Sell Gold Jewelry for Cash: The Definitive 2026 Guide

If you have old or unwanted gold jewelry collecting dust, you could be sitting on a nice pile of cash. Deciding when to sell is a mix of timing and personal need, but right now, the market is presenting a compelling opportunity for anyone looking to make a move. This guide will walk you through valuing your gold like a professional, so you can sell with total confidence.

Why Now Is a Great Time to Sell Your Gold

Selling gold isn’t some niche activity; it is a global practice that heats up whenever gold prices and economic conditions align. Jewelry has always been a massive part of the world’s gold demand. Even with market ups and downs, demand stayed strong because gold plays a dual role: it is a status symbol and a shield against economic trouble.

When currencies wobble or inflation bites, people often sell their gold jewelry to get their hands on cash fast. And when gold prices spike, like they have in recent years, soaring over $4,000 per ounce, more people decide to cash in. You can dig deeper into these trends over at the World Gold Council.

Key Factors Driving the Gold Market

A few key ingredients are making this a strong seller’s market, which should give you confidence if you are thinking about selling.

Economic Uncertainty: When inflation is high or the stock market gets shaky, investors flock to gold as a “safe haven”, which naturally pushes its price up. Think of it as financial insurance; when traditional investments feel risky, the tangible value of gold becomes much more attractive.

High Buyer Competition: A hot market means more buyers, from your local jeweler to online refineries, are all competing for gold. This competition is great for you, as it often leads to better offers. More buyers vying for a limited supply forces them to offer more competitive prices to secure inventory.

Robust Resale Demand: Fashion trends come and go, but gold as a raw material is always in high demand for creating new jewelry and for industrial uses. You can be sure there is a market for your items, regardless of their style.

Understanding Your Payout

Here is something crucial to understand: buyers purchase your jewelry based on its “melt value”. That is simply the value of the pure gold content in your items. They will offer you a percentage of that value because they have their own refining costs and, of course, a profit margin to consider.

The table below gives you a realistic idea of what different types of buyers typically pay. This will help you manage your expectations when you start getting offers.

| Buyer Type | Typical Payout of Melt Value | Best For |

|---|---|---|

| Pawn Shops | 60% to 75% | Quick cash, convenience |

| Local Jewelers | 70% to 85% | Trust and local service |

| Online Buyers | 80% to 95% | Higher payouts, convenience |

| Refineries | 85% to 98% | Highest payouts, bulk sales |

Knowing the baseline melt value of your gold is your most powerful negotiating tool. It transforms you from a passive seller into an informed one, ready to secure a fair price.

Figuring Out What Your Gold Is Really Worth

Before you even think about selling your gold jewelry for cash, taking a moment to understand what you actually have is your biggest advantage. It turns what feels like a guessing game into a clear, manageable process.

Let’s walk through how you can get a solid idea of your gold’s value right at home. This isn’t about becoming a professional appraiser overnight. It’s about gathering the basic facts, purity, weight, and markings, so you can talk intelligently with any buyer and know what a fair offer looks like.

Decoding Gold Purity: What Karats Really Mean

The single most important factor driving your gold’s value is its purity, which we measure in karats. Think of it as a simple ratio: how many parts of pure gold are in your item, out of a total of 24 parts.

Pure, 24 karat gold is incredibly soft, so for most jewelry, it is mixed with stronger metals like copper, silver, or zinc to make it durable enough for everyday wear. This mix is what creates the different karat levels you see.

Here is a quick rundown of what you will commonly find:

- 24K Gold: This is 99.9% pure gold. It is the most valuable but also the softest, which is why you rarely see it used in jewelry meant to be worn often.

- 18K Gold: At 75% pure gold (18 parts gold, 6 parts other metals), this alloy has a beautiful, deep yellow color and is a favorite for high end pieces.

- 14K Gold: This is 58.3% pure gold (14 parts gold, 10 parts other metals). It is the most popular choice in the U.S. for its fantastic balance of durability, value, and rich color.

- 10K Gold: Containing 41.7% pure gold (10 parts gold, 14 parts other metals), this is the most durable and affordable option. It is the minimum purity that can be legally sold as “gold” in the United States.

Simply put, the higher the karat number, the more pure gold your item contains, and the more it is worth.

Finding the Hidden Clues: Hallmarks and Stamps

So, how do you figure out the karat of your jewelry? Most pieces have tiny stamps called hallmarks that spell it all out. You will probably need a magnifying glass to spot them, but they are usually tucked away on an inconspicuous spot like the inside of a ring or on the clasp of a necklace.

These little stamps are your road map. Here is what to look for:

| Karat Value | American Stamp (Karat) | European Stamp (Fineness) |

|---|---|---|

| 10K | 10K, 10Kt | 417 |

| 14K | 14K, 14Kt | 583 or 585 |

| 18K | 18K, 18Kt | 750 |

| 22K | 22K, 22Kt | 916 |

| 24K | 24K, 24Kt | 999 |

Be on the lookout for stamps like “GP” (Gold Plated), “GF” (Gold Filled), or “HGE” (Heavy Gold Electroplate). These mean the item is not solid gold and unfortunately has little to no melt value.

If you cannot find a stamp or you are not sure what it means, do not sweat it. Any reputable buyer will test the item for you. You can also check out our guide on how to test gold purity for a few simple methods you can try at home.

Getting an Accurate Weight at Home

Once you have identified the purity, the next piece of the puzzle is weight. A simple digital kitchen scale that measures in grams will do the trick just fine. Just be sure to weigh only the gold items. If you can, remove any large gemstones, as buyers will not pay for their weight.

After you have the weight in grams, you can plug that number into a tool like our Gold Calculator to see what it is worth. Officially, precious metals are traded in troy ounces, and some buyers might mention pennyweights (dwt). To give you some context, one troy ounce is about 10% heavier than a standard ounce.

1 troy ounce = 31.1 grams = 20 pennyweights

While you can do the math yourself, an online calculator makes life a lot easier. Just enter the weight from your scale and the karat you found on the hallmark. This will give you the baseline “melt value” based on the day’s market price. A buyer will offer you a percentage of this number, but now you will walk in the door knowing exactly what that full value is, putting you in a much stronger negotiating position.

Choosing the Right Place for Selling Gold Jewelry for Cash

You’ve got a solid idea of your gold’s purity and weight. Now comes the most important decision you will make in this whole process: picking the right buyer.

The landscape is packed with options, and each one strikes a different balance between speed, convenience, and, most importantly, price. Making the right call here is the difference between an okay deal and a great one. Think of it less like a transaction and more like a brief partnership. Your goal is to find a buyer whose business model fits what you need, whether that is the highest possible payout or cash in your hand an hour from now.

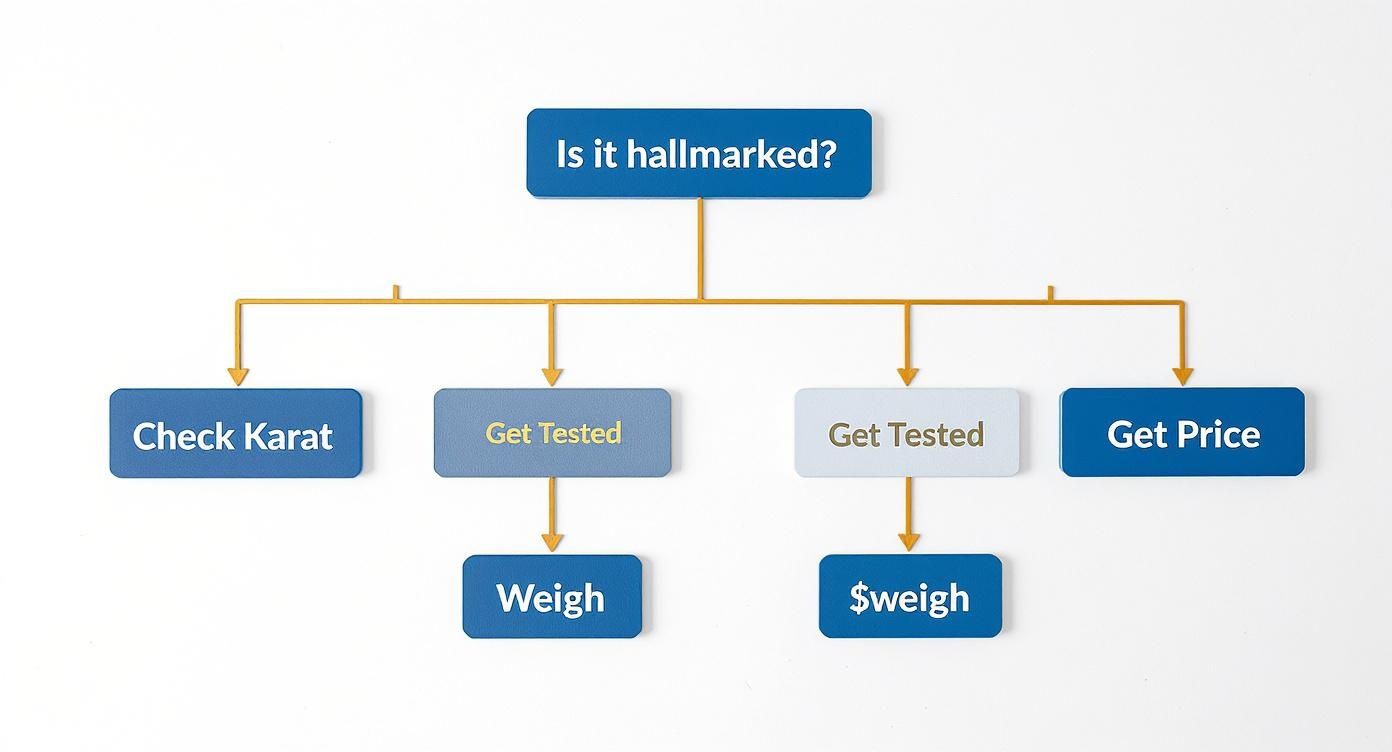

To get started, this decision tree can help you map out the initial valuation steps before you even talk to a buyer.

This visual guide breaks down the appraisal process, showing a clear path to finding your item’s value, whether it has hallmarks or not.

Local Buyers: Pawn Shops and Jewelers

For most people, the first instinct is to head to a local shop. These brick and mortar stores offer the big advantage of face to face interaction and immediate payment, which is definitely appealing.

Pawn shops are the undisputed champions of speed. You can walk in with your gold and walk out with cash, often in minutes. That convenience comes at a steep price, though. Their offers typically land somewhere between 60% to 75% of the actual melt value because their business model is built around short term loans and quick flips.

Your local jeweler usually brings more expertise to the table. They might offer a slightly better rate than a pawn shop, maybe in the 70% to 85% range. This is because they have a better eye for a unique piece they could resell or have direct relationships with refiners. You get trust and a familiar face, but since their main business is selling, not buying, jewelry, their offer might still be conservative.

Specialized ‘We Buy Gold’ Stores

You have seen them in strip malls, with big, bright signs promising “Cash for Gold”. These businesses are specialists; their entire operation is built around buying precious metals from the public. Because they are so focused, they are often more efficient and can offer better prices than a generalist like a pawn shop.

Because buying gold is their core business, these stores are more competitive and often pay in the range of 70% to 85% of the melt value. Their process is streamlined for quick, on the spot assessment and payment.

The catch? The quality and reputation of these stores can be all over the map. It is absolutely crucial to check online reviews and make sure they use certified scales and are transparent about their entire testing and pricing process.

Reputable Online Mail In Buyers

If your top priority is getting the absolute highest payout, reputable online mail in buyers are almost always the best bet. These companies have much lower overhead than physical stores, and they can pass those savings on to you with better offers.

The process is surprisingly simple and secure:

- First, you request a free, fully insured shipping kit from their website.

- Then, you mail your gold jewelry to their secure facility.

- Their experts test and weigh your items, often under video surveillance for transparency.

- Finally, you receive a no obligation offer you can accept or decline.

If you accept the offer, payment is sent quickly via direct deposit or check. If you decline, they ship your items right back to you, fully insured. Top tier online buyers can pay between 85% to 95% of the melt value, a huge jump over most local options. To help you choose the right service, we have put together a detailed breakdown of where to sell gold for the highest price in our complete guide.

Comparing Gold Buyer Options

To simplify your decision, let’s lay out the key differences between these buyer types. This table clearly shows the trade offs you will be making between payout, speed, and overall experience.

| Buyer Type | Typical Payout of Melt Value | Transaction Speed | Best For |

|---|---|---|---|

| Pawn Shops | 60% to 75% | Immediate (Under 1 Hour) | An urgent need for cash and convenience. |

| Local Jewelers | 70% to 85% | Same Day | Valuing trust and local, in person service. |

| ‘We Buy Gold’ Stores | 70% to 85% | Same Day | Getting a better local payout than a pawn shop. |

| Online Buyers | 85% to 95% | 2 to 5 Business Days | Maximizing your financial return above all else. |

Ultimately, the best place to sell your gold comes down to what you value most. If you need cash in your hand by the end of the day, a local buyer is your answer. But if you have a few days to spare, an online service will almost always put more money in your pocket.

Closing the Deal: How to Sell Your Gold Safely and Confidently

You’ve done the hard part, you know what your gold is worth and you’ve found a potential buyer. Now it is time for the final, most crucial step: the sale itself. This is where your preparation pays off, allowing you to navigate the transaction with confidence and get the cash you deserve.

Successfully selling your gold is not just about taking the first offer thrown your way. It is about understanding the process, knowing what to look out for, and being ready to stand firm on your valuation. Whether you are standing in a local jewelry store or packing a box for an online buyer, being an informed seller puts you in complete control.

Spotting the Red Flags Before They Cost You

Legitimate gold buyers operate with transparency. Scammers, on the other hand, thrive on confusion, pressure, and hoping you do not know any better. Learning to recognize the warning signs will immediately tell you who you’re dealing with. Do not be afraid to walk right out the door if something feels off.

Here are a few classic red flags that should set off alarm bells:

Shady Scales: A professional buyer will always weigh your gold on a state certified scale, right in front of you. If they disappear into a back room with your jewelry or the scale has no official certification sticker, that is a huge problem.

High Pressure Tactics: Anyone rushing you is a major red flag. If you hear things like, “This offer is only good for right now”, or they make you feel uncomfortable for wanting to think about it, they are using pressure to keep you from getting a second opinion.

Vague Explanations: The buyer should be able to clearly walk you through their offer. That means telling you the exact weight they measured, the karat they confirmed, and what percentage of the spot price they are paying. If they’re cagey with the details, it is because they’re hiding a lowball offer in the fine print.

These tactics are designed to make you feel powerless. Your research is your best defense, ensuring the entire process stays fair and on your terms.

The Art of a Good Negotiation

Negotiating does not have to be a big, scary confrontation. When you’ve already done your homework, it is really just a calm conversation to get the buyer’s offer in line with the fair market value you already know. That estimate you calculated earlier? It is your single most powerful tool in this conversation.

When you get an offer, pull out your estimate and compare it. If it is way lower than you expected, do not just accept it. Ask them to explain how they got to their number.

A simple, confident question can completely change the dynamic: “Based on today’s gold price, I calculated the melt value for my 14 karat items weighing X grams to be around $Y. Could you help me understand the difference in your offer?”

This is not aggressive; it is informed. It instantly signals that you’re not someone they can take advantage of and shifts the conversation from a simple “take it or leave it” to a respectful negotiation based on facts.

Remember, every buyer has overhead, so you’ll never get 100% of the melt value. But knowing the typical payout range for pawn shops vs. refineries gives you the power to push back against an offer that is just too low. For a deeper dive, our guide on how to sell scrap gold breaks down exactly what to expect.

Your Final Checklist for a Secure Transaction

Whether you are selling online or face to face, the details matter. A written record is non negotiable, it protects both you and the buyer. Before you hand over your gold for good, get everything in writing.

This is more important than ever in a hot market. With a growing market, new buyers are popping up everywhere, making it critical to verify who you are working with.

To make sure everything is handled correctly, run through this quick checklist before you finalize the sale:

| Transaction Step | What to Verify | Why It Matters |

|---|---|---|

| Get a Receipt | Make sure it details the item, weight, karat, price per gram, and total payout. | This is your official sales record for your own files, tax purposes, or any future disputes. |

| Confirm Identity | A legitimate business will have a license, and they will require your government issued ID. | This is a legal requirement for buyers to prevent the sale of stolen goods and document transactions. |

| Understand Terms | For online sales, confirm the insurance coverage, tracking details, and return policy. | This protects your gold from being lost or damaged while it is out of your hands. |

| Payment Method | Know if you are getting cash, a check, or a direct deposit, and exactly when to expect it. | This prevents any unwelcome surprises and ensures you get your money when and how you agreed. |

By methodically checking these boxes, you can walk away from the sale knowing you handled it like a pro, protected your interests, and got the best possible price for your gold.

When Your Jewelry Is Worth More Than Its Gold Content

So far, we have been laser focused on figuring out the melt value of your gold. This is the perfect way to handle broken chains, single earrings, and outdated stuff where the gold itself is the main attraction. But it’s a massive mistake to assume every piece of gold jewelry should be sold for its scrap weight.

Some pieces have a story, a brand name, or a level of craftsmanship that makes them worlds more valuable than their raw materials. Selling this kind of jewelry to a standard “cash for gold” buyer who only sees melt value is like selling a classic car for its scrap metal price. You would be leaving a serious amount of money on the table.

Identifying Pieces with Premium Value

Before you toss everything into one pile, take a minute to really look at each item. You’re hunting for characteristics that give a piece a premium value that goes way beyond its gold content. Spotting these features is the key to getting the best possible payout.

Keep an eye out for these indicators:

Designer Brands: Is your piece stamped with a name like Cartier, Tiffany & Co., Van Cleef & Arpels, or Bulgari? These iconic brands are hot commodities on the resale market because of their reputation for quality and timeless style.

Antique or Vintage Craftsmanship: Does the piece have unique, intricate details you just do not see in modern jewelry? Anything over 100 years old is considered antique, while pieces over 20 years old are vintage. Their value often comes from rarity, the historical period they represent, and sheer artistry.

Significant Gemstones: Is your jewelry set with large, high quality diamonds, sapphires, rubies, or emeralds? A standard gold buyer will not pay you a dime for these stones, but a specialized buyer will assess their value separately.

Pausing to check each item for these qualities is the single most important thing you can do. A five minute inspection could literally uncover hundreds or even thousands of dollars in hidden value you would otherwise miss.

Why Melt Value Falls Short for Premium Jewelry

When you sell an item for its melt value, the buyer is just purchasing the raw gold. They could not care less about the labor, design, brand recognition, or the value of any gemstones. This is totally fine for actual scrap gold, but it is a huge financial blunder for your premium items.

For example, a simple 14K gold chain is priced correctly by its weight. But a vintage Art Deco engagement ring with delicate filigree and a quality diamond has value in three separate areas: its gold, the diamond’s market price, and its appeal as a finished piece of antique jewelry. A scrap buyer completely ignores those last two.

Finding the Right Buyer for Your High Value Pieces

Once you have flagged a piece that might be worth more than its weight in gold, you need to find a buyer who gets it. Your average pawn shop or “We Buy Gold” storefront just is not set up to appraise or sell these items for what they are truly worth.

Instead, you’ll want to explore places that specialize in reselling finished jewelry. These buyers understand the nuances of brand names, historical value, and gemology. They’ll make sure you get paid for the total value of your piece, not just a fraction of it.

This table breaks down your best options:

| Selling Avenue | Best For | Appraisal Focus | Payout Structure |

|---|---|---|---|

| Auction Houses | Extremely rare, high value, or historically significant items. | Provenance, rarity, and auction market demand. | A percentage of the final sale price, minus fees. |

| Consignment Shops | Designer brand jewelry and desirable vintage pieces. | Resale appeal, brand, and current fashion trends. | A split of the final sale price (e.g., 60/40) after it sells. |

| Estate Jewelers | Antique and vintage jewelry, especially with valuable gemstones. | Gemstone quality, craftsmanship, and period authenticity. | An immediate offer based on the full market value. |

Choosing the right venue is everything. Taking a signed Tiffany & Co. bracelet to a scrap buyer might get you a few hundred dollars based on its gold content. But selling that same piece through a consignment shop or an estate jeweler could fetch a price much closer to its $1,500+ retail value, depending on its condition and what the market is paying.

Common Questions About Selling Gold Jewelry

Even after you have done your homework, a few lingering questions can pop up right before you sell. It is completely normal. Getting clear answers to these common hang ups is often the final piece of the puzzle, giving you the confidence to move forward.

Let’s tackle some of the most frequent questions we hear from sellers.

Will I Get Paid for Small Diamonds or Gemstones?

For most “cash for gold” buyers, the short answer is no. These buyers are typically interested in one thing: the melt value of your gold. That means they’re focused on the weight and purity of the metal itself.

They will usually remove any small gemstones before weighing your jewelry, and those stones often are not returned or factored into your payout.

However, the game changes completely if your piece has significant, high quality gems. We are talking large diamonds (over half a carat), valuable rubies, sapphires, or emeralds. In that case, you should not be talking to a scrap gold buyer at all. Your best bet is to find a reputable estate jeweler who can properly appraise and pay for both the precious metal and the valuable gemstones.

Do I Need a Formal Appraisal Before Selling?

A formal, written appraisal is almost always unnecessary if you are just selling your gold for its metal value. These appraisals are created for insurance purposes and reflect a retail replacement cost, which is always drastically higher than the scrap value. Waving an insurance appraisal in front of a gold buyer will not help you negotiate a better price.

Your best tool is not a formal appraisal, it is your own research. By figuring out the karat, weighing your items, and plugging those numbers into a reliable gold calculator, you can get a very accurate estimate of the melt value. This gives you a realistic baseline for what your gold is worth today, which is the only number that matters in this kind of sale.

The only number you need to focus on is the current melt value, which is based on the live spot price of gold. Forget about retail or insurance figures; they do not apply here and will not help you get a fair cash offer.

Is It Safe to Mail My Gold Jewelry to an Online Buyer?

Yes, it can be extremely safe, but only if you partner with a top tier, reputable online gold buyer. The legitimate players in this space have built secure, transparent processes designed to protect you from start to finish.

A trustworthy company will provide a free shipping kit with durable packaging and a prepaid, fully insured shipping label. That insurance is non negotiable, it covers your items against loss or damage while they are in transit. Many of the best online buyers also video record the entire unboxing and evaluation process, leaving no room for doubt.

Before you send anything, do your due diligence. Check the company’s online reviews, read their insurance policies carefully, and look up their Better Business Bureau rating.

Ready to see what your gold is really worth? The Gold Calculator gives you an instant, accurate estimate using real time market prices. Calculate your gold’s value for free today at TheGoldCalculator.com and go into your sale with confidence.