity (Fineness): This is the percentage of pure silver in your item. You will often see it stamped as a number like “925” for sterling silver.

- Weight: Simply how heavy your silver is. It is usually measured in grams or troy ounces.

- Spot Price: This is the live, fluctuating market price for one troy ounce of pure silver. It changes all day, every day.

A scrap silver calculator takes these three factors and multiplies them together to give you the melt value—the raw, baseline worth of the pure silver locked inside your items.

The Three Things That Determine Your Silver’s Value

Before any scrap silver calculator can spit out a number, it needs to know three critical details about your item. Think of them as the core ingredients in the recipe for your silver’s value. Nail these three, and you will have a rock solid idea of what your silver is actually worth.

Let’s pull back the curtain and look at how this all works, piece by piece.

First: The Live Spot Price

The first and most fluid factor is the spot price of silver. You can think of this as the live, global stock market price for one troy ounce of pure, .999 fine silver. This price is anything but static; it moves constantly throughout the day, driven by global supply and demand, investor trading, and big picture economic news.

A trustworthy scrap silver calculator is always plugged into this live data stream. This is crucial because it means your estimate is based on the most current price, not an outdated number from last week or even a few hours ago.

The market itself is also shaped by larger economic forces. A stubborn imbalance between supply and demand has created a major deficit that has a direct effect on recycling economics. For the fifth year in a row, global silver demand outstripped supply by an estimated 117.6 million ounces. This adds to a massive cumulative deficit of 678 million ounces from the years before, which naturally puts upward pressure on prices and makes recycling your old silver more worthwhile.

Second: Purity (or Fineness)

The second ingredient is purity, which you will also hear called fineness. It is extremely rare to find items made of 100% pure silver. Why? Because pure silver is just too soft for practical things like jewelry or forks. To make it durable enough for everyday life, it is mixed with other metals (usually copper) to create a stronger alloy.

Purity is simply the percentage of your item that is actual, pure silver. This is where most people get tripped up, but it is pretty simple once you know what you are looking for.

This percentage is usually stamped right on the piece in a small mark called a hallmark. The number you see represents the silver content per thousand parts. So, a “925” stamp means the item is 92.5% pure silver.

Here is a quick rundown of the common silver purities you will likely come across:

| Hallmark (Stamp) | Purity Name | Pure Silver Content | Common Uses |

|---|---|---|---|

| 999 | Fine Silver | 99.9% | Investment bullion, bars, and some coins |

| 958 | Britannia Silver | 95.8% | British coinage and high end silverware |

| 925 | Sterling Silver | 92.5% | Most common for jewelry, flatware, tableware |

| 900 | Coin Silver | 90.0% | Older US coins (pre 1965) and others |

| 800 | European Silver | 80.0% | Often found in antique German or Italian silver |

Getting a handle on these markings is fundamental to valuing your silver. You can get a deeper dive into the most common stamp by understanding 925 sterling silver and why it is so prevalent. If your item has no markings or you are just not sure, getting it tested is the next step a process very similar to our methods for gold purity testing.

Third: Accurate Weight

The third and final piece of the puzzle is weight. This might seem like a no brainer, but when it comes to precious metals, precision is everything. A tiny error in weight can make a surprisingly big difference in the final payout.

The industry standards for weighing precious metals are grams (g) and troy ounces (ozt). It is critical to know that a troy ounce is not the same as the regular kitchen ounce (officially called an “avoirdupois” ounce) you use for baking.

- 1 Troy Ounce = 31.103 grams

- 1 Standard Ounce = 28.35 grams

That difference is almost 10%, which is why you cannot just toss your silver on a food scale and expect an accurate number. Every reputable buyer uses a calibrated jewelry scale, and if you want to double check their math, you should use one too.

When you plug numbers into a scrap silver calculator, you will enter the item’s total weight. The calculator then does the math: it takes the purity percentage to figure out how much of that weight is pure silver, then multiplies that number by the live spot price. These three factors—spot price, purity, and weight—are the non negotiable inputs for any accurate valuation.

Calculating Your Silver’s Melt Value by Hand

While an online scrap silver calculator gives you instant answers, there is a real sense of empowerment in knowing how to do the math yourself. It pulls back the curtain on the valuation process, giving you the confidence that you are getting a fair shake instead of just accepting a number from a black box.

The formula is much simpler than you might think. It really just boils down to one core idea: figure out how much pure silver you have, then multiply that by the current market price. Let’s break it down step by step. This hands on approach will arm you with the knowledge to double check any online tool or buyer’s offer. After all, the best negotiations happen when you understand the numbers just as well as they do.

The Basic Melt Value Formula

At its heart, the calculation is incredibly straightforward. You are just converting your item’s total weight into the weight of its pure silver content, then finding its value based on the live market price.

The formula looks like this:

(Total Weight of Your Item) x (Purity Percentage) = Fine Silver Weight

(Fine Silver Weight) x (Current Spot Price of Silver) = Total Melt Value

This two step process is the exact logic that powers our scrap silver calculator. By doing it yourself, you get to see exactly how the sausage is made. This method is nearly identical to how gold’s value is determined; you can dive deeper into that in our guide on the gold calculation formula.

A Practical Example, Step By Step

Let’s put this formula into action with a real world item. Imagine you have an old sterling silver tray that you have confirmed is marked “925.”

First, you need an accurate weight. Let’s say your tray weighs exactly 150 grams.

Now, let’s assume the live spot price for silver today is $29.50 per troy ounce. See the mismatch in units? Your tray is in grams, but the price is in troy ounces. This is a common hurdle we need to clear, and it is an easy one to stumble over if you are not careful.

Here is how to work through it:

- Calculate the Fine Silver Weight:

Your tray is sterling silver, which means it has a purity of 92.5% (or 0.925). To find out how much pure silver is in your 150 gram tray, you just multiply its total weight by its purity.- 150 grams x 0.925 = 138.75 grams of pure silver

- Convert Grams to Troy Ounces:

Since the spot price is quoted in troy ounces, you have to convert your pure silver weight from grams into troy ounces. The magic number here is the conversion factor: 1 troy ounce = 31.103 grams.- 138.75 grams / 31.103 = 4.46 troy ounces of pure silver

- Calculate the Final Melt Value:

Finally, you multiply the weight of your pure silver in troy ounces by the current spot price to get the total melt value.- 4.46 troy ounces x $29.50 per troy ounce = $131.57

So, the total melt value of your 150 gram sterling silver tray is $131.57. This number is your baseline—it is the raw value of the metal it contains, before any refining costs or buyer fees are factored in.

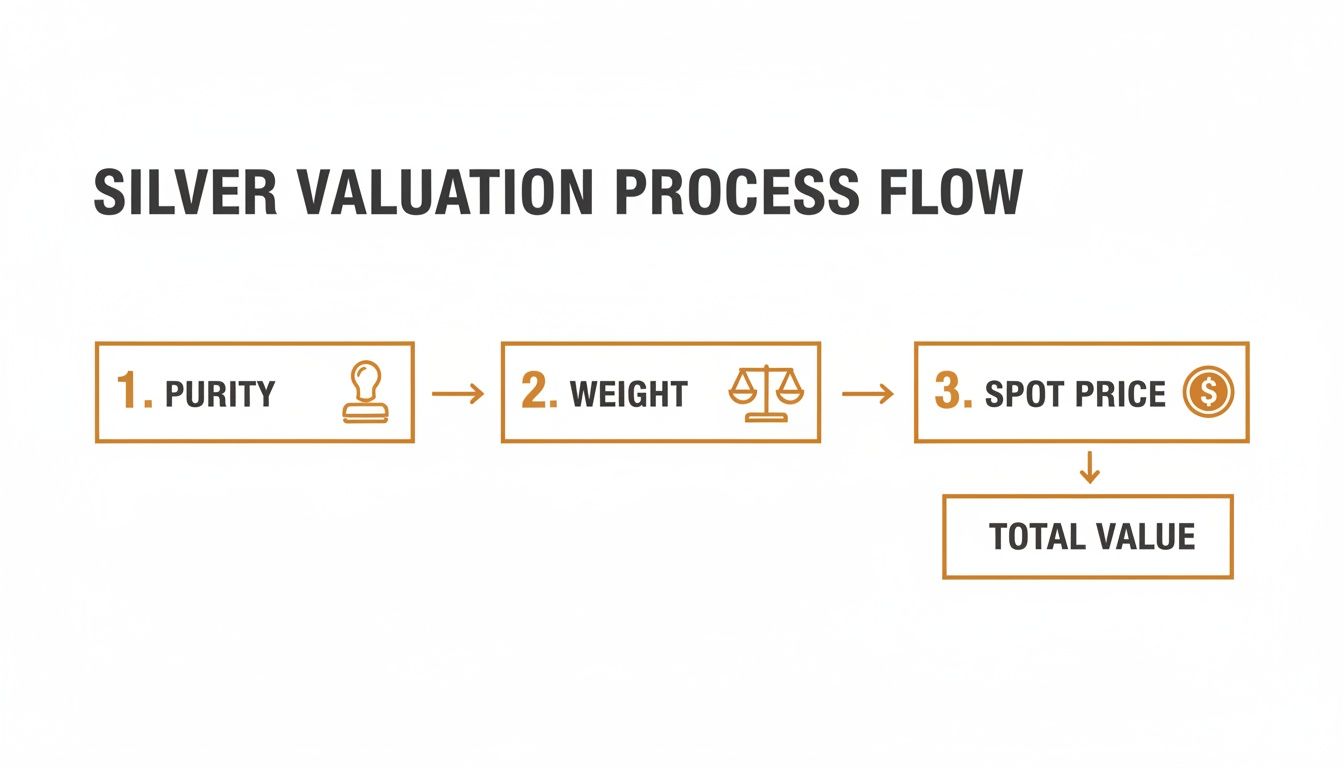

This chart breaks down the simple flow of determining your silver’s value, from checking its purity and weight to referencing the spot price.

This visual reinforces that these three distinct steps—verifying purity, getting an accurate weight, and checking the live market price—are the essential building blocks for any accurate valuation.

Fine Silver Content in Common Silver Items

To make your manual calculations even faster, you do not always have to pull out a calculator for the purity conversion. This handy table shows you exactly how much pure silver is in 100 grams of material for the most common purities you will encounter.

| Silver Purity (Marking) | Percentage of Pure Silver | Fine Silver in 100 Grams | Commonly Found In |

|---|---|---|---|

| 999 (Fine Silver) | 99.9% | 99.9 grams | Investment bullion, modern commemorative coins, and bars. |

| 958 (Britannia) | 95.8% | 95.8 grams | Historic British silverware and some modern high end pieces. |

| 925 (Sterling) | 92.5% | 92.5 grams | The most common standard for jewelry, flatware, and tableware. |

| 900 (Coin Silver) | 90.0% | 90.0 grams | Found in older U.S. dimes, quarters, and half dollars (pre 1965). |

| 800 (European Silver) | 80.0% | 80.0 grams | Often seen in antique silver from Germany, Italy, and Europe. |

Think of this table as your quick cheat sheet. If you know your item’s weight and purity, you can quickly estimate its fine silver content and get one step closer to its final melt value without missing a beat.

Using an Online Scrap Silver Calculator

Now that you have got the manual math down, let’s look at the easy way to do it. Think of an online scrap silver calculator as your expert shortcut—it does all the heavy lifting for you, instantly and accurately.

Using a calculator completely removes the risk of fumbling a conversion or using an outdated spot price. It turns a multi step headache into a simple, one minute process, ensuring your estimate is always based on live market data.

Let’s walk through exactly how to use our calculator to get a reliable valuation for your silver right now.

A Step by Step Guide to Instant Valuation

The tool is designed to be dead simple. You just plug in what you already know about your silver, and the calculator handles all the tricky conversions and real time price lookups behind the scenes.

Here is how it works:

- Select the Purity: First, click the purity dropdown menu. You will see a list of the usual suspects like Sterling .925, Coin Silver .900, and Fine Silver .999. Just pick the one that matches the hallmark on your item.

- Enter the Weight: Next, type your item’s total weight into the box. Make sure to choose the correct unit from the menu next to it, whether it is grams (g), troy ounces (ozt), or something else.

- Get Your Instant Value: The moment you enter the weight, the total melt value pops up. This number is based on the live spot price of silver, which is constantly updated, so your estimate is as accurate as it gets.

The whole interface is clean and straightforward. The spots for purity and weight are clearly marked, and the final value is displayed prominently, leaving no room for guesswork.

A Real World Example

Let’s make this tangible. Say you have gathered a small pile of old sterling silver jewelry—a broken necklace and a few mismatched earrings. You pop them on a digital scale and find they weigh a combined 45 grams.

Here is what you would do with the calculator:

- In the purity dropdown, select “Sterling .925”.

- In the weight field, enter “45” and make sure the unit is set to “Grams”.

That is it. Instantly, the tool gets to work. It figures out that your items have 41.63 grams of pure silver (45 g x 0.925), converts that to 1.34 troy ounces, and multiplies it by the live spot price.

If the spot price at that moment was $29.50, your instant melt value estimate would be $39.53.

Using a scrap silver calculator completely demystifies the valuation process. It gives you a transparent, data driven starting point, putting the same information a professional buyer uses right at your fingertips.

This immediate feedback is incredibly powerful. It arms you with a solid baseline value before you even think about talking to a buyer, making sure you can start any negotiation from a place of confidence and knowledge. And because the price is live, your estimate is never stale—it reflects the true market value at that very moment.

Why a Buyer’s Offer Is Less Than the Melt Value

So, you have used a scrap silver calculator and have a solid number in your head: the melt value. This figure represents the raw, intrinsic worth of the pure silver locked inside your items. It can be a bit of a shock, then, when a buyer’s offer comes in noticeably lower than what your calculator showed. Is this just a lowball tactic?

Not usually. The gap between the melt value and the cash you are offered exists for a simple reason: turning old, unwanted silver back into a pure, usable product costs money. Buyers, from your local jeweler to a massive refinery, are running a business with very real expenses.

Seeing their offer as a reflection of that process—not an attempt to rip you off—is the first step to becoming a savvy seller.

The Business Behind the Payout

Think of it like selling fresh picked apples from your backyard orchard to a grocery store. The store will not pay you the full price they charge customers. They have to factor in the costs of transportation, refrigeration, paying their staff, and the risk that some apples might spoil before they are sold.

A silver buyer operates on the same principles. They have a whole chain of costs tied to transforming your old silverware and broken jewelry into pure silver bullion.

Here is a look at what is happening behind the scenes after they buy your silver:

- Smelting and Refining: This is the biggest expense by far. Your scrap silver gets melted down in industrial furnaces at scorching temperatures to separate the pure silver from other metals like copper or nickel. It is a heavy duty process that requires specialized equipment, skilled workers, and a tremendous amount of energy.

- Assaying and Testing: Before anything gets melted, the buyer has to know exactly what they are dealing with. They perform a professional analysis, called an assay, to verify the precise purity of every item. This step is critical to avoid costly mistakes.

- Overhead and Operational Costs: Every business has bills to pay. This covers everything from the rent on their shop, employee salaries, and insurance to security systems and the marketing needed to find sellers like you in the first place.

- Market Risk: The price of silver changes by the minute. A buyer is taking on the risk that the spot price could plummet between the moment they pay you and the moment they sell the refined silver.

All of these factors are baked into their business model, which brings us to the most important concept for a seller: the payout percentage.

Understanding the Payout Percentage

Because of these very real costs, a buyer will offer you a percentage of the total melt value. This is called the payout percentage—it is the slice of the melt value pie that you actually receive in cash. Reputable dealers are completely transparent about this and will often explain their rates upfront.

A typical payout percentage from a trustworthy scrap silver buyer will be in the range of 70% to 95% of the melt value. The final rate often depends on how much you are selling and what the market is doing that day.

This business model is what keeps the entire silver recycling ecosystem running. The demand for recycled silver is huge; in fact, silver recycling recently hit a 12 year high, reaching 193.9 million ounces. While a lot of that comes from industrial scrap, silverware recycling also jumped 11 percent, pushed by stronger prices and cost of living pressures. This secondary supply is vital, making up about 19 percent of all silver consumed worldwide. You can dig deeper into these global trends over at the Silver Institute’s website.

The whole system, from you selling a few old spoons to a global refiner producing massive silver bars, depends on this margin to operate profitably.

Spotting a Fair Offer from a Lowball One

So, how does this knowledge help you? By understanding the payout percentage, you can instantly tell if an offer is fair or if someone is trying to take you for a ride. If a buyer’s offer lands somewhere in that 70% to 95% sweet spot, you are likely dealing with a legitimate business.

Here is a simple table showing what this looks like with a melt value of $100.

| Payout Percentage | Cash Offer on $100 Melt Value | Assessment |

|---|---|---|

| 90% | $90.00 | Excellent Offer |

| 85% | $85.00 | Very Good Offer |

| 75% | $75.00 | Fair Offer |

| 60% | $60.00 | Low Offer |

| 50% or less | $50.00 or less | Unfair/Lowball |

Any offer that dips below 70% should set off alarm bells. It could mean the buyer has ridiculously high overhead, or they might just be trying to pocket an unfair profit at your expense. Armed with your calculator’s estimate and a realistic payout expectation, you can now negotiate with confidence—or simply walk away and find someone who will give you a better deal.

Getting the Best Price for Your Scrap Silver

Knowledge is power, especially when you want to turn old silver into cash. To make sure you get the best possible payout, it is smart to approach selling with a clear strategy. Think of these tips as your pre selling checklist, designed to put you in the driver’s seat of the transaction.

This proactive approach turns selling from a passive exchange into a business deal where you hold the key information. When you prepare beforehand, you can negotiate from a position of strength and confidence.

Prepare Your Items for Valuation

Before you even think about getting a quote, a little bit of organization goes a long way. This simple prep work ensures you present your items clearly, which helps buyers give you a more accurate and competitive offer right from the start.

Here are three simple steps to take first:

- Sort by Purity: Group your items based on their hallmarks. Put all the “925” sterling pieces in one pile, any “900” coin silver in another, and so on. This makes the valuation process much faster and more transparent for everyone involved.

- Get an Accurate Weight: Use a calibrated digital kitchen or jewelry scale to weigh each pile. Be sure to record these weights so you have your own numbers to reference later.

- Check the Live Spot Price: Right before you head out or contact a buyer, check the current spot price of silver. This gives you the most up to date baseline for your own calculations.

Comparing Your Selling Options

The single most effective way to guarantee you are getting a fair price is to get multiple offers. Never, ever accept the first quote you receive without seeing what else is out there. Different buyers have different overhead costs and payout structures.

| Buyer Type | Typical Payout Range | Best For |

|---|---|---|

| Online Refiners | 85% to 95% | Sellers with larger quantities who prioritize the highest payout. |

| Local Jewelers | 75% to 90% | Those who value in person service and quick, convenient transactions. |

| Pawn Shops | 70% to 85% | Speed and immediate cash, though often at a lower payout percentage. |

Shopping your silver around to at least two or three different types of buyers is a crucial step. While this guide focuses on silver, many of the same principles apply to other precious metals. You can explore our detailed comparison of the best place to sell gold to see how different buyer models stack up. This strategy empowers you to find the buyer offering the best combination of price and service.

The global scrap silver recycling market was valued at around USD 5 billion and is expected to hit USD 9.2 billion within the next decade. This growth highlights recycling’s shift from a niche activity to a key part of the economy. You can find more details on this growing market and its economic impact by checking out these insights on the global scrap silver recycling market.

Common Questions About Selling Scrap Silver

To wrap things up, let’s tackle a few of the most common questions people have when they are thinking about selling silver. These are the practical, need to know details that will give you the confidence to move forward.

What Are the Most Common Types of Scrap Silver I Might Have?

You might be surprised by what you own that qualifies as scrap silver. It is not just about broken chains or single earrings; it is anything where the value lies in the metal itself, not in the item’s design or function.

Keep an eye out for these common finds:

- Sterling Silver Flatware: This is a big one. Old forks, spoons, knives, and serving platters, often marked with “925” or “Sterling,” are prime candidates.

- Old or Broken Jewelry: That tangled necklace, the ring that no longer fits, or the bracelet with a broken clasp are all perfect examples of scrap silver.

- Pre 1965 US Coins: American dimes, quarters, and half dollars minted before 1965 are made of 90% silver. They are frequently sold for their melt value rather than their face value.

- Decorative Items: Do not overlook old sterling silver picture frames, candlestick holders, bowls, and trophies that might just be collecting dust.

How Can I Perform a Basic Purity Test at Home?

While only a professional can give you a definitive answer with an acid test, a couple of simple, non destructive tests at home can quickly weed out the fakes.

The magnet test is your best first step. Silver is not magnetic. Grab a strong magnet (like a neodymium one) and see if it sticks to your item. If it latches on, you are almost certainly dealing with silver plated steel or another base metal.

Also, get in the habit of looking for hallmarks. A magnifying glass will help you spot tiny stamps like “925,” “Sterling,” “900 Coin,” or “800.” While hallmarks can be counterfeited, finding one is a great starting point.

Should I Sell to a Local Buyer or an Online Service?

This is the classic trade off between speed and payout. There is no single “right” answer here; it really boils down to what you prioritize most.

Here is a simple breakdown of how they stack up:

| Feature | Local Buyer (Jeweler, Pawn Shop) | Online Service (Mail In Refiner) |

|---|---|---|

| Payout Speed | Immediate, same day cash payment. | Slower, usually takes several days. |

| Payout Rate | Often a bit lower (70% to 90%). | Generally higher (85% to 95%). |

| Convenience | High, with face to face interaction. | Requires you to package and ship your items. |

| Transparency | You can watch the weighing and testing. | Relies on trusting the company’s process. |

A smart strategy is to get a quote from a trusted local jeweler first. This gives you a real, concrete offer you can use as a benchmark when comparing what online refiners are offering, making sure you get the best deal possible.

Ready to discover what your precious metals are really worth? The Gold Calculator offers a free, live calculator that gives you an instant, transparent estimate of your items’ melt value based on real time market prices. Get your accurate valuation today and sell with confidence.