How to Use a Today Gold Price Calculator for Accurate Valuations

Ever look at an old necklace or a handful of coins and wonder, “What is this actually worth right now?” A today gold price calculator cuts through the guesswork, giving you an instant estimate of your gold’s raw value based on live market data.

Think of it as a specialized currency converter. Instead of turning dollars into euros, it translates your item’s weight and purity into a real time dollar amount. It is an essential first step for anyone thinking about selling gold, making an investment, or just satisfying their curiosity.

How a Gold Calculator Instantly Shows Your Gold’s Worth

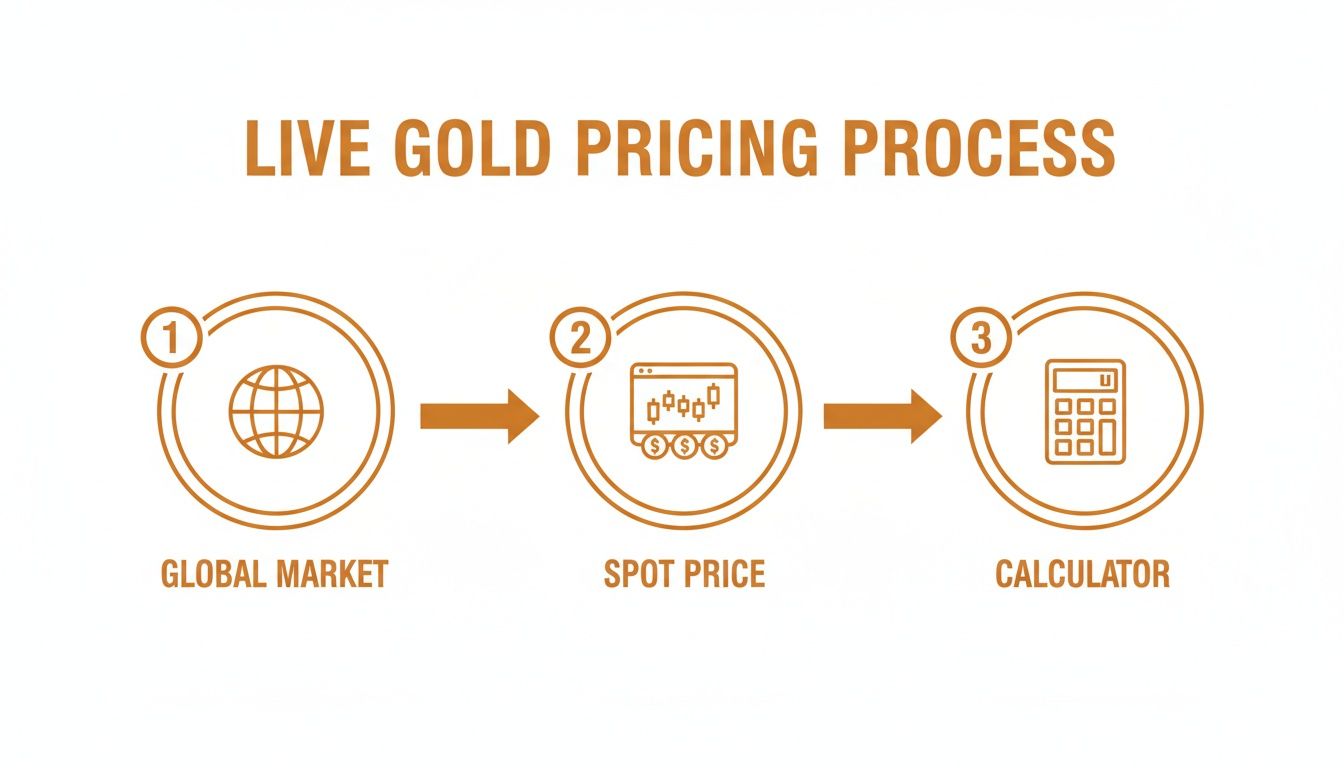

A good gold calculator demystifies the valuation process, giving you a clear, transparent number in seconds. It works by taking the global market price for gold, known as the spot price, and applying it to the exact amount of pure gold in your specific item.

This tool arms you with critical knowledge before you even think about selling. It is important to realize this calculation gives you the melt value, not necessarily the final payout. Before diving deeper, it helps to understand what fair market value truly means for an item like gold. Grasping a few key terms can give you an insider’s edge and help you approach any potential sale with confidence.

Understanding the Core Components

Any calculator is only as good as the numbers you put into it. The final estimate you see on the screen is determined by three foundational inputs.

- Spot Price: This is the live, constantly changing market price for one troy ounce of pure, 24 karat gold. It is the universal baseline for all gold valuations across the globe.

- Karat (Purity): This measures how pure your gold is. Most jewelry is not pure gold; it is mixed with other metals for strength. The karat tells you the percentage of pure gold. For example, 14K is 58.3% gold.

- Weight: This is simply the total mass of your item. It is usually measured in grams, but sometimes in pennyweights (dwt) or troy ounces.

The recent market shows just how essential these real time calculations are. For instance, if gold prices surge due to economic news, a live calculator reflects that increased value in your items instantly.

When you use a calculator that pulls live spot prices, you can see exactly how those market gains translate into a higher value for the specific items you own, right down to the dollar.

Gathering Your Gold’s Key Information

To get a reliable estimate from a gold price calculator, you need to feed it accurate information. Think of it like a recipe. The final dish is only as good as the ingredients you start with. For gold, the key ingredients are its purity, weight, and the correct unit of measurement.

Getting these three details right is the most important step in finding out the true melt value of your items. Let’s break down exactly what you need to know, so you can gather this information with confidence.

Decoding Gold Purity: Karats and Fineness

The first, and arguably most crucial, piece of the puzzle is purity. This tells you how much actual gold is in your item. Since pure gold is incredibly soft, it is almost always mixed with stronger metals (called alloys) to make it durable enough for jewelry. This purity is measured in karats (K) or by a three digit number called fineness.

Most of the time, you can find this information stamped directly on your jewelry. Check for tiny markings on discreet spots like the inside of a ring, the clasp of a necklace, or the back of an earring. You will probably need a magnifying glass to see it clearly. For a deeper dive, our guide on gold purity testing has everything you need.

To help you figure out what those tiny stamps mean, here is a quick breakdown of the most common markings you will see.

| Karat Value | Fineness Marking | Pure Gold Content (%) | Common Use |

|---|---|---|---|

| 24K | 999 | 99.9% | High purity bullion and investment coins |

| 18K | 750 | 75.0% | Fine jewelry, watches, luxury items |

| 14K | 585 | 58.3% | The most popular choice for U.S. jewelry |

| 10K | 417 | 41.7% | Durable, affordable everyday jewelry |

Knowing your gold’s exact fineness is the foundation of an accurate valuation. If you cannot find a marking, there are several ways to figure it out; you can learn how to test gold purity using various methods at home or with a professional.

Measuring Weight and Choosing the Right Unit

Next up, you need to weigh your gold. Do not worry, you do not need a professional jeweler’s scale for a solid estimate. A simple digital kitchen or postage scale that measures in grams will work just fine.

The key here is to weigh only the gold. If your jewelry has gemstones, try to remove them if you can, as they add weight but have no gold value. To give you an idea, a one carat diamond weighs 0.2 grams, enough to throw off your calculation if you leave it in.

Finally, pay close attention to the unit of measurement you are using. This is where a lot of people make mistakes. While most of us use grams (g) in daily life, the precious metals industry has its own lingo.

Here are the units you will encounter:

- Troy Ounce (ozt): This is the official standard for precious metals. One troy ounce equals 31.1 grams, which is heavier than a standard “avoirdupois” ounce (28.35 grams) used for food.

- Pennyweight (dwt): This is an older unit, but some jewelers and pawn shops still use it. One pennyweight is equal to 1.555 grams.

It is absolutely critical that you select the correct unit in the calculator. Entering 10 ounces when you really mean 10 grams will give you a wildly inflated and useless number. Always double check that your scale’s setting and the calculator’s input match perfectly.

Understanding the Live Market Data Behind the Numbers

The secret ingredient in any good gold price calculator is the live, real time data humming just beneath the surface. This is not some static number pulled from a weekly report; it is a dynamic figure that pulses with the rhythm of the global economy. Pulling back the curtain on where this data comes from is key to trusting the valuation you receive.

At the heart of every calculation is the gold spot price. Think of it as the stock ticker for gold. It represents the current market price for one troy ounce of pure, 24 karat gold, ready for immediate delivery. This price is not set by a single person or committee but is the result of constant buying and selling on major commodities exchanges all over the world.

How Our Calculator Captures the Live Price

Just like a stock market app on your phone, a reliable gold calculator needs to plug directly into a live feed of market data. Our tool connects to verified financial market sources, like the COMEX division of the New York Mercantile Exchange, which is a primary hub for metals trading. This direct link ensures the numbers you see are a true snapshot of the market at that very moment.

This real time connection is absolutely critical for accuracy. The value of gold can, and often does, shift significantly throughout the day. It reacts to economic news, geopolitical events, and swings in currency values. A calculator using yesterday’s price could easily give you an outdated and misleading estimate.

The gold spot price can fluctuate by several dollars per ounce within a single trading day. A live data feed ensures that your calculation accounts for these movements, giving you the most precise melt value possible.

Comparing Data Sources for Accuracy

Not all calculators are built the same. The quality of the data source has a direct impact on how reliable your estimate will be. A trustworthy calculator is always transparent about where its numbers are coming from.

To see why this matters, let’s look at the different kinds of data feeds a calculator might use.

| Data Source Type | Update Frequency | Accuracy Level | Why It Matters |

|---|---|---|---|

| Live Market Feed | Every few minutes | Very High | Captures real time market fluctuations for the most accurate spot value. |

| Daily Fixed Price | Once or twice a day | Moderate | Misses intraday price swings, potentially undervaluing or overvaluing your gold. |

| Manual/Static Price | Infrequently | Low | Often outdated and unreliable for making timely financial decisions. |

By using a tool that provides a constantly refreshed price, you are basing your decisions on the best information available. You can see this in action by using a live gold calculator that shows just how quickly and accurately the value of gold updates based on global trading. This commitment to live data is fundamental to building trust and providing a genuinely useful service.

From Calculated Value to Actual Payout

So, you have punched your numbers into a gold price calculator, the weight, the purity, and now you have a figure staring back at you. That number is the melt value, the raw worth of the pure gold in your item based on the live spot price. But here’s a crucial piece of inside baseball: the cash offer you get from a buyer will almost always be lower.

Why the gap? It is not a scam or some industry secret. It is just the business of buying and selling precious metals. Gold buyers, whether they are a local jewelry store or a large online refiner, have real world costs to cover. Understanding these factors is the key to setting realistic expectations and knowing a fair deal when you see one.

Why the Offer Is Lower Than the Spot Price

When you sell your old jewelry, you are essentially stepping into a supply chain. The buyer is the middleman whose job is to collect enough scrap gold to sell to a large scale refinery. That refinery then melts it all down, purifies it, and turns it back into raw gold bullion.

That whole process is not free. Several necessary costs get chipped away from the spot price before the buyer can even think about their own profit.

- Refining and Smelting Fees: Melting gold and removing impurities is an industrial process. It takes specialized equipment, a lot of energy, and skilled technicians, and the refinery charges for it.

- Assay Costs: Before melting anything, the refinery needs to verify the exact purity of the gold through a process called an assay. This is a scientific analysis that ensures accuracy, and it has a price tag.

- Business Overhead: This bucket covers all the day to day expenses of the buyer you are dealing with. Rent for their shop, employee salaries, security systems, insurance, and marketing.

- Profit Margin: At the end of the day, they are a business. A small percentage is their profit, which keeps the lights on and allows them to offer the service in the first place.

The calculator gives you the gross value of your gold. The buyer’s offer is the net value after all these operational realities are factored in.

Understanding the Payout Percentage

Okay, so what should you actually expect to walk away with? A reputable buyer will typically pay between 70% and 95% of the spot melt value. That is a pretty wide range, and where your offer falls depends on a few key variables.

Think of it this way: the easier you make the buyer’s job, the higher your percentage will be. This table breaks down what moves the needle.

| Factor Affecting Payout | Higher Percentage (e.g., 90-95%) | Lower Percentage (e.g., 70-80%) |

|---|---|---|

| Quantity of Gold | A large batch of items (several ounces) | A single, small piece of jewelry |

| Item Purity | High purity items like 22K or 24K gold | Lower purity items like 10K gold |

| Buyer’s Business Model | Lean, high volume online mail in services | Brick and mortar pawn shops with high overhead |

| Market Competition | Selling in a city with dozens of gold buyers | A small town with only one or two options |

Knowing this puts you in the driver’s seat during a negotiation. If you have a large amount of high karat gold, you have leverage. If you have one small 10K ring, your expectations should be more modest.

For a deeper dive, check out our guide on the best places to sell gold, which compares different types of buyers and what they typically pay. The more you understand the business from their side of the counter, the better you will be at spotting a fair offer, and walking away from a bad one.

A Step By Step Gold Calculation Example

Theory is one thing, but seeing the numbers in action is where it all clicks. Let’s walk through a real world scenario to show you exactly how a gold price calculator turns your item’s stats into a dollar amount. This is where all the concepts we have talked about, purity, weight, and spot price, come together.

We will use a very common piece for our example: a 14K gold chain that weighs 15 grams. To keep the math simple, let’s pretend the current gold spot price is a clean $75 per gram for pure, 24K gold.

Step 1: Find the Pure Gold Content

First things first, we need to figure out how much actual gold is in that 14K chain. As we know, 14 karat gold is not pure; it is an alloy made stronger with other metals.

Specifically, 14K gold is 58.3% pure gold by weight. The other 41.7% is a mix of metals like copper, silver, or zinc that give it durability. To start our calculation, we just need to convert that percentage into a decimal.

Pure Gold Percentage = 58.3% or 0.583

This decimal is the key to unlocking the true melt value of your item.

Step 2: Calculate the Pure Gold Weight

Okay, now we know the percentage of pure gold. Next, we apply that to the chain’s total weight to find out how many grams of pure gold we are actually working with.

- Total Weight: 15 grams

- Purity Decimal: 0.583

The math is simple multiplication:

15 grams (total weight) × 0.583 (purity) = 8.745 grams of pure gold.

So, even though your scale reads 15 grams, the value of the piece is based on the 8.745 grams of pure, 24K equivalent gold it contains.

Step 3: Determine the Final Melt Value

We are on the home stretch. Now that we have the exact weight of the pure gold, we can calculate its market value using our spot price.

- Pure Gold Weight: 8.745 grams

- Spot Price Per Gram: $75.00

The final calculation could not be easier:

8.745 grams × $75.00 per gram = $655.88

And there you have it. The estimated melt value of our 15 gram, 14K gold chain is $655.88. A good gold price calculator does all three of these steps in the blink of an eye, giving you this exact number without you ever having to touch a calculator.

Why Trust and Accuracy Matter for Gold Calculators

Not all online calculators are created equal. When you pull up a gold price calculator, you are trusting it to give you an accurate financial snapshot, and that trust has to be earned. The difference between a reliable tool and a mediocre one often boils down to a single factor: the quality and timeliness of its data.

A trustworthy calculator is built on a foundation of transparency and precision. It should pull its live data directly from credible financial exchanges like COMEX, update frequently, and be crystal clear about how it arrives at its final number. This is a world away from tools that might use stale, once a day prices or hide where their numbers are coming from.

Key Features of a Dependable Calculator

To make sure you are getting a precise estimate, you need to know what to look for. The best calculators are designed to empower you with information you can count on, turning you into a more discerning user of any online financial tool.

| Feature | Why It Matters for Accuracy | What to Look For |

|---|---|---|

| Live Spot Price Feed | Guarantees your valuation reflects the market right now, not hours ago. | Updates every few minutes from a verified source like COMEX. |

| Data Source Transparency | Builds confidence that the numbers are based on real market activity. | The provider clearly states where they get their price data. |

| Historical Data Access | Provides context to understand if current prices are high, low, or average. | Charts or tools showing long term price trends are available. |

Context is everything. Looking at long term trends provides valuable perspective. Calculators that show you historical data help you see if today’s prices are peaks or valleys in the grand scheme of things, empowering you to make more strategic decisions.

Common Questions Answered

Stepping into the world of precious metals can feel a bit overwhelming, and it is natural to have questions, especially when you are trying to figure out what your items are worth. To help you move forward with confidence, we have put together some of the most common questions people have when using a gold price calculator.

Here are some clear, straightforward answers.

Just How Accurate Is an Online Gold Calculator?

A quality online gold calculator is incredibly accurate for one specific job: finding the melt value of your gold. Its precision comes down to two things: a live, up to the minute gold spot price and the correct weight and purity details you plug in. The best tools pull their data directly from global financial markets, so you know the price reflects what is happening right now.

But here is the crucial part to remember: that calculated value is not a cash offer. Any buyer’s final offer will be lower, usually somewhere between 70% to 95% of the melt value. This difference covers their refining fees, business costs, and profit margin.

What if My Gold Jewelry Has No Purity Markings?

If your jewelry is missing a stamp like “14K” or “585,” do not assume it is not real gold. On well loved pieces like rings, those tiny markings can easily wear away after years of use. It happens all the time.

The only way to know for sure is to have it professionally tested by a jeweler or a precious metals buyer. They use tools like an X ray fluorescence (XRF) scanner, which is a non destructive way to find the exact gold content without leaving a scratch. We strongly recommend staying away from at home acid test kits. They can be notoriously inaccurate and might permanently damage your jewelry.

Does the Calculator Factor in Gemstones or Diamonds?

Nope. A gold price calculator is designed to do one thing and do it well: calculate the value of the gold itself. It cannot account for any diamonds, gemstones, or the unique craftsmanship that makes your piece special.

When you sell gold for its scrap value, buyers will almost always remove the stones before they weigh the metal. If you think the stones in your piece have significant value, it is absolutely essential to get them appraised by a qualified gemologist before you decide to sell the item for its gold weight.

Ready to see what your gold is worth right now? Use the free, real time tool from Gold Calculator. Our calculator gives you an instant, transparent estimate based on live spot prices, arming you with the knowledge you need to make a smart decision. Get your accurate valuation at https://thegoldcalculator.com today.