What’s My Gold Worth? A Guide to Its True Market Value

So, you are wondering, “what’s my gold worth?” The short answer is its value boils down to three key things: its weight, its purity (karat), and the current market price of gold. For example, a 10 gram, 14K gold ring could easily be worth several hundred dollars, but that number changes every single day.

Your Quick Guide to Gold Valuation

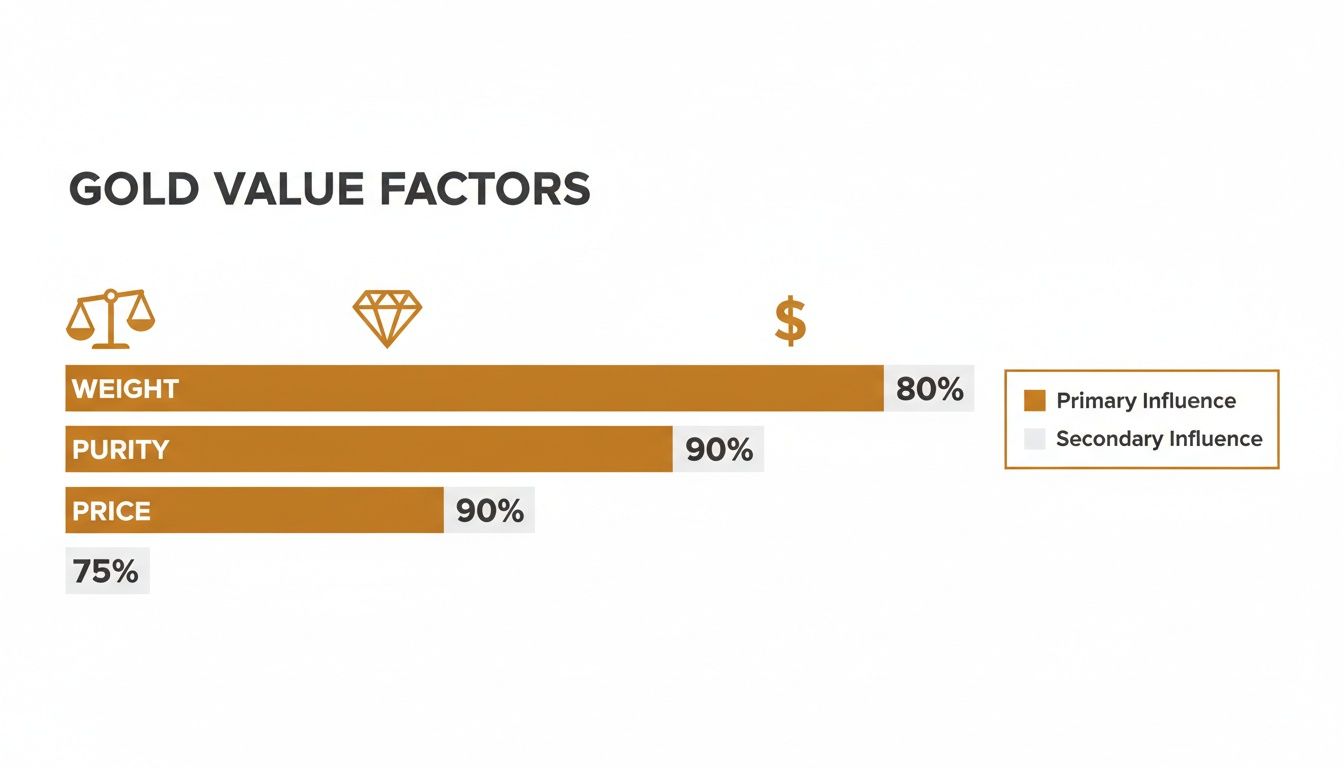

Figuring out the true value of your gold might seem like a complex puzzle, but it is actually more like a simple recipe. The final result depends entirely on the quality and quantity of your ingredients. The three core components, weight, purity, and the live market price (also known as the spot price), work together to establish your item’s baseline value.

This initial calculation gives you what is called the “melt value”, the raw, intrinsic worth of the gold itself. But it is crucial to understand that the cash offer you will get from a buyer will be a percentage of this number. Why? Because buyers have to cover their own costs for testing, refining, and running their business. A huge part of this process is grasping the concept of intrinsic value, which is simply the underlying worth of the raw gold in your item, stripped of any other factors.

This infographic breaks down those three core factors perfectly.

As you can see, each piece of the puzzle is just as important as the others. You cannot get an accurate picture without all three.

What Payout Can You Realistically Expect?

Alright, let’s talk real numbers. What percentage of that melt value should you actually expect to see in your hand? Typically, offers will fall somewhere between 70% and 95%. The exact amount depends heavily on who you sell to, since every buyer has different overhead costs and business models. For instance, online buyers with lower operating costs can often afford to give you a more competitive rate.

To help set clear expectations, here is a look at what different types of buyers generally offer.

Estimated Payout Percentages by Buyer Type

This table breaks down the typical payout you can expect from different buyers, giving you a good idea of where to start.

| Buyer Type | Typical Payout Range (% of Spot Value) | Best For |

|---|---|---|

| Online Mail In Buyer | 80% to 95% | Convenience and often higher payouts due to lower overhead. |

| Local Jeweler | 75% to 90% | Trusted, in person transactions and immediate payment. |

| Pawn Shop | 70% to 85% | Fast cash for a wide variety of items, not just gold. |

| Precious Metal Refiner | 90% to 98% | Highest payouts, but they usually require you to sell in bulk. |

Remember, this is a general guide. The best move is always to shop around and get quotes from a few different places before making a final decision. Knowledge is power, especially when you are looking to get the best price for your gold.

The Three Pillars of Valuing Your Gold

So, you are asking, “What’s my gold worth?” To get a real, confident answer, you need to get a handle on the three things that truly determine its value. Think of them as the three legs of a stool; if you get one wrong, the whole valuation gets wobbly. These pillars are the gold spot price, the purity of your item, and its weight.

Let’s walk through each one. Once you see how they fit together, you will have a crystal clear picture of what your gold is worth.

Pillar 1: The Gold Spot Price

First up is the spot price. This is the live, up to the minute market price for one troy ounce of pure, 24 karat gold. It is basically the stock price for gold, and it is constantly shifting based on global trading, economic news, and supply and demand.

Every gold buyer on the planet uses this number as the starting point for their calculations. But remember, this price is for pure gold. Your 14K ring is not pure, which brings us to the next crucial piece of the puzzle.

Pillar 2: Gold Purity (Karat)

Purity tells you how much actual gold is in your item compared to the other metals, called alloys. We measure this in karats (K). Pure gold is 24K, but it is way too soft for most jewelry, so it is mixed with tougher metals like copper, zinc, or silver to make it durable.

A higher karat number means a higher percentage of pure gold, and a higher value. For instance, an 18K gold chain is 75% pure gold, while a 10K ring is only 41.7% pure gold.

This is a massive deal. Two items that weigh exactly the same can have wildly different values based on their karat alone. If you are not sure about your item’s purity, you can start by learning how to test gold purity to look for tiny stamps or other clues.

Pillar 3: The Weight of Your Gold

The final piece is simple but essential: weight. The more gold you have, the more it is worth. Gold buyers usually measure in grams or pennyweights (DWT), while banks and investors talk in troy ounces. Even a decent kitchen or jewelry scale can give you a solid starting point.

Here is a quick glance table showing the pure gold content for common karat types.

| Karat Value | Pure Gold Content | Fineness Stamp | Common Use |

|---|---|---|---|

| 24K | 99.9% | 999 | Gold bars, investment coins |

| 22K | 91.7% | 917 | High end jewelry, bullion coins |

| 18K | 75.0% | 750 | Fine jewelry, luxury watches |

| 14K | 58.3% | 583 | Most common for jewelry in the US |

| 10K | 41.7% | 417 | Durable, affordable jewelry |

When you combine these three pillars, the live spot price, your item’s specific purity, and its exact weight, you can figure out its base “melt value.” This is the number you absolutely need to know before you can make sense of any offer a buyer gives you.

Using a Gold Calculator for an Instant Estimate

Now that you know what goes into valuing gold, it is time to put that knowledge to work. Instead of wrestling with formulas and live market data, an online gold calculator does all the heavy lifting for you. It is the fastest way to get a straight answer to the question, “What’s my gold worth?”

This approach cuts through the guesswork and gives you a reliable melt value in seconds. All you need are a couple of key details about your item. This simple step empowers you to walk into any negotiation with a clear, data backed number, ensuring you know your gold’s baseline value before you even start talking to a buyer.

Let’s walk through the steps together.

Step 1: Find the Purity or Karat Stamp

First things first, you need to figure out your gold’s purity. Most jewelry made by a commercial producer will have a tiny stamp, known as a hallmark, that tells you its karat value. You will have to look closely; check the inside of a ring band, the clasp of a necklace, or the back of an earring post.

You are looking for a small set of numbers. Here is what they mean:

- 10K or 417: This means your item is 41.7% pure gold.

- 14K or 583: This stamp indicates the piece is 58.3% pure gold.

- 18K or 750: This signifies your jewelry is 75.0% pure gold.

Finding this little number is the crucial first step because it tells the calculator exactly how much actual gold is in your piece.

This screenshot shows a typical online gold calculator where you would enter your information.

As you can see, the layout is designed for simplicity, allowing you to select purity and enter weight without any confusion.

Step 2: Weigh Your Gold Item

Next up, you need to weigh your gold. For the most precise reading, a digital jewelry scale is your best bet. However, a simple digital kitchen scale that measures in grams will work just fine for getting a solid initial estimate. Just make sure the scale is set to grams, as it is the standard unit for weighing jewelry.

Pop your item on the scale and jot down the weight. Try to be accurate here. Even a fraction of a gram can shift the final value, so precision pays off.

Step 3: Enter Your Details for a Live Value

With your gold’s purity and weight in hand, you are ready to get your number. This is where an online tool really shines. You can try our live gold calculator to see it in action.

All you do is select the karat from the dropdown menu, type in the weight in grams, and the calculator instantly crunches the numbers for you. It pulls the current spot price of gold and gives you the live melt value on the spot. This immediate feedback turns an unknown into a concrete figure you can actually use.

Why Gold Prices Are Hitting Record Highs

Have you ever glanced at the news and wondered why gold’s value seems to be shooting through the roof? The price of the gold in your hands, whether it is an old ring or a coin, is directly connected to major global economic trends. Grasping these forces gives you a much clearer picture of what your gold is worth and why right now might be an incredible time to sell.

Think of gold as a “safe haven” asset. When the global economy feels shaky or unpredictable, investors and even entire countries flock to something stable to protect their wealth. This stampede for safety drives the price of gold up for everyone, including you.

Key Drivers Behind Gold’s Soaring Value

Several powerful factors are currently converging to push gold prices to new heights. Each one reinforces the metal’s reputation as a reliable store of value during turbulent times.

Here are the main engines powering the price surge:

- Economic Uncertainty: When stock markets get volatile or geopolitical tensions flare up, investors often pull their money from riskier assets and pour it into gold. This “flight to safety” creates a huge surge in demand that naturally boosts its price.

- Inflation Worries: Gold has been a trusted hedge against inflation for centuries. As the purchasing power of currencies like the US dollar weakens, the value of gold tends to climb, effectively preserving wealth.

- Central Bank Buying: This one is a huge deal. Central banks around the world are buying gold at a record setting pace to diversify their reserves and move away from the US dollar. This massive institutional demand is a primary force behind the current price boom.

That last point about central banks is especially powerful. For example, in 2023, central banks added a massive 1,037 tonnes of gold to their reserves, showing an incredible demand that supports higher prices for everyone.

Key Takeaway: The price of your gold is not random. It is directly influenced by global economic health, inflation rates, and the strategic decisions of the world’s largest financial institutions.

This table breaks down how different economic conditions typically affect the demand for gold, and as a result, its price.

| Economic Condition | Impact on Gold Demand | Resulting Gold Price Trend |

|---|---|---|

| High Inflation | Increases | Rises |

| Economic Recession | Increases | Rises |

| Low Interest Rates | Increases | Rises |

| Strong Economic Growth | Decreases | Stabilizes or Falls |

Understanding these relationships helps explain why your old jewelry might be worth significantly more today than it was just a few years ago. For a deeper dive into the investment potential of gold, including market trends and historical value, a comprehensive guide to investing in gold coins UK can give you an even broader perspective on gold’s timeless appeal.

Understanding Your Payout and What Is a Fair Offer

So, you have used a gold calculator and now you have a solid number for your gold’s melt value. Awesome. But when you get an offer from a buyer, you might be a little surprised to see it is a bit lower than that figure. Do not worry, this is a completely normal and expected part of selling gold.

Think of a gold buyer as any other business. They have real costs to cover, from rent and employee salaries to the specialized equipment they need to accurately test and process precious metals. That gap between your gold’s market value and their offer is simply how they cover those expenses and stay in business.

From Melt Value to Cash Offer

The journey from a piece of scrap jewelry to a pure, refined gold bar is not free. Buyers have to factor in the entire process, which includes testing your item to verify its purity, melting it down, and often sending it to a refinery to strip away the alloys and bring it back to its pure 24K form.

This is why offers are always presented as a percentage of the total melt value. When a buyer offers you 85% of the spot price, that remaining 15% is what covers their operational overhead and the cost of refining.

A fair offer is not about getting 100% of the melt value. It is about getting a competitive percentage from a transparent, reputable buyer. Getting this distinction right is the key to a successful sale.

What Is a Fair Payout Percentage?

Okay, so what percentage should you actually be looking for? While it can vary, a competitive offer for scrap gold typically lands somewhere between 70% and 95% of the melt value. Anything below this range is likely a lowball offer, and anything above it is extremely rare for typical scrap gold transactions.

Most sellers pocket around 70% to 95% of the spot melt value after all the fees are accounted for. This means an item with a $1,000 melt value might realistically net you $700 to $950 in cash. If you are curious about the bigger picture, you can discover more insights about gold outlook research to understand market dynamics.

This range gives buyers enough margin to operate while still giving you a fair price. To make it crystal clear, here is a quick breakdown of how a final payout gets calculated.

| Calculation Step | Example (10g of 14K Gold) | Description |

|---|---|---|

| 1. Calculate Melt Value | $432 (at $74/gram for 24K) | The raw value based on weight, purity (58.3%), and the day’s spot price. |

| 2. Apply Buyer’s Percentage | 85% (example) | The buyer’s offer after factoring in their operational costs. |

| 3. Calculate Final Payout | $367 | The actual cash you would receive in this scenario. |

Knowing this calculation puts you in a much stronger position. It helps you realistically size up any offer and gives you the confidence to ask questions if a price seems off, making sure you walk away with what your gold is truly worth.

How to Sell Your Gold and Avoid Common Pitfalls

Alright, you have done the hard work. You have a solid grasp of what your gold is worth, which puts you in a powerful position. Now for the final step: navigating the sale itself to make sure you walk away with the best possible price. A little prep work here goes a long way and stops you from leaving money on the table.

The good news? The market outlook for gold is strong, which is fantastic for sellers. In fact, some analysts are forecasting that gold could continue its upward trend. Keeping an eye on these trends can seriously boost your payout.

Your Pre Sale Checklist

Before you even think about approaching a buyer, run through this quick checklist. It is designed to help you sidestep common mistakes and get the most for your items. Knowing what your gold is worth is half the battle; the other half is selling it smartly.

To get a better handle on your options, check out our guide on the best place to sell gold. It offers a much deeper look into the different types of buyers you will encounter.

The biggest mistake you can make is selling in a hurry. Patience and preparation are your best negotiating tools. They let you compare offers without pressure and choose the one that truly reflects your gold’s value.

Common Pitfalls and How to Avoid Them

Here are some of the most common traps people fall into when selling gold, along with simple ways to make sure you get a fair deal.

| Common Mistake | How to Avoid It |

| :— | :— | :— |

| Accepting the First Offer | Always get at least three different quotes. This creates competition among buyers and gives you a clear sense of the real market rate. |

| Not Separating by Karat | Group your 10K, 14K, and 18K items separately. This prevents a buyer from lumping it all together and valuing everything at the lowest karat. |

| Ignoring Gemstones | Never sell items with valuable gems for their melt value alone. If a stone is significant, get a separate appraisal for it first. |

| Using Vague Mail In Services | Only use mail in services that provide a clear, fully insured process and a transparent payout structure before you send anything. |

Frequently Asked Questions About Valuing Gold

Even after you have nailed down the basics, a few specific questions always seem to pop up when you are trying to figure out what your gold is worth. Let’s tackle the most common ones we hear. Getting these final details right will give you the confidence you need when it is time to sell.

Think of these as the finishing touches on your valuation knowledge, ensuring you see the whole picture.

Does the Brand Name Affect Scrap Gold Value?

For the most part, no. When you are selling gold for its melt value, the buyer is really only looking at two things: the weight of the item and its gold purity. The brand name, whether it is Zales or Kay Jewelers, does not add anything to its raw material worth.

But there is one major exception to this rule. If your jewelry is from a high end luxury brand like Cartier, Tiffany & Co., or Van Cleef & Arpels, it could be worth far more as a pre owned designer piece than it is as scrap. Always do a quick search on the item before you assume it is just worth its weight in gold.

Troy Ounce vs. Regular Ounce: What’s the Difference?

This is a classic mix up that can cost you real money. The standard ounce we use for things like groceries (an “avoirdupois” ounce) weighs 28.35 grams. A troy ounce, which is the universal standard for precious metals, is heavier at 31.1 grams.

It is a critical distinction. The spot price of gold is always quoted per troy ounce. If you accidentally use the lighter standard ounce in your math, you could undervalue your gold by nearly 10%. Always make sure your calculations are based on the correct unit.

How Can I Test Gold Without Any Hallmarks?

It is common to find older pieces with no visible purity stamp. If that is the case, you can try a couple of simple at home tests to get a better idea of what you have.

First, grab a strong magnet. Real gold is not magnetic, so if your item snaps firmly to the magnet, you can be sure it is not solid gold.

For a more hands on approach, you can try measuring its density with a precise scale and a cup of water, but this can be tricky to get right. Honestly, for a definitive answer, your best bet is to have it professionally tested by a reputable jeweler or gold buyer. It removes all the guesswork and is the only way to get a truly accurate valuation.

Ready to find out exactly what your gold is worth with a tool trusted by thousands? The Gold Calculator gives you a free, instant valuation based on live market prices. Get your accurate estimate in seconds and sell with confidence. Visit us at https://thegoldcalculator.com to get started.