Where to Sell Gold for Highest Price: 7 Top Options for 2026

Selling gold can feel like navigating a maze. With fluctuating market prices and a sea of buyers offering vastly different sums, it’s difficult to know if you’re getting a fair price or leaving significant money on the table. The uncertainty often leads to hesitation, but the truth is, securing the highest price for your gold is achievable with the right strategy and knowledge. The key isn’t just finding a buyer; it’s understanding your asset’s true worth and knowing where to sell gold for the highest price based on what you own, whether it’s jewelry, coins, or bullion.

This guide eliminates the guesswork. We provide a clear, actionable roadmap to maximize your payout. First, we’ll walk you through the essential preparation steps: how to use a live gold calculator to get a data backed estimate of your items’ melt value, how to perform simple at home tests to verify authenticity, and what documentation you need to ensure a smooth transaction. This foundational knowledge empowers you to negotiate effectively and set realistic expectations.

Then, we dive into our curated roundup of the best platforms to sell your gold. From major online bullion dealers like APMEX and JM Bullion to the peer to peer marketplace of eBay, each option is broken down with its pros, cons, and typical payout ranges. For each platform, we’ll provide direct links and practical insights to help you choose the best venue for your specific needs, ensuring you can move forward with confidence and turn your gold into the cash it’s truly worth.

1. Gold Calculator

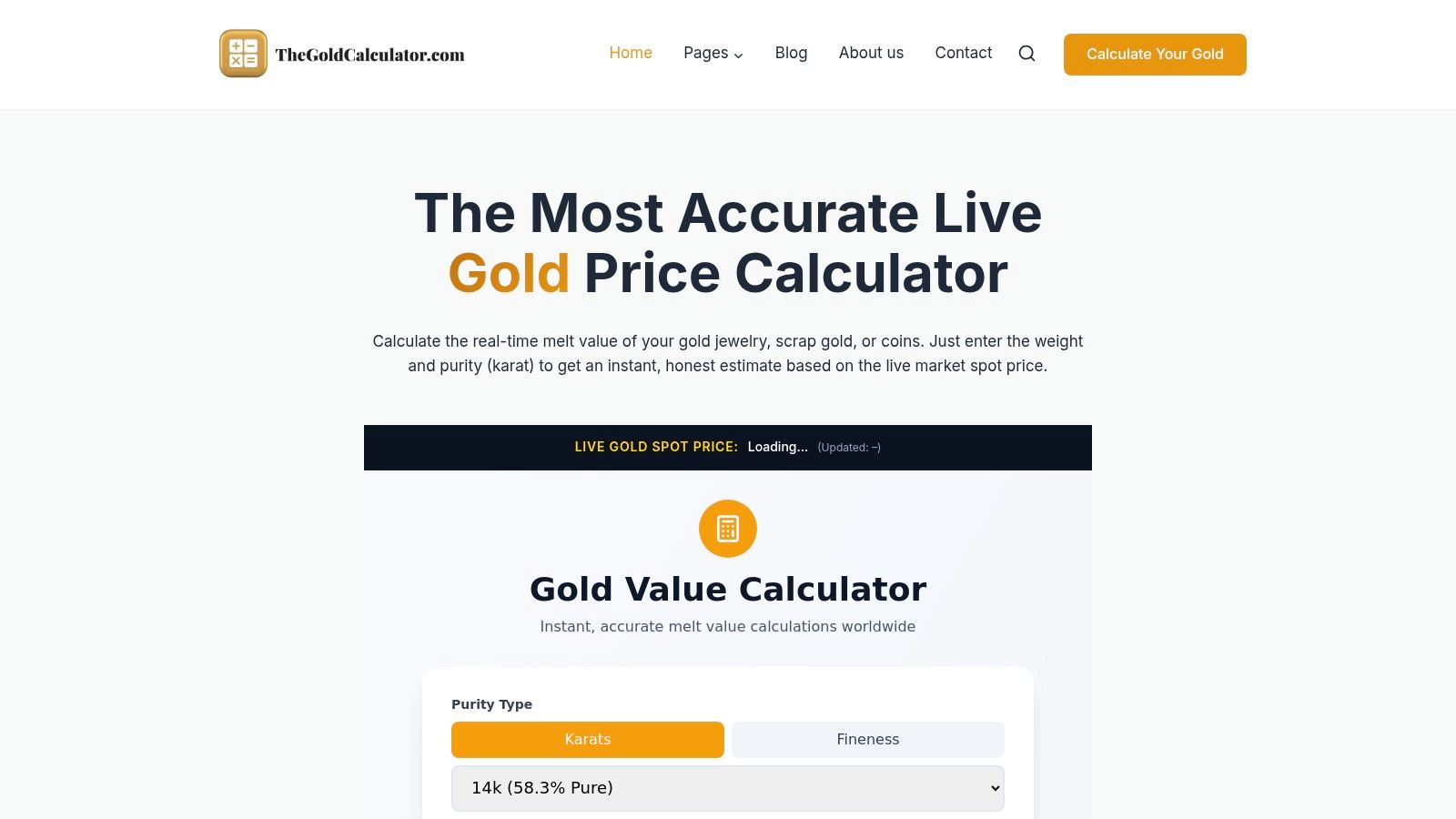

Before you can determine where to sell gold for the highest price, you must first establish a baseline value. Without an objective, data driven starting point, you are negotiating blind. This is where TheGoldCalculator.com excels, positioning itself not as a buyer, but as an indispensable free tool for sellers. It empowers you with the most critical piece of information: the real time melt value of your gold.

The platform provides a free, live gold price calculator that uses verified market data from COMEX and Metals API, with spot prices refreshing every five minutes. This ensures the valuation you receive is not static or arbitrary but reflects the current market, giving you a powerful reference point for every potential offer. The user experience is straightforward and designed for anyone from a first time seller to a seasoned jeweler.

Why It Stands Out: Transparency and Precision

What truly sets Gold Calculator apart is its commitment to transparency and user control. It demystifies the valuation process, which is often a black box for sellers. Instead of just giving you a single number, the tool offers unparalleled flexibility to match your specific items.

You can input weight in grams, troy ounces, pennyweight (dwt), and even less common units like tola or tael. It also supports every common purity, from 8K to 24K gold, as well as fineness measurements (e.g., .999). This precision ensures you are not using a generic estimate but a calculation tailored to your exact items.

Key Insight: The platform includes an optional “Refining Fee” toggle. This unique feature models a buyer’s perspective by showing you what your gold’s value might be after a typical 5% to 20% deduction for their costs. This helps you set realistic expectations and evaluate offers more effectively.

How to Use It for Maximum Advantage

To leverage this tool, simply follow a few steps:

- Select Purity: Choose the karat (e.g., 14K) or fineness of your gold.

- Enter Weight: Accurately weigh your item and enter the number, selecting the correct unit.

- Choose Currency: View the melt value in your local currency for immediate relevance.

The result is the spot melt value, the price your gold would be worth if melted down and sold as raw material on the open market. This number is your anchor for negotiations. For a deeper understanding of how this works, you can learn more about calculating gold’s price and the factors buyers consider.

Melt Value vs. Payout: A Practical Example

Understanding the difference between the calculator’s result and a buyer’s offer is crucial. The table below illustrates how a buyer’s offer corresponds to the melt value for a 10 gram 14K gold chain, assuming a spot price of $2,350 per troy ounce.

| Payout Percentage | Offer from Buyer | How It Compares |

|---|---|---|

| 100% (Melt Value) | $450.75 | This is your baseline value from the calculator. |

| 90% (Excellent Offer) | $405.68 | A highly competitive offer, often from refineries. |

| 80% (Good Offer) | $360.60 | A fair price from a reputable online buyer or jeweler. |

| 70% (Average Offer) | $315.53 | A typical offer from many local gold buyers. |

| <60% (Low Offer) | <$270.45 | An offer to be cautious of; common at some pawn shops. |

Pros:

- Real Time Accuracy: Live market data ensures your valuation is current.

- Highly Flexible: Supports all common weight units, purities, and currencies.

- Completely Free: No fees or sign ups required, promoting transparent access to information.

- Educational Resources: Paired with guides on testing, hallmarks, and selling strategies.

- Trusted and Proven: With over 50,000 valuations completed, it’s a reliable resource.

Cons:

- Melt Value Only: The tool does not assess numismatic, antique, or brand name value.

- Input Dependent: Accuracy relies on the user providing correct weight and purity.

By starting at TheGoldCalculator.com, you arm yourself with objective data, transforming from a hopeful seller into an informed negotiator ready to secure the highest price.

2. APMEX

When your priority shifts from selling miscellaneous scrap gold to liquidating investment grade coins or bars, turning to a national online bullion dealer like APMEX becomes a strategic move. As one of the largest and most reputable precious metals retailers in the United States, APMEX offers a highly structured and transparent buyback program, making it an excellent choice for sellers with substantial holdings who are looking for the highest price on specific bullion products.

APMEX is not your typical cash for gold mailer; it is a high volume market maker. This distinction is crucial because its business model relies on deep liquidity and constant inventory turnover, not on maximizing margins from a single scrap purchase. This often translates into more competitive wholesale bids, especially for popular items it can quickly resell.

How the APMEX Buyback Program Works

The process is designed for efficiency and security, catering to experienced investors rather than casual sellers of broken jewelry. You start by calling their customer service to lock in a price for your items. This price lock is a binding agreement based on the live spot price at that moment, protecting you from market fluctuations while your items are in transit.

After locking in your price, you will receive shipping instructions. APMEX provides a secure, insured shipping process, and payment is typically issued within 3 to 5 business days after your metals are received and their authenticity is verified by their expert team.

Key Insight: The primary advantage of APMEX is its role as an authorized purchaser for major world mints, like the U.S. Mint and the Royal Canadian Mint. This relationship means they have a constant need for popular products like American Gold Eagles and Canadian Gold Maple Leafs, often enabling them to pay a premium over melt value for these items in good condition.

Ideal Seller Profile and Requirements

APMEX is best suited for sellers with investment grade bullion, such as government minted coins or well known private refinery bars. It is also a potential outlet for larger lots of scrap or jewelry, but the transaction must meet a $1,000 minimum value.

APMEX Buyback Program At a Glance

| Feature | Details |

|---|---|

| Best For | Investment grade gold coins, bars, and larger scrap lots. |

| Transaction Minimum | $1,000 |

| Price Lock | Yes, by phone. Binding agreement protects against market drops. |

| Payout Time | Typically 3 to 5 business days after receipt and verification. |

| Transparency | “Buy Prices” are often listed on product pages for reference. |

Pros:

- Strong Reputation: Decades of trust and a high volume business model.

- Price Transparency: Many products feature a live “We’re Paying” price on the website.

- Premium Payouts: Often pays above melt value for in demand bullion coins and bars.

Cons:

- High Minimum: The $1,000 minimum excludes very small sellers.

- Tiered Pricing: The highest advertised buy prices are often reserved for transactions totaling $10,000 or more.

For more information on their selling process, visit the APMEX Selling Page.

3. JM Bullion

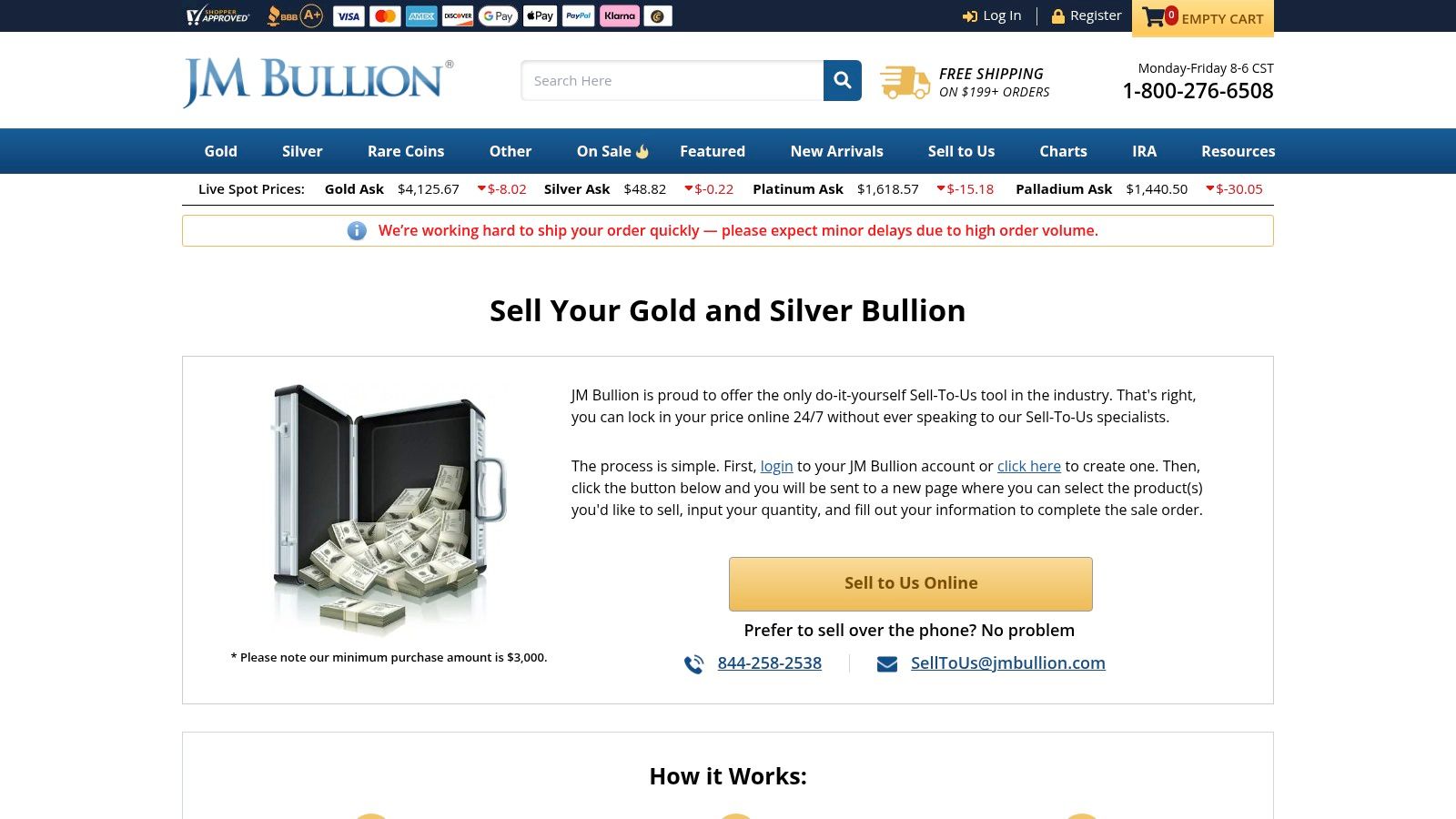

For sellers who prioritize convenience and speed without sacrificing competitive pricing, JM Bullion presents a compelling, tech forward option. As a major online precious metals dealer, JM Bullion competes directly with the largest names in the industry, but it distinguishes itself with an innovative self service online portal. This feature allows you to lock in a binding sale price for your gold 24/7, making it a standout choice for those who want to act decisively when the market moves.

Similar to other large dealers, JM Bullion operates on a high volume, low margin business model, which means their buyback prices are driven by market demand and liquidity. They are not just buying scrap to melt; they are acquiring inventory to resell. This operational focus often results in stronger payouts for popular bullion products and even fair market rates for scrap jewelry compared to local, low volume buyers.

How the JM Bullion Buyback Program Works

The process is notably streamlined, especially through their online “Sell To Us” tool. You can browse their catalog, add the specific items you are selling to a sell back cart, and check out to lock in your price based on the live spot price. This can be done at any time, day or night, which is a significant advantage over competitors who require a phone call during business hours.

Once your price is locked, you will receive a purchase order and instructions for shipping your items. JM Bullion provides a free, insured shipping label, which simplifies the process and protects your assets in transit. After your package is received and its contents are verified, payment is typically processed within 1 to 3 business days. For transactions under the online minimum or for items not listed on their site, you can still sell via phone or email.

Key Insight: JM Bullion’s 24/7 online price lock feature is its biggest differentiator. It empowers you to secure a favorable price instantly from home, even outside of traditional market hours, giving you ultimate control over the timing of your sale. This is a game changer for sellers who closely monitor market fluctuations.

Ideal Seller Profile and Requirements

JM Bullion is an excellent fit for sellers of investment grade gold coins and bars, pre 1933 U.S. gold, and scrap or jewelry. The platform is particularly well suited for those comfortable with a DIY online process. The self service portal has a $3,000 minimum transaction value, but the company often accommodates smaller sales starting around $1,000 if you contact their team by phone.

JM Bullion Buyback Program At a Glance

| Feature | Details |

|---|---|

| Best For | Bullion coins/bars, pre 33 gold, and scrap jewelry. |

| Transaction Minimum | $3,000 for online tool; phone assistance available for ~$1,000+. |

| Price Lock | Yes, 24/7 self service online, or by phone/email during business hours. |

| Payout Time | Typically 1 to 3 business days after receipt and verification. |

| Transparency | Publishes live buy prices for many popular bullion products online. |

Pros:

- 24/7 Online Price Lock: Unmatched convenience for locking in prices anytime.

- Transparent Buy Prices: Live “We Are Paying” prices are listed for many items.

- Free Insured Shipping: Simplifies logistics and removes a key cost for the seller.

Cons:

- High Online Minimum: The $3,000 minimum for the online tool may exclude smaller sellers who must then call in.

- Less Personal: The online first approach may be less suitable for those who prefer direct human interaction for their transactions.

To learn more about their process, visit the JM Bullion Sell-To-Us Page.

4. SD Bullion

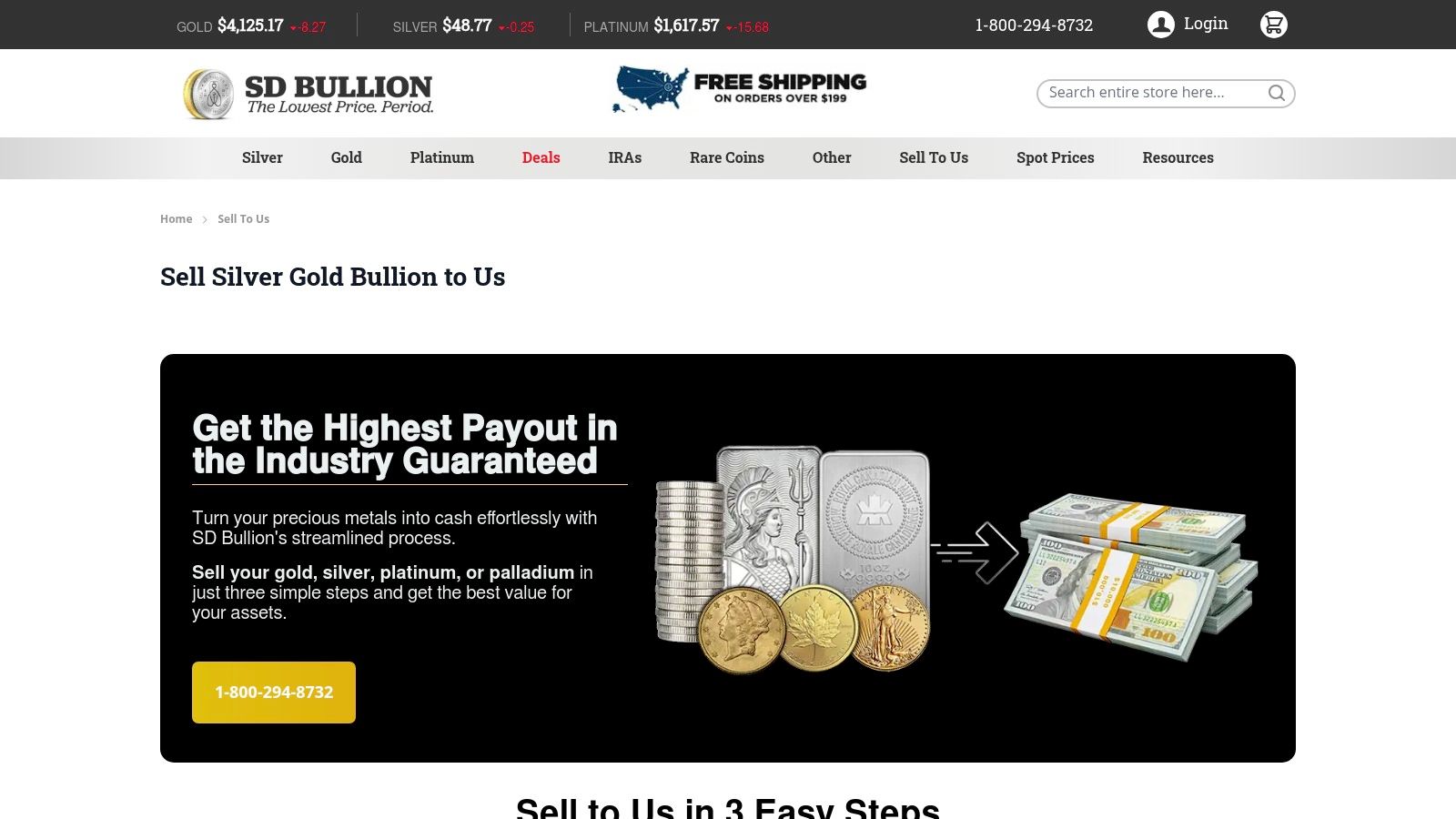

When searching for where to sell gold for the highest price, transparency is a key factor that can significantly impact your confidence and final payout. SD Bullion excels in this area, operating as a major online bullion dealer with a straightforward buyback program that openly displays what it is paying for many popular items. This makes it an ideal choice for sellers who want to research and gauge potential returns before ever picking up the phone.

Like other national dealers, SD Bullion is a high volume market maker, not a local “cash for gold” shop. Its business is built on acquiring inventory it can quickly sell to its large customer base. This model often results in highly competitive offers for investment grade gold and silver, as they have a constant need to replenish their stock of sought after products.

How the SD Bullion Buyback Program Works

The process is designed for clarity and speed, catering to sellers who value both a fair price and an efficient transaction. The first step for many is to browse the “Sell to Us” section of their website, where live bid prices are often listed for common coins and bars. Once you are ready to proceed, you must call their trading department to lock in your price, which creates a binding contract based on the spot price at that moment.

After the price lock, you receive a purchase order and detailed shipping instructions. SD Bullion can provide discounted, fully insured shipping labels, simplifying the logistics of sending your valuable metals. Payment is processed swiftly, typically within 1 to 3 business days after your items are received and verified.

Key Insight: SD Bullion’s public facing bid board is its standout feature. This allows you to monitor what they are paying for items like a 1 oz American Gold Eagle in real time. This level of transparency helps you set realistic expectations and choose the best moment to sell without having to make a phone call first.

Ideal Seller Profile and Requirements

This platform is best for sellers of investment grade bullion who meet their specific minimums. Unlike a flat dollar minimum, SD Bullion sets thresholds by metal type: 1 oz for gold or platinum, 20 oz for silver, and 1 oz for palladium. This makes it accessible even for those selling a single one ounce gold coin.

SD Bullion Buyback Program At a Glance

| Feature | Details |

|---|---|

| Best For | Common bullion coins, bars, and rounds with transparent bids. |

| Transaction Minimum | 1 oz Gold; 20 oz Silver; 1 oz Platinum; 1 oz Palladium. |

| Price Lock | Yes, by phone. Creates a binding agreement. |

| Payout Time | Typically 1 to 3 business days after receipt and verification. |

| Transparency | Live “Bid” prices are published on their website for many items. |

Pros:

- Transparent Live Bids: The website’s bid board allows you to see what they are paying before you call.

- Fast Turnaround: The process from receipt to payment is one of the fastest in the industry.

- Logistical Support: Provides insured shipping labels to streamline a secure selling process.

Cons:

- Phone Lock in Required: Website bids are indicative; you must call to finalize the price.

- Focused on Bullion: Less of a primary destination for scrap or miscellaneous jewelry.

For more information, visit the SD Bullion Selling Page.

5. Money Metals Exchange

Similar to other major online bullion dealers, Money Metals Exchange provides a competitive and transparent buyback program, making it a top contender for those wondering where to sell gold for the highest price. What sets Money Metals Exchange apart is its flexible process and an innovative alternative to selling outright: a metals backed lending program for those who need liquidity but do not want to part with their assets permanently.

Money Metals Exchange operates as a high volume dealer, purchasing investment grade coins and bars, including items not originally bought from them. Their business is built on acquiring inventory for resale, which means they are motivated to offer strong prices for popular, easily resold bullion products. This focus on inventory needs ensures their buy prices remain competitive within the market.

How the Money Metals Exchange Buyback Program Works

The selling process is designed for user convenience, offering two ways to lock in a price. Sellers can either call their specialists to secure a price over the phone or, for many products, simply navigate to the item’s page on their website and click the “Sell to Us” button to lock in the price online. This price lock is a binding agreement based on the current spot price.

Once your price is confirmed, you will receive detailed instructions for securely packaging and shipping your items to their depository. It is important to note that sellers are responsible for arranging and insuring their own shipment. Payments are processed quickly, usually within a few business days after the items are received and their authenticity is verified.

Key Insight: The unique feature of Money Metals Exchange is its metals backed lending option. For sellers with substantial holdings (typically starting around $15,000), this program allows you to use your gold as collateral for a loan. This provides immediate cash without triggering a taxable event or losing your long term position in the precious metals market.

Ideal Seller Profile and Requirements

This platform is ideal for individuals selling investment grade bullion, such as government minted coins or bars from recognized refiners. They have clear requirements regarding the condition and branding of bars and rounds they will purchase. While there isn’t a strict dollar minimum for every transaction, the process is best suited for investment level quantities rather than single pieces of scrap jewelry.

Money Metals Exchange Buyback Program At a Glance

| Feature | Details |

|---|---|

| Best For | Investment grade gold coins and bars. |

| Transaction Minimum | No strict minimum, but best for investment level sales. |

| Price Lock | Yes, available online via product pages or by phone. |

| Payout Time | Typically 2 to 3 business days after receipt and verification. |

| Unique Offering | Metals backed lending program as an alternative to selling. |

Pros:

- Flexible Price Locking: Lock in your price online or over the phone.

- Quick Payment: Fast processing once items are received and verified.

- Lending Alternative: Unique option to borrow against your gold instead of selling, preserving ownership.

Cons:

- Seller Managed Shipping: You are responsible for the cost and risk of shipping and insurance.

- High Lending Threshold: The lending program is only available for larger collateral amounts.

For more information on their selling process, visit the Money Metals Exchange Selling Page.

6. Kitco

When you are looking for a counterparty with a deep global presence and a reputation built on market data and analysis, Kitco is a compelling choice. For decades, Kitco has been a primary source of precious metals news, charts, and data for investors worldwide. This expertise underpins their buyback program, making them a trusted destination for selling both investment bullion and scrap gold.

Kitco is not just a retailer; it is an institution in the precious metals market. Their business model is integrated with their media and data operations, which gives them a unique perspective on metal flows and market demand. For sellers, this translates into dealing with a highly knowledgeable and well established entity that understands the intrinsic value of gold beyond just its weight.

How the Kitco Buyback Program Works

Kitco’s selling process is straightforward and accessible through its dedicated online portal or by phone. You begin by contacting their team to receive a quote and lock in your price based on the current market rates. This commitment protects you from price declines while your items are shipped and processed.

Once your price is locked, Kitco provides detailed instructions for securely packaging and shipping your metals to one of their receiving depots. Upon arrival, your items are inspected and verified. Provided everything matches the description, payment is issued promptly. This process is designed to be transparent, ensuring you know what to expect at each stage.

Key Insight: Kitco’s greatest strength is its long standing brand and global recognition. Selling to a company that is also a primary source of market information for millions provides an inherent layer of trust. They have a vested interest in maintaining a reputation for fairness and transparency, which benefits sellers looking for the highest price and a secure transaction.

Ideal Seller Profile and Requirements

Kitco is an excellent option for a broad range of sellers. This includes individuals with investment grade coins and bars, as well as those looking to liquidate scrap gold jewelry. While their process is professional, it is accessible enough for both seasoned investors and first time sellers. Sellers should contact Kitco directly to confirm any transaction minimums or fees, as these details can vary. Before sending your items, it’s always a good idea to perform your own assessment; you can find helpful tips on how to test gold purity at home.

Kitco Buyback Program At a Glance

| Feature | Details |

|---|---|

| Best For | Both investment grade bullion and scrap gold jewelry. |

| Transaction Minimum | Varies; contact Kitco for a specific quote and requirements. |

| Price Lock | Yes, by phone or through their online portal. |

| Payout Time | Typically processed shortly after receipt and verification. |

| Transparency | Renowned market data provider with a reputation for integrity. |

Pros:

- Brand Longevity: Decades of experience in the precious metals market builds trust.

- Supports All Gold Types: Buys back both high grade bullion and scrap gold.

- Global Counterparty: A well known and respected name in the international market.

Cons:

- Less Explicit Details: Minimums and fees are not always listed publicly and require a direct quote.

- Process Can Seem Corporate: May feel less personal than a local coin shop.

To start the process, visit the Kitco Selling Page.

7. eBay

For sellers aiming to capture the absolute highest retail price for desirable gold coins and bullion, cutting out the middleman via a peer to peer marketplace like eBay is the ultimate strategy. This platform exposes your items to the largest possible pool of retail buyers, allowing you to set the price and potentially achieve a value far above what any dealer, wholesale or local, could offer. It essentially transforms you from a price taker into a price setter.

eBay’s strength lies in its sheer scale and direct to consumer model. Instead of selling at a wholesale discount to a business that needs to resell for a profit, you are marketing directly to the end collector or investor. This is particularly effective for numismatic coins, rare bullion, or any item with strong collector demand, where the retail premium over melt value can be substantial.

How Selling Gold on eBay Works

Selling on eBay gives you complete control over the process. You are responsible for creating a compelling listing with high quality photos, writing an accurate description, and setting your price via a fixed price “Buy It Now” format or a competitive auction. Once an item sells, eBay’s managed payments system processes the transaction, and you are responsible for securely packaging and shipping the item to the buyer.

The platform offers seller protections and extensive listing tools to help manage sales. However, success hinges on building a trustworthy reputation through positive feedback and adhering to best practices to avoid scams and disputes. For a deeper look into the nuances of online selling, you can learn more about how to sell scrap gold.

Key Insight: The trade off for potentially achieving the highest price is the significant cost in fees and effort. eBay’s final value fees, especially in the Bullion category, can take a large percentage of the final sale price. You must factor these costs, plus shipping and insurance, into your pricing strategy to ensure you come out ahead.

Ideal Seller Profile and Requirements

eBay is best for experienced sellers with in demand, easily verifiable items like American Gold Eagles, popular bars, or slabbed numismatic coins. It requires a hands on approach to listing management, customer communication, and shipping. Sellers must be diligent in vetting buyers and documenting every step of the transaction to protect themselves.

Selling Gold on eBay At a Glance

| Feature | Details |

|---|---|

| Best For | In demand bullion, numismatic coins, and items with high collector appeal. |

| Pricing | Seller controlled; can achieve full retail market value or higher. |

| Fees | Final value fees are significant (e.g., up to 13.6% for bullion under $7,500). |

| Payout Time | Payouts are initiated after buyer payment is confirmed, subject to holds. |

| Effort Required | High; requires listing creation, buyer vetting, shipping, and customer service. |

Pros:

- Highest Price Potential: Direct access to the largest retail market can yield top of market prices.

- Massive Audience: Unmatched global reach for your items.

- Seller Control: You set the price, terms, and listing details.

Cons:

- High Marketplace Fees: Final value fees can significantly reduce your net profit.

- Risk of Scams: Requires careful vetting of buyers and strict adherence to seller protection policies.

- High Effort: The entire process from listing to shipping is managed by you.

For more information, visit the eBay Seller Center.

Comparing Top Gold Buyers

Choosing the right buyer depends on what you are selling and your goals. This table breaks down our top 7 options to help you see how they stack up against each other. For example, while eBay might offer the highest retail price, it comes with high fees and effort. A dealer like APMEX offers competitive prices for bullion but has a high minimum transaction. Use this comparison to find the best fit for your needs.

| Gold Buyer | Best For | Payout Speed | Key Advantage |

|---|---|---|---|

| Gold Calculator | Getting a Baseline Value | N/A (Valuation Tool) | Free, instant melt value based on live market data. |

| APMEX | Investment Bullion | 3-5 Business Days | High liquidity and premiums for popular coins. |

| JM Bullion | Bullion & Scrap | 1-3 Business Days | 24/7 online price lock and free insured shipping. |

| SD Bullion | Bullion | 1-3 Business Days | Transparent live bid prices published on their website. |

| Money Metals | Bullion | 2-3 Business Days | Flexible price locking and a loan alternative. |

| Kitco | Bullion & Scrap | Varies | Trusted global brand with deep market expertise. |

| eBay | Collectible Bullion | Varies (After Sale) | Potential to achieve the highest retail price directly. |

Making Your Final Decision with Confidence

Navigating the gold market to sell your precious items can feel complex, but by now, you’re equipped with a powerful roadmap to success. We’ve explored a variety of avenues, from large scale online bullion dealers like APMEX and JM Bullion to the vast marketplace of eBay, each offering a unique balance of price, speed, and effort. The journey to securing the highest price for your gold isn’t about finding a single “best” place; it’s about finding the best place for your specific items and needs.

The foundational step, as we’ve emphasized throughout this guide, is knowledge. You cannot negotiate effectively or recognize a fair offer without first understanding what your gold is worth. This is where objective, data driven tools become your most valuable asset, transforming you from a passive seller into an empowered one.

Synthesizing Your Strategy: The Path to the Best Payout

Your ideal selling strategy will hinge on three core factors: what you’re selling, how quickly you need the cash, and how much work you’re willing to put in. Let’s distill the key takeaways to help you chart your course.

For Standard Bullion (Coins and Bars):

Online dealers like APMEX, SD Bullion, and Money Metals Exchange are often your most efficient and competitive options. Their business models are built on high volume, low margin transactions for standardized products. The key here is to compare their buyback prices simultaneously, as they can fluctuate based on inventory needs and market conditions. Your primary leverage is comparison shopping.

For Scrap and Unmarked Jewelry:

This is where due diligence pays the highest dividends. Before approaching anyone, calculating the melt value is non negotiable. This number is your floor, the absolute minimum you should consider. A local, reputable jeweler or a specialized “We Buy Gold” service might offer competitive rates because they can assess any additional value beyond the metal itself, such as small diamonds or unique craftsmanship. However, be prepared to get multiple in person quotes to ensure you find a buyer offering a fair percentage of the spot price.

For Collectible, Antique, or Designer Pieces:

Marketplaces like eBay or specialized auction houses offer the highest potential upside, but they demand the most effort. Here, you’re not just selling gold; you’re selling a story, a brand, or a piece of history. Success requires high quality photography, detailed and honest descriptions, and managing the logistics of shipping and customer service. The potential to connect directly with a collector who sees value beyond the melt weight can lead to a significant premium.

Your Final Action Plan

Before you make a single move, run through this final checklist to ensure you’re in the strongest possible position to determine where to sell gold for highest price:

- Inventory and Document: Create a detailed list of every item, noting weights, karats, and any distinguishing marks or features. Take clear, well lit photos from multiple angles.

- Calculate Your Baseline: Use a live gold calculator to determine the current melt value of your entire collection. This is your most critical piece of data.

- Segment Your Items: Separate standard bullion from scrap jewelry and from any potentially valuable collectible pieces. They may require different selling venues.

- Gather Quotes: For bullion, check the buyback prices on at least three of the online dealers we’ve reviewed. For scrap and jewelry, get at least three local offers.

- Evaluate and Execute: Compare all offers not just on price, but also on the convenience, security, and speed of the transaction. Choose the path that aligns with your goals and confidently complete the sale.

By following this structured approach, you remove guesswork and emotion from the equation. You are no longer just a person with gold to sell; you are an informed participant in the market, ready to command the best possible return for your assets. The power to get the highest price has been in your hands all along, it just needed to be unlocked with the right information and a clear plan.

Ready to take the first and most important step toward getting the best price for your gold? Use the free, live price tool from Gold Calculator to instantly discover the melt value of your items based on real-time market data. Arm yourself with this crucial information before you even think about getting a quote.

Visit the Gold Calculator to get your accurate valuation in seconds.